Online Tax Payment Aggregator

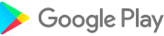

What is e-Pay Punjab?

ePay Punjab is the first ever digital payment aggregator for Public to Government (P2G) and Business to Government (B2G) payments in Pakistan.

Using ePay Punjab, dues can be paid through the following payment channels.

• Mobile Banking

• Internet Banking

• ATM

• OTC (Over the Counter)

• Mobile Wallets

• Telco Agents

The solution is developed by The Punjab IT Board (PITB) under the instructions and guidance of The Finance Department of Punjab. At the backend it is integrated with State Bank of Pakistan (SBP) and 1-link for interconnectivity across the entire banking network in Pakistan.

Payment Process and Channels

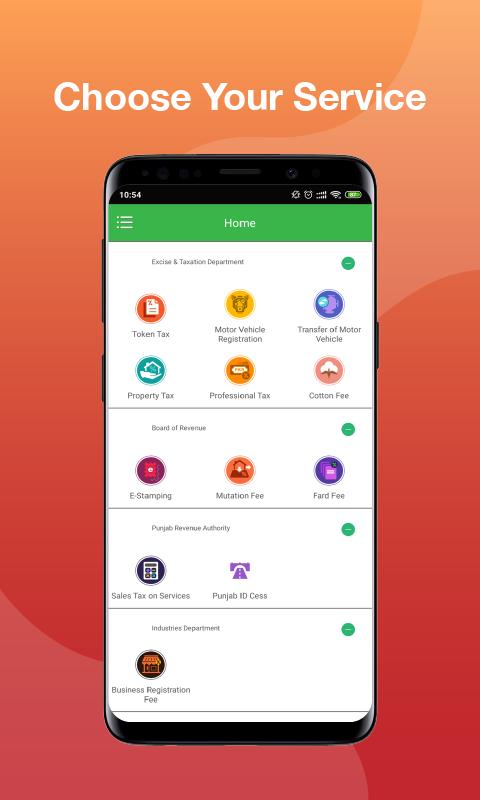

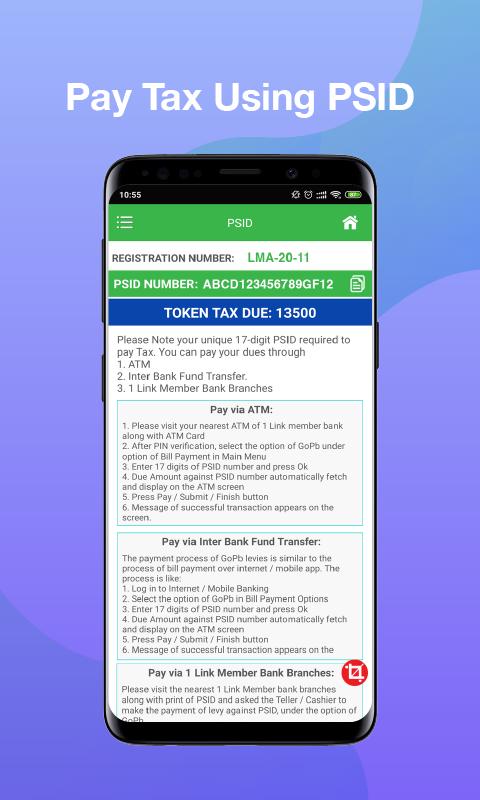

To pay the tax dues, an individual will access ePay Punjab application or website to generate a 17-digit PSID number. The PSID number that is unique for each transaction could subsequently be used on the aforementioned Six payment channels i.e. Mobile Banking, Internet Banking, ATM, OTC, Mobile Wallets and Telco Agents by the citizens to pay the tax dues.

Zindigi Account Holders can pay tax online through ePay Punjab. This service will increase in the number of customers using the bank's bill payment services, reduction in the number of late payments, improvement in customer satisfaction level and user experience.

