Hi! This is MobilePay. You know, that app that makes payments very, very easy: Send money to a friend (or someone you don't know), pay in shops, online, or in other apps. And that's far from the only thing you can do.

You can also use MobilePay to:

* Request money

* Receive money

* Pay your bills

* Have recurring payment agreements

* Split expenses in a group

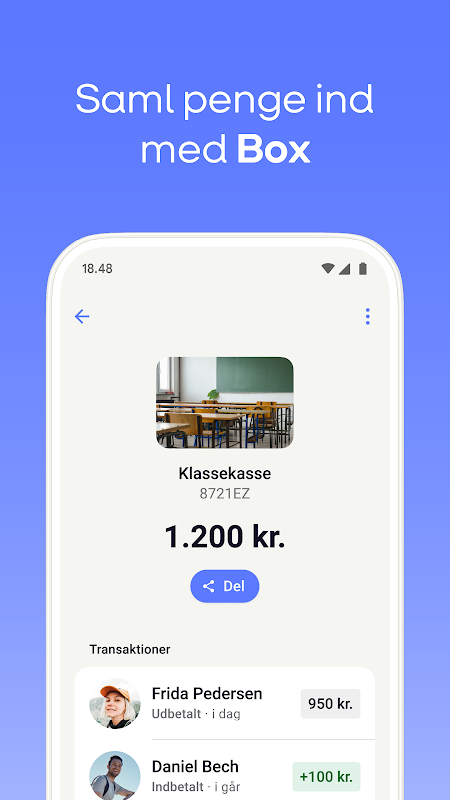

* Collect money with a box

* Send (scheduled) money gifts wrapped in digital wrapping paper

Did we mention that it's completely safe and completely free to send money and pay with MobilePay? If that's not very, very easy, well, then we don't know…

The only thing you need (besides permission from your parents if you're under 18) is a payment card from and an account in a Danish bank – and a phone number, an email address, and MitID.

And remember, this app is only made for private use. If you want to use us for that, you can of course do that too – then you just need a business agreement. Luckily, you can get that very easily. Read more about it and much more at mobilepay.dk.

MobilePay is made in the Nordics with a love for simplification, so it's naturally available in Danish, English, Swedish, Finnish, and two kinds of Norwegian.

Introduction

MobilePay is Denmark's most popular mobile payment platform, revolutionizing the way people make payments and transfer money. With over 4.6 million active users, it has become an integral part of Danish society, facilitating seamless and secure financial transactions.

Functionality

MobilePay enables users to make instant payments to other users, businesses, and government agencies. It also allows for splitting bills, sending payment requests, and managing subscriptions. Additionally, MobilePay offers a range of financial services, including a digital wallet, budgeting tools, and personal loans.

Security and Privacy

MobilePay prioritizes security and privacy. It employs multiple layers of protection, including end-to-end encryption, two-factor authentication, and fraud detection systems. Users' personal and financial data are stored securely in accordance with industry standards.

Convenience and Accessibility

MobilePay is designed for maximum convenience. Its user-friendly app is available for both iOS and Android devices. The platform integrates with a wide range of banks and financial institutions, allowing users to link their bank accounts and make payments directly from their smartphones.

Business Solutions

MobilePay offers tailored solutions for businesses of all sizes. It provides tools for accepting payments, managing invoices, and automating payment processes. Businesses can also leverage MobilePay's loyalty programs and marketing tools to engage with customers.

Integration with Other Services

MobilePay seamlessly integrates with a variety of third-party services, including online stores, social media platforms, and government websites. This integration enables users to make payments and manage their finances directly within these services.

Innovation and Expansion

MobilePay is constantly innovating and expanding its offerings. It has recently introduced new features such as voice-activated payments, facial recognition authentication, and a mobile ID service. The platform has also expanded into other Nordic countries, including Sweden and Norway.

Benefits of Using MobilePay

* Instant and secure payments

* Convenient and accessible

* Integrates with multiple banks

* Offers a range of financial services

* Tailored solutions for businesses

* Integrates with other services

* Constantly innovating and expanding

Conclusion

MobilePay is the leading mobile payment platform in Denmark, offering a comprehensive range of services and benefits. Its user-friendly app, robust security measures, and wide range of integrations make it an essential tool for individuals and businesses alike. As MobilePay continues to innovate and expand, it is poised to remain a driving force in the digital payments landscape.

Hi! This is MobilePay. You know, that app that makes payments very, very easy: Send money to a friend (or someone you don't know), pay in shops, online, or in other apps. And that's far from the only thing you can do.

You can also use MobilePay to:

* Request money

* Receive money

* Pay your bills

* Have recurring payment agreements

* Split expenses in a group

* Collect money with a box

* Send (scheduled) money gifts wrapped in digital wrapping paper

Did we mention that it's completely safe and completely free to send money and pay with MobilePay? If that's not very, very easy, well, then we don't know…

The only thing you need (besides permission from your parents if you're under 18) is a payment card from and an account in a Danish bank – and a phone number, an email address, and MitID.

And remember, this app is only made for private use. If you want to use us for that, you can of course do that too – then you just need a business agreement. Luckily, you can get that very easily. Read more about it and much more at mobilepay.dk.

MobilePay is made in the Nordics with a love for simplification, so it's naturally available in Danish, English, Swedish, Finnish, and two kinds of Norwegian.

Introduction

MobilePay is Denmark's most popular mobile payment platform, revolutionizing the way people make payments and transfer money. With over 4.6 million active users, it has become an integral part of Danish society, facilitating seamless and secure financial transactions.

Functionality

MobilePay enables users to make instant payments to other users, businesses, and government agencies. It also allows for splitting bills, sending payment requests, and managing subscriptions. Additionally, MobilePay offers a range of financial services, including a digital wallet, budgeting tools, and personal loans.

Security and Privacy

MobilePay prioritizes security and privacy. It employs multiple layers of protection, including end-to-end encryption, two-factor authentication, and fraud detection systems. Users' personal and financial data are stored securely in accordance with industry standards.

Convenience and Accessibility

MobilePay is designed for maximum convenience. Its user-friendly app is available for both iOS and Android devices. The platform integrates with a wide range of banks and financial institutions, allowing users to link their bank accounts and make payments directly from their smartphones.

Business Solutions

MobilePay offers tailored solutions for businesses of all sizes. It provides tools for accepting payments, managing invoices, and automating payment processes. Businesses can also leverage MobilePay's loyalty programs and marketing tools to engage with customers.

Integration with Other Services

MobilePay seamlessly integrates with a variety of third-party services, including online stores, social media platforms, and government websites. This integration enables users to make payments and manage their finances directly within these services.

Innovation and Expansion

MobilePay is constantly innovating and expanding its offerings. It has recently introduced new features such as voice-activated payments, facial recognition authentication, and a mobile ID service. The platform has also expanded into other Nordic countries, including Sweden and Norway.

Benefits of Using MobilePay

* Instant and secure payments

* Convenient and accessible

* Integrates with multiple banks

* Offers a range of financial services

* Tailored solutions for businesses

* Integrates with other services

* Constantly innovating and expanding

Conclusion

MobilePay is the leading mobile payment platform in Denmark, offering a comprehensive range of services and benefits. Its user-friendly app, robust security measures, and wide range of integrations make it an essential tool for individuals and businesses alike. As MobilePay continues to innovate and expand, it is poised to remain a driving force in the digital payments landscape.