Relay is a no-fee, online business banking and money platform that puts you in complete control of your cash flow.

The banking basics… and beyond

Robust business banking features without the usual fees, branch visits or paperwork.

• Bank without account fees or minimum balances that tie up cash flow

• Open up to 20 individual checking accounts

• Issue 50 virtual and physical debit cards

• Send and receive payments via ACH, wire or check

• Collect payments from tools like PayPal, Stripe, Square and more

• Get hands-on help whenever you need it

Cash flow that’s as clear as day

Always be on top of what your business is earning, spending and saving.

• Apportion income to expense and reserve accounts (like operations, payroll and taxes)

• Organize spend using dedicated debit cards (like travel and marketing)

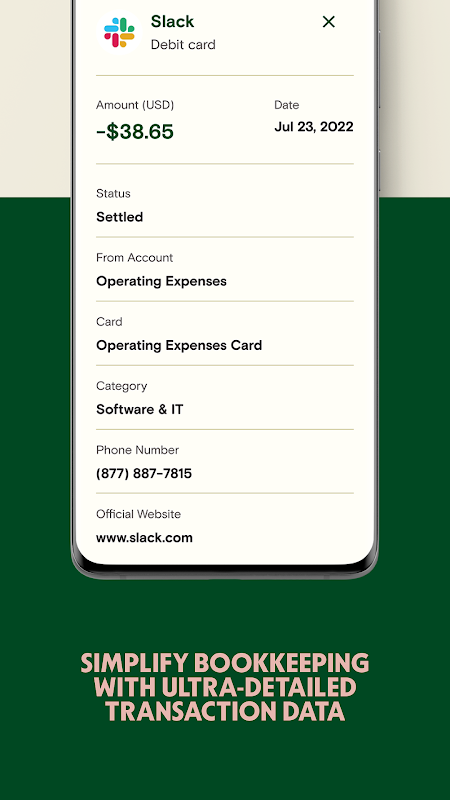

• Get ultra-detailed transaction data that takes the grind out of expense tracking

• Simplify and speed up bookkeeping with direct QuickBooks Online and Xero integrations

Banking that’s better because it’s done together

Work with financial advisors and team members without compromising security or convenience.

• Invite your accountant, bookkeeper or team members to Relay

• Control what each invited user can do and see in your bank account

• Safely share banking data and monthly statements

• Delegate financial management tasks like paying the bills

Plus, Relay’s security features provide peace of mind. Logins are protected by two-factor authentication and biometric security, and you can feel safe knowing that you’re FDIC insured up to $250,000 per business.

Learn more at relayfi.com.

Overview

Relay is a modern business banking platform that empowers entrepreneurs and small businesses with a comprehensive suite of financial tools and services. Designed to simplify banking, streamline operations, and drive growth, Relay offers a tailored experience that meets the unique needs of businesses of all sizes.

Key Features

Simplified Banking:

- Intuitive online and mobile banking interfaces for easy account management and transactions.

- Real-time transaction notifications and customizable alerts to stay informed about account activity.

- Integration with popular accounting software for seamless bookkeeping and reconciliation.

Flexible Funding:

- Business loans and lines of credit to support growth and expansion.

- Quick and easy application process with tailored financing solutions to match business needs.

- Flexible repayment terms and competitive rates to minimize financial burden.

Streamlined Operations:

- Payroll processing services to simplify employee compensation and tax payments.

- Automated expense management tools to track, categorize, and reconcile business expenses.

- Virtual card issuance for secure and efficient purchasing.

Insights and Growth Tools:

- Real-time financial insights and reporting to monitor business performance and identify opportunities.

- Budgeting and forecasting tools to plan for future growth and mitigate risks.

- Access to expert advice and resources to support business decision-making.

Security and Reliability:

- Bank-grade security measures to protect sensitive financial information.

- Multi-factor authentication and encryption for enhanced account security.

- FDIC-insured deposits for peace of mind and financial protection.

Tailored Experience:

Relay understands that every business is unique, which is why it offers customizable banking solutions tailored to specific industry needs. Whether it's healthcare, e-commerce, or professional services, Relay provides tailored features and support to optimize business banking.

Benefits

Time Savings:

- Automated processes and streamlined tools free up valuable time for entrepreneurs to focus on growing their businesses.

Cost Reduction:

- Competitive fees and tailored solutions help businesses minimize banking costs and maximize profitability.

