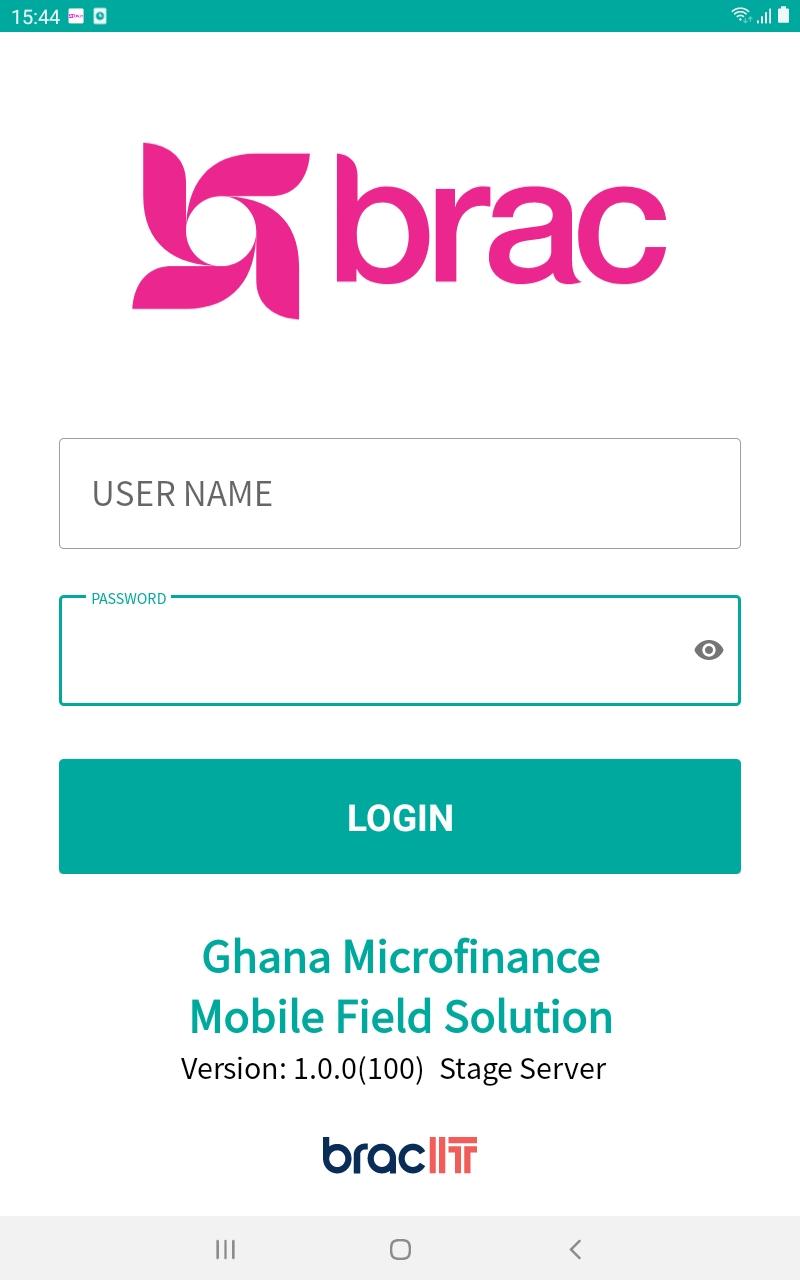

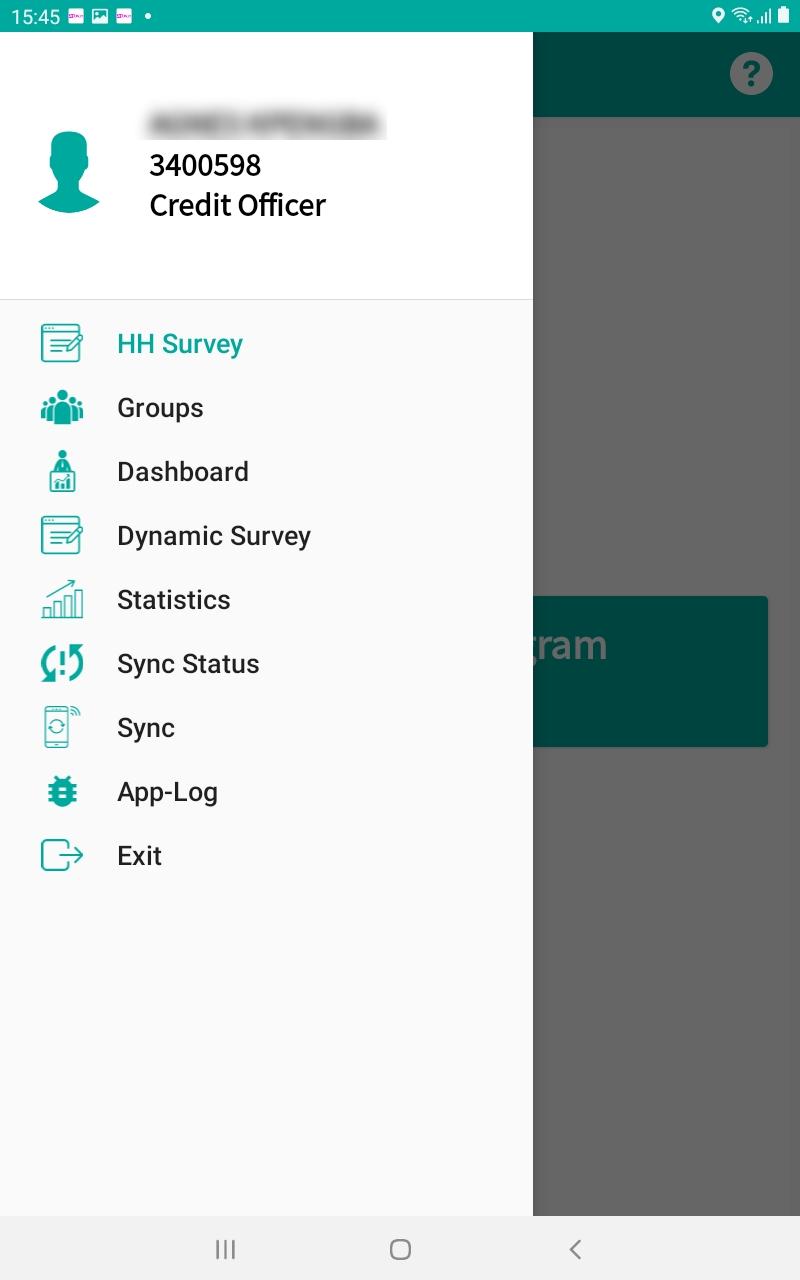

