ET Money, the trusted choice of millions of investors across India for investment in Direct Mutual Funds, NPS, Fixed Deposit & ET Money Genius.

ET Money also provides the ultimate guide for all your financial needs, including investing in MFs through SIP/lumpsum investment, stocks, managing personal finances, and securing your retirement.

📌

Why Invest in ET Money Direct Mutual Funds?

-Zero Commission: Manage your funds with no commission charges🤩.

-Fast and Paperless: Invest in Direct Mutual Funds effortlessly and without any problem..

-Versatile Options: Choose between SIPs or lump sum investments.

-Enhanced Returns: Switch to Direct Plans for up to 1% extra returns on existing investments.

-Tax Savings: Invest in ELSS mutual funds starting SIP at just ₹500 per month.

-Expert Guidance: Discover top-rated MF schemes tailored to your financial goals and risk tolerance.

-Seamless Integration with UPI Payment Apps: Google Pay, PhonePe, BHIM UPI, Paytm, and more.

-Explore Diverse Mutual Fund Options, including equity, ELSS, small-cap, large-cap, balanced, gold, sector, etc., all within a single MF app.

-Invest in top MF schemes from AMCs like SBI Mutual Fund, Nippon India Mutual Fund, ICICI Prudential Mutual Fund, and many more.

📌

Why Trust ET Money App for the Investment?

💸

Most Trusted Investment App

ET Money is proud to be recognized as a trusted app for investing in Direct Mutual Funds and comprehensive Personal Finance Management.

💸

Investment Made Easy

With ET Money app, you can seamlessly invest, monitor, manage, and educate yourself about mutual fund investments.

💸

Create Personalized Investment Plan

ET Money Genius: Multi-asset investment solution with quant models for optimal returns, considering rates, inflation, equity, and market trends. This can create personalized investment plan and suggest mutual funds & stocks portfolio as per investor personality

💸

Track your Mutual Funds Portfolio Health

ET Money Mutual Fund App provides you a streamlined dashboard for external mutual funds, easy PDF uploads, track returns, and receive risk-reducing suggestions in investment health reports.

💸

Start Your Investment Journey for Free

Begin investing for free, create an account in minutes, start SIPs/lump sum investments effortlessly, with a minimum of ₹500 per month.

💸

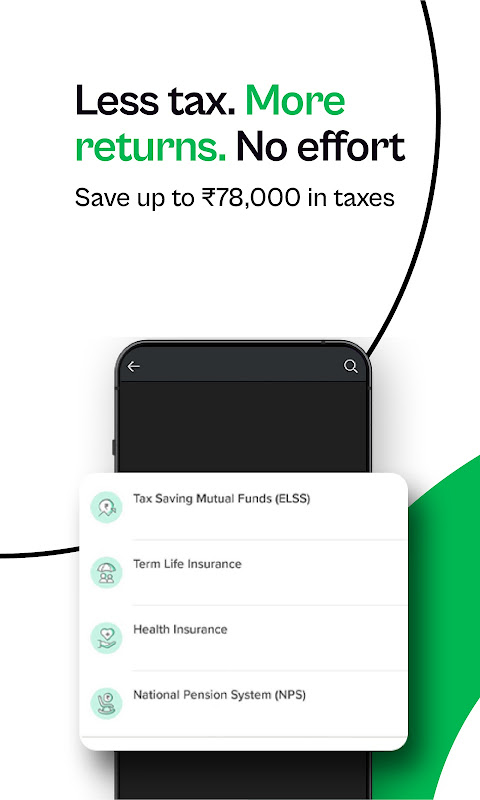

Maximize Your Tax Savings

ET Money Tax Saving Maximiser assists you to save up to ₹78,000 on taxes💵: ₹46,800 with ELSS Mutual Fund & Term Insurance, ₹15,600 via NPS, and ₹15,600 with Health Insurance.

💸

Secure and Lucrative Fixed Deposits

Through ET Money Fixed Deposits with Bajaj Finance, earn higher returns compared to traditional bank FDs, with assured returns up to 8.60%.

💸

Plan Your Retirement with NPS

Open a hassle-free NPS account. Existing investors can contribute using their PRAN. Contribute to NPS through an SIP or lump sum investments.

