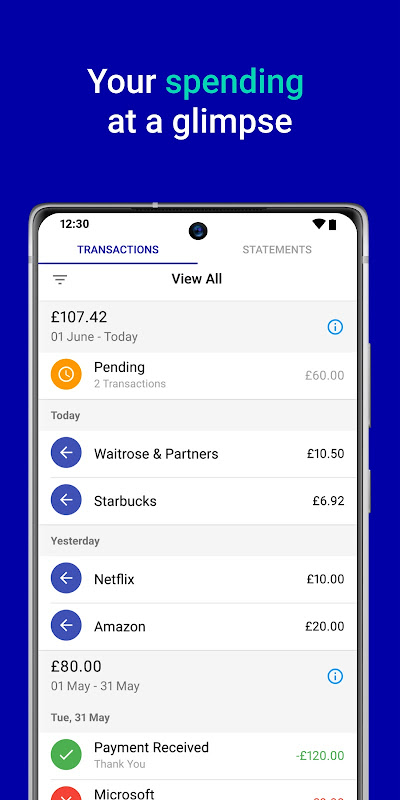

Manage your account anywhere, anytime, with our secure mobile app. Free to download now, we have lots of features to enable you to manage your account easily:

• View your latest balance and available credit limit

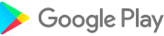

• View your latest transactions, including transactions that are still pending

• Make a payment on your account

• Set up or manage your Direct Debit

• Manage your statement preferences

• Update your contact details

• Get in contact with us and view our FAQs

Registered for Online Account Manager already?

If you’re registered for Online Account Manager already then you’ll be able to use these details to login. No need to re-register!

Not Registered for Online Account Manger?

If you’re not registered for Online Account Manager then no problem! Download the app and click ‘Register for Online Account Manager’. You’ll need the following details to hand:

• Last name

• Date of birth

• Postcode

• Your card details OR your account number

The Aqua Credit Card is a credit card issued by Aqua Finance, a leading provider of financial services in the United Kingdom. Aqua offers a range of credit cards, including the Aqua Classic Credit Card, Aqua Reward Credit Card, and Aqua Platinum Credit Card.

Aqua Classic Credit Card

The Aqua Classic Credit Card is a basic credit card with a low credit limit and a high interest rate. It is designed for people with a poor credit history or no credit history. The card has an annual fee of £24 and a representative APR of 34.9%.

Aqua Reward Credit Card

The Aqua Reward Credit Card is a rewards credit card that earns points on every purchase. Points can be redeemed for a variety of rewards, including gift cards, travel, and merchandise. The card has an annual fee of £24 and a representative APR of 21.9%.

Aqua Platinum Credit Card

The Aqua Platinum Credit Card is a premium credit card with a high credit limit and a low interest rate. It is designed for people with a good credit history. The card has an annual fee of £48 and a representative APR of 18.9%.

Features and Benefits

All Aqua Credit Cards come with a range of features and benefits, including:

* Contactless payments

* Online account management

* Mobile app

* Purchase protection

* Fraud protection

Eligibility

To be eligible for an Aqua Credit Card, you must be at least 18 years old and a UK resident. You must also have a regular income and a good credit history.

Application Process

You can apply for an Aqua Credit Card online or by phone. The application process is quick and easy, and you will typically receive a decision within a few minutes.

Customer Service

Aqua Finance has a dedicated customer service team that is available to help you with any questions or problems you may have. You can contact customer service by phone, email, or live chat.

Conclusion

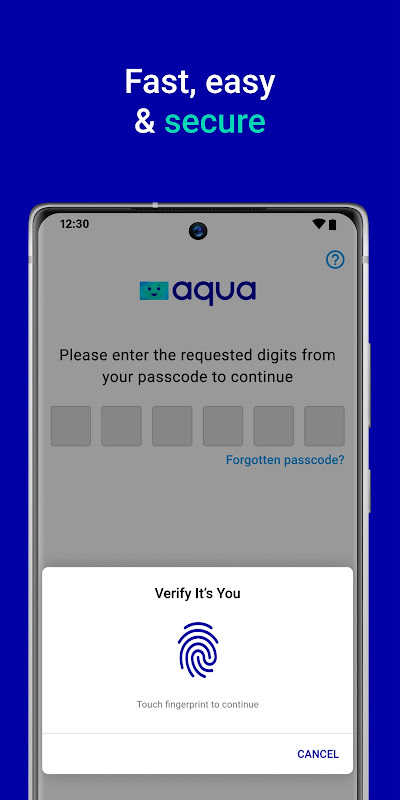

The Aqua Credit Card is a good option for people with a poor credit history or no credit history. The card has a low credit limit and a high interest rate, but it can help you build your credit score over time. If you have a good credit history, you may want to consider a different credit card with a lower interest rate and higher rewards.

Manage your account anywhere, anytime, with our secure mobile app. Free to download now, we have lots of features to enable you to manage your account easily:

• View your latest balance and available credit limit

• View your latest transactions, including transactions that are still pending

• Make a payment on your account

• Set up or manage your Direct Debit

• Manage your statement preferences

• Update your contact details

• Get in contact with us and view our FAQs

Registered for Online Account Manager already?

If you’re registered for Online Account Manager already then you’ll be able to use these details to login. No need to re-register!

Not Registered for Online Account Manger?

If you’re not registered for Online Account Manager then no problem! Download the app and click ‘Register for Online Account Manager’. You’ll need the following details to hand:

• Last name

• Date of birth

• Postcode

• Your card details OR your account number

The Aqua Credit Card is a credit card issued by Aqua Finance, a leading provider of financial services in the United Kingdom. Aqua offers a range of credit cards, including the Aqua Classic Credit Card, Aqua Reward Credit Card, and Aqua Platinum Credit Card.

Aqua Classic Credit Card

The Aqua Classic Credit Card is a basic credit card with a low credit limit and a high interest rate. It is designed for people with a poor credit history or no credit history. The card has an annual fee of £24 and a representative APR of 34.9%.

Aqua Reward Credit Card

The Aqua Reward Credit Card is a rewards credit card that earns points on every purchase. Points can be redeemed for a variety of rewards, including gift cards, travel, and merchandise. The card has an annual fee of £24 and a representative APR of 21.9%.

Aqua Platinum Credit Card

The Aqua Platinum Credit Card is a premium credit card with a high credit limit and a low interest rate. It is designed for people with a good credit history. The card has an annual fee of £48 and a representative APR of 18.9%.

Features and Benefits

All Aqua Credit Cards come with a range of features and benefits, including:

* Contactless payments

* Online account management

* Mobile app

* Purchase protection

* Fraud protection

Eligibility

To be eligible for an Aqua Credit Card, you must be at least 18 years old and a UK resident. You must also have a regular income and a good credit history.

Application Process

You can apply for an Aqua Credit Card online or by phone. The application process is quick and easy, and you will typically receive a decision within a few minutes.

Customer Service

Aqua Finance has a dedicated customer service team that is available to help you with any questions or problems you may have. You can contact customer service by phone, email, or live chat.

Conclusion

The Aqua Credit Card is a good option for people with a poor credit history or no credit history. The card has a low credit limit and a high interest rate, but it can help you build your credit score over time. If you have a good credit history, you may want to consider a different credit card with a lower interest rate and higher rewards.