Relay is a no-fee, online business banking and money platform that puts you in complete control of your cash flow.

The banking basics… and beyond

Robust business banking features without the usual fees, branch visits or paperwork.

• Bank without account fees or minimum balances that tie up cash flow

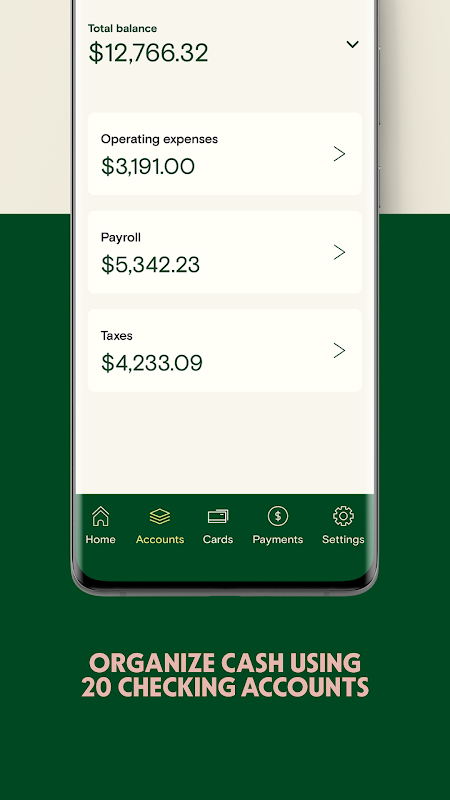

• Open up to 20 individual checking accounts

• Issue 50 virtual and physical debit cards

• Send and receive payments via ACH, wire or check

• Collect payments from tools like PayPal, Stripe, Square and more

• Get hands-on help whenever you need it

Cash flow that’s as clear as day

Always be on top of what your business is earning, spending and saving.

• Apportion income to expense and reserve accounts (like operations, payroll and taxes)

• Organize spend using dedicated debit cards (like travel and marketing)

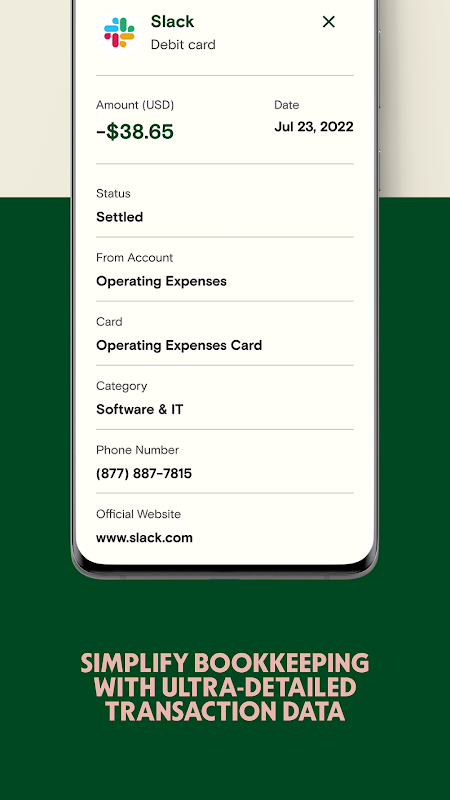

• Get ultra-detailed transaction data that takes the grind out of expense tracking

• Simplify and speed up bookkeeping with direct QuickBooks Online and Xero integrations

Banking that’s better because it’s done together

Work with financial advisors and team members without compromising security or convenience.

• Invite your accountant, bookkeeper or team members to Relay

• Control what each invited user can do and see in your bank account

• Safely share banking data and monthly statements

• Delegate financial management tasks like paying the bills

Plus, Relay’s security features provide peace of mind. Logins are protected by two-factor authentication and biometric security, and you can feel safe knowing that you’re FDIC insured up to $250,000 per business.

Learn more at relayfi.com.

Relay's core strength lies in its multi-user access capabilities. This allows business owners, financial managers, and accountants to access the same financial data simultaneously, fostering transparency and eliminating the need for tedious back-and-forth communication. This shared access facilitates faster decision-making and reduces the risk of errors arising from outdated or conflicting information. Different access levels can be assigned to different users, ensuring data security and maintaining appropriate control over sensitive financial information.

