Thanks to all its features, Linxo goes beyond the simple application of your bank. You take charge of your budget and your savings.

100% secure technology, approved by the Banque de France (under number 16928)

NEARLY 320 BANKS AND ACCOUNTS AVAILABLE IN ONE APP

Your Linxo secure space is automatically synchronized every day with more than 320 banks and types of accounts (Personal, Pro, Association, CB, Passbooks, Life Insurance, etc.).

REFERENCE TECHNOLOGY

• Linxo technology is used in France by the largest banking and insurance groups such as HSBC and LCL.

• We are supported by a recognized banking shareholder (Crédit Agricole) and remain independent in our choices

• Linxo is capitalized at 23.2 million euros

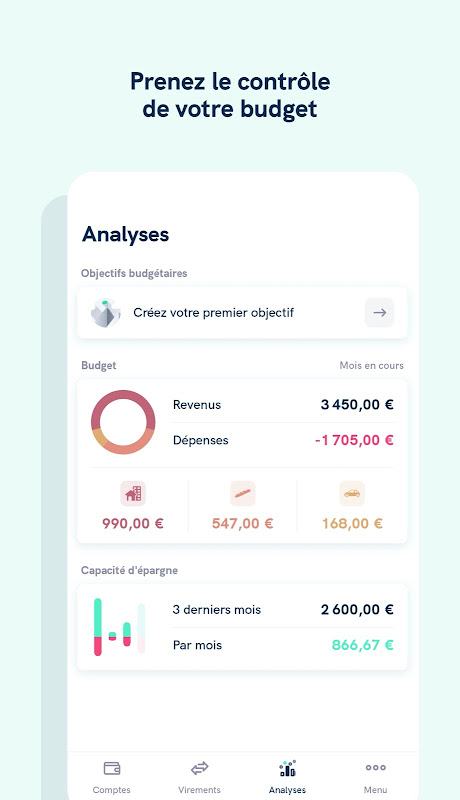

KNOW (FINALLY) WHERE YOUR MONEY GOES EACH MONTH

• Automatic classification of all your operations in customizable categories (food, salary, etc.).

• Interactive charts for a simplified view

FOLLOW ALL YOUR INVESTMENTS (in beta)

Beyond the overview of your classic accounts, Linxo offers you simplified monitoring of all your savings accounts (PEA, PEE, PER, life insurance, etc.) regardless of your financial institution. You can also view the distribution of your investment funds as well as track their performance over time.

MAKE YOUR TRANSFERS SIMPLY:

Linxo now allows you to make a transfer in a few clicks. This feature is available in more than 37 banks. Add your beneficiaries without validation time from your bank or initiate your transfers without pre-registration.

BEFORE YOU CONSULTED YOUR ACCOUNTS?

Now your accounts are consulting you!

Receive notifications when you receive your salary, for your bank charges, or in case of important news on your accounts. All configurable according to your wishes.

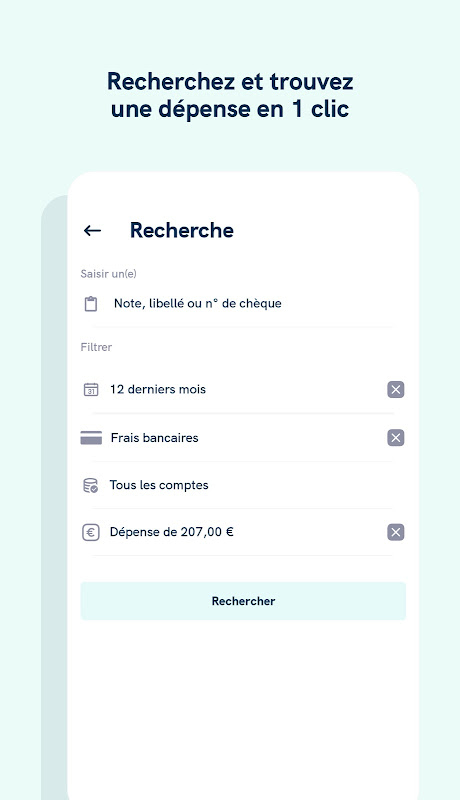

SEARCH. FIND. IN 2 SECONDS. Really.

With the multi-criteria search (exclusive to Linxo!), easily find one or more transactions based on its wording, amount, range of amount or category.

GO FURTHER WITH LINXO PREMIUM

A Premium version is available for in-app purchase. It allows you, among other things:

• forecast the balance of your accounts over 30 rolling days

• to carry out unlimited searches over time

• create your own expense or income categories

PREDICT THE FUTURE OF YOUR ACCOUNTS

Forget about accidental overdrafts thanks to Forecasting!

Linxo automatically identifies your recurring transactions (salary, rent, etc.) even including your specific transactions (cheques, for example).

