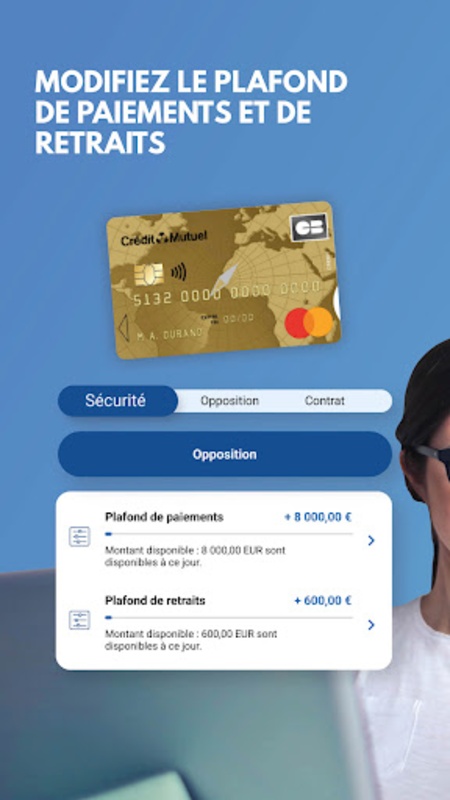

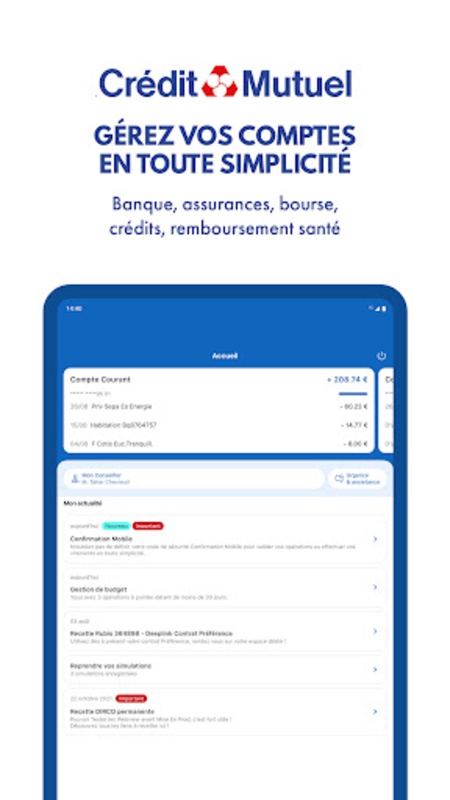

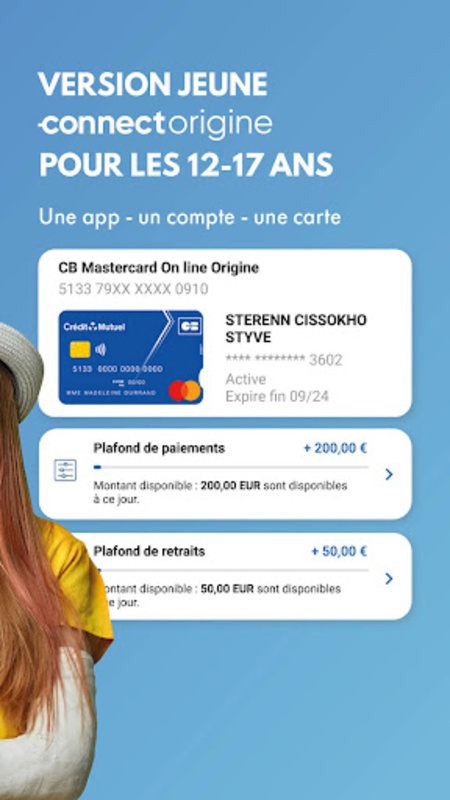

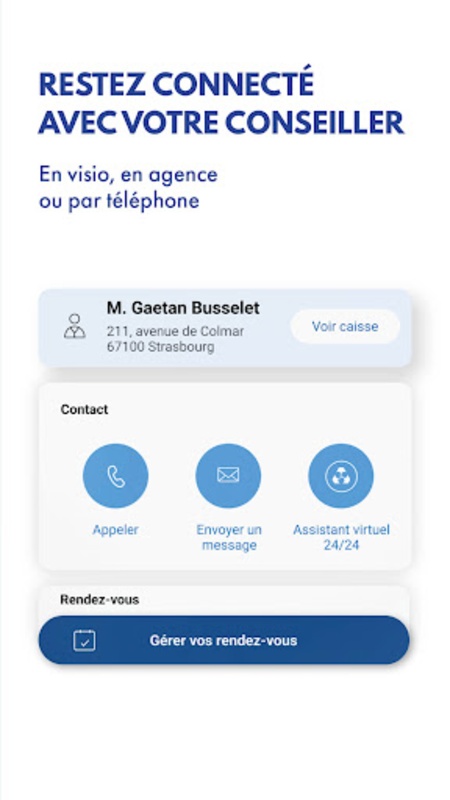

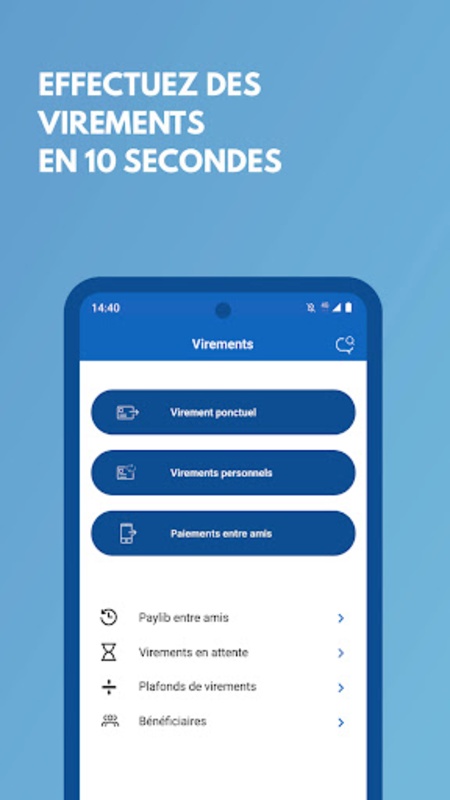

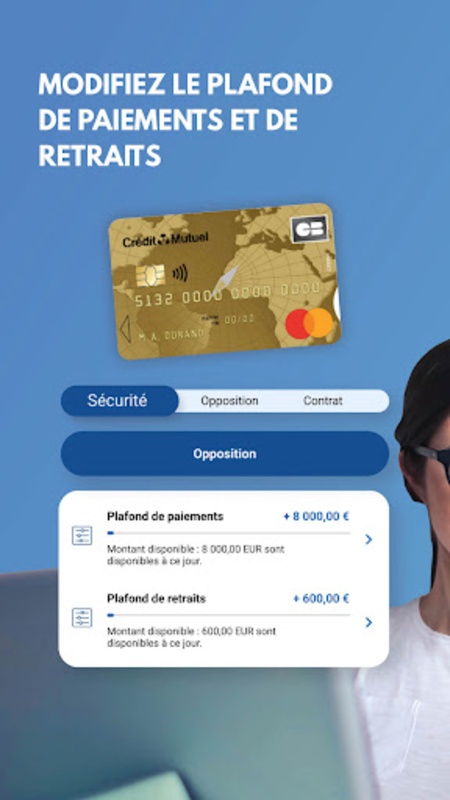

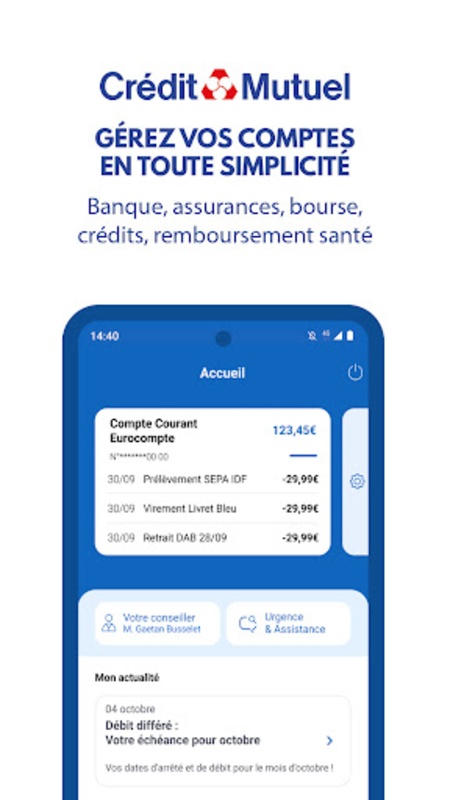

The Crédit Mutuel app is an all-in-one mobile banking solution designed to facilitate the management of personal finances for its users. It allows individuals to confidently handle banking transactions and oversee various financial products directly from their smartphone.