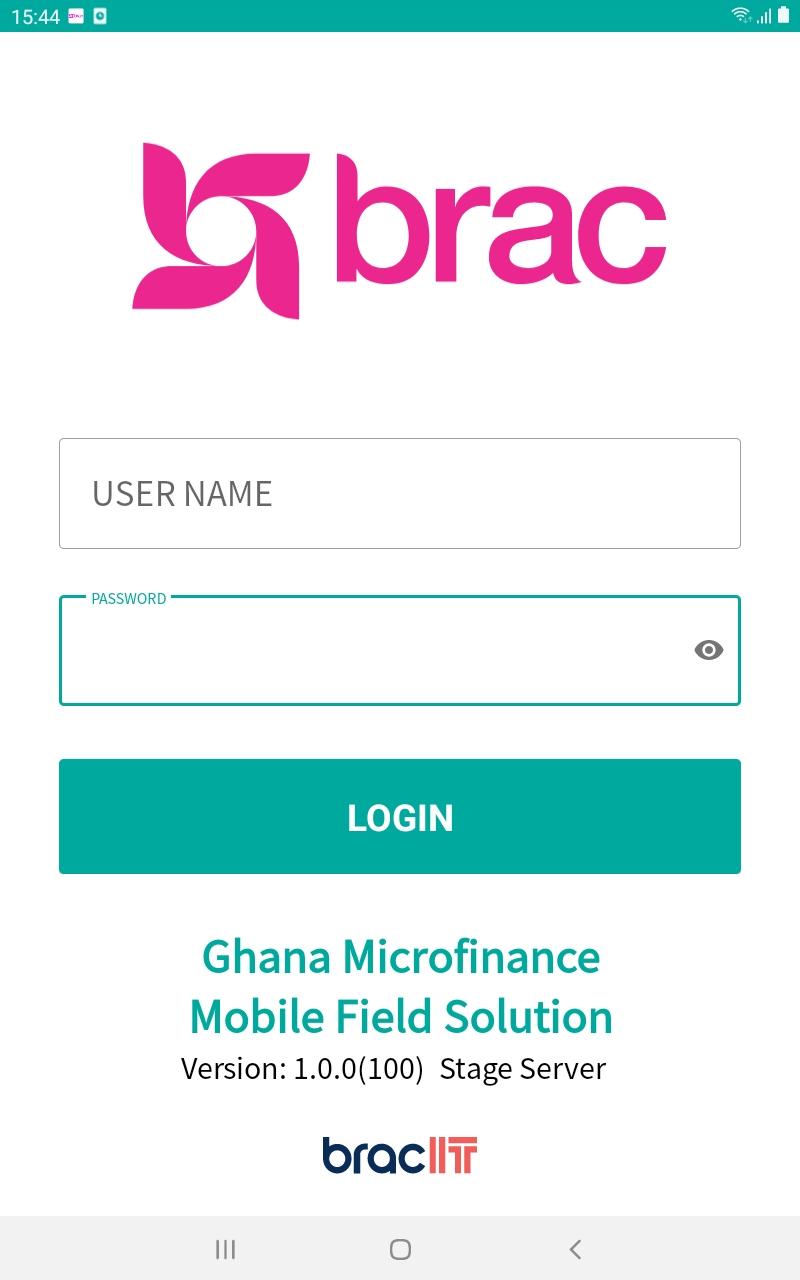

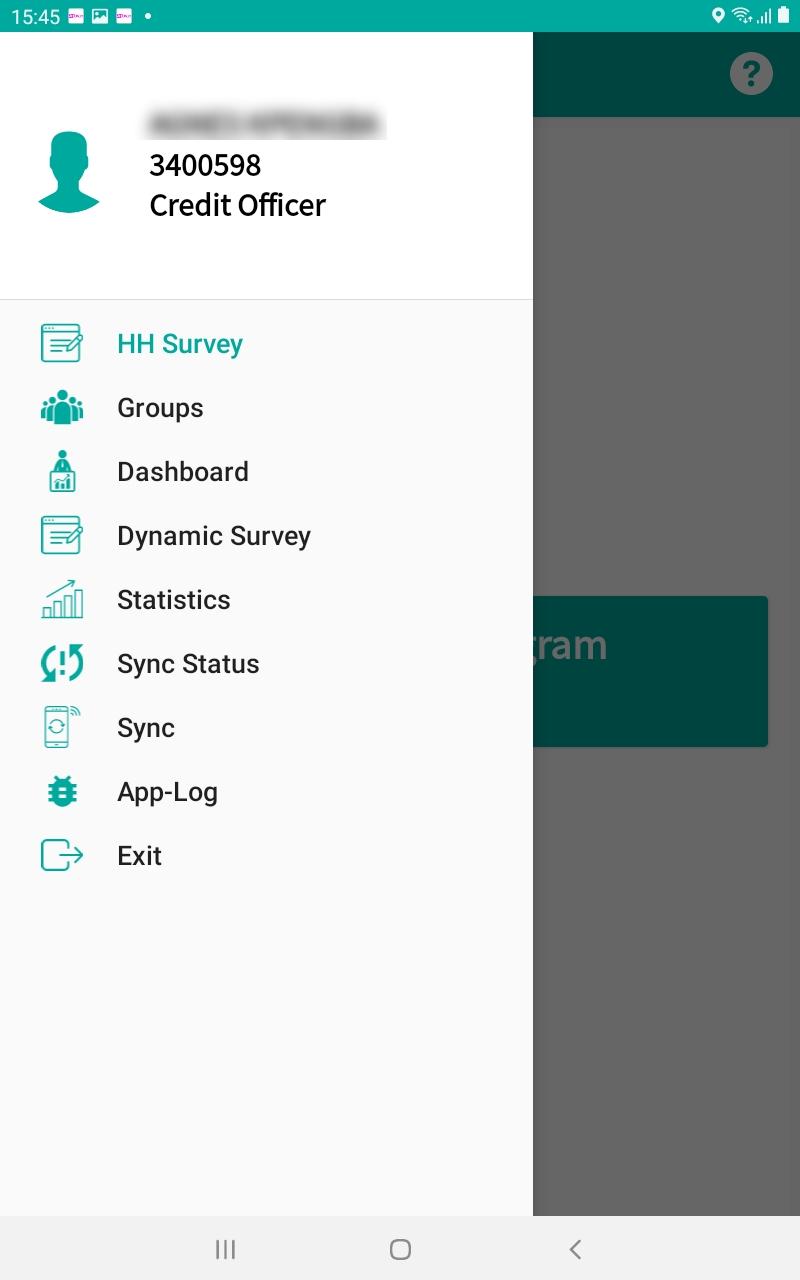

Mobile field solution of micro-finance for BRAC Ghana

Features of the BRAC micro-finance for Ghana:

