Welcome to NayaPay: The financial partner of choice for 1,000,000+ users.

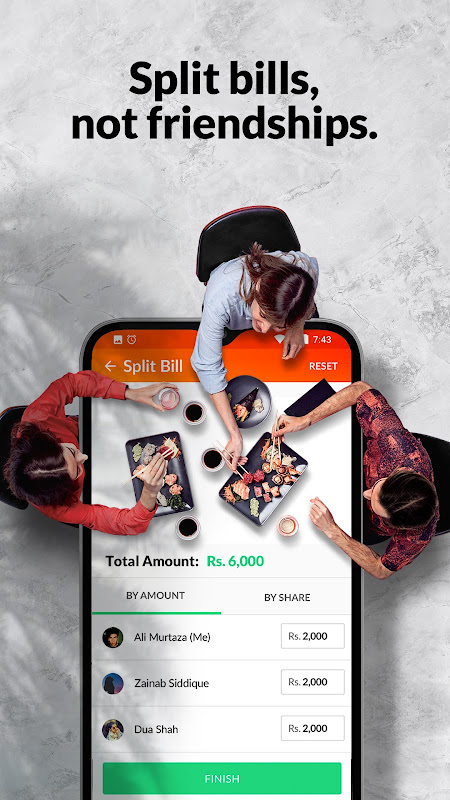

One wallet for all your everyday payments. Send money, pay bills, receive remittances from around the world, chat with friends, and shop worldwide with a free Visa debit card.

Here’s why you’ll love NayaPay:

GET STARTED INSTANTLY

Download the app and set up your account right away - no wait, no fees. All you need is your CNIC and a few minutes of your time. We’ll take care of the rest.

FREE MEANS FREE

Say goodbye to surprises (read: shocks) and unnecessary charges. No hidden fees, no annual charges and no SMS surcharge to worry about. Enjoy a free Visa card, seamless fee-free money transfers to one another and complete transparency about your money.

GO INTERNATIONAL WITH VISA

You’ll get your FREE Visa Virtual debit card on your phone immediately upon account creation. Get a physical Visa debit card delivered to your doorstep for in-store shopping and cash withdrawals from ATMs anywhere in the world.

YOU’RE IN CONTROL

Order a new card, set spending limits, freeze or unfreeze your card, change your PIN, enable or disable international transactions, online payments and contactless payments - all from within your app.

SEAMLESS MONEY TRANSFERS

Make free, instant money transfers to any bank. Your mobile number serves as your NayaPay account number, easy to remember and share with anyone to receive funds. Connect your Raast ID to your NayaPay account to send and receive money through Raast.

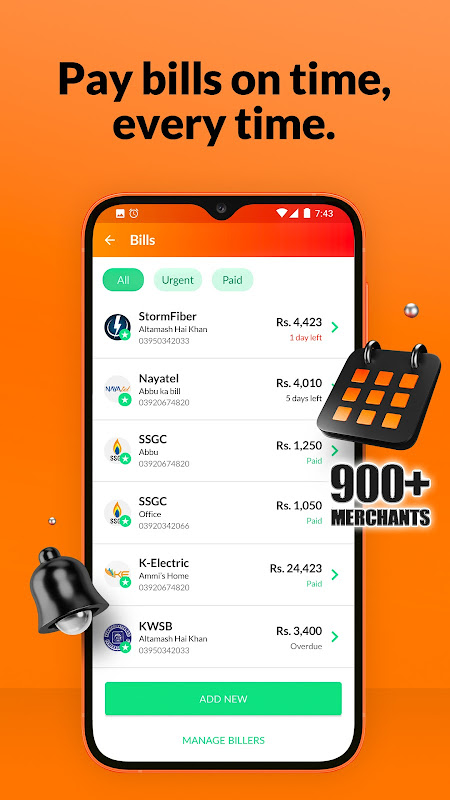

BILL PAYMENTS MADE EASY

Manage all your bills in one place. Pay hundreds of merchants from K-Electric, LESCO, and MEPCO to SNGPL, SSGC, and StormFiber right through the app. We’ll also send you reminders when your bill is due, helping you avoid pesky late payment penalties.

GLOBAL REMITTANCES

Looking to receive home remittance or freelance payments from abroad? Simply share your NayaPay IBAN, and our global remittance partners, including Payoneer, Western Union, Wise, Remitly, RIA, ACE, and more, will handle the rest. Your funds will be deposited directly in your account.

ADD MONEY TO START SPENDING

Link your bank account to effortlessly add funds to your NayaPay app. Deposit cash at partner banks or transfer money from any bank to NayaPay to load up your account and get cracking.

TOP UP AND MORE

Whether it’s Prepaid, Postpaid, or handy bundles, we’ve got you covered for Ufone, Telenor, Zong, and Jazz. From call packages to data bundles for Whatsapp, Facebook, Youtube, Tiktok, and PUBG, find all your mobile top-up needs in one place.

