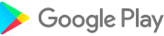

Credit score,Loans & Credit cards. Build your Score & Improve your Credit Health

With CreditFit, you can check your Free credit score and improve your credit health. We offer a wide range of loans & credit cards that are uniquely matched to your profile from top banks (Yes Bank Limited, InCred Financial Services Limited, Shriram Finance Limited etc.)

CreditFit’s credit score is powered by Equifax - 1 of the 4 credit bureaus authorized by RBI.

CreditMantri's CreditFit is trusted by more than 18 million Indians🛡️ and 40+ lenders.

🏁 Things you can do

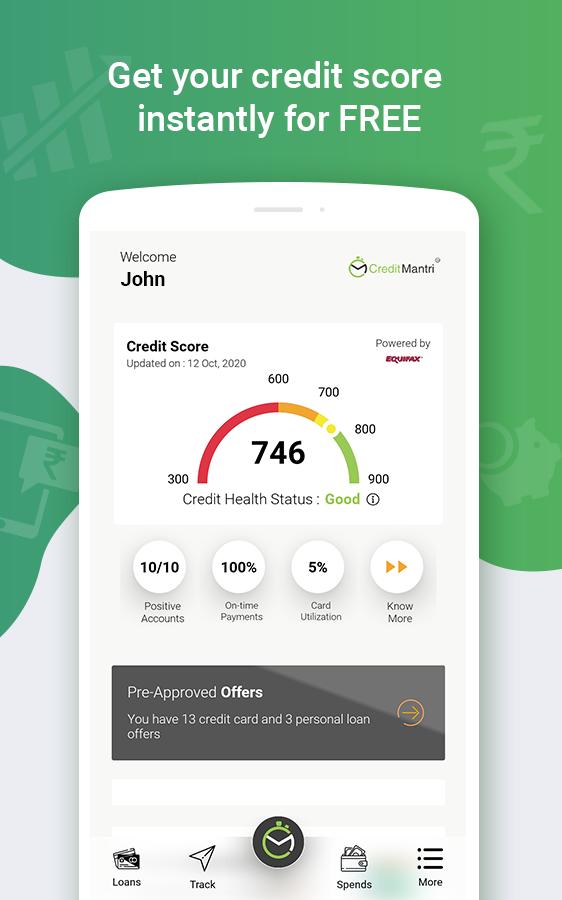

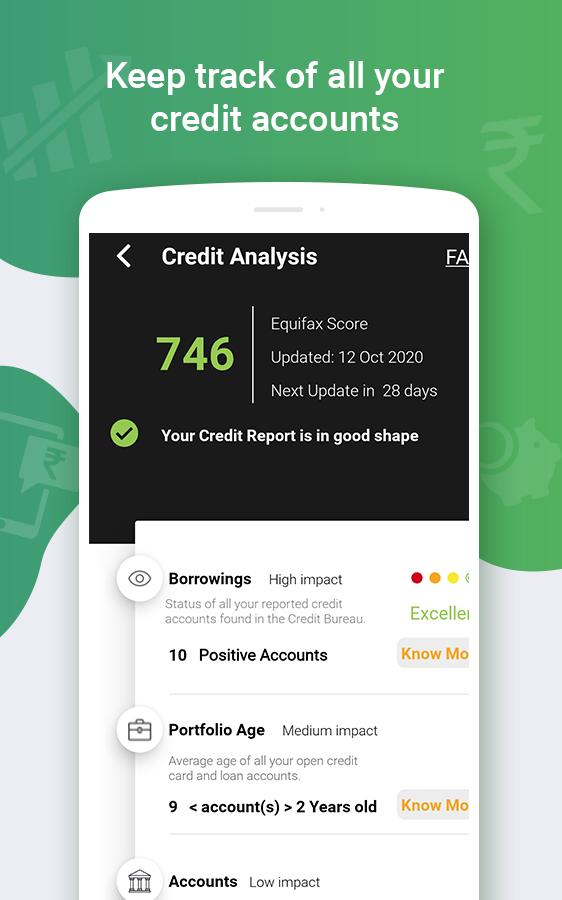

🎰 Credit Score and Analysis

- Check your credit score for FREE & get detailed analysis of your credit profile