1. Doing the household survey

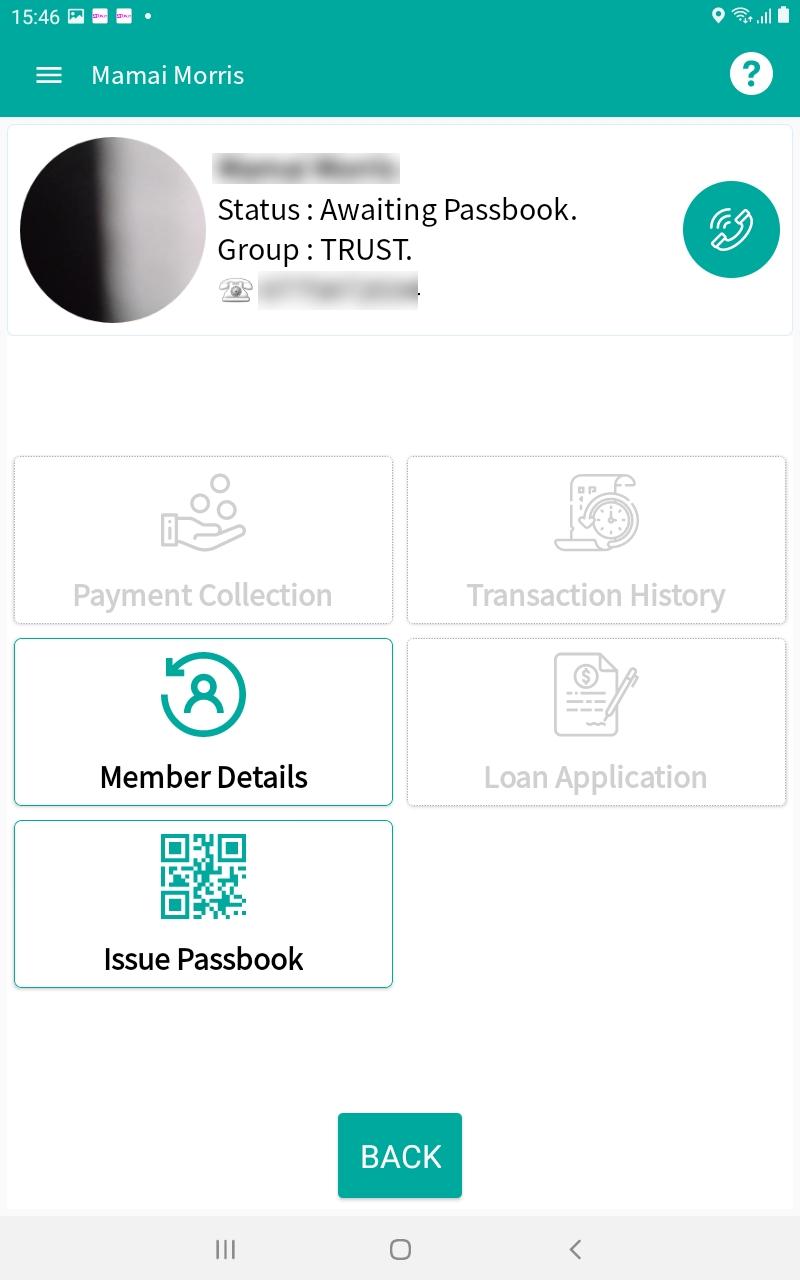

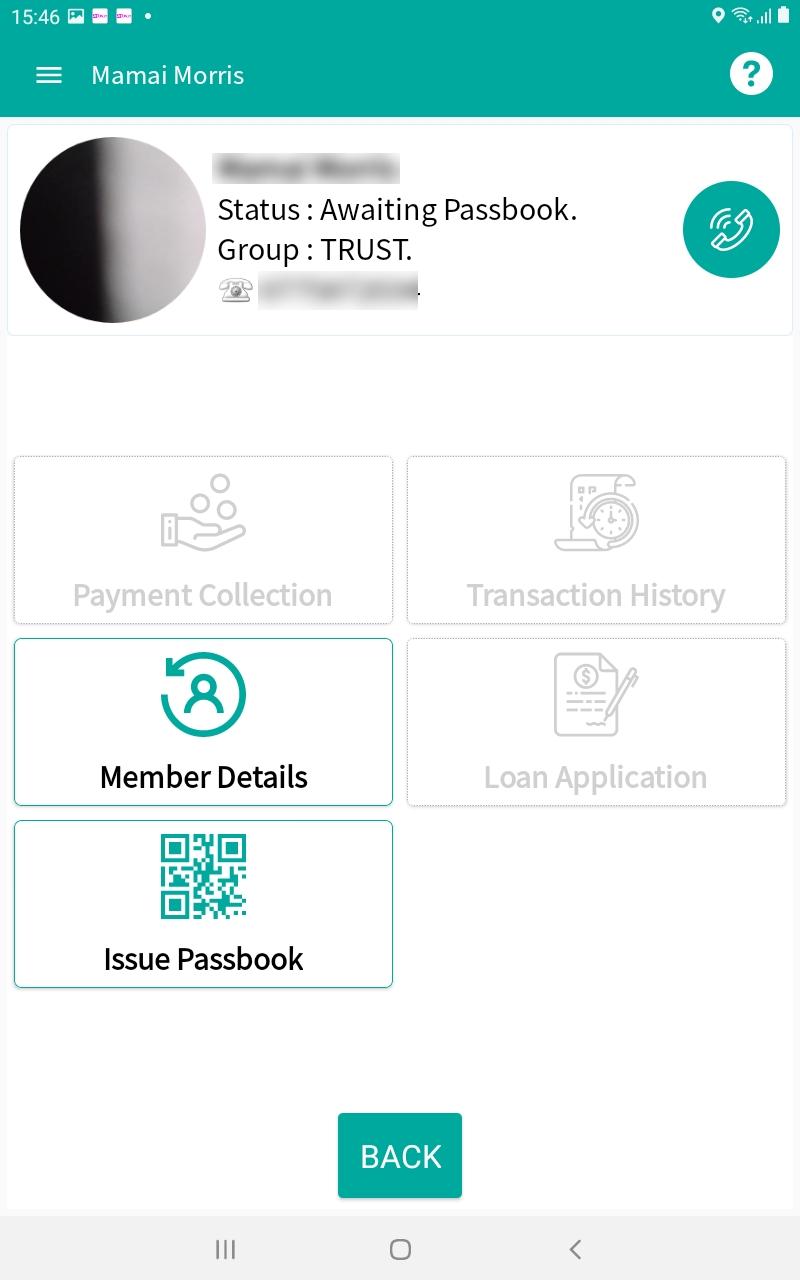

2. Registering members

3. Loan application and loan disbursement

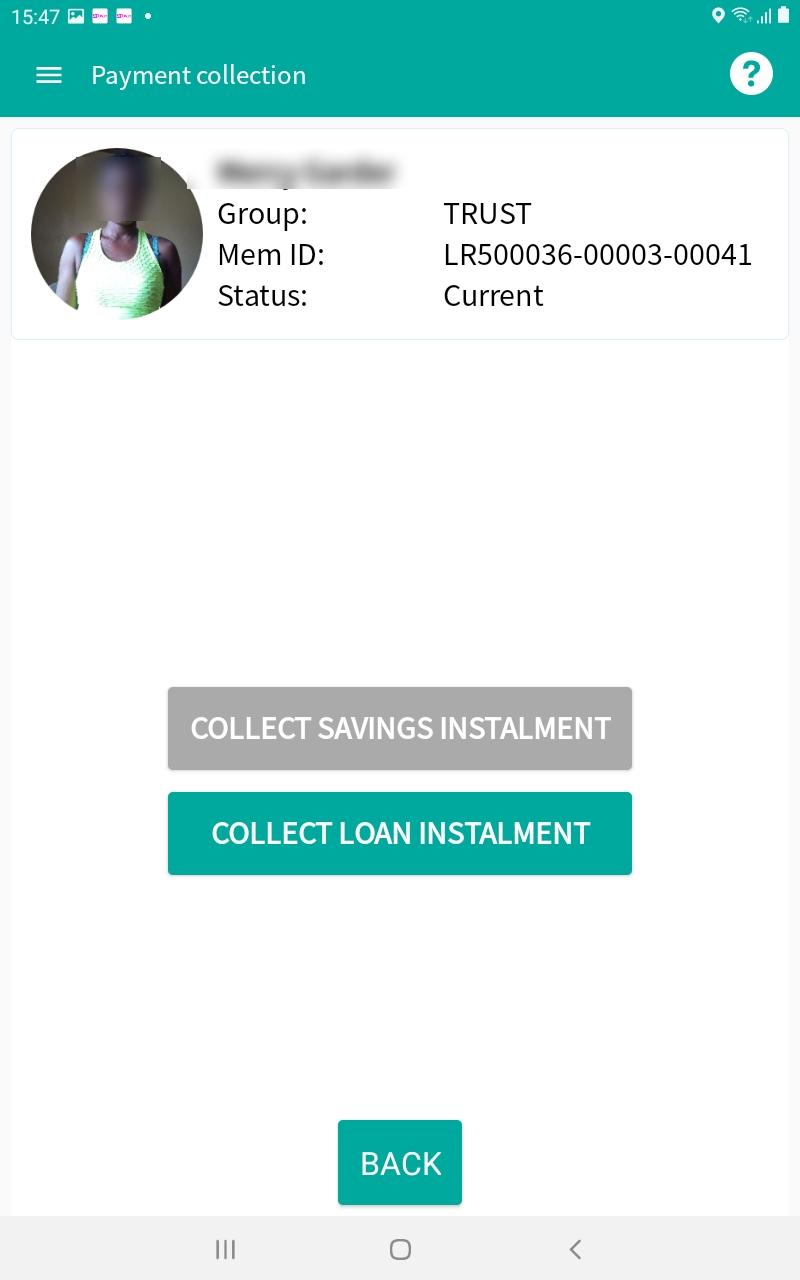

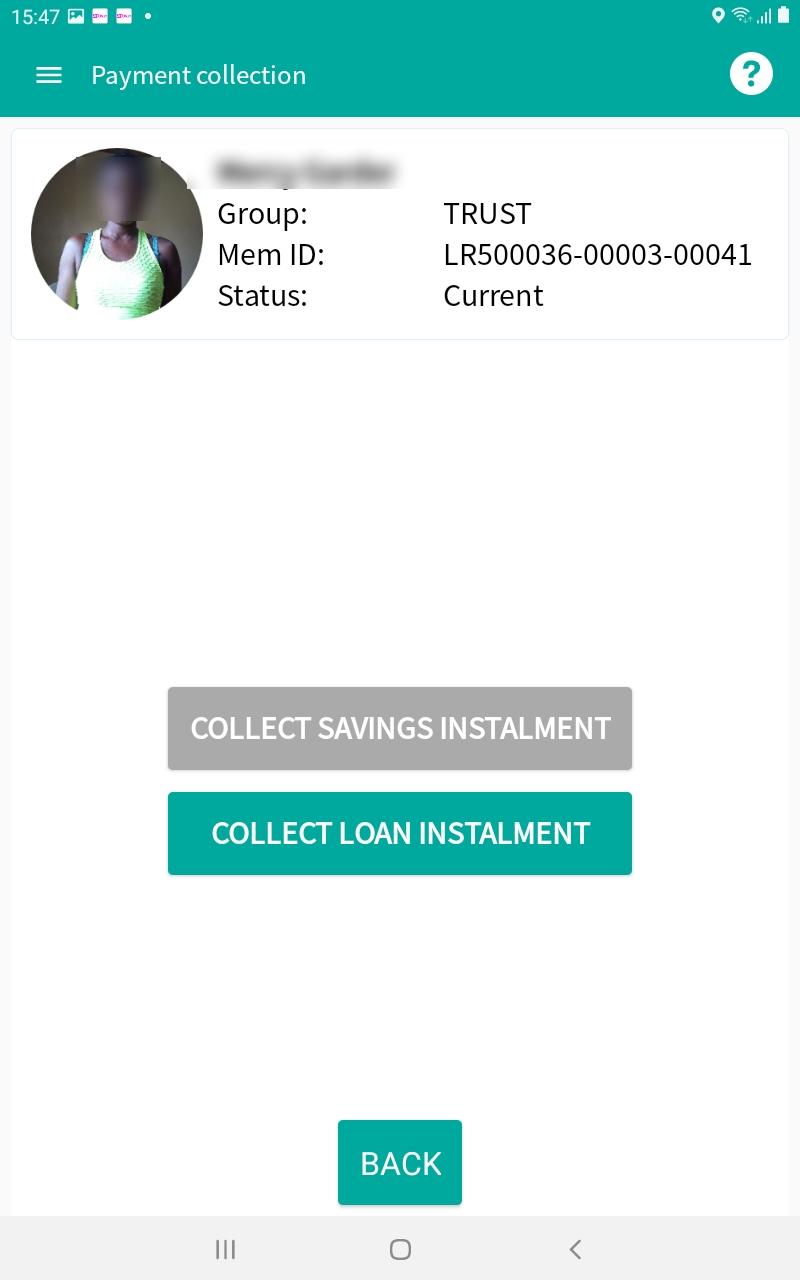

4. Loan collection from members

What's New in the Latest Version 1.0.141

Last updated on Jul 2, 2024

Exciting News: We've just released a new update for our app! 🚀 This update includes performance improvements, bug fixes, and some cool new features to enhance your experience. Update now to enjoy a smoother and more enjoyable app. Thank you for your continued support!

