Fintech P2P lending for developing your funds with SME funding / loans

Akseleran is a fintech crowdfunding Peer-to-Peer Lending / P2P Lending platform in Indonesia that connects SMEs that need loans / funding to develop their businesses, with crowd lenders who have more funds to finance their businesses. lent to these businesses.

The provision of loans / SME funding carried out by the general public and business actors can be an alternative fund development solution with attractive interest rates to meet various financial goals in the future.

BENEFITS OF LENDERS

Akseleran is the right P2P Lending fintech platform for lenders who want to develop funds because:

💡 EASY

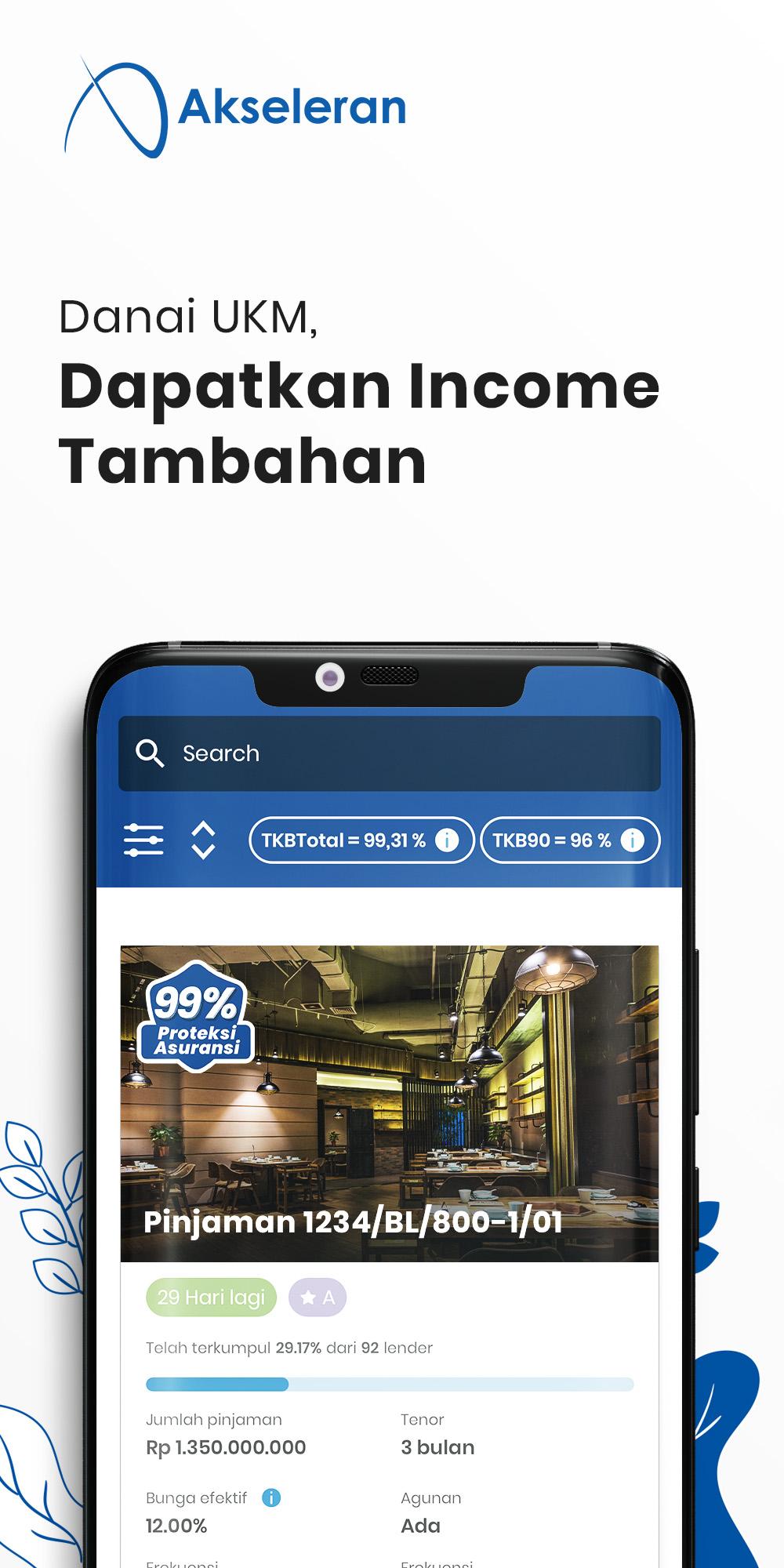

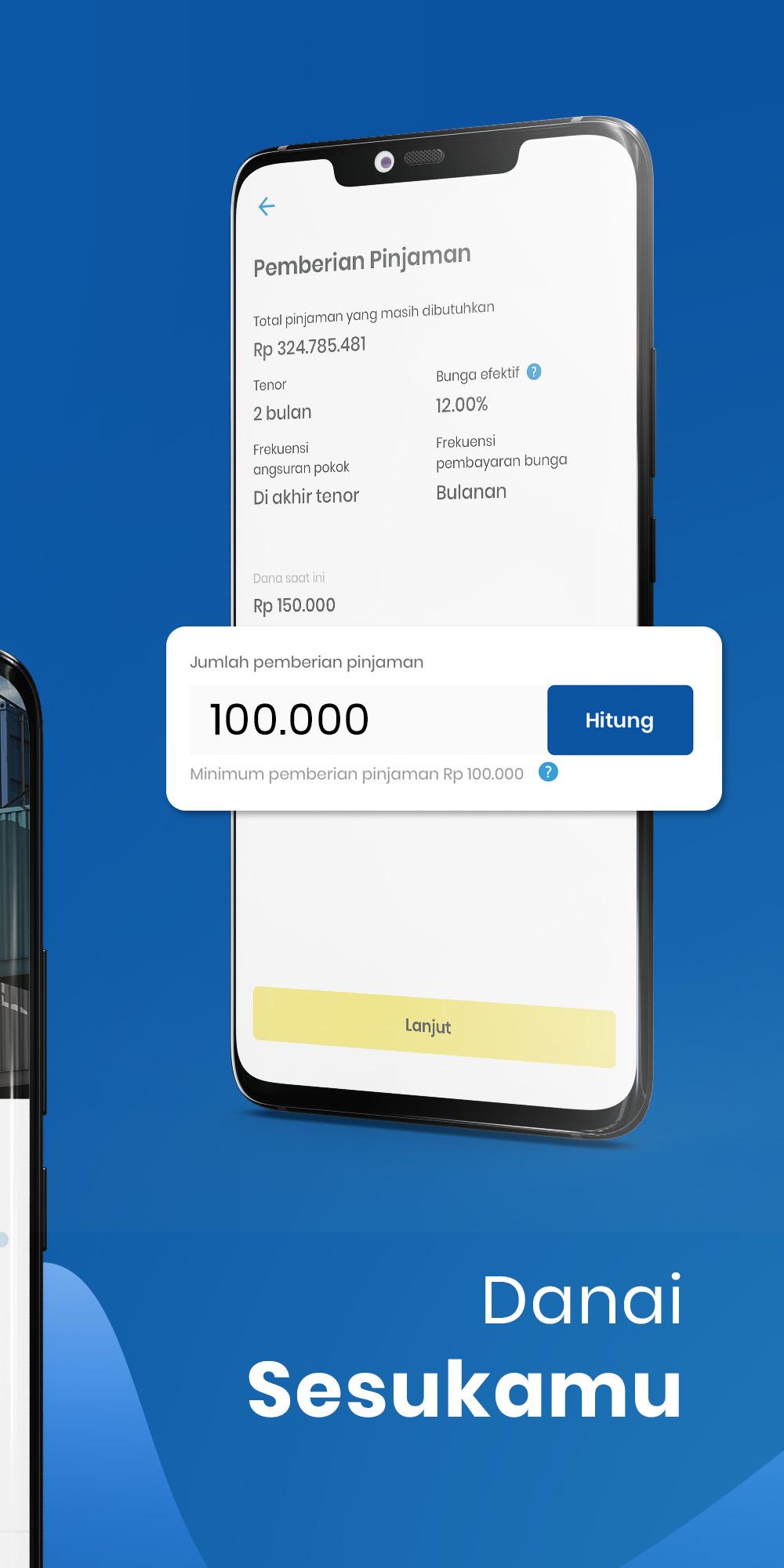

As a financial technology (fintech) platform, Akseleran opens access to loans with affordable initial funds starting from IDR 100 thousand without additional fees. This SME loan/funding can be accessed from anywhere, anytime and using an easy concept.

🔒 RELIABLE

P2P Lending Acceleration as a fintech platform is registered and supervised by the Financial Services Authority (OJK) and more than 98% of the value of the collateralized loan portfolio. A full operational permit from the OJK has also been obtained based on the certificate of approval KEP-122/D.05/2019 on December 13, 2019.

Loan applications are selected through a rigorous process of evaluating the financial condition of SMEs by a professional and experienced team. In addition, currently insurance protects 99% of the loan principal in arrears, applicable to the majority of funding opportunities when conducting the SME funding process.