- Subscribe to premium credit health report for personalized recommendations

- Improve your credit score with inputs from our experts

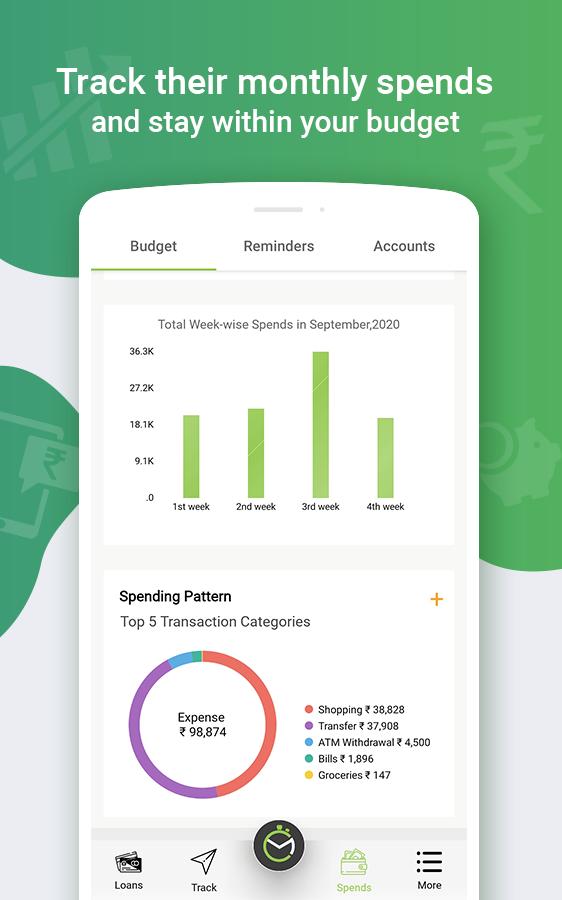

💸 Track Spends & Bills

- Plan your budget & track your spends across categories

- Quickly add any cash spent to accurately track your expenses

- Get EMI reminders & credit card bill reminders to pay on-time

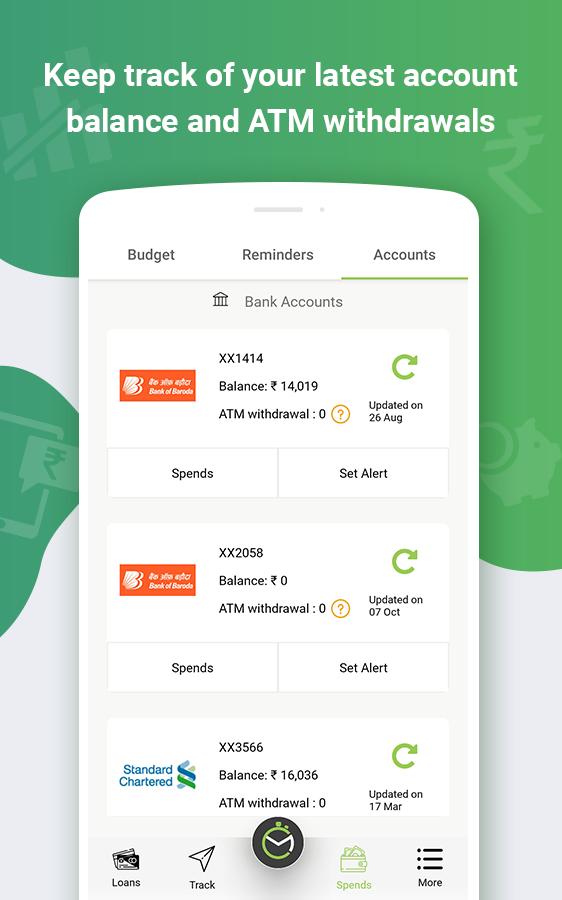

- Check bank balance & ATM 🏧 withdrawal count

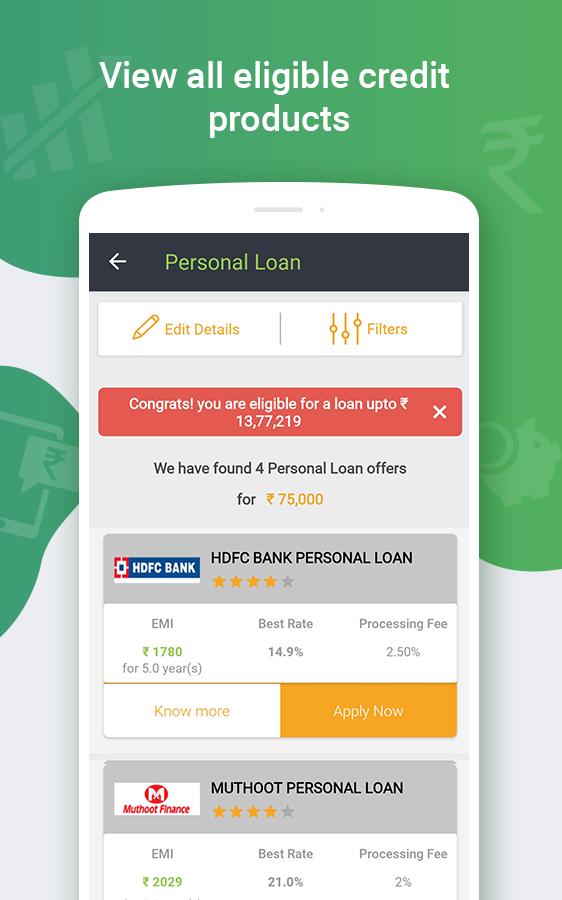

💰 Loans & Card offers

- Apply for exclusive loans & credit cards from lenders, get Instant approval

- Build your credit score with your first credit product

🆓 Credit score FAQs❔

What is a credit score & how is a credit score calculated?

Credit score is an indicator of a borrower's ability to make credit payments on time. Credit score is calculated based on the data provided by the banks and NBFCs to the bureau. Major factors that influence a credit score calculation are timely credit payments, current outstanding balance and new credit enquiries etc.

If I check my credit score, will it hurt my credit report?

No, requesting your credit score through CreditFit is considered a soft inquiry on your credit report (as opposed to a hard inquiry, when a lender requests your credit score during a loan decision).

I have a low credit score. What can I do to improve my score and become loan eligible?

You might have a low credit score due to negative accounts and/or delayed payment(s) in your credit report. CreditMantri can help you identify the negative accounts and help you attain better credit health by resolving the issues.

💡 Loans FAQs

What are the kind of loans available?

