Google Pay - A fast, easy and private online payment service.

Important update:

The U.S. version of the standalone Google Pay app will no longer be available for use starting June 4, 2024.

If you use your Android phone to shop in stores where Google Pay is accepted, you can continue to tap to pay in stores with the Google Wallet app.

Here are the key changes and important dates:

As of Feb 22, 2024 you will no longer be able to view or activate deals in the app. If you previously activated a deal, and are still waiting for cash back, regular reward timelines apply.

Changes to peer-to-peer payments: As of June 4, 2024, you will no longer be able to send, request or receive money from others through the U.S. version of the Google Pay app.

Manage your Google Pay balance from the Google Pay app until June 4: You can use the U.S. version of the Google Pay app until June 4, 2024 to view and transfer your Google Pay balance to your bank account. You can continue to view and transfer your funds to your bank account after June 4, 2024 from the Google Pay website.

If you have linked accounts on Google Pay to monitor your transactions and insights, you’ll still be able to view your transactions on the Google Pay website in the transactions tab after June 4, 2024. If you wish to disconnect your accounts after June 4, 2024, you will be able to unlink them on the Google Pay website.

If you've used the Google Pay app in the US to send money with Wise from the US to India or Singapore, this feature and related transaction information will no longer be available in the app starting June 4, 2024. This does not impact your Wise account, which you can continue to access at wise.com.

Google Payment Corporation's Customer Service and Error Resolution Policy and applicable processes still apply to report unauthorized transactions related to Google Pay. If you have any further questions about your balance in the app, you can learn more about your Google Pay balance.

Still have questions? Head over to https://support.google.com/googlepay

*Payments processed by Google Payment Corp., a licensed money transmitter (NMLS ID: 911607). Licensed as a money transmitter by the NY State Dept. of Financial Services and to Transmit Money By Check, Draft or Money Order By The Department of Banking and Securities, Commonwealth of Pennsylvania. To learn more about Google Payments, visit the Google Payments Help Center.

What's New in the Latest Version 223.1.4 (arm64-v8a_release_flutter)

Last updated on Apr 18, 2024

We're giving the app a fresh new look. Enjoy the latest features and offers, from Groups experiences to convenient card payments!

Google Pay, formerly known as Android Pay and later rebranded as Google Wallet before reverting back to Google Pay, is a digital wallet platform developed by Google that allows users to make contactless payments in stores, online, and through apps. It also serves as a hub for storing loyalty cards, gift cards, boarding passes, transit passes, and, in some regions, government-issued identification.The core functionality of Google Pay revolves around near-field communication (NFC) technology. This technology enables short-range wireless communication between devices, allowing users to simply tap their phones on compatible payment terminals to complete transactions. This eliminates the need to physically carry credit or debit cards. Users add their card details to the Google Pay app, which then generates a virtual card number that is used for transactions, ensuring the security of the user's actual card information.

