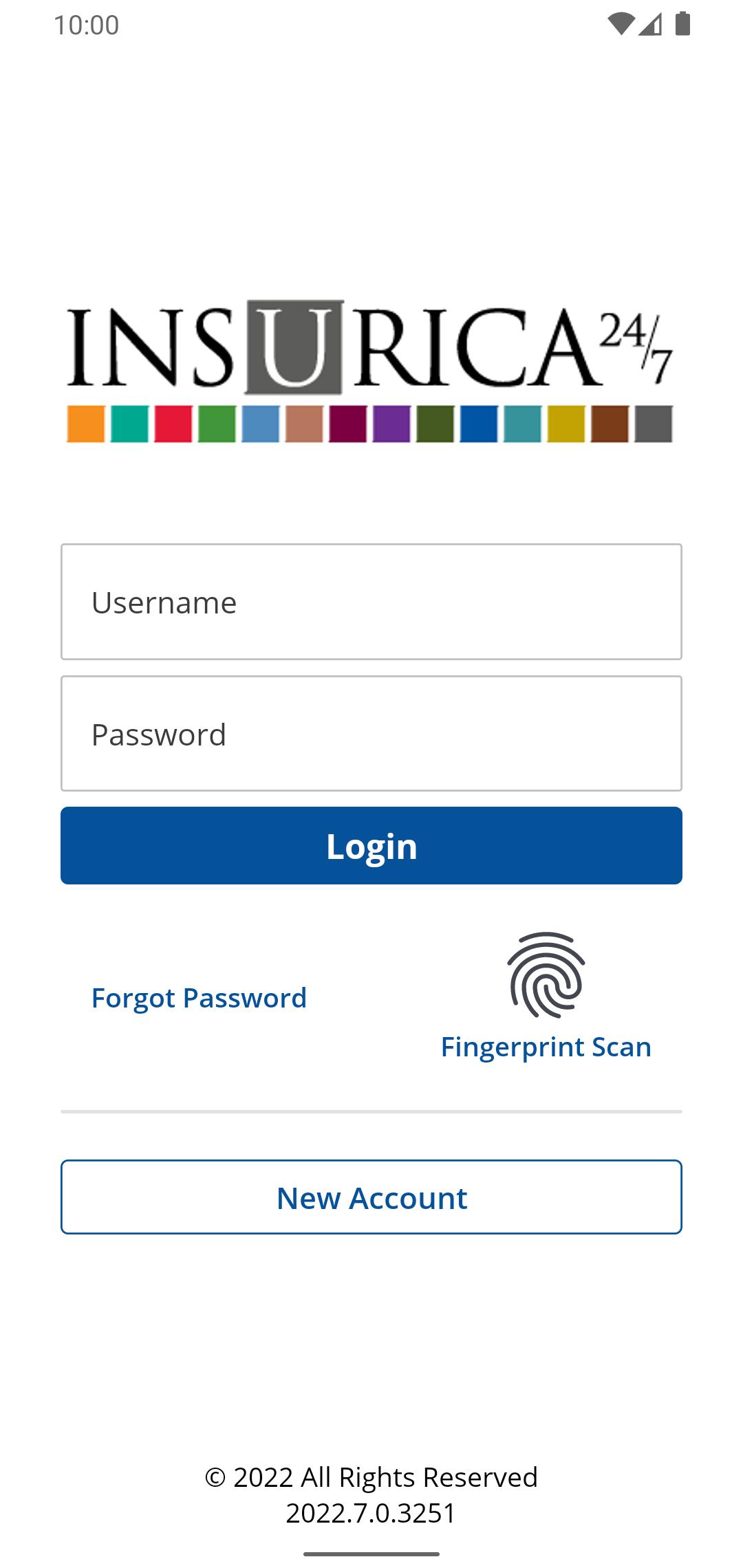

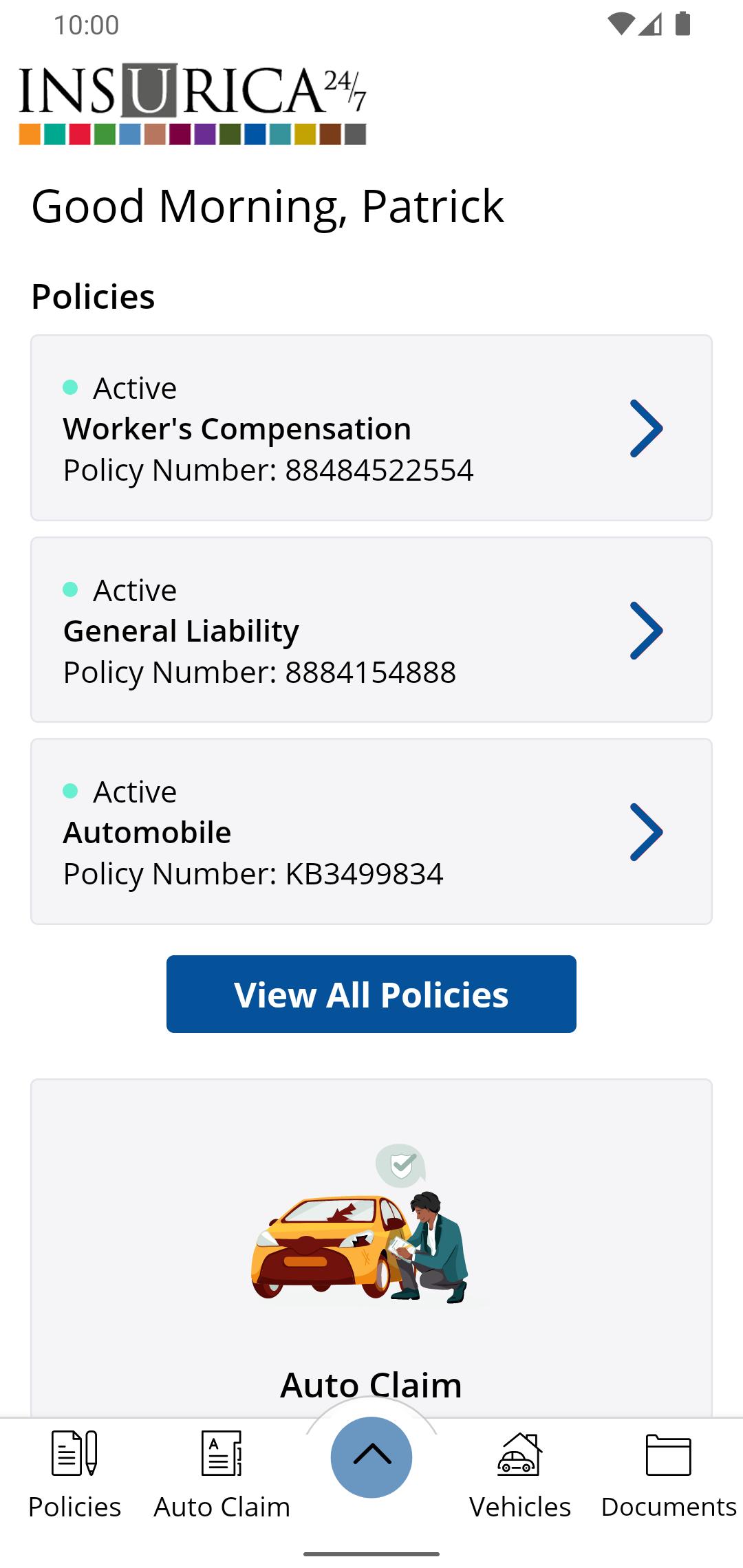

