Why do we recommend Tax@Home for your employee assessment or tax return 🌠?

💶💶💶 Get your tax back with the tips from the tax book.

👋 With the

tax return dialog

we query your expenses and create your tax return documents fully automatically. Brilliantly simple!

🎉

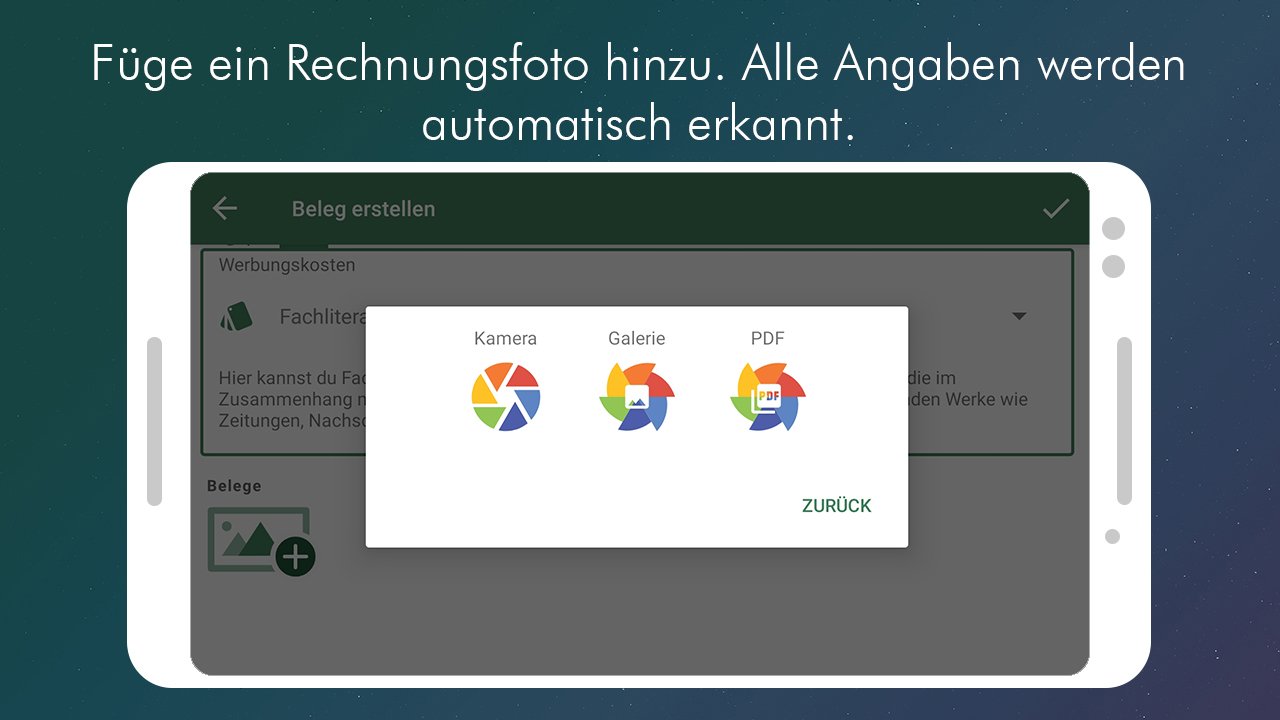

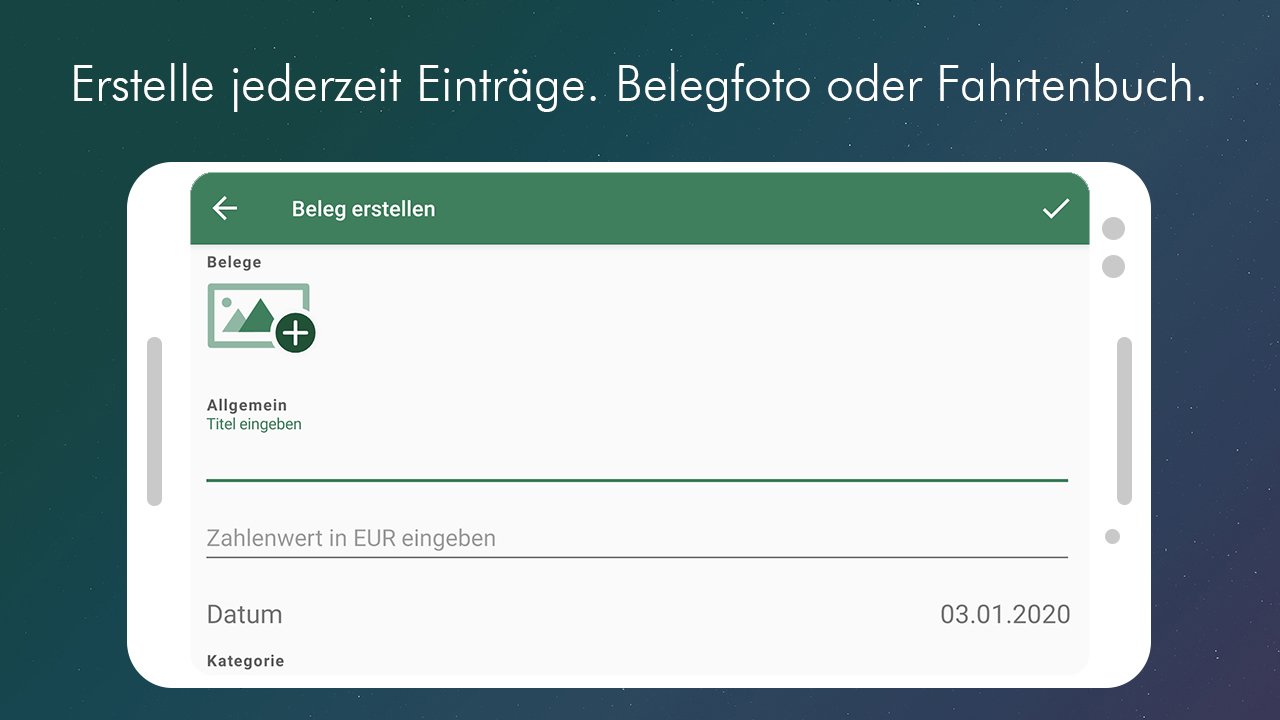

Store digitally

