Sapient Finserv is an app for Investors to track their Investment Portfolio. Products covered include Mutual Funds & Equity Shares. Details of Insurance, FD's and Other asset classes will also be available shortly.

Key Features of Sapient

1. Family Portfolio- Check updated Family Portfolio.

2. Applicant Portfolio- Check updated Applicant wise Portfolio.

3. Asset Allocation- Get the details of your Net Worth and its composition.

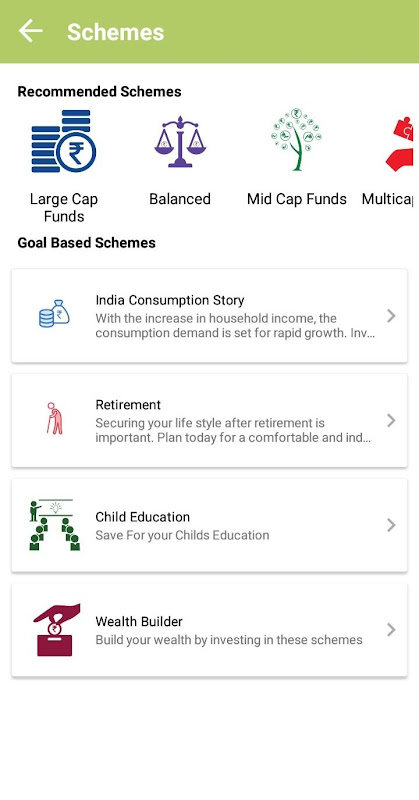

4. Sector Allocation- Get to know sector wise allocation of your investment.

5. Scheme Allocation- Total exposure in different schemes and its current value.

6. Last Transaction- Check your last 10 Transactions which have done.

7. One Day Change- Check how your Schemes performed yesterday.

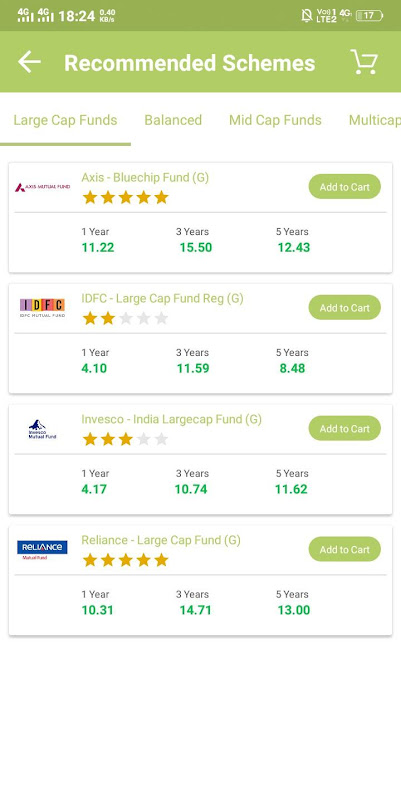

8. Latest NAV- Track the NAV for any schemes.

9. Scheme Performance- Check the Top Performing Scheme based on returns.

10. By Folio - Check your scheme wise and folio wise balance units and current values.

Introduction

Sapient Finserv is a comprehensive financial services solution designed to cater to the diverse needs of financial institutions. It offers a wide range of modules that address core banking, lending, wealth management, and risk management functions. With its robust capabilities and flexible architecture, Sapient Finserv empowers financial institutions to streamline operations, enhance customer experiences, and gain a competitive edge in the dynamic financial landscape.

Core Banking

Sapient Finserv's core banking module provides a centralized platform for managing customer accounts, transactions, and financial operations. It supports various account types, including demand deposits, savings accounts, and loans. The module offers real-time transaction processing, account reconciliation, and comprehensive reporting capabilities. Additionally, it integrates with external systems, such as payment gateways and clearing houses, to facilitate seamless financial transactions.

Lending

The lending module of Sapient Finserv streamlines the entire loan lifecycle, from origination to servicing. It automates loan applications, credit scoring, and approval processes, reducing turnaround time and improving efficiency. The module supports various loan products, including personal loans, mortgages, and commercial loans. It provides robust risk assessment tools, including credit bureau integration and income verification, to ensure prudent lending decisions.