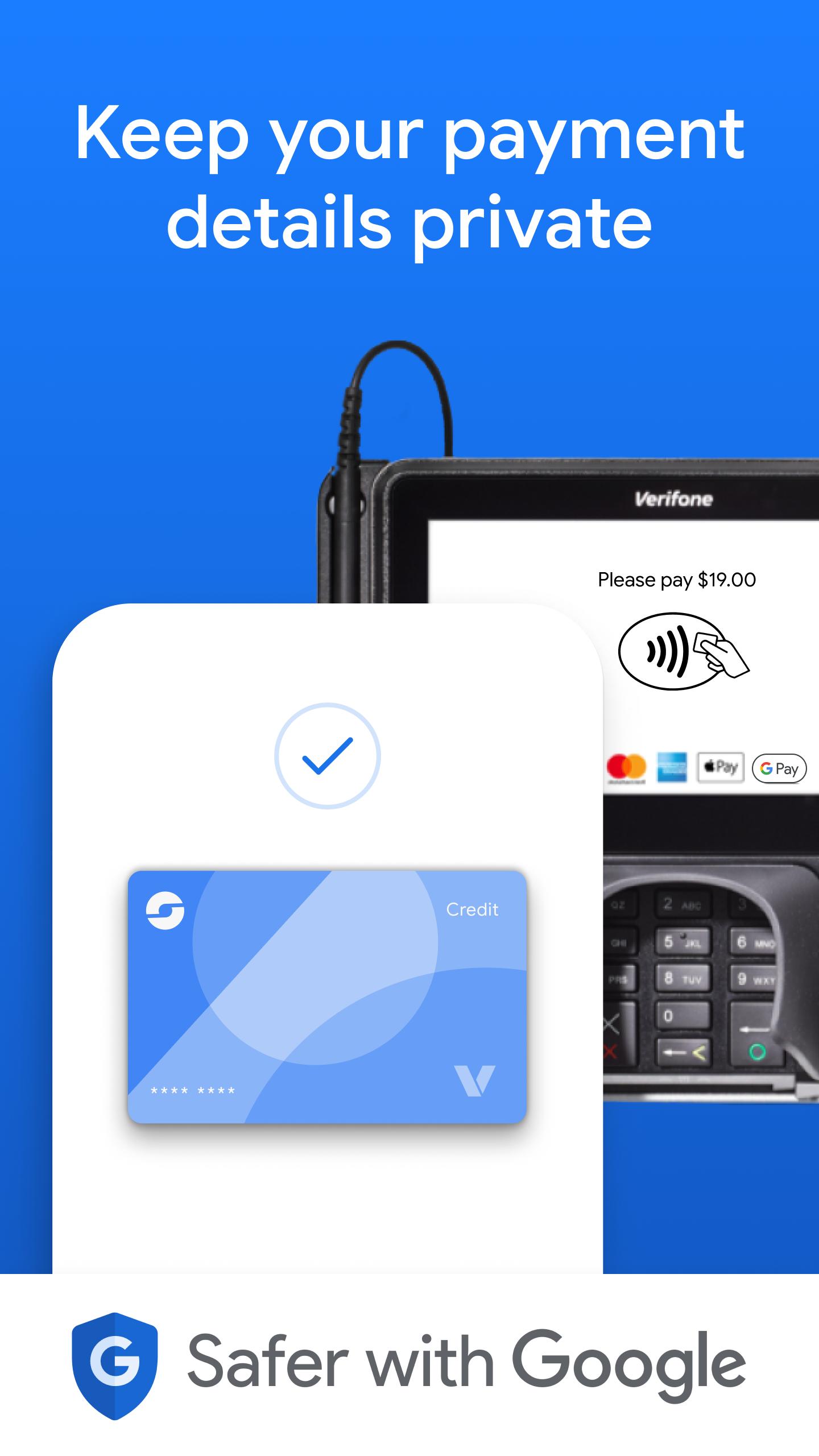

Security is a paramount concern for any digital payment platform, and Google Pay incorporates several measures to protect user data. Firstly, tokenization replaces sensitive card details with unique tokens, preventing merchants from accessing the actual card number. Secondly, transactions require authentication, typically through a PIN, fingerprint scan, or facial recognition, depending on the device and user settings. Thirdly, Google Pay benefits from the underlying security of the Android operating system, which includes regular security updates and patches.

Adding a card to Google Pay is a straightforward process. Users simply open the app, select the "Add a card" option, and then either manually enter their card details or use the camera to scan their card. Once the card is added, it can be used immediately for payments. Users can also add multiple cards to Google Pay, allowing them to choose their preferred payment method for each transaction.