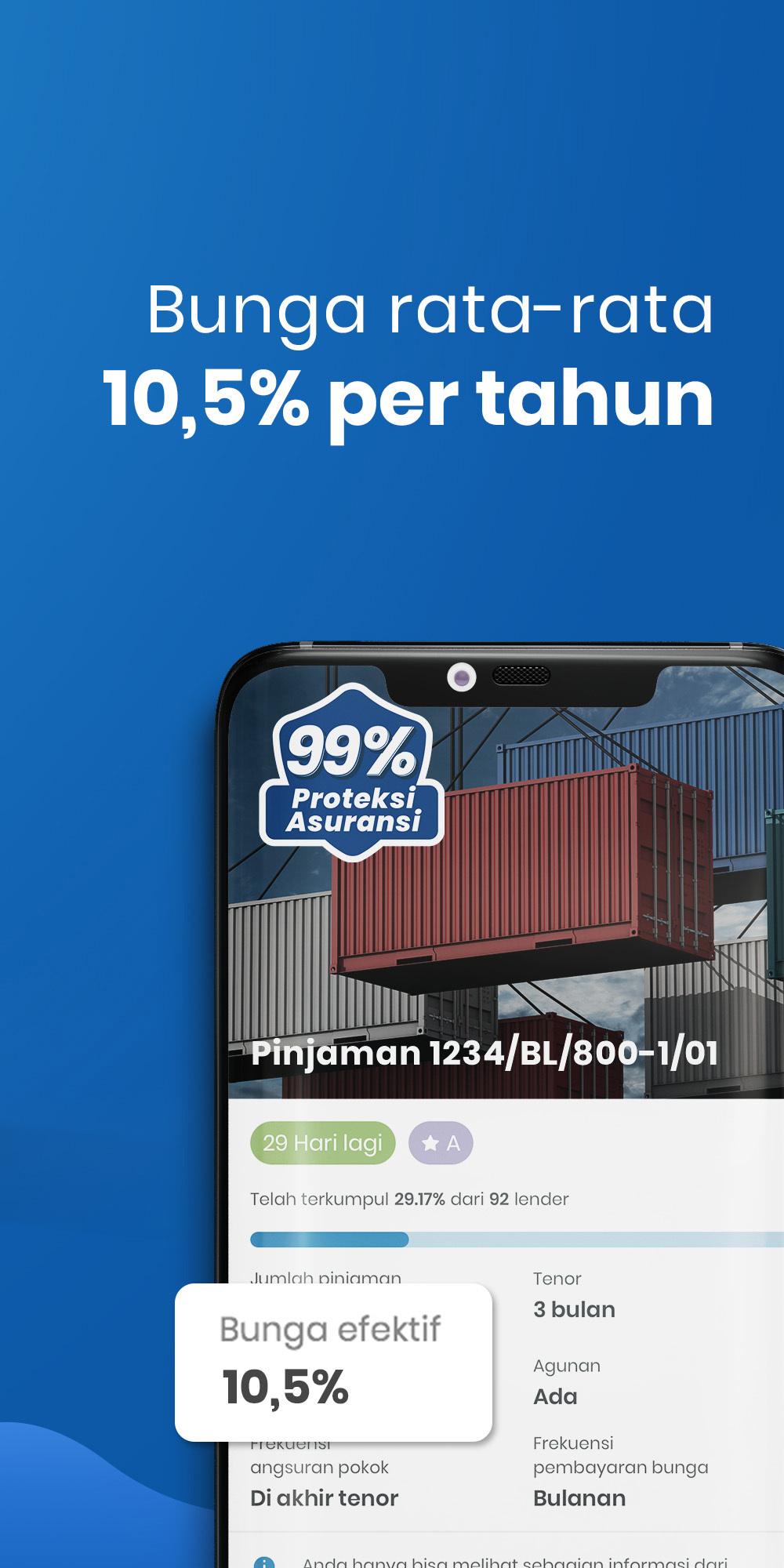

💰 INTERESTING FLOWER

With a measured risk, you can earn an average interest of 9.5%-10.5% per year. This interest is higher than some conventional investment instruments.

Example: If you make funding at Akseleran per month worth IDR 1 million within 12 months with an interest of 10.5% per year. So, the funds that you will receive are Rp. 12,704,884. This means that there is an additional income of Rp. 704,884 that you receive after 12 months compared to if you only saved the funds.

BORROWER BENEFITS

Why do many SMEs choose P2P Lending Akseleran as an alternative funding solution to develop their business?

📝 COMPETITIVE INTEREST

Accelerator offers competitive rates

⏰ FLEXIBLE

Collateral that can be chosen by SMEs in applying for loans at Akseleran is also easier, no need for fixed assets. Collateral in Acceleration is usually in the form of Invoice, Inventory, PO/SPK/Contract

💸 AFFORDABLE COST

If the loan application is successful, we only charge 0.375% per month of the total disbursed loan funds as well as notary fees and legal documentation processes

Product Information:

- Loan tenor: the minimum tenor for personal loans is 180 days and the maximum tenor is 360 days

- Loan interest: starting from 3.99% per month

- Maximum annual interest rate: 66% (including service fee)