SECURED

• As secure as a bank's website

• Linxo Group has obtained ISO 27001 certification, thus being the 1st in the EU to have this level of recognition in terms of security

• The security of our servers is checked daily by McAfee, a reference in data protection

• Security processes regularly audited by partner banks

• Your information is permanently encrypted and secure and is NEVER stored on your smartphone

THEY TALK ABOUT US :

• European FinTech Awards 2016: No. 1 in France, European Top 20

• Top FrenchWeb of French Tech companies: 2016 and 2017

• “Best app in finance category” - App Store

AVAILABLE BANKS:

See the list of nearly 320 banks and account types available on the Linxo website, including:

• Agricultural credit

• Societe Generale

• BNP Paribas

• Savings bank

• The postal bank

• LCL

• People's Bank

• Boursorama

• American Express

• Hello Bank!

• BRED

• CIC

• Mutual credit

• Crédit du Nord & group banks

• BforBank

• HSBC

• Fortuneo

• ING Direct

• Shine

• Axa bank

• Yomoni

• Nickel Account

• Carrefour Bank

• Amundi

• Qonto

• Casino Bank

• And many others...

Linxo is a comprehensive budgeting app that empowers users to take control of their finances and achieve their financial goals. With its intuitive interface and advanced features, Linxo makes it easy to track expenses, create budgets, and stay on top of financial obligations.

Expense Tracking:

Linxo seamlessly connects to users' bank accounts, credit cards, and other financial accounts, automatically importing transactions and categorizing them. This eliminates the need for manual data entry, ensuring accuracy and saving valuable time. The app's powerful search and filtering capabilities allow users to quickly find specific transactions and analyze their spending patterns.

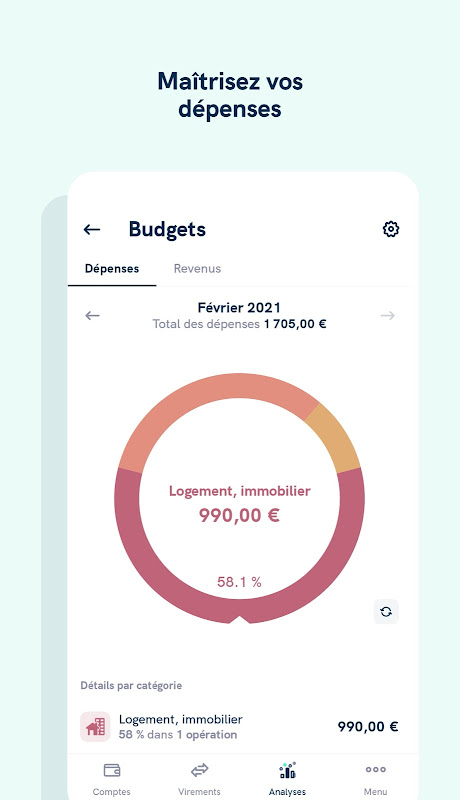

Budgeting:

Based on the imported transactions, Linxo helps users create realistic budgets. The app provides customizable budget categories and allows users to set spending limits for each category. Linxo's visual budgeting tools provide clear insights into how expenses align with the budget, highlighting areas where adjustments can be made.

Financial Analysis:

Linxo offers advanced financial analysis tools to help users understand their spending habits and identify potential areas for improvement. The app generates reports that provide detailed breakdowns of expenses by category, payee, and time period. These reports empower users to identify trends, make informed decisions, and optimize their financial strategies.

Goal Setting:

Linxo allows users to set financial goals, such as saving for a down payment or paying off debt. The app tracks progress towards these goals and provides personalized recommendations on how to adjust spending and increase savings.

Security:

Linxo prioritizes the security of users' financial data. The app utilizes industry-leading encryption and adheres to strict data protection regulations. Linxo also offers two-factor authentication to enhance account security.

Additional Features:

In addition to its core features, Linxo offers a range of additional features to enhance the user experience:

* Bill Reminders: Set reminders for upcoming bills to avoid late payments and penalties.

* Split Transactions: Easily split transactions into multiple categories, providing a more granular view of expenses.

* Notes and Attachments: Add notes and attach receipts to transactions for additional context and documentation.

* Export Data: Export financial data in various formats for use in other applications or for sharing with financial advisors.

Benefits of Using Linxo:

* Comprehensive Expense Tracking: Eliminate manual data entry and gain a clear picture of spending.

* Effective Budgeting: Create and manage budgets to stay within financial limits.

* Advanced Financial Analysis: Identify spending patterns, optimize strategies, and make informed decisions.

* Goal Setting and Tracking: Set financial goals and track progress towards achieving them.

* Enhanced Security: Protect financial data with industry-leading encryption and security measures.

Thanks to all its features, Linxo goes beyond the simple application of your bank. You take charge of your budget and your savings.

100% secure technology, approved by the Banque de France (under number 16928)

NEARLY 320 BANKS AND ACCOUNTS AVAILABLE IN ONE APP

Your Linxo secure space is automatically synchronized every day with more than 320 banks and types of accounts (Personal, Pro, Association, CB, Passbooks, Life Insurance, etc.).

REFERENCE TECHNOLOGY

• Linxo technology is used in France by the largest banking and insurance groups such as HSBC and LCL.