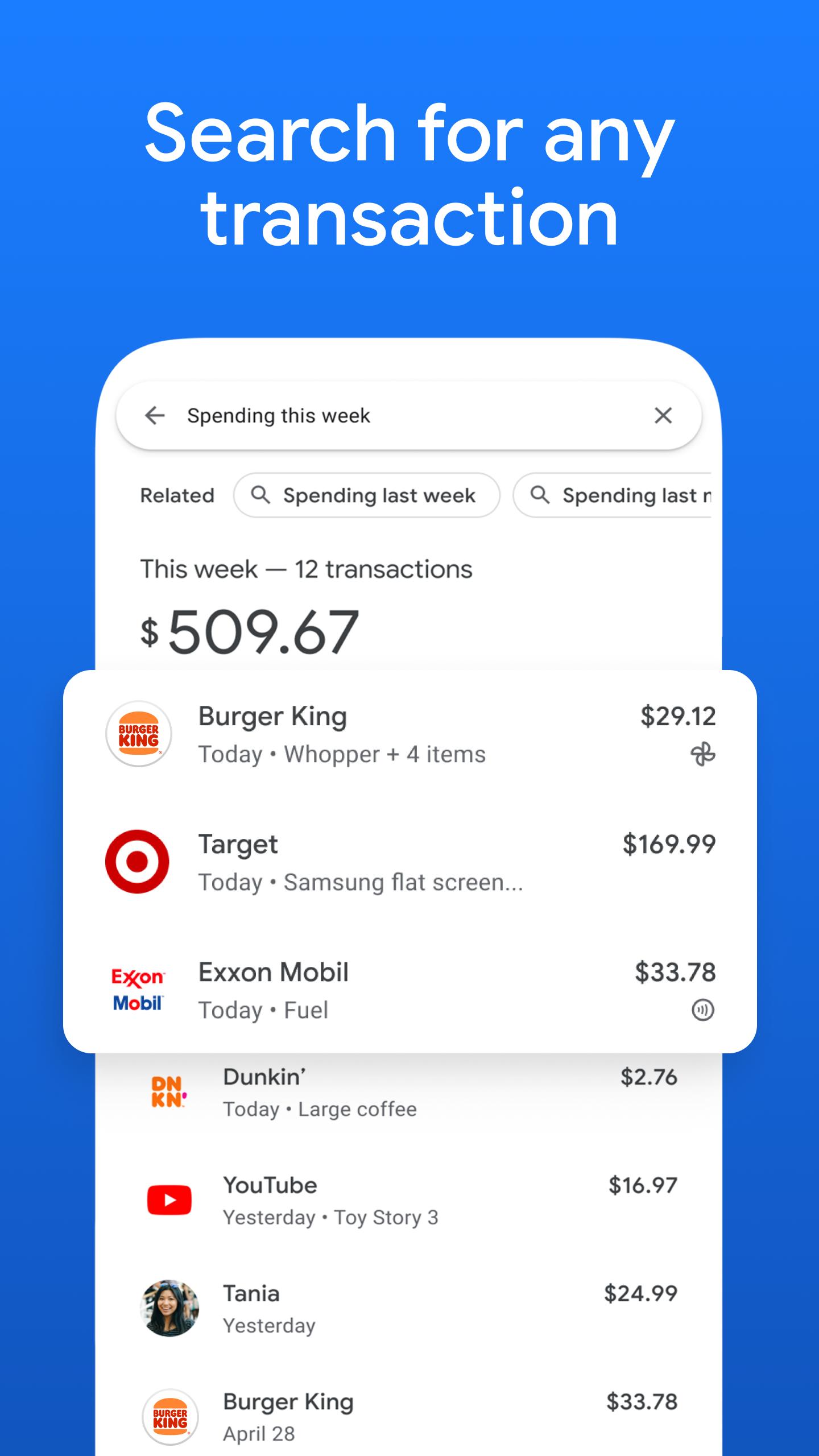

Beyond contactless payments, Google Pay facilitates online and in-app purchases. When shopping online or within supported apps, users can choose Google Pay as their payment method, streamlining the checkout process. This eliminates the need to repeatedly enter card details, saving time and enhancing convenience.