Example: If you apply for an online cash loan of Rp. 10,000,000 with a tenor of 12 months and an interest of 3.99% per month, then the loan amount that can be disbursed is Rp. 9,400,000 which has been deducted by a service fee of 6% or Rp. 600,000, and monthly installments have to pay every month is Rp1,232,333. The total you have to pay is IDR 14,788,000

By using the Akseleran fintech platform, you can progress faster to prepare for your financial and business future. Come on, start #BERANIAKSELERASI by providing loans / funding to SMEs in Indonesia now or applying for a loan at Akseleran easily and reliably!

For more information, contact us at:

Phone: (021) 50916006

E-mail:

Facebook: Acceleration

Instagram: @Akseleran_id

URL: www.akseleran.co.id

Indonesian Financial Inclusive Acceleration

Sahid Sudirman Center

Floor 11 Unit G

Jl. Gen. Sudirman Kav. 86

Jakarta 10220

What's New in the Latest Version 3.19.0

Last updated on Jun 21, 2024

Akseleran Versi 3.19.0

Update info dan perbaikan berkala untuk mengoptimalkan pendanaan ke UKM potensial.

- Loan Grup

- Perbaikan bug dan penyempurnaan

Update selalu aplikasi mobile Akseleran kamu untuk mendapatkan kenyamanan bertansaksi dari mana saja, kapan saja.

Overview

Akseleran is an Indonesian peer-to-peer (P2P) lending platform that connects borrowers with lenders. It offers various loan products tailored to meet the financial needs of both individuals and businesses. With a focus on transparency, security, and accessibility, Akseleran has become a trusted and reliable platform for alternative financing in Indonesia.