Improved Efficiency:

- Centralized banking platform and integrated tools enhance operational efficiency and reduce manual tasks.

Data-Driven Decisions:

- Real-time insights and reporting empower businesses to make informed decisions based on accurate financial data.

Exceptional Support:

- Dedicated customer support team provides personalized assistance and expert guidance throughout the banking journey.

Conclusion

Relay is the ultimate business banking solution for entrepreneurs and small businesses seeking a modern, simplified, and growth-oriented banking experience. Its comprehensive suite of features, tailored services, and unwavering support empowers businesses to thrive in today's competitive landscape.

Relay is a no-fee, online business banking and money platform that puts you in complete control of your cash flow.

The banking basics… and beyond

Robust business banking features without the usual fees, branch visits or paperwork.

• Bank without account fees or minimum balances that tie up cash flow

• Open up to 20 individual checking accounts

• Issue 50 virtual and physical debit cards

• Send and receive payments via ACH, wire or check

• Collect payments from tools like PayPal, Stripe, Square and more

• Get hands-on help whenever you need it

Cash flow that’s as clear as day

Always be on top of what your business is earning, spending and saving.

• Apportion income to expense and reserve accounts (like operations, payroll and taxes)

• Organize spend using dedicated debit cards (like travel and marketing)

• Get ultra-detailed transaction data that takes the grind out of expense tracking

• Simplify and speed up bookkeeping with direct QuickBooks Online and Xero integrations

Banking that’s better because it’s done together

Work with financial advisors and team members without compromising security or convenience.

• Invite your accountant, bookkeeper or team members to Relay

• Control what each invited user can do and see in your bank account

• Safely share banking data and monthly statements

• Delegate financial management tasks like paying the bills

Plus, Relay’s security features provide peace of mind. Logins are protected by two-factor authentication and biometric security, and you can feel safe knowing that you’re FDIC insured up to $250,000 per business.

Learn more at relayfi.com.

Overview

Relay is a modern business banking platform that empowers entrepreneurs and small businesses with a comprehensive suite of financial tools and services. Designed to simplify banking, streamline operations, and drive growth, Relay offers a tailored experience that meets the unique needs of businesses of all sizes.

Key Features

Simplified Banking:

- Intuitive online and mobile banking interfaces for easy account management and transactions.

- Real-time transaction notifications and customizable alerts to stay informed about account activity.

- Integration with popular accounting software for seamless bookkeeping and reconciliation.

Flexible Funding:

- Business loans and lines of credit to support growth and expansion.

- Quick and easy application process with tailored financing solutions to match business needs.

- Flexible repayment terms and competitive rates to minimize financial burden.

Streamlined Operations:

- Payroll processing services to simplify employee compensation and tax payments.

- Automated expense management tools to track, categorize, and reconcile business expenses.

- Virtual card issuance for secure and efficient purchasing.

Insights and Growth Tools:

- Real-time financial insights and reporting to monitor business performance and identify opportunities.

- Budgeting and forecasting tools to plan for future growth and mitigate risks.

- Access to expert advice and resources to support business decision-making.

Security and Reliability:

- Bank-grade security measures to protect sensitive financial information.

- Multi-factor authentication and encryption for enhanced account security.

- FDIC-insured deposits for peace of mind and financial protection.

Tailored Experience:

Relay understands that every business is unique, which is why it offers customizable banking solutions tailored to specific industry needs. Whether it's healthcare, e-commerce, or professional services, Relay provides tailored features and support to optimize business banking.

Benefits

Time Savings:

- Automated processes and streamlined tools free up valuable time for entrepreneurs to focus on growing their businesses.

Cost Reduction:

- Competitive fees and tailored solutions help businesses minimize banking costs and maximize profitability.

Improved Efficiency:

- Centralized banking platform and integrated tools enhance operational efficiency and reduce manual tasks.

Data-Driven Decisions:

- Real-time insights and reporting empower businesses to make informed decisions based on accurate financial data.

Exceptional Support:

- Dedicated customer support team provides personalized assistance and expert guidance throughout the banking journey.

Conclusion

Relay is the ultimate business banking solution for entrepreneurs and small businesses seeking a modern, simplified, and growth-oriented banking experience. Its comprehensive suite of features, tailored services, and unwavering support empowers businesses to thrive in today's competitive landscape.