instead of paper chaos, paperwork and forgetting. You can conveniently collect the receipts using your smartphone. We ensure that receipts are automatically assigned to tax categories and depreciation is taken into account. You have collected everything in the app.

⭐ Your data is processed locally on the smartphone.

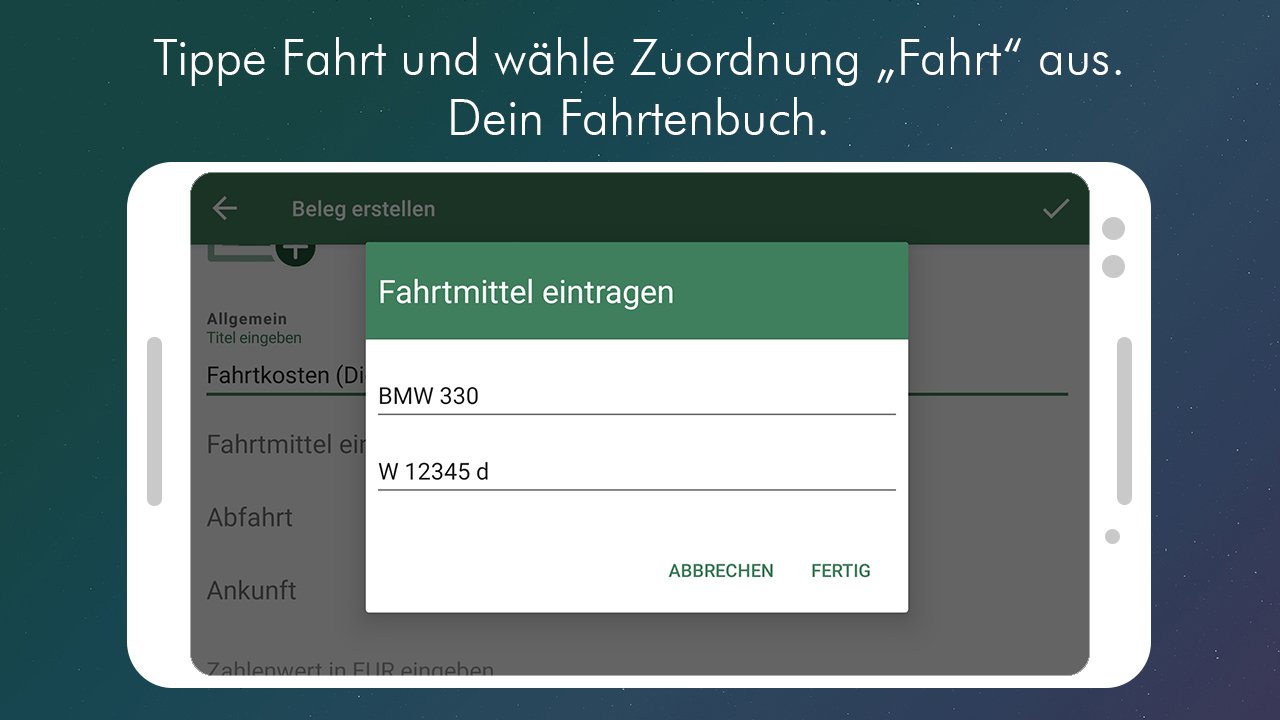

🚗

With the digital logbook

you can deduct business trips, whether by car or bicycle, from your taxes. Everything in one app.