Borrower Services

Akseleran provides a range of loan options for borrowers, including:

* Invoice Financing: Short-term loans secured against unpaid invoices, providing businesses with immediate access to cash flow.

* Business Loans: Medium-term loans designed to support business expansion, equipment purchases, or working capital needs.

* Personal Loans: Unsecured loans for individuals seeking financing for personal expenses, such as home renovations or debt consolidation.

Lender Services

Investors on Akseleran can earn competitive returns by lending their funds to pre-screened borrowers. The platform offers:

* High-Yield Returns: Potential returns of up to 16% per annum, significantly higher than traditional savings accounts.

* Diversified Portfolio: Access to a diversified pool of borrowers, reducing risk and maximizing returns.

* Low Minimum Investment: Starting from Rp 100,000, making it accessible to investors of all levels.

Risk Management

Akseleran employs a rigorous risk management framework to ensure the safety of both borrowers and lenders:

* Credit Assessment: Borrowers undergo a comprehensive credit assessment process to determine their creditworthiness.

* Loan Insurance: Loans are backed by insurance to mitigate the risk of default.

* Transparency: All loan information, including borrower profiles and financial data, is transparently disclosed to investors.

Platform Features

Akseleran's user-friendly platform offers a range of features to enhance the user experience:

* Mobile App: Convenient access to account management, loan applications, and investment opportunities on the go.

* Automated Matching: Borrowers and lenders are automatically matched based on risk profile and investment preferences.

* Secure Transactions: All transactions are processed through secure and encrypted channels, ensuring data privacy.

Regulation and Compliance

Akseleran is regulated by the Indonesian Financial Services Authority (OJK) and adheres to strict compliance standards. The platform is also certified with ISO 27001 for information security management.

Conclusion

Akseleran is a trusted and innovative P2P lending platform that offers a range of financial solutions for both borrowers and lenders in Indonesia. With a focus on risk management, transparency, and accessibility, Akseleran empowers individuals and businesses to achieve their financial goals.

Fintech P2P lending for developing your funds with SME funding / loans

Akseleran is a fintech crowdfunding Peer-to-Peer Lending / P2P Lending platform in Indonesia that connects SMEs that need loans / funding to develop their businesses, with crowd lenders who have more funds to finance their businesses. lent to these businesses.

The provision of loans / SME funding carried out by the general public and business actors can be an alternative fund development solution with attractive interest rates to meet various financial goals in the future.

BENEFITS OF LENDERS

Akseleran is the right P2P Lending fintech platform for lenders who want to develop funds because:

💡 EASY

As a financial technology (fintech) platform, Akseleran opens access to loans with affordable initial funds starting from IDR 100 thousand without additional fees. This SME loan/funding can be accessed from anywhere, anytime and using an easy concept.

🔒 RELIABLE

P2P Lending Acceleration as a fintech platform is registered and supervised by the Financial Services Authority (OJK) and more than 98% of the value of the collateralized loan portfolio. A full operational permit from the OJK has also been obtained based on the certificate of approval KEP-122/D.05/2019 on December 13, 2019.

Loan applications are selected through a rigorous process of evaluating the financial condition of SMEs by a professional and experienced team. In addition, currently insurance protects 99% of the loan principal in arrears, applicable to the majority of funding opportunities when conducting the SME funding process.

💰 INTERESTING FLOWER

With a measured risk, you can earn an average interest of 9.5%-10.5% per year. This interest is higher than some conventional investment instruments.

Example: If you make funding at Akseleran per month worth IDR 1 million within 12 months with an interest of 10.5% per year. So, the funds that you will receive are Rp. 12,704,884. This means that there is an additional income of Rp. 704,884 that you receive after 12 months compared to if you only saved the funds.

BORROWER BENEFITS

Why do many SMEs choose P2P Lending Akseleran as an alternative funding solution to develop their business?