• We are supported by a recognized banking shareholder (Crédit Agricole) and remain independent in our choices

• Linxo is capitalized at 23.2 million euros

KNOW (FINALLY) WHERE YOUR MONEY GOES EACH MONTH

• Automatic classification of all your operations in customizable categories (food, salary, etc.).

• Interactive charts for a simplified view

FOLLOW ALL YOUR INVESTMENTS (in beta)

Beyond the overview of your classic accounts, Linxo offers you simplified monitoring of all your savings accounts (PEA, PEE, PER, life insurance, etc.) regardless of your financial institution. You can also view the distribution of your investment funds as well as track their performance over time.

MAKE YOUR TRANSFERS SIMPLY:

Linxo now allows you to make a transfer in a few clicks. This feature is available in more than 37 banks. Add your beneficiaries without validation time from your bank or initiate your transfers without pre-registration.

BEFORE YOU CONSULTED YOUR ACCOUNTS?

Now your accounts are consulting you!

Receive notifications when you receive your salary, for your bank charges, or in case of important news on your accounts. All configurable according to your wishes.

SEARCH. FIND. IN 2 SECONDS. Really.

With the multi-criteria search (exclusive to Linxo!), easily find one or more transactions based on its wording, amount, range of amount or category.

GO FURTHER WITH LINXO PREMIUM

A Premium version is available for in-app purchase. It allows you, among other things:

• forecast the balance of your accounts over 30 rolling days

• to carry out unlimited searches over time

• create your own expense or income categories

PREDICT THE FUTURE OF YOUR ACCOUNTS

Forget about accidental overdrafts thanks to Forecasting!

Linxo automatically identifies your recurring transactions (salary, rent, etc.) even including your specific transactions (cheques, for example).

SECURED

• As secure as a bank's website

• Linxo Group has obtained ISO 27001 certification, thus being the 1st in the EU to have this level of recognition in terms of security

• The security of our servers is checked daily by McAfee, a reference in data protection

• Security processes regularly audited by partner banks

• Your information is permanently encrypted and secure and is NEVER stored on your smartphone

THEY TALK ABOUT US :

• European FinTech Awards 2016: No. 1 in France, European Top 20

• Top FrenchWeb of French Tech companies: 2016 and 2017

• “Best app in finance category” - App Store

AVAILABLE BANKS:

See the list of nearly 320 banks and account types available on the Linxo website, including:

• Agricultural credit

• Societe Generale

• BNP Paribas

• Savings bank

• The postal bank

• LCL

• People's Bank

• Boursorama

• American Express

• Hello Bank!

• BRED

• CIC

• Mutual credit

• Crédit du Nord & group banks

• BforBank

• HSBC

• Fortuneo

• ING Direct

• Shine

• Axa bank

• Yomoni

• Nickel Account

• Carrefour Bank

• Amundi

• Qonto

• Casino Bank

• And many others...

Linxo is a comprehensive budgeting app that empowers users to take control of their finances and achieve their financial goals. With its intuitive interface and advanced features, Linxo makes it easy to track expenses, create budgets, and stay on top of financial obligations.

Expense Tracking:

Linxo seamlessly connects to users' bank accounts, credit cards, and other financial accounts, automatically importing transactions and categorizing them. This eliminates the need for manual data entry, ensuring accuracy and saving valuable time. The app's powerful search and filtering capabilities allow users to quickly find specific transactions and analyze their spending patterns.

Budgeting:

Based on the imported transactions, Linxo helps users create realistic budgets. The app provides customizable budget categories and allows users to set spending limits for each category. Linxo's visual budgeting tools provide clear insights into how expenses align with the budget, highlighting areas where adjustments can be made.

Financial Analysis:

Linxo offers advanced financial analysis tools to help users understand their spending habits and identify potential areas for improvement. The app generates reports that provide detailed breakdowns of expenses by category, payee, and time period. These reports empower users to identify trends, make informed decisions, and optimize their financial strategies.

Goal Setting:

Linxo allows users to set financial goals, such as saving for a down payment or paying off debt. The app tracks progress towards these goals and provides personalized recommendations on how to adjust spending and increase savings.

Security:

Linxo prioritizes the security of users' financial data. The app utilizes industry-leading encryption and adheres to strict data protection regulations. Linxo also offers two-factor authentication to enhance account security.

Additional Features:

In addition to its core features, Linxo offers a range of additional features to enhance the user experience:

* Bill Reminders: Set reminders for upcoming bills to avoid late payments and penalties.

* Split Transactions: Easily split transactions into multiple categories, providing a more granular view of expenses.

* Notes and Attachments: Add notes and attach receipts to transactions for additional context and documentation.

* Export Data: Export financial data in various formats for use in other applications or for sharing with financial advisors.

Benefits of Using Linxo:

* Comprehensive Expense Tracking: Eliminate manual data entry and gain a clear picture of spending.

* Effective Budgeting: Create and manage budgets to stay within financial limits.

* Advanced Financial Analysis: Identify spending patterns, optimize strategies, and make informed decisions.

* Goal Setting and Tracking: Set financial goals and track progress towards achieving them.

* Enhanced Security: Protect financial data with industry-leading encryption and security measures.