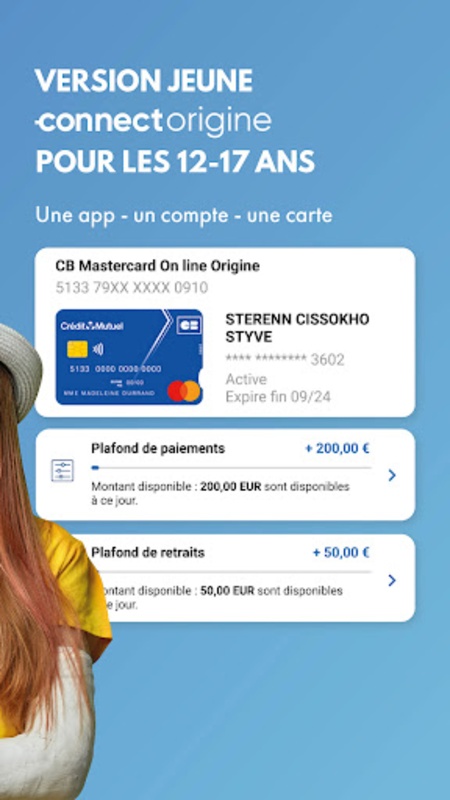

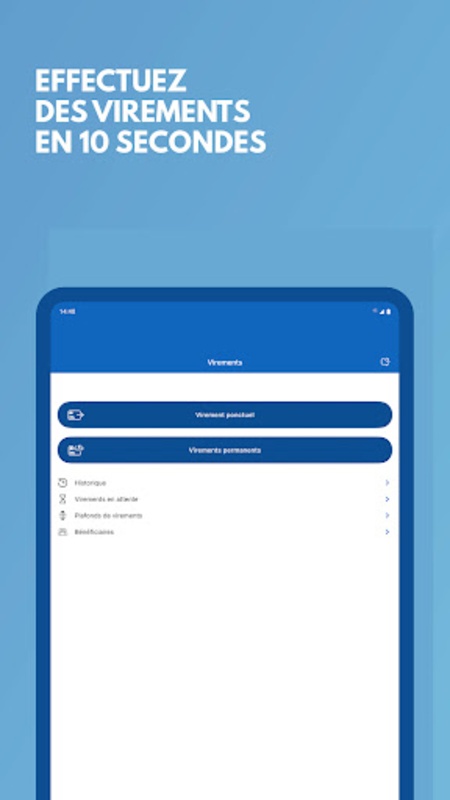

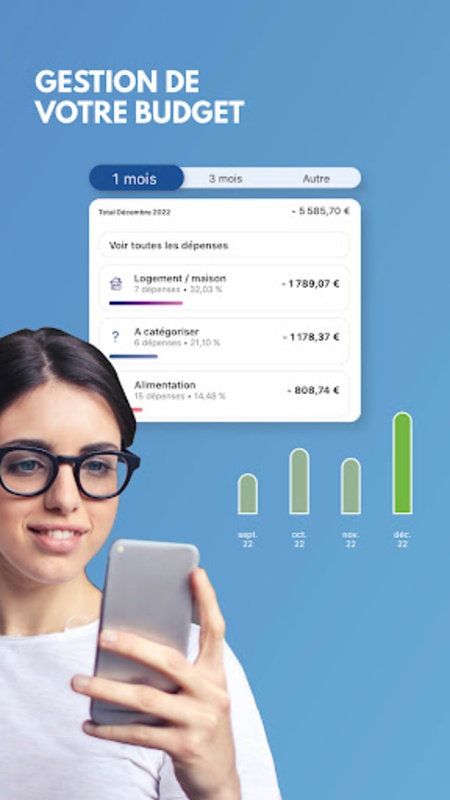

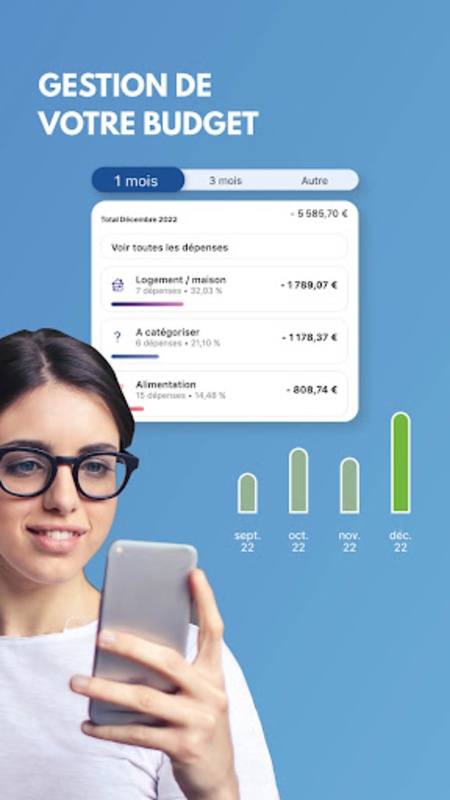

With this comprehensive tool, users can effortlessly monitor and manage their budget. It provides tools for income categorization and expense tracking, and offers visual aids for better financial planning. Stay informed with easy access to account statements, and conveniently check balances of bank and savings accounts.