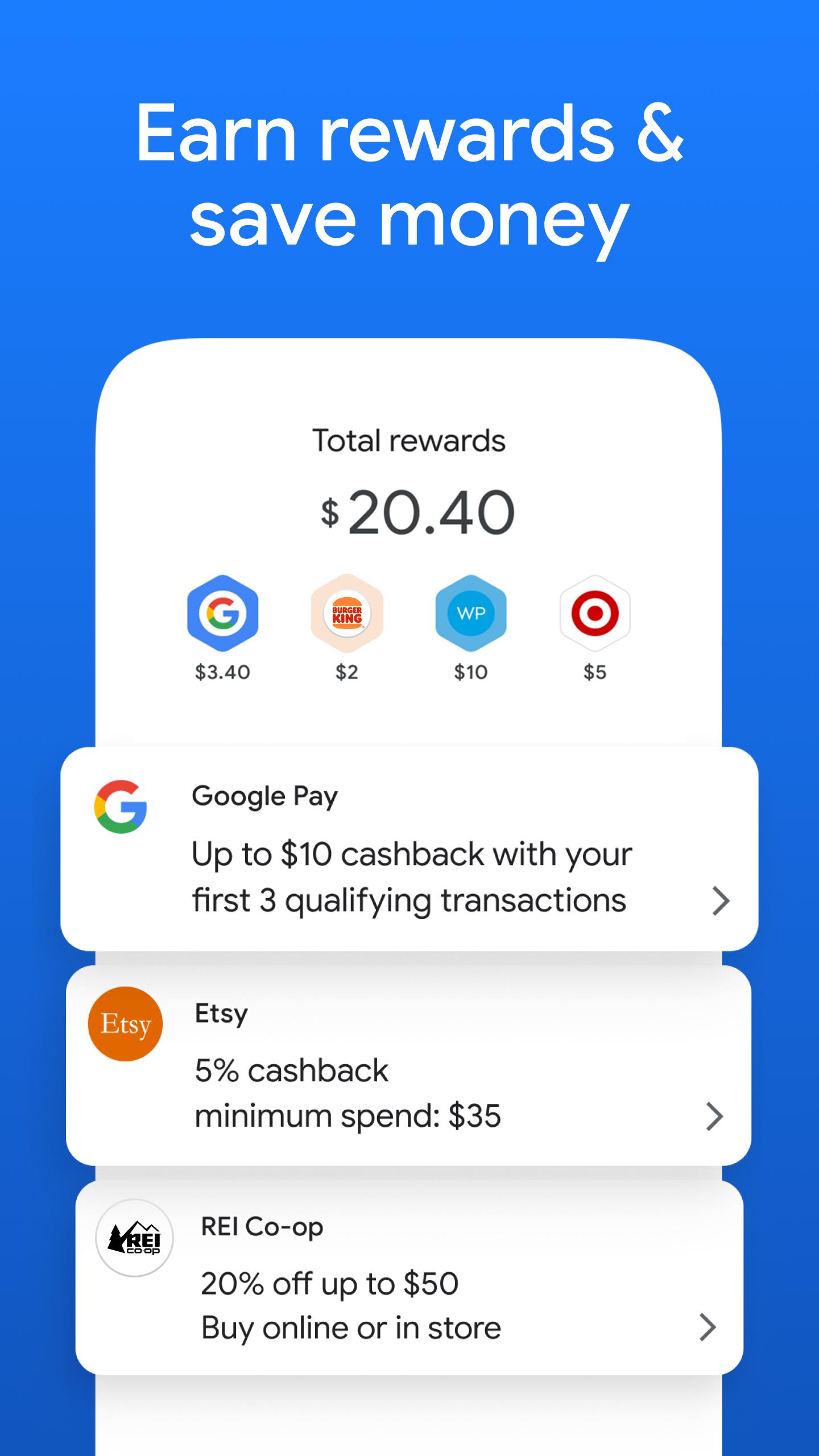

Google Pay also serves as a central repository for various other items, including loyalty cards, gift cards, boarding passes, and transit passes. Users can add these items to the app, eliminating the need to carry physical cards. This digital organization simplifies everyday tasks, from earning rewards points to accessing public transportation.

In certain regions, Google Pay is expanding its functionality to include government-issued identification, such as driver's licenses and state IDs. This feature allows users to securely store and present their identification digitally, potentially streamlining interactions with authorities and businesses.

The availability and features of Google Pay vary depending on the region and the user's device. While contactless payments are widely supported, the availability of other features, such as transit passes and government-issued identification, may be limited to specific locations. Furthermore, Google Pay requires a compatible Android device with NFC capabilities.