Wealth Management

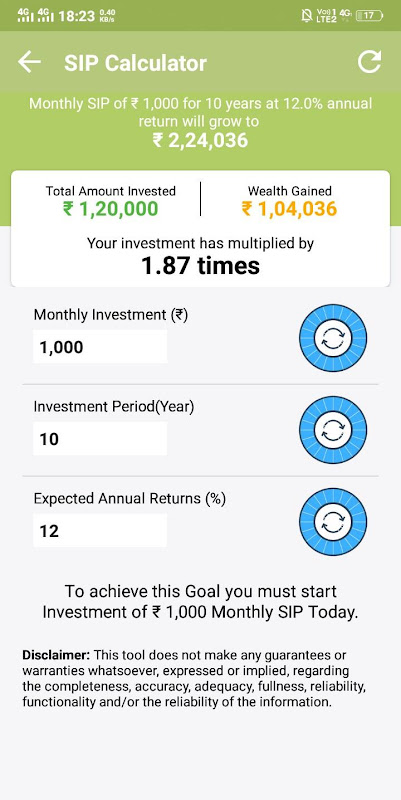

Sapient Finserv's wealth management module caters to the investment and financial planning needs of high-net-worth individuals and families. It offers portfolio management, investment advisory, and financial planning services. The module provides access to a wide range of investment products, including stocks, bonds, mutual funds, and alternative investments. It also offers performance tracking, risk management, and tax optimization tools to help clients achieve their financial goals.

Risk Management

The risk management module of Sapient Finserv provides a comprehensive framework for identifying, assessing, and mitigating financial risks. It includes tools for credit risk management, market risk management, and operational risk management. The module leverages advanced analytics and data mining techniques to identify potential risks and develop appropriate mitigation strategies. It also provides regulatory compliance reporting capabilities to ensure adherence to industry standards and regulations.

Integration and Customization

Sapient Finserv is highly customizable and can be integrated with existing systems and third-party applications. Its open architecture allows financial institutions to tailor the solution to their specific requirements. The module-based approach enables institutions to implement only the functionalities they need, reducing costs and complexity.

Benefits

Sapient Finserv offers numerous benefits to financial institutions, including:

* Streamlined operations and reduced costs

* Enhanced customer experiences and satisfaction

* Improved risk management and compliance

* Increased agility and adaptability to changing market conditions

* Gaining a competitive advantage in the financial services industry

Sapient Finserv is an app for Investors to track their Investment Portfolio. Products covered include Mutual Funds & Equity Shares. Details of Insurance, FD's and Other asset classes will also be available shortly.

Key Features of Sapient

1. Family Portfolio- Check updated Family Portfolio.

2. Applicant Portfolio- Check updated Applicant wise Portfolio.

3. Asset Allocation- Get the details of your Net Worth and its composition.

4. Sector Allocation- Get to know sector wise allocation of your investment.

5. Scheme Allocation- Total exposure in different schemes and its current value.

6. Last Transaction- Check your last 10 Transactions which have done.

7. One Day Change- Check how your Schemes performed yesterday.

8. Latest NAV- Track the NAV for any schemes.

9. Scheme Performance- Check the Top Performing Scheme based on returns.

10. By Folio - Check your scheme wise and folio wise balance units and current values.

Introduction

Sapient Finserv is a comprehensive financial services solution designed to cater to the diverse needs of financial institutions. It offers a wide range of modules that address core banking, lending, wealth management, and risk management functions. With its robust capabilities and flexible architecture, Sapient Finserv empowers financial institutions to streamline operations, enhance customer experiences, and gain a competitive edge in the dynamic financial landscape.

Core Banking

Sapient Finserv's core banking module provides a centralized platform for managing customer accounts, transactions, and financial operations. It supports various account types, including demand deposits, savings accounts, and loans. The module offers real-time transaction processing, account reconciliation, and comprehensive reporting capabilities. Additionally, it integrates with external systems, such as payment gateways and clearing houses, to facilitate seamless financial transactions.

Lending

The lending module of Sapient Finserv streamlines the entire loan lifecycle, from origination to servicing. It automates loan applications, credit scoring, and approval processes, reducing turnaround time and improving efficiency. The module supports various loan products, including personal loans, mortgages, and commercial loans. It provides robust risk assessment tools, including credit bureau integration and income verification, to ensure prudent lending decisions.

Wealth Management

Sapient Finserv's wealth management module caters to the investment and financial planning needs of high-net-worth individuals and families. It offers portfolio management, investment advisory, and financial planning services. The module provides access to a wide range of investment products, including stocks, bonds, mutual funds, and alternative investments. It also offers performance tracking, risk management, and tax optimization tools to help clients achieve their financial goals.

Risk Management

The risk management module of Sapient Finserv provides a comprehensive framework for identifying, assessing, and mitigating financial risks. It includes tools for credit risk management, market risk management, and operational risk management. The module leverages advanced analytics and data mining techniques to identify potential risks and develop appropriate mitigation strategies. It also provides regulatory compliance reporting capabilities to ensure adherence to industry standards and regulations.

Integration and Customization

Sapient Finserv is highly customizable and can be integrated with existing systems and third-party applications. Its open architecture allows financial institutions to tailor the solution to their specific requirements. The module-based approach enables institutions to implement only the functionalities they need, reducing costs and complexity.

Benefits

Sapient Finserv offers numerous benefits to financial institutions, including:

* Streamlined operations and reduced costs

* Enhanced customer experiences and satisfaction

* Improved risk management and compliance

* Increased agility and adaptability to changing market conditions

* Gaining a competitive advantage in the financial services industry