BRAC Microfinance Ghana: Empowering the UnbankedBRAC Microfinance Ghana is a leading microfinance institution that has been providing financial services to the unbanked and underbanked population in Ghana since 2008. As a subsidiary of the global BRAC Group, it has a mission to alleviate poverty and empower individuals by offering accessible and affordable financial products and services.

Financial Inclusion and Outreach

BRAC Microfinance Ghana's primary focus is on financial inclusion, particularly for women and low-income households. The institution operates through a network of over 100 branches and service centers, reaching remote and underserved areas across the country. By providing tailored financial products, such as microloans, savings accounts, and mobile banking, BRAC Microfinance Ghana enables individuals to access essential financial services, break the cycle of poverty, and improve their livelihoods.

Microloans for Small Businesses

Microloans are a cornerstone of BRAC Microfinance Ghana's operations. These small loans are designed to support entrepreneurs and small business owners who lack access to traditional banking channels. By providing financing for income-generating activities, BRAC Microfinance Ghana empowers individuals to start or expand their businesses, creating employment opportunities and contributing to economic growth.

Savings and Investment Services

BRAC Microfinance Ghana also offers a range of savings and investment services, including savings accounts, fixed deposits, and mobile banking. These services encourage financial discipline, provide a safe haven for savings, and enable individuals to accumulate wealth over time. The institution's commitment to financial inclusion extends to providing financial literacy training to its clients, ensuring they make informed financial decisions.

