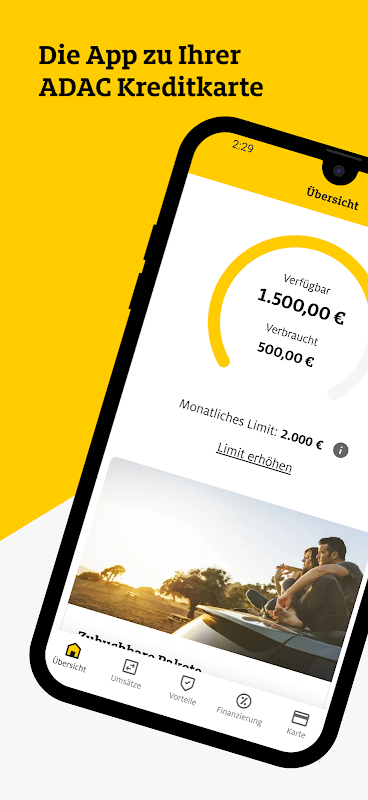

Manage your ADAC credit card easily and conveniently on your smartphone with the new banking app.

- Full transparency: stay informed about your current financial status anytime and anywhere.

- Full flexibility: Find out about your advantages, adapt your payment method to your personal needs or use one of our other financing offers.

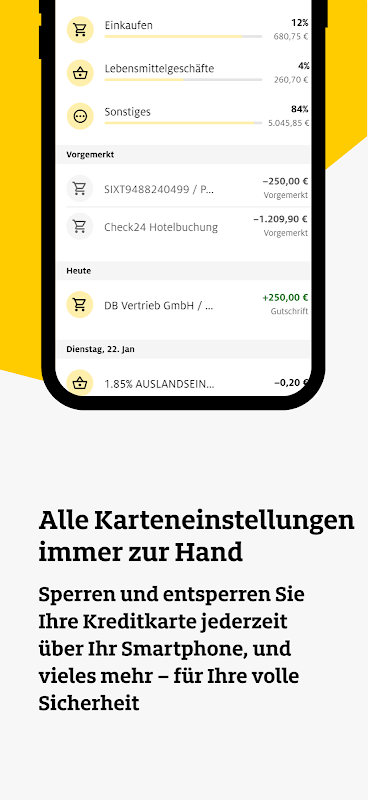

- Full control: Be informed in real time about new transactions, temporarily block your card and unblock it again or, in the event of loss, block it directly via your smartphone.

FUNCTIONS

Current financial status and absolute cost control

View the transactions you have already booked or reserved in real time, find out about the amount still available and call up your card statements.

Change billing type

Switch quickly and conveniently between the flexible repayment options for your bill - according to your financial needs and your wishes.

Manage credit card limit

Apply for an increase in your credit limit.

manage credit

Keep track of your credit balance and make transfers back to your checking account at any time.

Change reference account

Change your stored reference account from which card statements are collected.

Temporarily block or suspend card

Would you like to temporarily block your card from being used? No problem.

Block and unblock your card directly in the app, or block the card e.g. B. final in case of loss or theft.

Manage possible uses of your ADAC credit card

For your security, you can disable the use of your credit card for certain cases. For example, use abroad, on the Internet and at ATMs - as required.

Manage Notifications

Receive real-time push notifications on transactions made with your ADAC credit card.

Assign desired PIN

Is there a combination of numbers that you are particularly good at remembering?

Assign your desired PIN conveniently and securely directly in the app. You can change this again at any time in the app's map menu.

consents

Specify individually whether and how we may inform you about promotions and products and how we may use your data.

Login via FaceID and TouchID

Log in to the app as usual with your user name and password – or use the simple and secure login via biometrics.

Google Pay

Deposit your card with Google Pay in just a few clicks.

Need help?

Contact our customer service. We are there for you personally around the clock and will be happy to help you.

REQUIREMENTS

Our app is only compatible with the ADAC credit cards from Landesbank Berlin AG.

OTHER

We are constantly developing the functionalities of our app. Download the latest version to take advantage of all available features and improvements.

You can find the full functionality of credit card banking on our website https://adac.lbb.de/infos.

The ADAC Kreditkarte, issued by Consorsbank, is a premium credit card designed for members of the ADAC (Allgemeiner Deutscher Automobil-Club), Germany's largest automobile club. It offers a range of benefits and features tailored to the needs of motorists, including exclusive discounts, roadside assistance, and travel insurance.

Benefits

* Exclusive discounts: ADAC Kreditkarte holders enjoy exclusive discounts on fuel at participating gas stations, as well as on car rentals, travel bookings, and other automotive services.

* Roadside assistance: In case of a breakdown or accident, cardholders have access to 24/7 roadside assistance, including towing, tire changes, and battery jumpstarts.

* Travel insurance: The card provides comprehensive travel insurance coverage, including medical expenses, trip cancellation, and lost luggage.

* Contactless payments: The card supports contactless payments for quick and convenient transactions.

* Mobile app: Cardholders can manage their account, view transactions, and access exclusive offers through the ADAC Kreditkarte mobile app.

