We open the door for everyone to invest better than professional money managers.

QuantSmith creates dynamics for finding the right pattern to give you the right set of advisories. Our methodology and strategy have crunched data from over 100 years of various market cycles in all the markets across the globe, and are now equipped to help you find the most accurate ideas in the stock market.

QuantSmith uses proven portfolio allocation tools and research methodologies for portfolio construction and combines a human selection of stocks with machine-level forecasting of stock market direction. QuantSmith uses a combination of fundamental and technical analysis to identify key stocks, decide on the weightage of each stock in the portfolio, and time the entry and exit price for stocks. The whole process aims to eliminate the biases of human behavior in buying or selling which invariably leads to greed or fear in decision making.

How does QuantSmith platform work?

· QuantSmith blends fundamental, quantitative, and technical analysis with profile analysis that identifies stocks poised for outperformance.

· Our Data Scientists, Equity Analysts, and Technology team build products and portfolios that help you maximize your profit

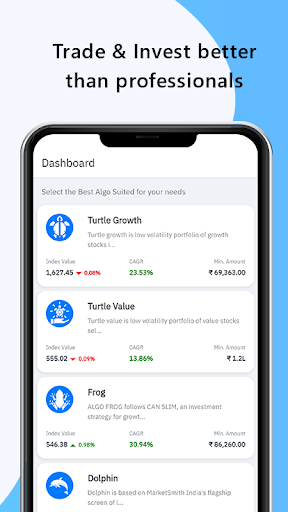

· Select the Portfolio best suited to your needs and seamlessly invest via a trading account from leading brokers

All you need to do is give an investing mandate to QuantSmith, and it will do the rest to help you make more money in the stock market. It truly is the future!

QuantSmith is a comprehensive algorithmic trading platform designed for experienced traders and quantitative analysts. It empowers users with advanced tools and features to automate trading strategies, optimize portfolio performance, and navigate complex financial markets.

Algorithmic Trading Automation:

QuantSmith's core strength lies in its ability to automate trading strategies using sophisticated algorithms. Traders can develop custom algorithms based on technical indicators, statistical models, and machine learning techniques. These algorithms monitor market data in real-time, identify trading opportunities, and execute trades automatically.

Strategy Optimization and Backtesting:

The platform provides robust optimization and backtesting capabilities to refine trading strategies. Traders can optimize algorithm parameters, evaluate historical performance, and assess risk-reward profiles before deploying them in live trading. QuantSmith's advanced backtesting engine allows users to test strategies on large datasets, simulating real-world market conditions.

Data Analysis and Visualization:

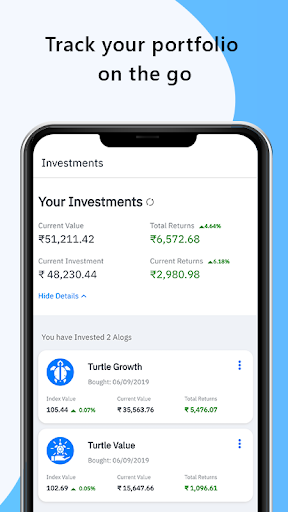

QuantSmith integrates powerful data analysis and visualization tools to facilitate in-depth market research and strategy development. Users can access historical and real-time market data, perform statistical analysis, and create custom charts and graphs. The platform's interactive dashboard provides a comprehensive overview of market trends, trading performance, and portfolio metrics.

Risk Management and Performance Monitoring:

Risk management is paramount in algorithmic trading. QuantSmith offers a range of risk management tools to control exposure and protect capital. Traders can set stop-loss levels, define position limits, and monitor risk metrics such as VaR and Sharpe ratio. The platform's performance monitoring dashboard provides detailed insights into trading results, allowing users to track profitability, efficiency, and risk-adjusted returns.

Community and Support:

QuantSmith fosters a vibrant community of experienced traders and quantitative analysts. Users can share ideas, collaborate on strategies, and access educational resources. The platform's support team provides dedicated assistance, ensuring a seamless user experience and addressing any technical queries.

