Bhim Aadhaar IOB Application is a merchant Application where customer payments are received using Customer Aadhaar Number and Biometric Validation. The process is interoperable in nature allowing our customer and other bank customer to transact through our Merchant Mobile and Biometric Device.

Overview

BHIM Aadhaar IOB is a mobile banking application launched by the Indian Overseas Bank (IOB) in collaboration with the National Payments Corporation of India (NPCI). The app enables users to make financial transactions using their Aadhaar number and biometric authentication, eliminating the need for physical cards or cash.

Features

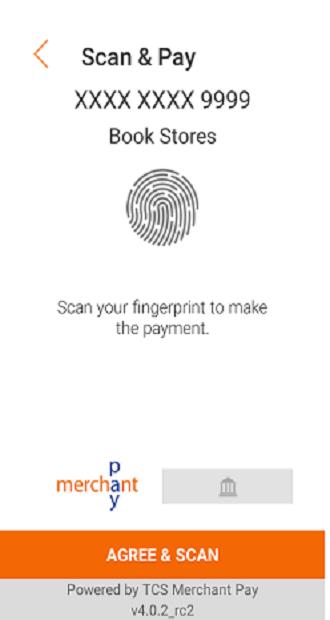

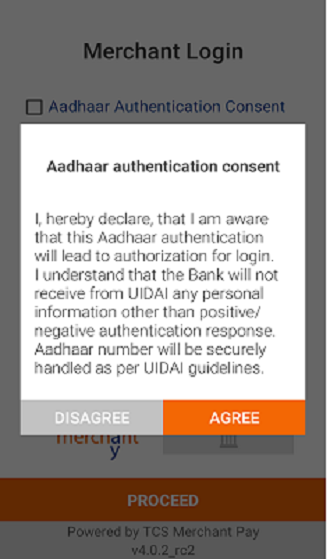

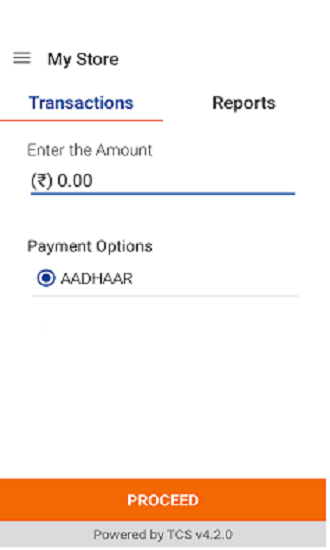

* Aadhaar-based Authentication: BHIM Aadhaar IOB utilizes the Aadhaar infrastructure for secure and convenient user authentication. Users can authenticate transactions using their Aadhaar number and biometric data (fingerprint or iris scan).

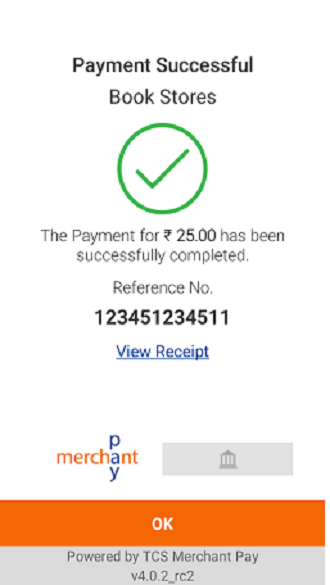

* Financial Transactions: The app facilitates various financial transactions, including:

* Fund transfer to any bank account in India

* Merchant payments at point-of-sale (POS) terminals

* Withdrawal of cash from ATMs without a physical card

* Balance Inquiry: Users can check their account balance and transaction history within the app.

* QR Code Scanning: BHIM Aadhaar IOB supports QR code scanning for quick and easy merchant payments.

* Secure Transactions: The app employs advanced security measures to protect user data and transactions, including encryption and tokenization.