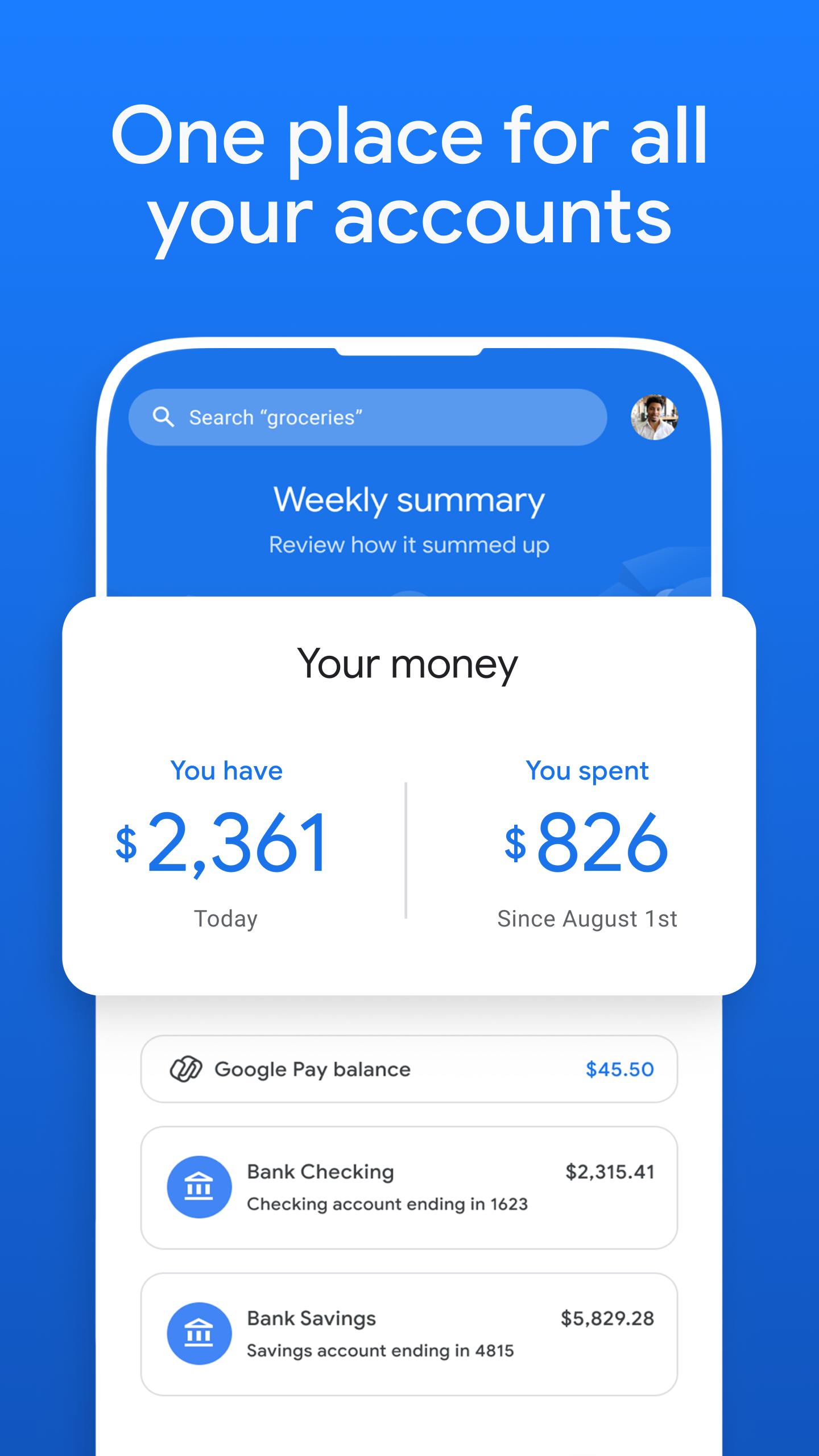

Google Pay integrates with other Google services, enhancing its overall utility. For example, users can send and receive money through Google Pay using their linked bank accounts. This feature facilitates peer-to-peer payments, making it easy to split bills or reimburse friends.

Google continues to develop and expand the capabilities of Google Pay, adding new features and functionalities over time. This ongoing development ensures that Google Pay remains a relevant and competitive player in the evolving landscape of digital payments. The platform's focus on security, convenience, and integration with other Google services positions it as a valuable tool for managing finances and simplifying everyday transactions. From contactless payments to digital organization, Google Pay offers a comprehensive suite of features designed to streamline the way users interact with money and essential documents in the digital age. Its continued evolution promises further advancements in the realm of digital payments and personal finance management.

Google Pay - A fast, easy and private online payment service.

Important update:

The U.S. version of the standalone Google Pay app will no longer be available for use starting June 4, 2024.

If you use your Android phone to shop in stores where Google Pay is accepted, you can continue to tap to pay in stores with the Google Wallet app.

Here are the key changes and important dates:

As of Feb 22, 2024 you will no longer be able to view or activate deals in the app. If you previously activated a deal, and are still waiting for cash back, regular reward timelines apply.

Changes to peer-to-peer payments: As of June 4, 2024, you will no longer be able to send, request or receive money from others through the U.S. version of the Google Pay app.

Manage your Google Pay balance from the Google Pay app until June 4: You can use the U.S. version of the Google Pay app until June 4, 2024 to view and transfer your Google Pay balance to your bank account. You can continue to view and transfer your funds to your bank account after June 4, 2024 from the Google Pay website.