Key Benefits:

* Automate trading strategies with sophisticated algorithms

* Optimize and backtest strategies to maximize performance

* Access historical and real-time market data for in-depth analysis

* Implement robust risk management measures to protect capital

* Connect with a community of experienced traders and analysts

* Benefit from dedicated support and educational resources

We open the door for everyone to invest better than professional money managers.

QuantSmith creates dynamics for finding the right pattern to give you the right set of advisories. Our methodology and strategy have crunched data from over 100 years of various market cycles in all the markets across the globe, and are now equipped to help you find the most accurate ideas in the stock market.

QuantSmith uses proven portfolio allocation tools and research methodologies for portfolio construction and combines a human selection of stocks with machine-level forecasting of stock market direction. QuantSmith uses a combination of fundamental and technical analysis to identify key stocks, decide on the weightage of each stock in the portfolio, and time the entry and exit price for stocks. The whole process aims to eliminate the biases of human behavior in buying or selling which invariably leads to greed or fear in decision making.

How does QuantSmith platform work?

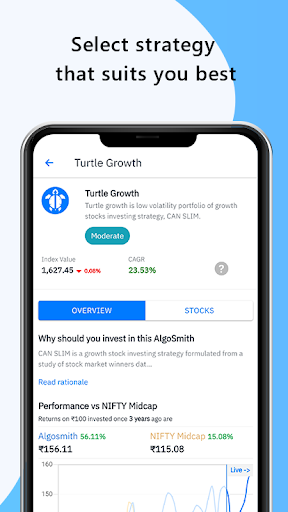

· QuantSmith blends fundamental, quantitative, and technical analysis with profile analysis that identifies stocks poised for outperformance.

· Our Data Scientists, Equity Analysts, and Technology team build products and portfolios that help you maximize your profit

· Select the Portfolio best suited to your needs and seamlessly invest via a trading account from leading brokers

All you need to do is give an investing mandate to QuantSmith, and it will do the rest to help you make more money in the stock market. It truly is the future!

QuantSmith is a comprehensive algorithmic trading platform designed for experienced traders and quantitative analysts. It empowers users with advanced tools and features to automate trading strategies, optimize portfolio performance, and navigate complex financial markets.

Algorithmic Trading Automation:

QuantSmith's core strength lies in its ability to automate trading strategies using sophisticated algorithms. Traders can develop custom algorithms based on technical indicators, statistical models, and machine learning techniques. These algorithms monitor market data in real-time, identify trading opportunities, and execute trades automatically.

Strategy Optimization and Backtesting:

The platform provides robust optimization and backtesting capabilities to refine trading strategies. Traders can optimize algorithm parameters, evaluate historical performance, and assess risk-reward profiles before deploying them in live trading. QuantSmith's advanced backtesting engine allows users to test strategies on large datasets, simulating real-world market conditions.

Data Analysis and Visualization:

QuantSmith integrates powerful data analysis and visualization tools to facilitate in-depth market research and strategy development. Users can access historical and real-time market data, perform statistical analysis, and create custom charts and graphs. The platform's interactive dashboard provides a comprehensive overview of market trends, trading performance, and portfolio metrics.

Risk Management and Performance Monitoring:

Risk management is paramount in algorithmic trading. QuantSmith offers a range of risk management tools to control exposure and protect capital. Traders can set stop-loss levels, define position limits, and monitor risk metrics such as VaR and Sharpe ratio. The platform's performance monitoring dashboard provides detailed insights into trading results, allowing users to track profitability, efficiency, and risk-adjusted returns.

Community and Support:

QuantSmith fosters a vibrant community of experienced traders and quantitative analysts. Users can share ideas, collaborate on strategies, and access educational resources. The platform's support team provides dedicated assistance, ensuring a seamless user experience and addressing any technical queries.

Key Benefits:

* Automate trading strategies with sophisticated algorithms

* Optimize and backtest strategies to maximize performance

* Access historical and real-time market data for in-depth analysis

* Implement robust risk management measures to protect capital

* Connect with a community of experienced traders and analysts

* Benefit from dedicated support and educational resources