💸

Stocks Recommendation

ET Money uses a momentum-based strategy to recommend stocks, providing two buy recommendations each week on the first business day.

💸

Streamline Finances with Expense Management

Monitor and manage your expenses and bills 🧾 in one place to never miss a payment.

💸

Useful Investment Guide and Tips

💡Learn all about Mutual Fund, FD, NPS, Stocks and other Personal Finance options.

📌

Permissions Explanation:

-Camera: To capture necessary KYC verification documents.

-Storage: To upload images from your device for KYC verification.

ET Money is your trusted financial partner, SEBI Reg. No. INA100006898. BanayanTree Services Limited. 📧 Contact us at [email protected] for assistance.

Introduction:

ET Money is a comprehensive financial management platform that offers a user-friendly mobile application for investing in mutual funds and setting up Systematic Investment Plans (SIPs). With a seamless and intuitive interface, the app empowers investors of all levels to make informed financial decisions and grow their wealth effortlessly.

Key Features:

Mutual Fund Investment:

* Access a wide range of mutual funds from top fund houses

* Choose from various investment options tailored to specific financial goals

* Invest in lumpsum or set up regular SIPs to automate investments

SIP Management:

* Create and manage multiple SIPs with ease

* Set up SIPs with flexible investment amounts and frequencies

* Track SIP performance and adjust contributions as needed

Investment Tracking:

* Monitor your investments in real-time with detailed portfolio analysis

* Track performance of individual funds and compare them against benchmarks

* Receive regular updates and notifications on investment activity

Goal-Based Investing:

* Set financial goals and create customized investment plans

* The app recommends suitable mutual funds based on your goals and risk appetite

* Track progress towards achieving your financial targets

Financial Planning Tools:

* Access free financial planning tools, including calculators and planners

* Get personalized recommendations based on your financial situation

* Learn about investment strategies and market trends

User Experience:

* Intuitive and easy-to-use interface

* Secure and reliable platform

* Excellent customer support via chat, email, and phone

Benefits:

* Convenience: Invest in mutual funds and SIPs anytime, anywhere

* Simplicity: Streamlined investment process for beginners and experienced investors

* Customization: Tailor investments to specific financial goals

* Transparency: Real-time portfolio tracking and regular updates

* Expertise: Access to financial planning tools and expert advice

Conclusion:

ET Money Mutual Fund & SIP App is an invaluable tool for anyone looking to invest in mutual funds and build their financial future. With its user-friendly interface, comprehensive features, and personalized recommendations, the app empowers investors to make informed decisions, automate investments, and achieve their financial goals effortlessly. Whether you're a seasoned investor or just starting out, ET Money provides the support and guidance you need to succeed in your financial journey.

ET Money, the trusted choice of millions of investors across India for investment in Direct Mutual Funds, NPS, Fixed Deposit & ET Money Genius.

ET Money also provides the ultimate guide for all your financial needs, including investing in MFs through SIP/lumpsum investment, stocks, managing personal finances, and securing your retirement.

📌

Why Invest in ET Money Direct Mutual Funds?

-Zero Commission: Manage your funds with no commission charges🤩.

-Fast and Paperless: Invest in Direct Mutual Funds effortlessly and without any problem..

-Versatile Options: Choose between SIPs or lump sum investments.

-Enhanced Returns: Switch to Direct Plans for up to 1% extra returns on existing investments.

-Tax Savings: Invest in ELSS mutual funds starting SIP at just ₹500 per month.

-Expert Guidance: Discover top-rated MF schemes tailored to your financial goals and risk tolerance.

-Seamless Integration with UPI Payment Apps: Google Pay, PhonePe, BHIM UPI, Paytm, and more.

-Explore Diverse Mutual Fund Options, including equity, ELSS, small-cap, large-cap, balanced, gold, sector, etc., all within a single MF app.

-Invest in top MF schemes from AMCs like SBI Mutual Fund, Nippon India Mutual Fund, ICICI Prudential Mutual Fund, and many more.

📌

Why Trust ET Money App for the Investment?

💸

Most Trusted Investment App

ET Money is proud to be recognized as a trusted app for investing in Direct Mutual Funds and comprehensive Personal Finance Management.