😃 Submit directly from your smartphone.

👋

You can answer questions from the tax office

with the clear tax report. We'll be happy to help you if you have any questions!

⭐ We offer you

understandable information

in the tax blog and with our chatbot in easy-to-understand language IDA. If the question is too complicated for IDA, our support will help you.

👋 A highlight of tax saving is our weekly

push notifications

. This is how you effectively save taxes.

💕

Enjoy all the advantages now.

Information about the app:

The app does not represent any government institution. The tax return is submitted via Finanzonline. The information is based on the current wage tax guidelines (e.g. https://www.bmf.gv.at/services/publikationen/das-steuerbuch.html). All financial data is stored locally.

Disclaimer:

Under no circumstances will Tax@Home and the authors of this application be liable for direct, indirect, specific or consequential damages. The underlying control system is constantly updated and checked to the best of our knowledge and belief. The information provided is the opinions of the developers and does not replace individual advice from a tax consulting firm. Any liability for this is excluded.

If you are wondering whether Tax@Home is the right tax app for you?

🧍 We help all working people save taxes, regardless of whether you have been doing your own tax return for years or for the first time. Our tips will help you

start your career!

We can help you with commuter allowances, negative tax and many tax situations. Ideal for apprentices, students, beginners, summer jobs and part-time jobs.

🧍 We help experienced

workers, employees, retirees

save taxes with more than 100 precise tips. There are always questions and we will help you so that you don't give money to the state.

👪 We help

families

save taxes. Do you already know the Family Bonus Plus, the single-earner, single-parent tax credit? There are big benefits, for both big and small incomes.

How much does the service cost?

We have decided to offer in-app products:

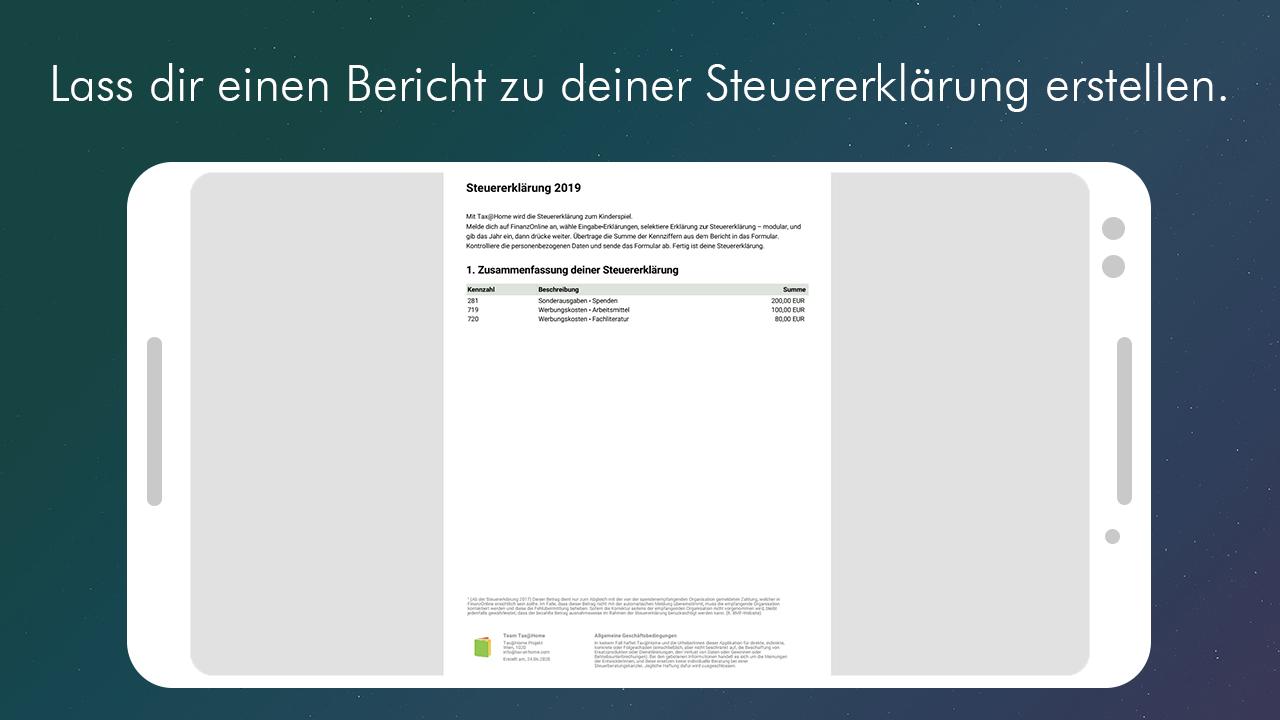

👋 The

PDF report

for €6.99 is an automatically generated report that prepares your information for the tax return. The report explains how to file your tax return. The report contains clear instructions for the tax return, a summary of your receipts and what you have to do if the tax office asks.

👋 Submitting directly online via the app costs €16.99. We will guide you through the submission step by step. After successful submission, you will receive the PDF report as documentation.

👋 The

full export

costs €25.99 and includes the PDF report, the prepared data as Excel and receipts as an image. You can take the document to a tax advisor if your tax return is too complicated for you. Find tax advice? You can search for tax advisors in the app.

The app uses Business, Money, Creative, Pencil, Mobile, Abstract, Coffee vector created by vectorjuice available on freepik.

Introduction

Tax@Home is a comprehensive software application designed to assist homeowners in navigating the complexities of property taxation. With its user-friendly interface and robust features, Tax@Home empowers homeowners to understand, manage, and optimize their property tax obligations.

Property Assessment and Valuation

Tax@Home provides detailed information on property assessments and valuations. Homeowners can access data on comparable properties, market trends, and local assessment policies. This knowledge helps homeowners determine the fairness of their property's assessment and identify potential areas for dispute.

Tax Calculations and Payments

Tax@Home calculates property taxes based on the latest tax rates and assessment information. Homeowners can easily view their current tax bill, estimate future tax payments, and set up automatic payments to avoid penalties. The software also allows homeowners to track their payment history and receive reminders for upcoming due dates.

Exemptions and Deductions

Tax@Home provides a comprehensive list of exemptions and deductions available to homeowners. These exemptions, such as homestead exemptions and senior citizen exemptions, can significantly reduce property tax liability. The software guides homeowners through the application process and helps them determine if they qualify for any exemptions or deductions.

Tax Appeals and Protests

In cases where homeowners believe their property assessment or tax bill is incorrect, Tax@Home offers support for tax appeals and protests. The software provides step-by-step instructions on how to file an appeal, gather evidence, and present their case to the local tax board.

Historical Tax Records and Data

Tax@Home maintains a comprehensive database of historical tax records and data. Homeowners can access information on past assessments, tax payments, and property values. This data can be invaluable for tracking changes in property value over time and identifying potential tax savings opportunities.

Advanced Features and Integrations

Tax@Home offers advanced features such as tax projections, which allow homeowners to estimate future tax liability based on different scenarios. The software also integrates with popular financial management tools, enabling homeowners to seamlessly track their property tax expenses alongside other financial data.

Benefits of Tax@Home

* Understand and manage property tax obligations

* Ensure accurate property assessments and valuations

* Maximize exemptions and deductions

* File tax appeals and protests effectively

* Track historical tax records and data

* Plan for future tax payments and expenses

* Integrate with financial management tools for comprehensive budgeting

Conclusion

Tax@Home is an indispensable tool for homeowners seeking to optimize their property tax obligations. With its user-friendly interface, comprehensive features, and reliable data, Tax@Home empowers homeowners to make informed decisions and navigate the complex world of home taxation.

Why do we recommend Tax@Home for your employee assessment or tax return 🌠?

💶💶💶 Get your tax back with the tips from the tax book.

👋 With the

tax return dialog

we query your expenses and create your tax return documents fully automatically. Brilliantly simple!

🎉

Store digitally

instead of paper chaos, paperwork and forgetting. You can conveniently collect the receipts using your smartphone. We ensure that receipts are automatically assigned to tax categories and depreciation is taken into account. You have collected everything in the app.

⭐ Your data is processed locally on the smartphone.

🚗

With the digital logbook

you can deduct business trips, whether by car or bicycle, from your taxes. Everything in one app.

😃 Submit directly from your smartphone.

👋

You can answer questions from the tax office

with the clear tax report. We'll be happy to help you if you have any questions!