Features

* Flexible payment options: Cardholders can choose to pay their balance in full each month or make minimum payments with interest charges.

* Low interest rates: The card offers competitive interest rates on both purchases and cash advances.

* Worldwide acceptance: The ADAC Kreditkarte is accepted at millions of merchants worldwide.

* Chip and PIN technology: The card uses chip and PIN technology for enhanced security and fraud protection.

* NFC (Near Field Communication): The card supports NFC technology for mobile payments and other contactless services.

Eligibility and Fees

To be eligible for the ADAC Kreditkarte, individuals must be members of the ADAC. The annual membership fee for the ADAC is €59. The annual fee for the ADAC Kreditkarte is €39.

Conclusion

The ADAC Kreditkarte is a valuable tool for ADAC members who seek a convenient and feature-rich credit card. With its exclusive discounts, comprehensive roadside assistance, and travel insurance coverage, it provides peace of mind and financial benefits for motorists. The card's competitive interest rates, flexible payment options, and worldwide acceptance make it a versatile choice for everyday spending and travel.

Manage your ADAC credit card easily and conveniently on your smartphone with the new banking app.

- Full transparency: stay informed about your current financial status anytime and anywhere.

- Full flexibility: Find out about your advantages, adapt your payment method to your personal needs or use one of our other financing offers.

- Full control: Be informed in real time about new transactions, temporarily block your card and unblock it again or, in the event of loss, block it directly via your smartphone.

FUNCTIONS

Current financial status and absolute cost control

View the transactions you have already booked or reserved in real time, find out about the amount still available and call up your card statements.

Change billing type

Switch quickly and conveniently between the flexible repayment options for your bill - according to your financial needs and your wishes.

Manage credit card limit

Apply for an increase in your credit limit.

manage credit

Keep track of your credit balance and make transfers back to your checking account at any time.

Change reference account

Change your stored reference account from which card statements are collected.

Temporarily block or suspend card

Would you like to temporarily block your card from being used? No problem.

Block and unblock your card directly in the app, or block the card e.g. B. final in case of loss or theft.

Manage possible uses of your ADAC credit card

For your security, you can disable the use of your credit card for certain cases. For example, use abroad, on the Internet and at ATMs - as required.

Manage Notifications

Receive real-time push notifications on transactions made with your ADAC credit card.

Assign desired PIN

Is there a combination of numbers that you are particularly good at remembering?

Assign your desired PIN conveniently and securely directly in the app. You can change this again at any time in the app's map menu.

consents

Specify individually whether and how we may inform you about promotions and products and how we may use your data.

Login via FaceID and TouchID

Log in to the app as usual with your user name and password – or use the simple and secure login via biometrics.

Google Pay

Deposit your card with Google Pay in just a few clicks.

Need help?

Contact our customer service. We are there for you personally around the clock and will be happy to help you.

REQUIREMENTS

Our app is only compatible with the ADAC credit cards from Landesbank Berlin AG.

OTHER

We are constantly developing the functionalities of our app. Download the latest version to take advantage of all available features and improvements.

You can find the full functionality of credit card banking on our website https://adac.lbb.de/infos.

The ADAC Kreditkarte, issued by Consorsbank, is a premium credit card designed for members of the ADAC (Allgemeiner Deutscher Automobil-Club), Germany's largest automobile club. It offers a range of benefits and features tailored to the needs of motorists, including exclusive discounts, roadside assistance, and travel insurance.

Benefits

* Exclusive discounts: ADAC Kreditkarte holders enjoy exclusive discounts on fuel at participating gas stations, as well as on car rentals, travel bookings, and other automotive services.

* Roadside assistance: In case of a breakdown or accident, cardholders have access to 24/7 roadside assistance, including towing, tire changes, and battery jumpstarts.

* Travel insurance: The card provides comprehensive travel insurance coverage, including medical expenses, trip cancellation, and lost luggage.

* Contactless payments: The card supports contactless payments for quick and convenient transactions.

* Mobile app: Cardholders can manage their account, view transactions, and access exclusive offers through the ADAC Kreditkarte mobile app.

Features

* Flexible payment options: Cardholders can choose to pay their balance in full each month or make minimum payments with interest charges.

* Low interest rates: The card offers competitive interest rates on both purchases and cash advances.

* Worldwide acceptance: The ADAC Kreditkarte is accepted at millions of merchants worldwide.

* Chip and PIN technology: The card uses chip and PIN technology for enhanced security and fraud protection.

* NFC (Near Field Communication): The card supports NFC technology for mobile payments and other contactless services.

Eligibility and Fees

To be eligible for the ADAC Kreditkarte, individuals must be members of the ADAC. The annual membership fee for the ADAC is €59. The annual fee for the ADAC Kreditkarte is €39.

Conclusion

The ADAC Kreditkarte is a valuable tool for ADAC members who seek a convenient and feature-rich credit card. With its exclusive discounts, comprehensive roadside assistance, and travel insurance coverage, it provides peace of mind and financial benefits for motorists. The card's competitive interest rates, flexible payment options, and worldwide acceptance make it a versatile choice for everyday spending and travel.