📝 COMPETITIVE INTEREST

Accelerator offers competitive rates

⏰ FLEXIBLE

Collateral that can be chosen by SMEs in applying for loans at Akseleran is also easier, no need for fixed assets. Collateral in Acceleration is usually in the form of Invoice, Inventory, PO/SPK/Contract

💸 AFFORDABLE COST

If the loan application is successful, we only charge 0.375% per month of the total disbursed loan funds as well as notary fees and legal documentation processes

Product Information:

- Loan tenor: the minimum tenor for personal loans is 180 days and the maximum tenor is 360 days

- Loan interest: starting from 3.99% per month

- Maximum annual interest rate: 66% (including service fee)

Example: If you apply for an online cash loan of Rp. 10,000,000 with a tenor of 12 months and an interest of 3.99% per month, then the loan amount that can be disbursed is Rp. 9,400,000 which has been deducted by a service fee of 6% or Rp. 600,000, and monthly installments have to pay every month is Rp1,232,333. The total you have to pay is IDR 14,788,000

By using the Akseleran fintech platform, you can progress faster to prepare for your financial and business future. Come on, start #BERANIAKSELERASI by providing loans / funding to SMEs in Indonesia now or applying for a loan at Akseleran easily and reliably!

For more information, contact us at:

Phone: (021) 50916006

E-mail:

Facebook: Acceleration

Instagram: @Akseleran_id

URL: www.akseleran.co.id

Indonesian Financial Inclusive Acceleration

Sahid Sudirman Center

Floor 11 Unit G

Jl. Gen. Sudirman Kav. 86

Jakarta 10220

What's New in the Latest Version 3.19.0

Last updated on Jun 21, 2024

Akseleran Versi 3.19.0

Update info dan perbaikan berkala untuk mengoptimalkan pendanaan ke UKM potensial.

- Loan Grup

- Perbaikan bug dan penyempurnaan

Update selalu aplikasi mobile Akseleran kamu untuk mendapatkan kenyamanan bertansaksi dari mana saja, kapan saja.

Overview

Akseleran is an Indonesian peer-to-peer (P2P) lending platform that connects borrowers with lenders. It offers various loan products tailored to meet the financial needs of both individuals and businesses. With a focus on transparency, security, and accessibility, Akseleran has become a trusted and reliable platform for alternative financing in Indonesia.

Borrower Services

Akseleran provides a range of loan options for borrowers, including:

* Invoice Financing: Short-term loans secured against unpaid invoices, providing businesses with immediate access to cash flow.

* Business Loans: Medium-term loans designed to support business expansion, equipment purchases, or working capital needs.

* Personal Loans: Unsecured loans for individuals seeking financing for personal expenses, such as home renovations or debt consolidation.

Lender Services

Investors on Akseleran can earn competitive returns by lending their funds to pre-screened borrowers. The platform offers:

* High-Yield Returns: Potential returns of up to 16% per annum, significantly higher than traditional savings accounts.

* Diversified Portfolio: Access to a diversified pool of borrowers, reducing risk and maximizing returns.

* Low Minimum Investment: Starting from Rp 100,000, making it accessible to investors of all levels.

Risk Management

Akseleran employs a rigorous risk management framework to ensure the safety of both borrowers and lenders:

* Credit Assessment: Borrowers undergo a comprehensive credit assessment process to determine their creditworthiness.

* Loan Insurance: Loans are backed by insurance to mitigate the risk of default.

* Transparency: All loan information, including borrower profiles and financial data, is transparently disclosed to investors.

Platform Features

Akseleran's user-friendly platform offers a range of features to enhance the user experience:

* Mobile App: Convenient access to account management, loan applications, and investment opportunities on the go.

* Automated Matching: Borrowers and lenders are automatically matched based on risk profile and investment preferences.

* Secure Transactions: All transactions are processed through secure and encrypted channels, ensuring data privacy.

Regulation and Compliance

Akseleran is regulated by the Indonesian Financial Services Authority (OJK) and adheres to strict compliance standards. The platform is also certified with ISO 27001 for information security management.

Conclusion

Akseleran is a trusted and innovative P2P lending platform that offers a range of financial solutions for both borrowers and lenders in Indonesia. With a focus on risk management, transparency, and accessibility, Akseleran empowers individuals and businesses to achieve their financial goals.