The platform provides a comprehensive overview of a business's financial health through its real-time transaction tracking and balance monitoring. Users can instantly see incoming and outgoing payments, track spending patterns, and monitor account balances across multiple accounts. This up-to-the-minute visibility enables businesses to proactively manage their cash flow, anticipate potential shortfalls, and make informed financial decisions. The ability to categorize transactions and generate detailed reports further enhances financial analysis and provides valuable insights into business performance.

Relay's integration with popular accounting software streamlines reconciliation processes and eliminates manual data entry. Transactions flow seamlessly from Relay into the accounting system, reducing the likelihood of errors and freeing up valuable time for more strategic financial management tasks. This integration also ensures data consistency across both platforms, providing a single source of truth for all financial information.

The platform offers a robust suite of payment tools, including ACH transfers, wire transfers, and bill pay. Businesses can schedule payments in advance, automate recurring payments, and manage all their payment activities from a single, centralized platform. This simplifies payment processes, reduces administrative overhead, and improves overall efficiency. The ability to approve payments from anywhere with internet access further enhances flexibility and control.

Relay emphasizes security and employs multiple layers of protection to safeguard customer funds. These include two-factor authentication, encryption, and fraud monitoring. The platform is also FDIC insured, providing additional peace of mind for businesses. Relay's commitment to security ensures that businesses can confidently manage their finances knowing that their funds are protected.

Relay's customer support team is readily available to assist users with any questions or issues they may encounter. The platform also offers a wealth of educational resources, including webinars, tutorials, and blog posts, to help businesses maximize their use of the platform and improve their financial management practices.

Relay is more than just a business banking platform; it's a financial management tool designed to empower businesses with the insights and control they need to thrive. Its focus on real-time visibility, collaborative access, and seamless integration makes it a valuable asset for businesses of all sizes. By streamlining financial operations and providing actionable insights, Relay enables businesses to focus on what they do best: growing their business.

Relay's commitment to innovation and customer satisfaction is evident in its continuous development and improvement of the platform. The company regularly releases new features and updates based on user feedback, ensuring that the platform remains at the forefront of business banking technology. This dedication to providing a cutting-edge solution makes Relay a valuable partner for businesses seeking to optimize their financial management practices.

Relay's transparent pricing structure and absence of hidden fees further enhance its appeal. Businesses can easily understand the costs associated with using the platform, allowing them to budget effectively and avoid unexpected expenses. This transparency builds trust and reinforces Relay's commitment to providing a valuable and affordable service to its customers.

Relay's user-friendly interface and intuitive design make it easy for businesses to navigate the platform and access the information they need. The platform's clean and modern design contributes to a positive user experience, making financial management less daunting and more accessible. This ease of use is particularly beneficial for businesses that may not have dedicated financial expertise.

Relay's focus on mobile accessibility allows business owners and managers to stay connected to their finances even when they're on the go. The mobile app provides access to key features, including transaction monitoring, balance checking, and payment approvals, enabling businesses to manage their finances from anywhere with internet access. This flexibility and convenience further enhances Relay's value proposition.

Relay's dedication to providing a comprehensive and user-friendly business banking experience positions it as a leader in the industry. Its commitment to innovation, security, and customer satisfaction makes it a valuable partner for businesses seeking to optimize their financial operations and achieve their growth objectives. By empowering businesses with the tools and insights they need to succeed, Relay is transforming the landscape of business banking.

Relay is a no-fee, online business banking and money platform that puts you in complete control of your cash flow.

The banking basics… and beyond

Robust business banking features without the usual fees, branch visits or paperwork.

• Bank without account fees or minimum balances that tie up cash flow

• Open up to 20 individual checking accounts

• Issue 50 virtual and physical debit cards

• Send and receive payments via ACH, wire or check

• Collect payments from tools like PayPal, Stripe, Square and more

• Get hands-on help whenever you need it

Cash flow that’s as clear as day

Always be on top of what your business is earning, spending and saving.

• Apportion income to expense and reserve accounts (like operations, payroll and taxes)

• Organize spend using dedicated debit cards (like travel and marketing)

• Get ultra-detailed transaction data that takes the grind out of expense tracking

• Simplify and speed up bookkeeping with direct QuickBooks Online and Xero integrations

Banking that’s better because it’s done together

Work with financial advisors and team members without compromising security or convenience.