Social Performance and Impact

Beyond financial services, BRAC Microfinance Ghana recognizes the importance of social performance and impact. The institution actively engages in community development initiatives, such as health awareness campaigns, educational programs, and women's empowerment activities. By addressing the social and economic challenges faced by its clients, BRAC Microfinance Ghana contributes to broader social progress and poverty reduction.

Sustainable Growth and Financial Stability

BRAC Microfinance Ghana is committed to sustainable growth and financial stability. The institution maintains strong financial performance and adheres to industry best practices. It is regulated by the Bank of Ghana and complies with all applicable laws and regulations. BRAC Microfinance Ghana's financial stability ensures the long-term viability of its operations and the protection of its clients' savings.

Conclusion

BRAC Microfinance Ghana is a transformative force in the financial landscape of Ghana. By providing accessible and affordable financial services to the unbanked and underbanked population, the institution empowers individuals, fosters economic growth, and promotes social inclusion. Its commitment to financial inclusion, social performance, and sustainable growth makes BRAC Microfinance Ghana a leading player in the microfinance sector and a vital partner in the fight against poverty.

Mobile field solution of micro-finance for BRAC Ghana

Features of the BRAC micro-finance for Ghana:

1. Doing the household survey

2. Registering members

3. Loan application and loan disbursement

4. Loan collection from members

What's New in the Latest Version 1.0.141

Last updated on Jul 2, 2024

Exciting News: We've just released a new update for our app! 🚀 This update includes performance improvements, bug fixes, and some cool new features to enhance your experience. Update now to enjoy a smoother and more enjoyable app. Thank you for your continued support!

BRAC Microfinance Ghana: Empowering the UnbankedBRAC Microfinance Ghana is a leading microfinance institution that has been providing financial services to the unbanked and underbanked population in Ghana since 2008. As a subsidiary of the global BRAC Group, it has a mission to alleviate poverty and empower individuals by offering accessible and affordable financial products and services.

Financial Inclusion and Outreach

BRAC Microfinance Ghana's primary focus is on financial inclusion, particularly for women and low-income households. The institution operates through a network of over 100 branches and service centers, reaching remote and underserved areas across the country. By providing tailored financial products, such as microloans, savings accounts, and mobile banking, BRAC Microfinance Ghana enables individuals to access essential financial services, break the cycle of poverty, and improve their livelihoods.

Microloans for Small Businesses

Microloans are a cornerstone of BRAC Microfinance Ghana's operations. These small loans are designed to support entrepreneurs and small business owners who lack access to traditional banking channels. By providing financing for income-generating activities, BRAC Microfinance Ghana empowers individuals to start or expand their businesses, creating employment opportunities and contributing to economic growth.

Savings and Investment Services

BRAC Microfinance Ghana also offers a range of savings and investment services, including savings accounts, fixed deposits, and mobile banking. These services encourage financial discipline, provide a safe haven for savings, and enable individuals to accumulate wealth over time. The institution's commitment to financial inclusion extends to providing financial literacy training to its clients, ensuring they make informed financial decisions.

Social Performance and Impact

Beyond financial services, BRAC Microfinance Ghana recognizes the importance of social performance and impact. The institution actively engages in community development initiatives, such as health awareness campaigns, educational programs, and women's empowerment activities. By addressing the social and economic challenges faced by its clients, BRAC Microfinance Ghana contributes to broader social progress and poverty reduction.

Sustainable Growth and Financial Stability

BRAC Microfinance Ghana is committed to sustainable growth and financial stability. The institution maintains strong financial performance and adheres to industry best practices. It is regulated by the Bank of Ghana and complies with all applicable laws and regulations. BRAC Microfinance Ghana's financial stability ensures the long-term viability of its operations and the protection of its clients' savings.

Conclusion

BRAC Microfinance Ghana is a transformative force in the financial landscape of Ghana. By providing accessible and affordable financial services to the unbanked and underbanked population, the institution empowers individuals, fosters economic growth, and promotes social inclusion. Its commitment to financial inclusion, social performance, and sustainable growth makes BRAC Microfinance Ghana a leading player in the microfinance sector and a vital partner in the fight against poverty.