Redesigned with you in mind, CIMB Clicks Mobile app is now the go-to choice for a simpler and faster mobile banking experience.

Bank simply and securely with Face ID, Biometrics Login and Digital Token. Accounts at a glance and quick-links to actions you do frequently. More self-services tool for your Clicks access - you can now use Singpass Face Verification to sign up, change password or unlock access.

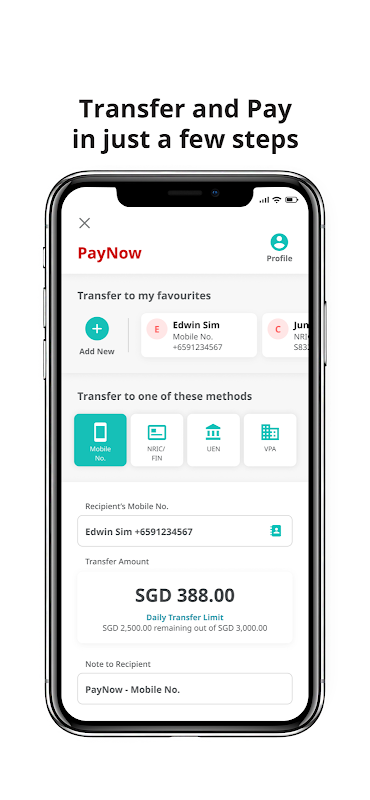

Pay and transfer anytime anywhere. PayNow to a friend, family or company. Scan & Pay at retail stores. Enjoy the best rates* with us when you transfer from Singapore to Malaysia.

Skip the Branch queue and perform account or card services from the comfort of your home. Open a SGD Fixed Deposit on the spot and easily make instant placements with one of the highest online SGD FD rates in Singapore. Apply for CIMB CashLite and get cash to your CIMB Account or any bank account (tagged to your PayNow) within 10 minutes.

*T&C apply.

What's New in this Version?

We heard your feedback. Even better than ever.

You can now view up to 12 months of transaction history on your accounts and make repeated payments or transfers faster. You can also add or delete your Favourites on Clicks Mobile App. Even more image backgrounds for transactions to keep putting that smile on your recipient’s face. Receive curated insights, the latest offers, and security alerts from us. Sign up, change your password, or unlock access made simpler for Singaporeans and PR with Singpass Face Verification.

CIMB Clicks Singapore is a secure and convenient online banking platform offered by CIMB Bank Singapore Limited, a leading regional banking group. This digital banking solution empowers customers to manage their finances seamlessly, anytime, anywhere.

Key Features and Benefits:

* Seamless Account Management: View account balances, transaction history, and account statements in real-time.

* Fast and Secure Transactions: Transfer funds domestically and internationally with ease, using a variety of methods including FAST and SWIFT.

* Bill Payments and Collections: Pay bills and manage recurring payments to over 1,500 billers. Collect payments from customers using eNETS Debit or QR Pay.

* Investment and Insurance: Access investment options and insurance products to grow wealth and protect against risks.

* Card Management: Activate, block, or replace credit and debit cards, set spending limits, and view transaction details.

* Personalization and Customization: Tailor the platform to suit individual preferences, including setting alerts, customizing dashboards, and managing beneficiaries.

* Enhanced Security: Utilize advanced security measures such as two-factor authentication, transaction limits, and fraud detection systems to safeguard financial data.

* Mobile Banking: Access banking services conveniently through the CIMB Clicks Mobile app, available for both iOS and Android devices.

Eligibility and Requirements:

To register for CIMB Clicks Singapore, individuals must be:

* Aged 18 years or above

* Singapore citizens, permanent residents, or foreigners with a valid work permit or student pass

* Customers of CIMB Bank Singapore Limited

Registration and Activation:

Registration for CIMB Clicks Singapore is straightforward. Customers can either visit a CIMB branch or register online through the bank's website. Once registered, activation requires verification through a secure token device or mobile number.

