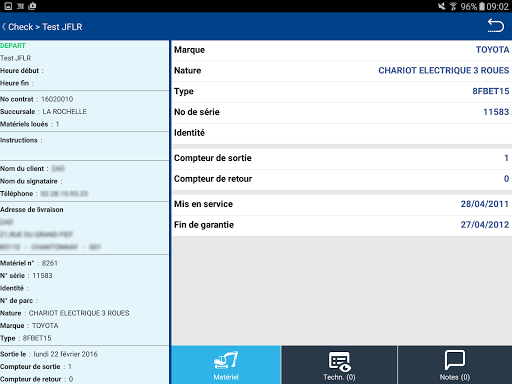

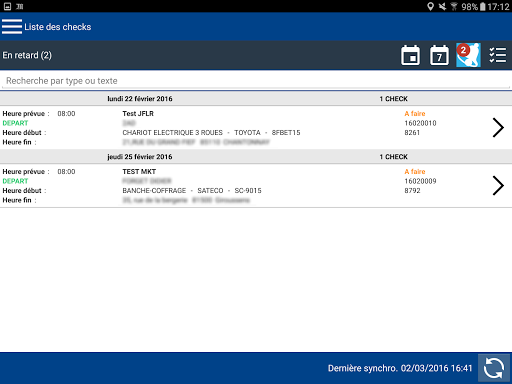

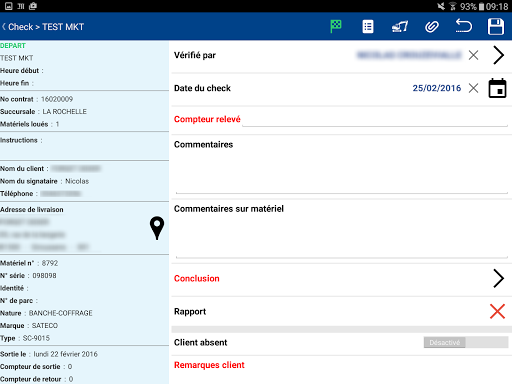

iMob® Check is a solution for mobile checkers on tablets.

The application enables checkers to receive their checks assignment, to complete their checks, to edit pdf to check equipment and to sign directly on their mobile device.

The information entered by the checker is updated on the dealer’s ERP in real time.

iMob® Check is an IRIUM’s product (N°1 European ERP for equipment distribution, rental and repair).

iMob® Check is a comprehensive mobile banking solution that empowers users to manage their finances conveniently and securely from their smartphones. With its intuitive interface and robust features, iMob® Check has revolutionized the way individuals interact with their banks.

Key Features:

* Account Management: View account balances, transaction history, and statements in real-time.

* Mobile Check Deposit: Capture and deposit checks using your smartphone's camera, eliminating the need for physical visits to the bank.

* Bill Pay: Schedule and pay bills electronically, ensuring timely payments and avoiding late fees.

* Person-to-Person Payments: Send and receive money instantly to and from other iMob® Check users using their phone numbers or email addresses.

* ATM and Branch Locator: Find nearby ATMs and bank branches with ease.

* Alerts and Notifications: Receive personalized alerts for account activity, bill payments, and fraud prevention.

Benefits of Using iMob® Check:

* Convenience: Access your finances anytime, anywhere, from the comfort of your smartphone.

* Security: Advanced encryption and multi-factor authentication protect your sensitive financial data.

* Time-Saving: Eliminate the hassle of visiting physical bank branches or mailing checks.

* Cost-Effective: Avoid fees associated with traditional banking services, such as check writing and ATM withdrawals.

* Enhanced Control: Monitor your account activity in real-time and make informed financial decisions.

Eligibility and Requirements:

To use iMob® Check, you must have an active account with a participating bank that offers the service. You will also need a compatible smartphone with a data connection and the iMob® Check app installed.

Security Measures:

iMob® Check employs multiple layers of security to safeguard your financial information:

* Biometric Authentication: Use fingerprint or facial recognition to securely access your account.

* Data Encryption: All data transmitted and stored is encrypted using industry-standard protocols.

* Multi-Factor Authentication: Requires multiple forms of identification, such as a password and a one-time code, for sensitive transactions.

Conclusion:

iMob® Check is an essential tool for modern banking. Its user-friendly interface, comprehensive features, and robust security measures empower users to manage their finances efficiently, conveniently, and securely from their smartphones. By embracing iMob® Check, individuals can simplify their banking experience and enjoy the benefits of mobile banking technology.

iMob® Check is a solution for mobile checkers on tablets.

The application enables checkers to receive their checks assignment, to complete their checks, to edit pdf to check equipment and to sign directly on their mobile device.

The information entered by the checker is updated on the dealer’s ERP in real time.

iMob® Check is an IRIUM’s product (N°1 European ERP for equipment distribution, rental and repair).

iMob® Check is a comprehensive mobile banking solution that empowers users to manage their finances conveniently and securely from their smartphones. With its intuitive interface and robust features, iMob® Check has revolutionized the way individuals interact with their banks.

Key Features:

* Account Management: View account balances, transaction history, and statements in real-time.

* Mobile Check Deposit: Capture and deposit checks using your smartphone's camera, eliminating the need for physical visits to the bank.

* Bill Pay: Schedule and pay bills electronically, ensuring timely payments and avoiding late fees.

* Person-to-Person Payments: Send and receive money instantly to and from other iMob® Check users using their phone numbers or email addresses.

* ATM and Branch Locator: Find nearby ATMs and bank branches with ease.

* Alerts and Notifications: Receive personalized alerts for account activity, bill payments, and fraud prevention.

Benefits of Using iMob® Check:

* Convenience: Access your finances anytime, anywhere, from the comfort of your smartphone.

* Security: Advanced encryption and multi-factor authentication protect your sensitive financial data.

* Time-Saving: Eliminate the hassle of visiting physical bank branches or mailing checks.

* Cost-Effective: Avoid fees associated with traditional banking services, such as check writing and ATM withdrawals.

* Enhanced Control: Monitor your account activity in real-time and make informed financial decisions.

Eligibility and Requirements:

To use iMob® Check, you must have an active account with a participating bank that offers the service. You will also need a compatible smartphone with a data connection and the iMob® Check app installed.

Security Measures:

iMob® Check employs multiple layers of security to safeguard your financial information:

* Biometric Authentication: Use fingerprint or facial recognition to securely access your account.

* Data Encryption: All data transmitted and stored is encrypted using industry-standard protocols.

* Multi-Factor Authentication: Requires multiple forms of identification, such as a password and a one-time code, for sensitive transactions.

Conclusion:

iMob® Check is an essential tool for modern banking. Its user-friendly interface, comprehensive features, and robust security measures empower users to manage their finances efficiently, conveniently, and securely from their smartphones. By embracing iMob® Check, individuals can simplify their banking experience and enjoy the benefits of mobile banking technology.