💸

Investment Made Easy

With ET Money app, you can seamlessly invest, monitor, manage, and educate yourself about mutual fund investments.

💸

Create Personalized Investment Plan

ET Money Genius: Multi-asset investment solution with quant models for optimal returns, considering rates, inflation, equity, and market trends. This can create personalized investment plan and suggest mutual funds & stocks portfolio as per investor personality

💸

Track your Mutual Funds Portfolio Health

ET Money Mutual Fund App provides you a streamlined dashboard for external mutual funds, easy PDF uploads, track returns, and receive risk-reducing suggestions in investment health reports.

💸

Start Your Investment Journey for Free

Begin investing for free, create an account in minutes, start SIPs/lump sum investments effortlessly, with a minimum of ₹500 per month.

💸

Maximize Your Tax Savings

ET Money Tax Saving Maximiser assists you to save up to ₹78,000 on taxes💵: ₹46,800 with ELSS Mutual Fund & Term Insurance, ₹15,600 via NPS, and ₹15,600 with Health Insurance.

💸

Secure and Lucrative Fixed Deposits

Through ET Money Fixed Deposits with Bajaj Finance, earn higher returns compared to traditional bank FDs, with assured returns up to 8.60%.

💸

Plan Your Retirement with NPS

Open a hassle-free NPS account. Existing investors can contribute using their PRAN. Contribute to NPS through an SIP or lump sum investments.

💸

Stocks Recommendation

ET Money uses a momentum-based strategy to recommend stocks, providing two buy recommendations each week on the first business day.

💸

Streamline Finances with Expense Management

Monitor and manage your expenses and bills 🧾 in one place to never miss a payment.

💸

Useful Investment Guide and Tips

💡Learn all about Mutual Fund, FD, NPS, Stocks and other Personal Finance options.

📌

Permissions Explanation:

-Camera: To capture necessary KYC verification documents.

-Storage: To upload images from your device for KYC verification.

ET Money is your trusted financial partner, SEBI Reg. No. INA100006898. BanayanTree Services Limited. 📧 Contact us at [email protected] for assistance.

Introduction:

ET Money is a comprehensive financial management platform that offers a user-friendly mobile application for investing in mutual funds and setting up Systematic Investment Plans (SIPs). With a seamless and intuitive interface, the app empowers investors of all levels to make informed financial decisions and grow their wealth effortlessly.

Key Features:

Mutual Fund Investment:

* Access a wide range of mutual funds from top fund houses

* Choose from various investment options tailored to specific financial goals

* Invest in lumpsum or set up regular SIPs to automate investments

SIP Management:

* Create and manage multiple SIPs with ease

* Set up SIPs with flexible investment amounts and frequencies

* Track SIP performance and adjust contributions as needed

Investment Tracking:

* Monitor your investments in real-time with detailed portfolio analysis

* Track performance of individual funds and compare them against benchmarks

* Receive regular updates and notifications on investment activity

Goal-Based Investing:

* Set financial goals and create customized investment plans

* The app recommends suitable mutual funds based on your goals and risk appetite

* Track progress towards achieving your financial targets

Financial Planning Tools:

* Access free financial planning tools, including calculators and planners

* Get personalized recommendations based on your financial situation

* Learn about investment strategies and market trends

User Experience:

* Intuitive and easy-to-use interface

* Secure and reliable platform

* Excellent customer support via chat, email, and phone

Benefits:

* Convenience: Invest in mutual funds and SIPs anytime, anywhere

* Simplicity: Streamlined investment process for beginners and experienced investors

* Customization: Tailor investments to specific financial goals

* Transparency: Real-time portfolio tracking and regular updates

* Expertise: Access to financial planning tools and expert advice

Conclusion:

ET Money Mutual Fund & SIP App is an invaluable tool for anyone looking to invest in mutual funds and build their financial future. With its user-friendly interface, comprehensive features, and personalized recommendations, the app empowers investors to make informed decisions, automate investments, and achieve their financial goals effortlessly. Whether you're a seasoned investor or just starting out, ET Money provides the support and guidance you need to succeed in your financial journey.