WE’LL TAKE YOU PLACES

Catching a flight? Pay for your Fly Jinnah ticket directly through the NayaPay app. Would you rather go on a road trip? We’ve got you there too. Ditch the toll queues, recharge your M-Tag using the app and have a smooth journey!

CHAT YOUR PAYMENTS AWAY

Add meaning to money transfers with payment notes. Chat with your friends, share photos, send voice notes, and much more. When words fall short, use our fun stickers to express yourself.

STAY ON TOP OF YOUR FINANCES

Track all your transactions with detailed, easy-to-understand transaction history. Manage your finances with digital receipts, making record-keeping a breeze.

NEVER LOSE SIGHT OF YOUR MONEY

You know what’s come in and what’s gone out instantly. Receive instant push notifications for every transaction - we’ll update you as soon as you send, receive and spend money so you’re always in the know.

YOU’RE SAFE WITH US

Enjoy secure transactions. NayaPay is PCI DSS and ISO 27001 certified. Each transaction is protected by fingerprint/Face ID or MPIN verification, ensuring only you can authorize payments.

NayaPay has been featured internationally by Forbes, TechCrunch, Nikkei Asia, Fintech Finance, Tech in Asia, Tech Node Global, The Asian Banker and more.

We are here to help, 24/7. Reach out to us via in-app chat, email at [email protected] or give us a call on +(9221) 111-222-729.

Introduction

NayaPay is a Pakistani fintech company that offers a comprehensive suite of financial services through its mobile application. Launched in 2020, the company has quickly gained popularity, becoming one of the leading digital payment platforms in Pakistan. NayaPay empowers users with a seamless and secure way to manage their finances, perform transactions, and access a range of financial products.

Key Features

NayaPay offers a wide array of features, including:

* Mobile Wallet: Users can create a NayaPay wallet to store and manage their funds, make payments, and receive money.

* Digital Payments: NayaPay enables users to make payments to businesses, individuals, and government entities through QR codes, mobile numbers, or IBANs.

* Utility Bill Payments: Users can conveniently pay their utility bills, such as electricity, gas, and water, through the NayaPay app.

* Mobile Top-Ups: NayaPay allows users to top up their mobile phone balance with ease.

* Financial Services: NayaPay offers access to a range of financial services, including micro-loans, insurance, and investment products.

* Merchant Services: Businesses can utilize NayaPay's merchant services to accept digital payments, manage invoices, and track transactions.

Security and Compliance

NayaPay prioritizes the security of its users' funds and personal information. The platform employs industry-leading security measures, including:

* PCI DSS Compliance: NayaPay is certified as compliant with the Payment Card Industry Data Security Standard (PCI DSS), ensuring the protection of sensitive financial data.

* Encryption: All data transmitted through the NayaPay app is encrypted using AES-256 encryption.

* Two-Factor Authentication: NayaPay utilizes two-factor authentication to prevent unauthorized access to user accounts.

* Biometric Authentication: Users can secure their NayaPay account with fingerprint or facial recognition technology.

Convenience and Accessibility

NayaPay is designed to provide users with a convenient and accessible financial experience. The mobile application is user-friendly and easy to navigate, making it accessible to users of all technical backgrounds. NayaPay also has a wide network of retail partners where users can deposit and withdraw funds, ensuring convenience and accessibility.

Conclusion

NayaPay is a comprehensive and innovative fintech platform that empowers Pakistani users with a wide range of financial services. Its user-friendly interface, robust security measures, and accessibility make it an ideal solution for individuals and businesses alike. As NayaPay continues to expand its offerings and partnerships, it is well-positioned to drive financial inclusion and revolutionize the digital payments landscape in Pakistan.

Welcome to NayaPay: The financial partner of choice for 1,000,000+ users.

One wallet for all your everyday payments. Send money, pay bills, receive remittances from around the world, chat with friends, and shop worldwide with a free Visa debit card.

Here’s why you’ll love NayaPay:

GET STARTED INSTANTLY

Download the app and set up your account right away - no wait, no fees. All you need is your CNIC and a few minutes of your time. We’ll take care of the rest.

FREE MEANS FREE

Say goodbye to surprises (read: shocks) and unnecessary charges. No hidden fees, no annual charges and no SMS surcharge to worry about. Enjoy a free Visa card, seamless fee-free money transfers to one another and complete transparency about your money.

GO INTERNATIONAL WITH VISA

You’ll get your FREE Visa Virtual debit card on your phone immediately upon account creation. Get a physical Visa debit card delivered to your doorstep for in-store shopping and cash withdrawals from ATMs anywhere in the world.

YOU’RE IN CONTROL

Order a new card, set spending limits, freeze or unfreeze your card, change your PIN, enable or disable international transactions, online payments and contactless payments - all from within your app.