If you have linked accounts on Google Pay to monitor your transactions and insights, you’ll still be able to view your transactions on the Google Pay website in the transactions tab after June 4, 2024. If you wish to disconnect your accounts after June 4, 2024, you will be able to unlink them on the Google Pay website.

If you've used the Google Pay app in the US to send money with Wise from the US to India or Singapore, this feature and related transaction information will no longer be available in the app starting June 4, 2024. This does not impact your Wise account, which you can continue to access at wise.com.

Google Payment Corporation's Customer Service and Error Resolution Policy and applicable processes still apply to report unauthorized transactions related to Google Pay. If you have any further questions about your balance in the app, you can learn more about your Google Pay balance.

Still have questions? Head over to https://support.google.com/googlepay

*Payments processed by Google Payment Corp., a licensed money transmitter (NMLS ID: 911607). Licensed as a money transmitter by the NY State Dept. of Financial Services and to Transmit Money By Check, Draft or Money Order By The Department of Banking and Securities, Commonwealth of Pennsylvania. To learn more about Google Payments, visit the Google Payments Help Center.

What's New in the Latest Version 223.1.4 (arm64-v8a_release_flutter)

Last updated on Apr 18, 2024

We're giving the app a fresh new look. Enjoy the latest features and offers, from Groups experiences to convenient card payments!

Google Pay, formerly known as Android Pay and later rebranded as Google Wallet before reverting back to Google Pay, is a digital wallet platform developed by Google that allows users to make contactless payments in stores, online, and through apps. It also serves as a hub for storing loyalty cards, gift cards, boarding passes, transit passes, and, in some regions, government-issued identification.The core functionality of Google Pay revolves around near-field communication (NFC) technology. This technology enables short-range wireless communication between devices, allowing users to simply tap their phones on compatible payment terminals to complete transactions. This eliminates the need to physically carry credit or debit cards. Users add their card details to the Google Pay app, which then generates a virtual card number that is used for transactions, ensuring the security of the user's actual card information.

Security is a paramount concern for any digital payment platform, and Google Pay incorporates several measures to protect user data. Firstly, tokenization replaces sensitive card details with unique tokens, preventing merchants from accessing the actual card number. Secondly, transactions require authentication, typically through a PIN, fingerprint scan, or facial recognition, depending on the device and user settings. Thirdly, Google Pay benefits from the underlying security of the Android operating system, which includes regular security updates and patches.

Adding a card to Google Pay is a straightforward process. Users simply open the app, select the "Add a card" option, and then either manually enter their card details or use the camera to scan their card. Once the card is added, it can be used immediately for payments. Users can also add multiple cards to Google Pay, allowing them to choose their preferred payment method for each transaction.

Beyond contactless payments, Google Pay facilitates online and in-app purchases. When shopping online or within supported apps, users can choose Google Pay as their payment method, streamlining the checkout process. This eliminates the need to repeatedly enter card details, saving time and enhancing convenience.

Google Pay also serves as a central repository for various other items, including loyalty cards, gift cards, boarding passes, and transit passes. Users can add these items to the app, eliminating the need to carry physical cards. This digital organization simplifies everyday tasks, from earning rewards points to accessing public transportation.

In certain regions, Google Pay is expanding its functionality to include government-issued identification, such as driver's licenses and state IDs. This feature allows users to securely store and present their identification digitally, potentially streamlining interactions with authorities and businesses.

The availability and features of Google Pay vary depending on the region and the user's device. While contactless payments are widely supported, the availability of other features, such as transit passes and government-issued identification, may be limited to specific locations. Furthermore, Google Pay requires a compatible Android device with NFC capabilities.

Google Pay integrates with other Google services, enhancing its overall utility. For example, users can send and receive money through Google Pay using their linked bank accounts. This feature facilitates peer-to-peer payments, making it easy to split bills or reimburse friends.

Google continues to develop and expand the capabilities of Google Pay, adding new features and functionalities over time. This ongoing development ensures that Google Pay remains a relevant and competitive player in the evolving landscape of digital payments. The platform's focus on security, convenience, and integration with other Google services positions it as a valuable tool for managing finances and simplifying everyday transactions. From contactless payments to digital organization, Google Pay offers a comprehensive suite of features designed to streamline the way users interact with money and essential documents in the digital age. Its continued evolution promises further advancements in the realm of digital payments and personal finance management.