CreditFit’s Marketplace offers a wide range of products matched to the customer’s credit profile which include personal loan, home loan, auto loan, gold loan, loan against property, business loan, education loan and two-wheeler loan

What is the loan amount, tenure and interest rate I can get on different types of loans?

Loan amount, tenure and interest rate are determined by your credit profile and requirements.

1. Personal loan: From ₹1,000 to ₹30 lakhs & tenure from 90 days to 5 years & interest rate varies from 11.99% to 35% per annum

2. Home loan: From ₹3 Lakhs to ₹10 Crores & tenure from 1 to 30 years & interest rate varies from 8.35% to 15% per annum

*Who are the lenders that partnered with CreditFit to provide Personal Loans?

CreditFit has partnered with Leading Banks to provide Personal Loans. Below is the list of Lenders :

Yes Bank Limited

InCred Financial Services Limited

Shriram Finance Limited

Representative example of the total cost of the loan:

Loan amount - ₹1,00,000

Interest rate(APR) - 13% p.a

Loan tenure - 12 months

Total Interest to be paid - ₹13,000

Processing fee + GST - ₹588 (₹499+GST)

Monthly EMI repayment - ₹9,466

Total amount to be repaid - ₹1,13,588

🔐Permissions Requested:

* Camera - To take photos of proof documents to quicken loan process.

* SMS - To help you track your spends and EMI reminders from bank SMSs

* Storage - To store photos captured by you for proof documents

* Phone call/Device state – To pre-fill the mobile number

🏆Awards

Red Herring Asia Top 100 Winner, 2017

Named in the “Top 250 Fin-Tech Companies in the world” by CB Insights, 2017 and 2018

Jason J.Spindler ‘Big Data for Impact Award, 2019

What's New in the Latest Version 4.1.1

Last updated on Jun 18, 2024

This update involves

1. Bug fixes

2. Seamless login experience

3. Enhanced loan application journey

Update the app now!