Crédit Mutuel is a French cooperative banking group, not typically considered a "game" in the traditional sense. However, its operational structure and financial performance can be analyzed strategically, similar to how one would approach a complex game. Crédit Mutuel operates as a decentralized network of local banks, each owned by its members (customers). This cooperative model differs significantly from traditional shareholder-owned banks. The "game" of Crédit Mutuel, therefore, revolves around balancing the interests of its member-owners, maintaining financial stability, and competing effectively in the broader banking market.

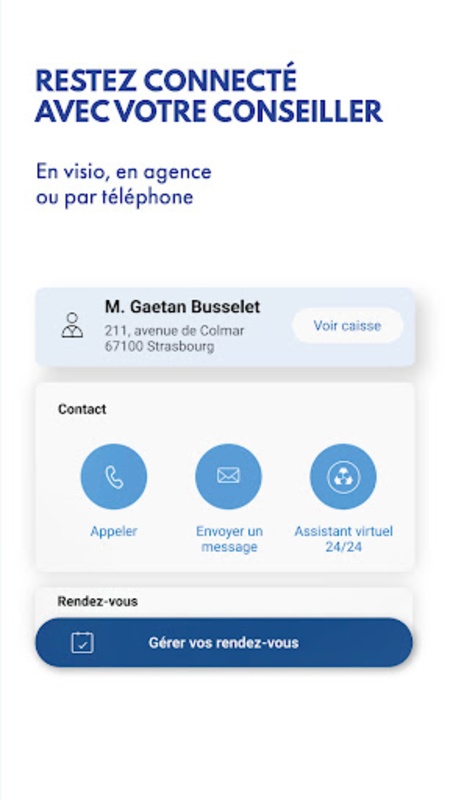

Success in this "game" depends on several factors. Firstly, fostering strong relationships with member-owners is crucial. This involves providing competitive financial products and services, while also actively engaging members in the decision-making process. Secondly, effective risk management is essential. Crédit Mutuel needs to navigate economic fluctuations, regulatory changes, and competitive pressures to ensure its long-term financial health. Thirdly, innovation and adaptation are vital. The banking industry is constantly evolving, and Crédit Mutuel must embrace new technologies and adapt its business model to remain relevant. The "score" in this game is measured by factors such as member satisfaction, financial performance, market share, and overall stability. Crédit Mutuel's unique cooperative structure presents both opportunities and challenges in this competitive landscape.

The Crédit Mutuel app is an all-in-one mobile banking solution designed to facilitate the management of personal finances for its users. It allows individuals to confidently handle banking transactions and oversee various financial products directly from their smartphone.

With this comprehensive tool, users can effortlessly monitor and manage their budget. It provides tools for income categorization and expense tracking, and offers visual aids for better financial planning. Stay informed with easy access to account statements, and conveniently check balances of bank and savings accounts.

Crédit Mutuel is a French cooperative banking group, not typically considered a "game" in the traditional sense. However, its operational structure and financial performance can be analyzed strategically, similar to how one would approach a complex game. Crédit Mutuel operates as a decentralized network of local banks, each owned by its members (customers). This cooperative model differs significantly from traditional shareholder-owned banks. The "game" of Crédit Mutuel, therefore, revolves around balancing the interests of its member-owners, maintaining financial stability, and competing effectively in the broader banking market.

Success in this "game" depends on several factors. Firstly, fostering strong relationships with member-owners is crucial. This involves providing competitive financial products and services, while also actively engaging members in the decision-making process. Secondly, effective risk management is essential. Crédit Mutuel needs to navigate economic fluctuations, regulatory changes, and competitive pressures to ensure its long-term financial health. Thirdly, innovation and adaptation are vital. The banking industry is constantly evolving, and Crédit Mutuel must embrace new technologies and adapt its business model to remain relevant. The "score" in this game is measured by factors such as member satisfaction, financial performance, market share, and overall stability. Crédit Mutuel's unique cooperative structure presents both opportunities and challenges in this competitive landscape.