SEAMLESS MONEY TRANSFERS

Make free, instant money transfers to any bank. Your mobile number serves as your NayaPay account number, easy to remember and share with anyone to receive funds. Connect your Raast ID to your NayaPay account to send and receive money through Raast.

BILL PAYMENTS MADE EASY

Manage all your bills in one place. Pay hundreds of merchants from K-Electric, LESCO, and MEPCO to SNGPL, SSGC, and StormFiber right through the app. We’ll also send you reminders when your bill is due, helping you avoid pesky late payment penalties.

GLOBAL REMITTANCES

Looking to receive home remittance or freelance payments from abroad? Simply share your NayaPay IBAN, and our global remittance partners, including Payoneer, Western Union, Wise, Remitly, RIA, ACE, and more, will handle the rest. Your funds will be deposited directly in your account.

ADD MONEY TO START SPENDING

Link your bank account to effortlessly add funds to your NayaPay app. Deposit cash at partner banks or transfer money from any bank to NayaPay to load up your account and get cracking.

TOP UP AND MORE

Whether it’s Prepaid, Postpaid, or handy bundles, we’ve got you covered for Ufone, Telenor, Zong, and Jazz. From call packages to data bundles for Whatsapp, Facebook, Youtube, Tiktok, and PUBG, find all your mobile top-up needs in one place.

WE’LL TAKE YOU PLACES

Catching a flight? Pay for your Fly Jinnah ticket directly through the NayaPay app. Would you rather go on a road trip? We’ve got you there too. Ditch the toll queues, recharge your M-Tag using the app and have a smooth journey!

CHAT YOUR PAYMENTS AWAY

Add meaning to money transfers with payment notes. Chat with your friends, share photos, send voice notes, and much more. When words fall short, use our fun stickers to express yourself.

STAY ON TOP OF YOUR FINANCES

Track all your transactions with detailed, easy-to-understand transaction history. Manage your finances with digital receipts, making record-keeping a breeze.

NEVER LOSE SIGHT OF YOUR MONEY

You know what’s come in and what’s gone out instantly. Receive instant push notifications for every transaction - we’ll update you as soon as you send, receive and spend money so you’re always in the know.

YOU’RE SAFE WITH US

Enjoy secure transactions. NayaPay is PCI DSS and ISO 27001 certified. Each transaction is protected by fingerprint/Face ID or MPIN verification, ensuring only you can authorize payments.

NayaPay has been featured internationally by Forbes, TechCrunch, Nikkei Asia, Fintech Finance, Tech in Asia, Tech Node Global, The Asian Banker and more.

We are here to help, 24/7. Reach out to us via in-app chat, email at [email protected] or give us a call on +(9221) 111-222-729.

Introduction

NayaPay is a Pakistani fintech company that offers a comprehensive suite of financial services through its mobile application. Launched in 2020, the company has quickly gained popularity, becoming one of the leading digital payment platforms in Pakistan. NayaPay empowers users with a seamless and secure way to manage their finances, perform transactions, and access a range of financial products.

Key Features

NayaPay offers a wide array of features, including:

* Mobile Wallet: Users can create a NayaPay wallet to store and manage their funds, make payments, and receive money.

* Digital Payments: NayaPay enables users to make payments to businesses, individuals, and government entities through QR codes, mobile numbers, or IBANs.

* Utility Bill Payments: Users can conveniently pay their utility bills, such as electricity, gas, and water, through the NayaPay app.

* Mobile Top-Ups: NayaPay allows users to top up their mobile phone balance with ease.

* Financial Services: NayaPay offers access to a range of financial services, including micro-loans, insurance, and investment products.

* Merchant Services: Businesses can utilize NayaPay's merchant services to accept digital payments, manage invoices, and track transactions.

Security and Compliance

NayaPay prioritizes the security of its users' funds and personal information. The platform employs industry-leading security measures, including:

* PCI DSS Compliance: NayaPay is certified as compliant with the Payment Card Industry Data Security Standard (PCI DSS), ensuring the protection of sensitive financial data.

* Encryption: All data transmitted through the NayaPay app is encrypted using AES-256 encryption.

* Two-Factor Authentication: NayaPay utilizes two-factor authentication to prevent unauthorized access to user accounts.

* Biometric Authentication: Users can secure their NayaPay account with fingerprint or facial recognition technology.

Convenience and Accessibility

NayaPay is designed to provide users with a convenient and accessible financial experience. The mobile application is user-friendly and easy to navigate, making it accessible to users of all technical backgrounds. NayaPay also has a wide network of retail partners where users can deposit and withdraw funds, ensuring convenience and accessibility.

Conclusion

NayaPay is a comprehensive and innovative fintech platform that empowers Pakistani users with a wide range of financial services. Its user-friendly interface, robust security measures, and accessibility make it an ideal solution for individuals and businesses alike. As NayaPay continues to expand its offerings and partnerships, it is well-positioned to drive financial inclusion and revolutionize the digital payments landscape in Pakistan.