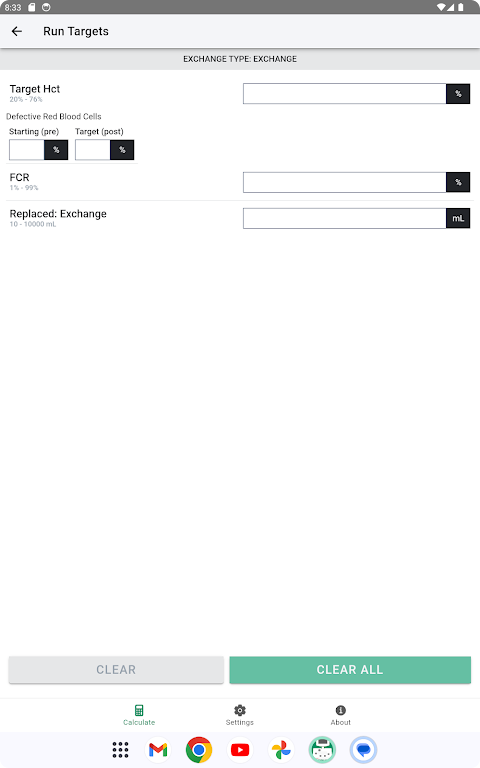

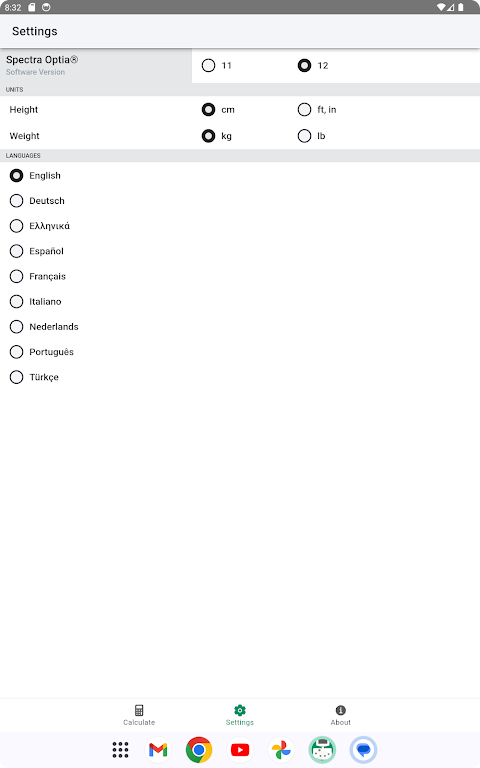

The Spectra Optia® Apheresis System RBCX Calculation Tool is intended to help medical professionals who are responsible for prescribing and performing red blood cell exchange (RBCX) procedures to estimate the volume of replacement fluid required to perform a procedure on the Spectra Optia system. Using the same patient data and the same fluid data that is entered on the Spectra Optia system, the RBCX Calculation Tool calculates and displays the estimated volume of replacement fluid required to achieve the target Hct and FCR. It can also determine whether a custom prime is recommended. While the tool is intended to help prepare for a procedure, it is not intended to be used for making medical decisions.

For more information about the tool, see the About page.

The RBCX Calculation Tool is a specialized instrument designed to assist professionals in calculating the RBCX ratio, a key financial metric used to evaluate the riskiness of a company's debt structure. This tool streamlines the computation process, providing accurate and timely results that aid in informed decision-making.

Understanding the RBCX Ratio

The RBCX ratio measures the relationship between a company's debt obligations and its ability to generate cash flow from operations. It is calculated as follows:

```

RBCX = (Net Income + Depreciation & Amortization) / Total Debt

```

A higher RBCX ratio indicates that a company has a greater capacity to service its debt, while a lower ratio suggests a higher risk of default.

Benefits of Using the RBCX Calculation Tool

The RBCX Calculation Tool offers several advantages for financial professionals:

* Accuracy and Efficiency: The tool automates the calculation process, eliminating manual errors and saving time.

* Standardization: It ensures consistent calculation methodology, promoting comparability across companies.

* Timely Results: The tool generates results in real-time, allowing for prompt decision-making.

* Customization: Users can tailor the tool to specific scenarios by adjusting parameters such as income and debt definitions.

Applications of the RBCX Calculation Tool

The RBCX Calculation Tool finds application in various financial contexts, including:

* Credit Analysis: Lenders and investors use the RBCX ratio to assess the creditworthiness of potential borrowers.

* Risk Management: Companies employ the tool to monitor their debt risk and make informed capital allocation decisions.

* Financial Planning: Financial analysts use the ratio to forecast a company's ability to meet its financial obligations.

* Industry Benchmarking: The tool enables companies to compare their RBCX ratios against industry peers to identify areas for improvement.

Conclusion

The RBCX Calculation Tool is an indispensable resource for financial professionals seeking to accurately and efficiently evaluate the riskiness of a company's debt structure. Its user-friendly interface, customizable settings, and reliable results make it an invaluable tool for credit analysis, risk management, financial planning, and industry benchmarking.

The Spectra Optia® Apheresis System RBCX Calculation Tool is intended to help medical professionals who are responsible for prescribing and performing red blood cell exchange (RBCX) procedures to estimate the volume of replacement fluid required to perform a procedure on the Spectra Optia system. Using the same patient data and the same fluid data that is entered on the Spectra Optia system, the RBCX Calculation Tool calculates and displays the estimated volume of replacement fluid required to achieve the target Hct and FCR. It can also determine whether a custom prime is recommended. While the tool is intended to help prepare for a procedure, it is not intended to be used for making medical decisions.

For more information about the tool, see the About page.

The RBCX Calculation Tool is a specialized instrument designed to assist professionals in calculating the RBCX ratio, a key financial metric used to evaluate the riskiness of a company's debt structure. This tool streamlines the computation process, providing accurate and timely results that aid in informed decision-making.

Understanding the RBCX Ratio

The RBCX ratio measures the relationship between a company's debt obligations and its ability to generate cash flow from operations. It is calculated as follows:

```

RBCX = (Net Income + Depreciation & Amortization) / Total Debt

```

A higher RBCX ratio indicates that a company has a greater capacity to service its debt, while a lower ratio suggests a higher risk of default.

Benefits of Using the RBCX Calculation Tool

The RBCX Calculation Tool offers several advantages for financial professionals:

* Accuracy and Efficiency: The tool automates the calculation process, eliminating manual errors and saving time.

* Standardization: It ensures consistent calculation methodology, promoting comparability across companies.

* Timely Results: The tool generates results in real-time, allowing for prompt decision-making.

* Customization: Users can tailor the tool to specific scenarios by adjusting parameters such as income and debt definitions.

Applications of the RBCX Calculation Tool

The RBCX Calculation Tool finds application in various financial contexts, including:

* Credit Analysis: Lenders and investors use the RBCX ratio to assess the creditworthiness of potential borrowers.

* Risk Management: Companies employ the tool to monitor their debt risk and make informed capital allocation decisions.

* Financial Planning: Financial analysts use the ratio to forecast a company's ability to meet its financial obligations.

* Industry Benchmarking: The tool enables companies to compare their RBCX ratios against industry peers to identify areas for improvement.

Conclusion

The RBCX Calculation Tool is an indispensable resource for financial professionals seeking to accurately and efficiently evaluate the riskiness of a company's debt structure. Its user-friendly interface, customizable settings, and reliable results make it an invaluable tool for credit analysis, risk management, financial planning, and industry benchmarking.