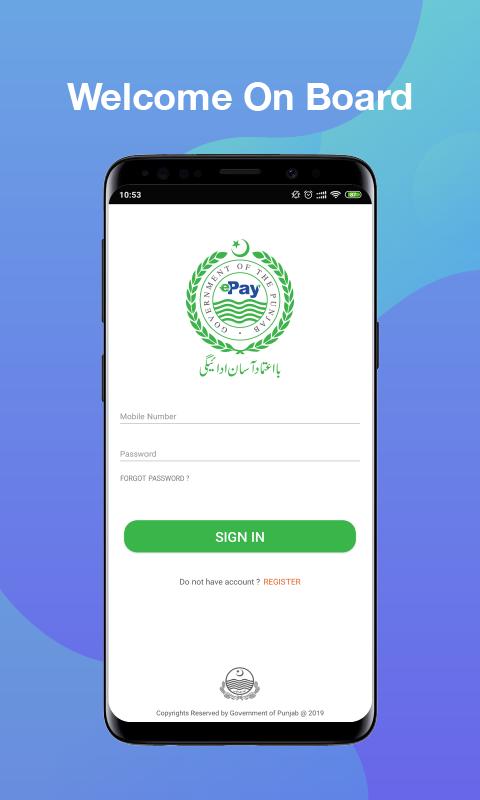

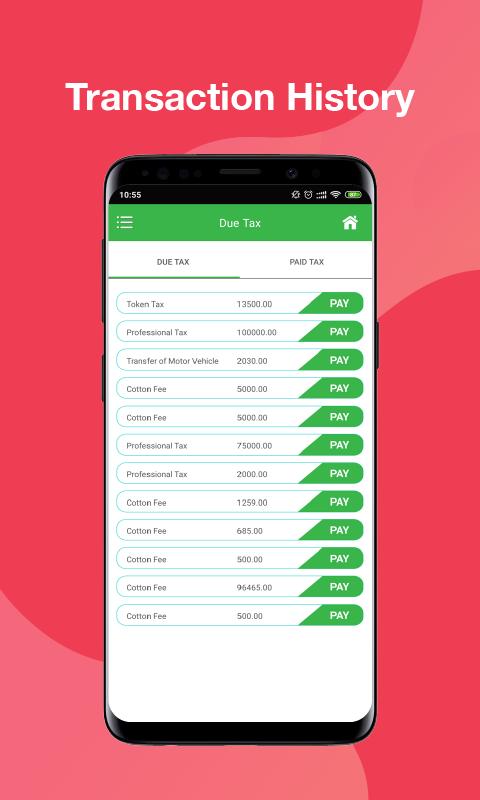

Currently, the following tax receipts can be paid via ePay Punjab:

Excise & Taxation

• Token Tax for Vehicle

• Motor Vehicle Registration

• Vehicle Transfer

• Property Tax

• Professional Tax

• Cotton fee

• e-Auction

Board of Revenue (BOR)

• e-Stamping

• Mutation fee

• Fard fee

Punjab Revenue Authority (PRA)

• Sales Tax on Services

• Punjab Infrastructural Development Cess

Industries

• Business Registration fee

• Price Magistrate

• Weight & Measures

Transport Department of Punjab

• Route Permit

• Vehicle Fitness Certificate

• Lahore Transport Company

Punjab Police

• Traffic Challan

• PHP Challan

• e-Challan (Safe City)

School Education Department

• PEPRIS Fee

• e-Registration of Private Colleges

Irrigation Department

• e-Abiana

• eProcurement

Labor and Human Resource Department

• Worker Participation Funds

Punjab Public Service Commission

• PPSC Exam Fee

Domicile

• Domicile

ePay Punjab: A Comprehensive OverviewePay Punjab is a cutting-edge digital payment platform designed to facilitate seamless financial transactions in the Indian state of Punjab. It provides a comprehensive suite of services, empowering individuals, businesses, and government entities to manage their finances conveniently and efficiently.

Core Features and Services

* Online Banking: ePay Punjab allows users to access their bank accounts remotely, enabling them to perform various banking operations such as balance inquiries, fund transfers, and bill payments.

* Mobile Wallet: The integrated mobile wallet enables users to make payments, receive funds, and store money securely on their mobile devices.

* Merchant Payments: Businesses can accept payments from customers using ePay Punjab's secure and convenient payment gateway.

* Government Payments: Citizens can pay their taxes, utility bills, and other government dues through the platform, streamlining the payment process and promoting transparency.

* Bulk Payments: Organizations can disburse salaries, vendor payments, and other bulk payments to multiple recipients with ease and efficiency.

* QR Code Payments: Merchants and individuals can generate and scan QR codes to facilitate quick and contactless payments.

* Digital Receipts: All transactions are documented with digital receipts, providing users with a secure and verifiable record of their financial activities.

Benefits and Advantages

* Convenience: ePay Punjab eliminates the need for physical visits to banks or government offices, allowing users to conduct financial transactions from anywhere, anytime.

* Security: The platform employs robust security measures, including encryption and two-factor authentication, to protect user data and financial transactions.

* Efficiency: The streamlined payment processes reduce transaction times and minimize delays, improving overall financial management efficiency.

* Transparency: Digital receipts and detailed transaction records provide users with a clear and transparent view of their financial activities.

* Financial Inclusion: ePay Punjab promotes financial inclusion by providing access to digital financial services to individuals and businesses that may have limited access to traditional banking channels.

Target Audience and Usage

ePay Punjab caters to a wide range of users, including:

* Individuals: Individuals can manage their personal finances, make payments, and receive funds conveniently.

* Businesses: Businesses can accept payments, manage their cash flow, and streamline their financial operations.

* Government Entities: Government departments can collect taxes, disburse payments, and improve transparency in financial transactions.

* Non-Profit Organizations: Non-profit organizations can receive donations, manage funds, and track their financial activities efficiently.