Credit score,Loans & Credit cards. Build your Score & Improve your Credit Health

With CreditFit, you can check your Free credit score and improve your credit health. We offer a wide range of loans & credit cards that are uniquely matched to your profile from top banks (Yes Bank Limited, InCred Financial Services Limited, Shriram Finance Limited etc.)

CreditFit’s credit score is powered by Equifax - 1 of the 4 credit bureaus authorized by RBI.

CreditMantri's CreditFit is trusted by more than 18 million Indians🛡️ and 40+ lenders.

🏁 Things you can do

🎰 Credit Score and Analysis

- Check your credit score for FREE & get detailed analysis of your credit profile

- Subscribe to premium credit health report for personalized recommendations

- Improve your credit score with inputs from our experts

💸 Track Spends & Bills

- Plan your budget & track your spends across categories

- Quickly add any cash spent to accurately track your expenses

- Get EMI reminders & credit card bill reminders to pay on-time

- Check bank balance & ATM 🏧 withdrawal count

💰 Loans & Card offers

- Apply for exclusive loans & credit cards from lenders, get Instant approval

- Build your credit score with your first credit product

🆓 Credit score FAQs❔

What is a credit score & how is a credit score calculated?

Credit score is an indicator of a borrower's ability to make credit payments on time. Credit score is calculated based on the data provided by the banks and NBFCs to the bureau. Major factors that influence a credit score calculation are timely credit payments, current outstanding balance and new credit enquiries etc.

If I check my credit score, will it hurt my credit report?

No, requesting your credit score through CreditFit is considered a soft inquiry on your credit report (as opposed to a hard inquiry, when a lender requests your credit score during a loan decision).

I have a low credit score. What can I do to improve my score and become loan eligible?

You might have a low credit score due to negative accounts and/or delayed payment(s) in your credit report. CreditMantri can help you identify the negative accounts and help you attain better credit health by resolving the issues.

💡 Loans FAQs

What are the kind of loans available?

CreditFit’s Marketplace offers a wide range of products matched to the customer’s credit profile which include personal loan, home loan, auto loan, gold loan, loan against property, business loan, education loan and two-wheeler loan

What is the loan amount, tenure and interest rate I can get on different types of loans?

Loan amount, tenure and interest rate are determined by your credit profile and requirements.

1. Personal loan: From ₹1,000 to ₹30 lakhs & tenure from 90 days to 5 years & interest rate varies from 11.99% to 35% per annum

2. Home loan: From ₹3 Lakhs to ₹10 Crores & tenure from 1 to 30 years & interest rate varies from 8.35% to 15% per annum

*Who are the lenders that partnered with CreditFit to provide Personal Loans?

CreditFit has partnered with Leading Banks to provide Personal Loans. Below is the list of Lenders :

Yes Bank Limited

InCred Financial Services Limited

Shriram Finance Limited

Representative example of the total cost of the loan:

Loan amount - ₹1,00,000

Interest rate(APR) - 13% p.a

Loan tenure - 12 months

Total Interest to be paid - ₹13,000

Processing fee + GST - ₹588 (₹499+GST)

Monthly EMI repayment - ₹9,466

Total amount to be repaid - ₹1,13,588

🔐Permissions Requested:

* Camera - To take photos of proof documents to quicken loan process.

* SMS - To help you track your spends and EMI reminders from bank SMSs

* Storage - To store photos captured by you for proof documents

* Phone call/Device state – To pre-fill the mobile number

🏆Awards

Red Herring Asia Top 100 Winner, 2017

Named in the “Top 250 Fin-Tech Companies in the world” by CB Insights, 2017 and 2018

Jason J.Spindler ‘Big Data for Impact Award, 2019

What's New in the Latest Version 4.1.1

Last updated on Jun 18, 2024

This update involves

1. Bug fixes

2. Seamless login experience

3. Enhanced loan application journey

Update the app now!