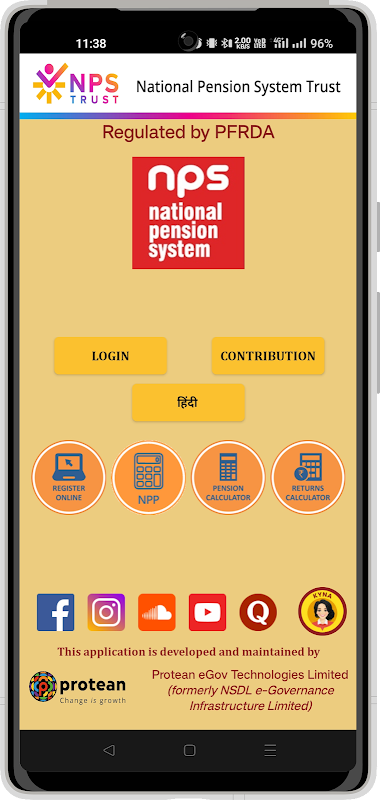

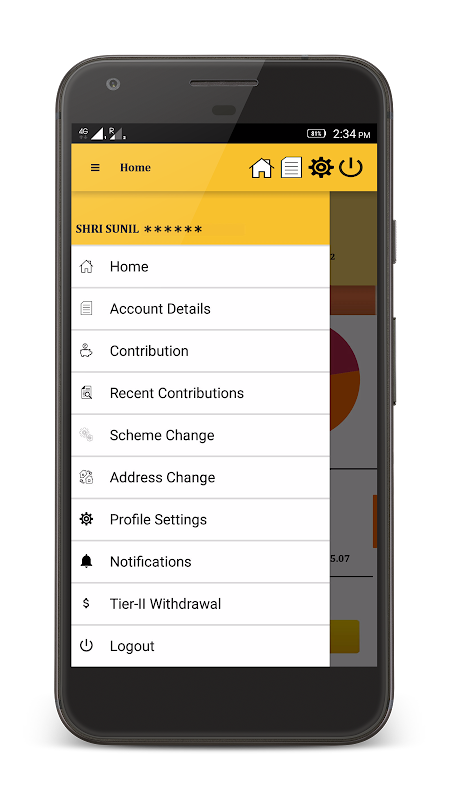

The new APP gives your details of Subscribers account online. The Subscriber can access latest account details as is available on the CRA web site using user ID (PRAN) and password. The APP access your account details online and provides you with user friendly interface to browse through your account information. It also enables you to maintain your latest contact details and password.

The APP gives better user experience and provides additional functionality such as

1. View current holdings

2. Request for Transaction Statement for the year on your email ID.

3. Submit Contribution for Tier I / Tier II

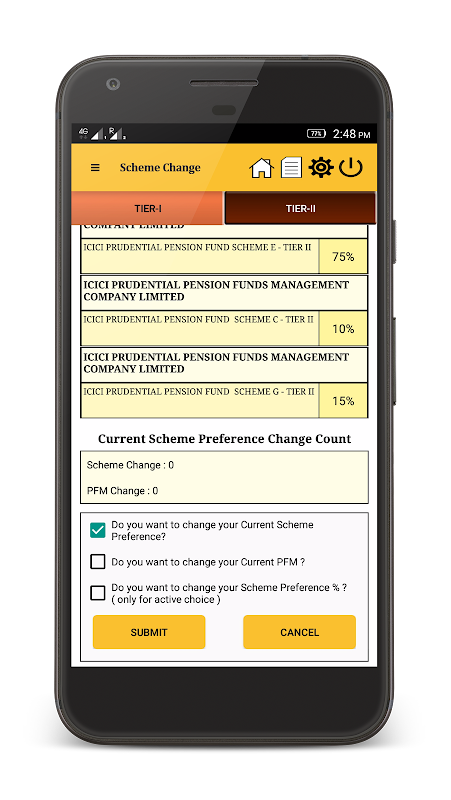

4. Change Scheme Preference

5. Initiate withdrawal from Tier II account

6. View your Account details.

7. Download e-PRAN

8. Inquiry/ raise Grievance

9. View Last 5 contribution transactions carried out

10. Change contact details like Telephone, Mobile no. and email ID.

11. Change your Password / Secret Question

12. Regenerate password using secret Question/ OTP

13. Get notifications related to NPS.

Gameplay:

NPS, an abbreviation for National Pension System, is a government-backed retirement savings scheme designed to provide a secure financial future for Indian citizens. Participants contribute a portion of their income to the scheme, which is then invested in various asset classes, including government securities, corporate bonds, and equity. The accumulated funds grow over time, providing a substantial corpus upon retirement.

Key Features:

* Tax Benefits: NPS offers significant tax benefits to subscribers. Contributions made to the scheme are eligible for tax deductions under Section 80C of the Income Tax Act. Additionally, the returns generated on these investments are tax-free, making it an attractive long-term investment option.