Benefits

* Convenience: BHIM Aadhaar IOB offers a seamless and convenient way to conduct financial transactions, eliminating the need for physical cards or cash.

* Security: Aadhaar-based authentication ensures a high level of security, reducing the risk of fraud and unauthorized transactions.

* Financial Inclusion: The app promotes financial inclusion by enabling individuals without traditional bank accounts to access banking services using their Aadhaar number.

* Cost-effectiveness: Transactions through BHIM Aadhaar IOB are typically free or incur minimal charges, making it an affordable option for users.

Eligibility

To use BHIM Aadhaar IOB, users must meet the following criteria:

* Possess an active Aadhaar card

* Have their Aadhaar number linked to their IOB bank account

* Have a smartphone with a fingerprint scanner or iris scanner

* Be registered for biometric authentication through the Aadhaar Enrolment Centre

Usage

* Download the BHIM Aadhaar IOB app from the Google Play Store or Apple App Store.

* Register your Aadhaar number and IOB bank account within the app.

* Set up a transaction PIN for added security.

* Use your Aadhaar number and biometric data to authenticate transactions.

Conclusion

BHIM Aadhaar IOB is a secure, convenient, and cost-effective mobile banking solution that leverages the power of Aadhaar authentication. It empowers users to conduct financial transactions seamlessly, promoting financial inclusion and simplifying daily banking tasks.

Bhim Aadhaar IOB Application is a merchant Application where customer payments are received using Customer Aadhaar Number and Biometric Validation. The process is interoperable in nature allowing our customer and other bank customer to transact through our Merchant Mobile and Biometric Device.

Overview

BHIM Aadhaar IOB is a mobile banking application launched by the Indian Overseas Bank (IOB) in collaboration with the National Payments Corporation of India (NPCI). The app enables users to make financial transactions using their Aadhaar number and biometric authentication, eliminating the need for physical cards or cash.

Features

* Aadhaar-based Authentication: BHIM Aadhaar IOB utilizes the Aadhaar infrastructure for secure and convenient user authentication. Users can authenticate transactions using their Aadhaar number and biometric data (fingerprint or iris scan).

* Financial Transactions: The app facilitates various financial transactions, including:

* Fund transfer to any bank account in India

* Merchant payments at point-of-sale (POS) terminals

* Withdrawal of cash from ATMs without a physical card

* Balance Inquiry: Users can check their account balance and transaction history within the app.

* QR Code Scanning: BHIM Aadhaar IOB supports QR code scanning for quick and easy merchant payments.

* Secure Transactions: The app employs advanced security measures to protect user data and transactions, including encryption and tokenization.

Benefits

* Convenience: BHIM Aadhaar IOB offers a seamless and convenient way to conduct financial transactions, eliminating the need for physical cards or cash.

* Security: Aadhaar-based authentication ensures a high level of security, reducing the risk of fraud and unauthorized transactions.

* Financial Inclusion: The app promotes financial inclusion by enabling individuals without traditional bank accounts to access banking services using their Aadhaar number.

* Cost-effectiveness: Transactions through BHIM Aadhaar IOB are typically free or incur minimal charges, making it an affordable option for users.

Eligibility

To use BHIM Aadhaar IOB, users must meet the following criteria:

* Possess an active Aadhaar card

* Have their Aadhaar number linked to their IOB bank account

* Have a smartphone with a fingerprint scanner or iris scanner

* Be registered for biometric authentication through the Aadhaar Enrolment Centre

Usage

* Download the BHIM Aadhaar IOB app from the Google Play Store or Apple App Store.

* Register your Aadhaar number and IOB bank account within the app.

* Set up a transaction PIN for added security.

* Use your Aadhaar number and biometric data to authenticate transactions.

Conclusion

BHIM Aadhaar IOB is a secure, convenient, and cost-effective mobile banking solution that leverages the power of Aadhaar authentication. It empowers users to conduct financial transactions seamlessly, promoting financial inclusion and simplifying daily banking tasks.