• Invite your accountant, bookkeeper or team members to Relay

• Control what each invited user can do and see in your bank account

• Safely share banking data and monthly statements

• Delegate financial management tasks like paying the bills

Plus, Relay’s security features provide peace of mind. Logins are protected by two-factor authentication and biometric security, and you can feel safe knowing that you’re FDIC insured up to $250,000 per business.

Learn more at relayfi.com.

Relay's core strength lies in its multi-user access capabilities. This allows business owners, financial managers, and accountants to access the same financial data simultaneously, fostering transparency and eliminating the need for tedious back-and-forth communication. This shared access facilitates faster decision-making and reduces the risk of errors arising from outdated or conflicting information. Different access levels can be assigned to different users, ensuring data security and maintaining appropriate control over sensitive financial information.

The platform provides a comprehensive overview of a business's financial health through its real-time transaction tracking and balance monitoring. Users can instantly see incoming and outgoing payments, track spending patterns, and monitor account balances across multiple accounts. This up-to-the-minute visibility enables businesses to proactively manage their cash flow, anticipate potential shortfalls, and make informed financial decisions. The ability to categorize transactions and generate detailed reports further enhances financial analysis and provides valuable insights into business performance.

Relay's integration with popular accounting software streamlines reconciliation processes and eliminates manual data entry. Transactions flow seamlessly from Relay into the accounting system, reducing the likelihood of errors and freeing up valuable time for more strategic financial management tasks. This integration also ensures data consistency across both platforms, providing a single source of truth for all financial information.

The platform offers a robust suite of payment tools, including ACH transfers, wire transfers, and bill pay. Businesses can schedule payments in advance, automate recurring payments, and manage all their payment activities from a single, centralized platform. This simplifies payment processes, reduces administrative overhead, and improves overall efficiency. The ability to approve payments from anywhere with internet access further enhances flexibility and control.

Relay emphasizes security and employs multiple layers of protection to safeguard customer funds. These include two-factor authentication, encryption, and fraud monitoring. The platform is also FDIC insured, providing additional peace of mind for businesses. Relay's commitment to security ensures that businesses can confidently manage their finances knowing that their funds are protected.

Relay's customer support team is readily available to assist users with any questions or issues they may encounter. The platform also offers a wealth of educational resources, including webinars, tutorials, and blog posts, to help businesses maximize their use of the platform and improve their financial management practices.

Relay is more than just a business banking platform; it's a financial management tool designed to empower businesses with the insights and control they need to thrive. Its focus on real-time visibility, collaborative access, and seamless integration makes it a valuable asset for businesses of all sizes. By streamlining financial operations and providing actionable insights, Relay enables businesses to focus on what they do best: growing their business.

Relay's commitment to innovation and customer satisfaction is evident in its continuous development and improvement of the platform. The company regularly releases new features and updates based on user feedback, ensuring that the platform remains at the forefront of business banking technology. This dedication to providing a cutting-edge solution makes Relay a valuable partner for businesses seeking to optimize their financial management practices.

Relay's transparent pricing structure and absence of hidden fees further enhance its appeal. Businesses can easily understand the costs associated with using the platform, allowing them to budget effectively and avoid unexpected expenses. This transparency builds trust and reinforces Relay's commitment to providing a valuable and affordable service to its customers.

Relay's user-friendly interface and intuitive design make it easy for businesses to navigate the platform and access the information they need. The platform's clean and modern design contributes to a positive user experience, making financial management less daunting and more accessible. This ease of use is particularly beneficial for businesses that may not have dedicated financial expertise.

Relay's focus on mobile accessibility allows business owners and managers to stay connected to their finances even when they're on the go. The mobile app provides access to key features, including transaction monitoring, balance checking, and payment approvals, enabling businesses to manage their finances from anywhere with internet access. This flexibility and convenience further enhances Relay's value proposition.

Relay's dedication to providing a comprehensive and user-friendly business banking experience positions it as a leader in the industry. Its commitment to innovation, security, and customer satisfaction makes it a valuable partner for businesses seeking to optimize their financial operations and achieve their growth objectives. By empowering businesses with the tools and insights they need to succeed, Relay is transforming the landscape of business banking.