Customer Support:

CIMB Clicks Singapore provides comprehensive customer support through various channels:

* Online Help Center: Access FAQs, user guides, and troubleshooting tips.

* Live Chat: Connect with a customer service representative in real-time.

* Email Support: Submit inquiries or request assistance via email.

* Phone Support: Call the designated hotline for immediate assistance.

Security and Privacy:

CIMB Clicks Singapore employs robust security measures to protect customer information and transactions. The platform is compliant with international security standards and undergoes regular audits to ensure data integrity and privacy.

Redesigned with you in mind, CIMB Clicks Mobile app is now the go-to choice for a simpler and faster mobile banking experience.

Bank simply and securely with Face ID, Biometrics Login and Digital Token. Accounts at a glance and quick-links to actions you do frequently. More self-services tool for your Clicks access - you can now use Singpass Face Verification to sign up, change password or unlock access.

Pay and transfer anytime anywhere. PayNow to a friend, family or company. Scan & Pay at retail stores. Enjoy the best rates* with us when you transfer from Singapore to Malaysia.

Skip the Branch queue and perform account or card services from the comfort of your home. Open a SGD Fixed Deposit on the spot and easily make instant placements with one of the highest online SGD FD rates in Singapore. Apply for CIMB CashLite and get cash to your CIMB Account or any bank account (tagged to your PayNow) within 10 minutes.

*T&C apply.

What's New in this Version?

We heard your feedback. Even better than ever.

You can now view up to 12 months of transaction history on your accounts and make repeated payments or transfers faster. You can also add or delete your Favourites on Clicks Mobile App. Even more image backgrounds for transactions to keep putting that smile on your recipient’s face. Receive curated insights, the latest offers, and security alerts from us. Sign up, change your password, or unlock access made simpler for Singaporeans and PR with Singpass Face Verification.

CIMB Clicks Singapore is a secure and convenient online banking platform offered by CIMB Bank Singapore Limited, a leading regional banking group. This digital banking solution empowers customers to manage their finances seamlessly, anytime, anywhere.

Key Features and Benefits:

* Seamless Account Management: View account balances, transaction history, and account statements in real-time.

* Fast and Secure Transactions: Transfer funds domestically and internationally with ease, using a variety of methods including FAST and SWIFT.

* Bill Payments and Collections: Pay bills and manage recurring payments to over 1,500 billers. Collect payments from customers using eNETS Debit or QR Pay.

* Investment and Insurance: Access investment options and insurance products to grow wealth and protect against risks.

* Card Management: Activate, block, or replace credit and debit cards, set spending limits, and view transaction details.

* Personalization and Customization: Tailor the platform to suit individual preferences, including setting alerts, customizing dashboards, and managing beneficiaries.

* Enhanced Security: Utilize advanced security measures such as two-factor authentication, transaction limits, and fraud detection systems to safeguard financial data.

* Mobile Banking: Access banking services conveniently through the CIMB Clicks Mobile app, available for both iOS and Android devices.

Eligibility and Requirements:

To register for CIMB Clicks Singapore, individuals must be:

* Aged 18 years or above

* Singapore citizens, permanent residents, or foreigners with a valid work permit or student pass

* Customers of CIMB Bank Singapore Limited

Registration and Activation:

Registration for CIMB Clicks Singapore is straightforward. Customers can either visit a CIMB branch or register online through the bank's website. Once registered, activation requires verification through a secure token device or mobile number.

Customer Support:

CIMB Clicks Singapore provides comprehensive customer support through various channels:

* Online Help Center: Access FAQs, user guides, and troubleshooting tips.

* Live Chat: Connect with a customer service representative in real-time.

* Email Support: Submit inquiries or request assistance via email.

* Phone Support: Call the designated hotline for immediate assistance.

Security and Privacy:

CIMB Clicks Singapore employs robust security measures to protect customer information and transactions. The platform is compliant with international security standards and undergoes regular audits to ensure data integrity and privacy.