* Flexibility: NPS provides flexibility to subscribers in terms of contribution amounts and investment options. Participants can choose to contribute a fixed amount monthly or make ad-hoc contributions. They can also customize their investment portfolio based on their risk appetite and retirement goals.

* Government Guarantee: NPS is backed by the Government of India, ensuring the safety and security of subscribers' funds. This guarantee provides peace of mind to investors, particularly those who are risk-averse.

* Professional Management: The funds accumulated under NPS are managed by experienced fund managers who invest them in a diversified portfolio. This professional management ensures optimal returns while minimizing risks.

* Regular Monitoring: NPS subscribers have access to regular account statements and performance updates. This allows them to track their investments and make informed decisions regarding their retirement savings.

Eligibility and Contribution:

NPS is open to all Indian citizens between the ages of 18 and 65. Contributions can be made through online portals, designated banks, or authorized collection centers. The minimum monthly contribution is Rs. 500, while the maximum contribution limit is Rs. 2 lakhs per financial year.

Retirement Benefits:

Upon reaching the age of 60, NPS subscribers can withdraw a portion of their accumulated funds as a lump sum. The remaining corpus is used to purchase an annuity plan that provides regular pension payments throughout their retirement years. The annuity payments are tax-free, ensuring a steady income stream during old age.

Additional Features:

* Auto-Debit Facility: Subscribers can set up an auto-debit facility to ensure timely contributions.

* Online Account Access: Subscribers can access their NPS accounts online to view account statements, make contributions, and update their personal details.

* Investment Options: NPS offers a range of investment options, including equity funds, government securities, and corporate bonds. Subscribers can choose the options that best align with their risk appetite and investment goals.

* Additional Voluntary Contributions: Subscribers can make additional voluntary contributions over and above the minimum required amount to enhance their retirement savings.

The new APP gives your details of Subscribers account online. The Subscriber can access latest account details as is available on the CRA web site using user ID (PRAN) and password. The APP access your account details online and provides you with user friendly interface to browse through your account information. It also enables you to maintain your latest contact details and password.

The APP gives better user experience and provides additional functionality such as

1. View current holdings

2. Request for Transaction Statement for the year on your email ID.

3. Submit Contribution for Tier I / Tier II

4. Change Scheme Preference

5. Initiate withdrawal from Tier II account

6. View your Account details.

7. Download e-PRAN

8. Inquiry/ raise Grievance

9. View Last 5 contribution transactions carried out

10. Change contact details like Telephone, Mobile no. and email ID.

11. Change your Password / Secret Question

12. Regenerate password using secret Question/ OTP

13. Get notifications related to NPS.

Gameplay:

NPS, an abbreviation for National Pension System, is a government-backed retirement savings scheme designed to provide a secure financial future for Indian citizens. Participants contribute a portion of their income to the scheme, which is then invested in various asset classes, including government securities, corporate bonds, and equity. The accumulated funds grow over time, providing a substantial corpus upon retirement.

Key Features:

* Tax Benefits: NPS offers significant tax benefits to subscribers. Contributions made to the scheme are eligible for tax deductions under Section 80C of the Income Tax Act. Additionally, the returns generated on these investments are tax-free, making it an attractive long-term investment option.

* Flexibility: NPS provides flexibility to subscribers in terms of contribution amounts and investment options. Participants can choose to contribute a fixed amount monthly or make ad-hoc contributions. They can also customize their investment portfolio based on their risk appetite and retirement goals.

* Government Guarantee: NPS is backed by the Government of India, ensuring the safety and security of subscribers' funds. This guarantee provides peace of mind to investors, particularly those who are risk-averse.

* Professional Management: The funds accumulated under NPS are managed by experienced fund managers who invest them in a diversified portfolio. This professional management ensures optimal returns while minimizing risks.

* Regular Monitoring: NPS subscribers have access to regular account statements and performance updates. This allows them to track their investments and make informed decisions regarding their retirement savings.

Eligibility and Contribution:

NPS is open to all Indian citizens between the ages of 18 and 65. Contributions can be made through online portals, designated banks, or authorized collection centers. The minimum monthly contribution is Rs. 500, while the maximum contribution limit is Rs. 2 lakhs per financial year.

Retirement Benefits:

Upon reaching the age of 60, NPS subscribers can withdraw a portion of their accumulated funds as a lump sum. The remaining corpus is used to purchase an annuity plan that provides regular pension payments throughout their retirement years. The annuity payments are tax-free, ensuring a steady income stream during old age.

Additional Features:

* Auto-Debit Facility: Subscribers can set up an auto-debit facility to ensure timely contributions.

* Online Account Access: Subscribers can access their NPS accounts online to view account statements, make contributions, and update their personal details.

* Investment Options: NPS offers a range of investment options, including equity funds, government securities, and corporate bonds. Subscribers can choose the options that best align with their risk appetite and investment goals.

* Additional Voluntary Contributions: Subscribers can make additional voluntary contributions over and above the minimum required amount to enhance their retirement savings.