⭐ We offer you

understandable information

in the tax blog and with our chatbot in easy-to-understand language IDA. If the question is too complicated for IDA, our support will help you.

👋 A highlight of tax saving is our weekly

push notifications

. This is how you effectively save taxes.

💕

Enjoy all the advantages now.

Information about the app:

The app does not represent any government institution. The tax return is submitted via Finanzonline. The information is based on the current wage tax guidelines (e.g. https://www.bmf.gv.at/services/publikationen/das-steuerbuch.html). All financial data is stored locally.

Disclaimer:

Under no circumstances will Tax@Home and the authors of this application be liable for direct, indirect, specific or consequential damages. The underlying control system is constantly updated and checked to the best of our knowledge and belief. The information provided is the opinions of the developers and does not replace individual advice from a tax consulting firm. Any liability for this is excluded.

If you are wondering whether Tax@Home is the right tax app for you?

🧍 We help all working people save taxes, regardless of whether you have been doing your own tax return for years or for the first time. Our tips will help you

start your career!

We can help you with commuter allowances, negative tax and many tax situations. Ideal for apprentices, students, beginners, summer jobs and part-time jobs.

🧍 We help experienced

workers, employees, retirees

save taxes with more than 100 precise tips. There are always questions and we will help you so that you don't give money to the state.

👪 We help

families

save taxes. Do you already know the Family Bonus Plus, the single-earner, single-parent tax credit? There are big benefits, for both big and small incomes.

How much does the service cost?

We have decided to offer in-app products:

👋 The

PDF report

for €6.99 is an automatically generated report that prepares your information for the tax return. The report explains how to file your tax return. The report contains clear instructions for the tax return, a summary of your receipts and what you have to do if the tax office asks.

👋 Submitting directly online via the app costs €16.99. We will guide you through the submission step by step. After successful submission, you will receive the PDF report as documentation.

👋 The

full export

costs €25.99 and includes the PDF report, the prepared data as Excel and receipts as an image. You can take the document to a tax advisor if your tax return is too complicated for you. Find tax advice? You can search for tax advisors in the app.

The app uses Business, Money, Creative, Pencil, Mobile, Abstract, Coffee vector created by vectorjuice available on freepik.

Introduction

Tax@Home is a comprehensive software application designed to assist homeowners in navigating the complexities of property taxation. With its user-friendly interface and robust features, Tax@Home empowers homeowners to understand, manage, and optimize their property tax obligations.

Property Assessment and Valuation

Tax@Home provides detailed information on property assessments and valuations. Homeowners can access data on comparable properties, market trends, and local assessment policies. This knowledge helps homeowners determine the fairness of their property's assessment and identify potential areas for dispute.

Tax Calculations and Payments

Tax@Home calculates property taxes based on the latest tax rates and assessment information. Homeowners can easily view their current tax bill, estimate future tax payments, and set up automatic payments to avoid penalties. The software also allows homeowners to track their payment history and receive reminders for upcoming due dates.

Exemptions and Deductions

Tax@Home provides a comprehensive list of exemptions and deductions available to homeowners. These exemptions, such as homestead exemptions and senior citizen exemptions, can significantly reduce property tax liability. The software guides homeowners through the application process and helps them determine if they qualify for any exemptions or deductions.

Tax Appeals and Protests

In cases where homeowners believe their property assessment or tax bill is incorrect, Tax@Home offers support for tax appeals and protests. The software provides step-by-step instructions on how to file an appeal, gather evidence, and present their case to the local tax board.

Historical Tax Records and Data

Tax@Home maintains a comprehensive database of historical tax records and data. Homeowners can access information on past assessments, tax payments, and property values. This data can be invaluable for tracking changes in property value over time and identifying potential tax savings opportunities.

Advanced Features and Integrations

Tax@Home offers advanced features such as tax projections, which allow homeowners to estimate future tax liability based on different scenarios. The software also integrates with popular financial management tools, enabling homeowners to seamlessly track their property tax expenses alongside other financial data.

Benefits of Tax@Home

* Understand and manage property tax obligations

* Ensure accurate property assessments and valuations

* Maximize exemptions and deductions

* File tax appeals and protests effectively

* Track historical tax records and data

* Plan for future tax payments and expenses

* Integrate with financial management tools for comprehensive budgeting

Conclusion

Tax@Home is an indispensable tool for homeowners seeking to optimize their property tax obligations. With its user-friendly interface, comprehensive features, and reliable data, Tax@Home empowers homeowners to make informed decisions and navigate the complex world of home taxation.