Conclusion

ePay Punjab is a transformative digital payment platform that revolutionizes financial transactions in the state of Punjab. Its comprehensive features, ease of use, and commitment to security make it an invaluable tool for individuals, businesses, and government entities alike. By embracing ePay Punjab, users can experience the benefits of seamless financial management, improved efficiency, and greater transparency.

Online Tax Payment Aggregator

What is e-Pay Punjab?

ePay Punjab is the first ever digital payment aggregator for Public to Government (P2G) and Business to Government (B2G) payments in Pakistan.

Using ePay Punjab, dues can be paid through the following payment channels.

• Mobile Banking

• Internet Banking

• ATM

• OTC (Over the Counter)

• Mobile Wallets

• Telco Agents

The solution is developed by The Punjab IT Board (PITB) under the instructions and guidance of The Finance Department of Punjab. At the backend it is integrated with State Bank of Pakistan (SBP) and 1-link for interconnectivity across the entire banking network in Pakistan.

Payment Process and Channels

To pay the tax dues, an individual will access ePay Punjab application or website to generate a 17-digit PSID number. The PSID number that is unique for each transaction could subsequently be used on the aforementioned Six payment channels i.e. Mobile Banking, Internet Banking, ATM, OTC, Mobile Wallets and Telco Agents by the citizens to pay the tax dues.

Zindigi Account Holders can pay tax online through ePay Punjab. This service will increase in the number of customers using the bank's bill payment services, reduction in the number of late payments, improvement in customer satisfaction level and user experience.

Currently, the following tax receipts can be paid via ePay Punjab:

Excise & Taxation

• Token Tax for Vehicle

• Motor Vehicle Registration

• Vehicle Transfer

• Property Tax

• Professional Tax

• Cotton fee

• e-Auction

Board of Revenue (BOR)

• e-Stamping

• Mutation fee

• Fard fee

Punjab Revenue Authority (PRA)

• Sales Tax on Services

• Punjab Infrastructural Development Cess

Industries

• Business Registration fee

• Price Magistrate

• Weight & Measures

Transport Department of Punjab

• Route Permit

• Vehicle Fitness Certificate

• Lahore Transport Company

Punjab Police

• Traffic Challan

• PHP Challan

• e-Challan (Safe City)

School Education Department

• PEPRIS Fee

• e-Registration of Private Colleges

Irrigation Department

• e-Abiana

• eProcurement

Labor and Human Resource Department

• Worker Participation Funds

Punjab Public Service Commission

• PPSC Exam Fee

Domicile

• Domicile

ePay Punjab: A Comprehensive OverviewePay Punjab is a cutting-edge digital payment platform designed to facilitate seamless financial transactions in the Indian state of Punjab. It provides a comprehensive suite of services, empowering individuals, businesses, and government entities to manage their finances conveniently and efficiently.

Core Features and Services

* Online Banking: ePay Punjab allows users to access their bank accounts remotely, enabling them to perform various banking operations such as balance inquiries, fund transfers, and bill payments.

* Mobile Wallet: The integrated mobile wallet enables users to make payments, receive funds, and store money securely on their mobile devices.

* Merchant Payments: Businesses can accept payments from customers using ePay Punjab's secure and convenient payment gateway.

* Government Payments: Citizens can pay their taxes, utility bills, and other government dues through the platform, streamlining the payment process and promoting transparency.

* Bulk Payments: Organizations can disburse salaries, vendor payments, and other bulk payments to multiple recipients with ease and efficiency.

* QR Code Payments: Merchants and individuals can generate and scan QR codes to facilitate quick and contactless payments.

* Digital Receipts: All transactions are documented with digital receipts, providing users with a secure and verifiable record of their financial activities.

Benefits and Advantages

* Convenience: ePay Punjab eliminates the need for physical visits to banks or government offices, allowing users to conduct financial transactions from anywhere, anytime.

* Security: The platform employs robust security measures, including encryption and two-factor authentication, to protect user data and financial transactions.

* Efficiency: The streamlined payment processes reduce transaction times and minimize delays, improving overall financial management efficiency.

* Transparency: Digital receipts and detailed transaction records provide users with a clear and transparent view of their financial activities.

* Financial Inclusion: ePay Punjab promotes financial inclusion by providing access to digital financial services to individuals and businesses that may have limited access to traditional banking channels.

Target Audience and Usage

ePay Punjab caters to a wide range of users, including:

* Individuals: Individuals can manage their personal finances, make payments, and receive funds conveniently.

* Businesses: Businesses can accept payments, manage their cash flow, and streamline their financial operations.

* Government Entities: Government departments can collect taxes, disburse payments, and improve transparency in financial transactions.

* Non-Profit Organizations: Non-profit organizations can receive donations, manage funds, and track their financial activities efficiently.

Conclusion

ePay Punjab is a transformative digital payment platform that revolutionizes financial transactions in the state of Punjab. Its comprehensive features, ease of use, and commitment to security make it an invaluable tool for individuals, businesses, and government entities alike. By embracing ePay Punjab, users can experience the benefits of seamless financial management, improved efficiency, and greater transparency.