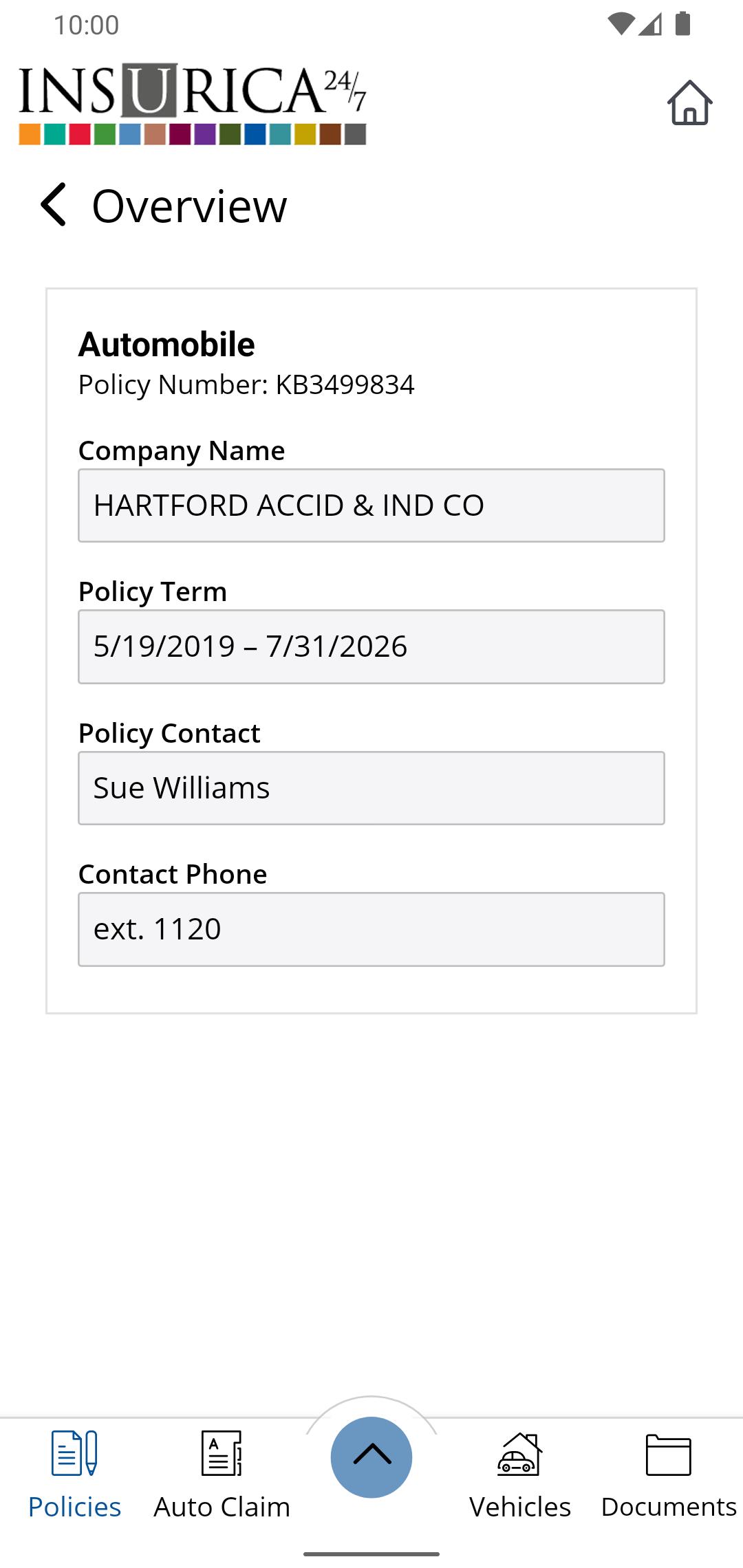

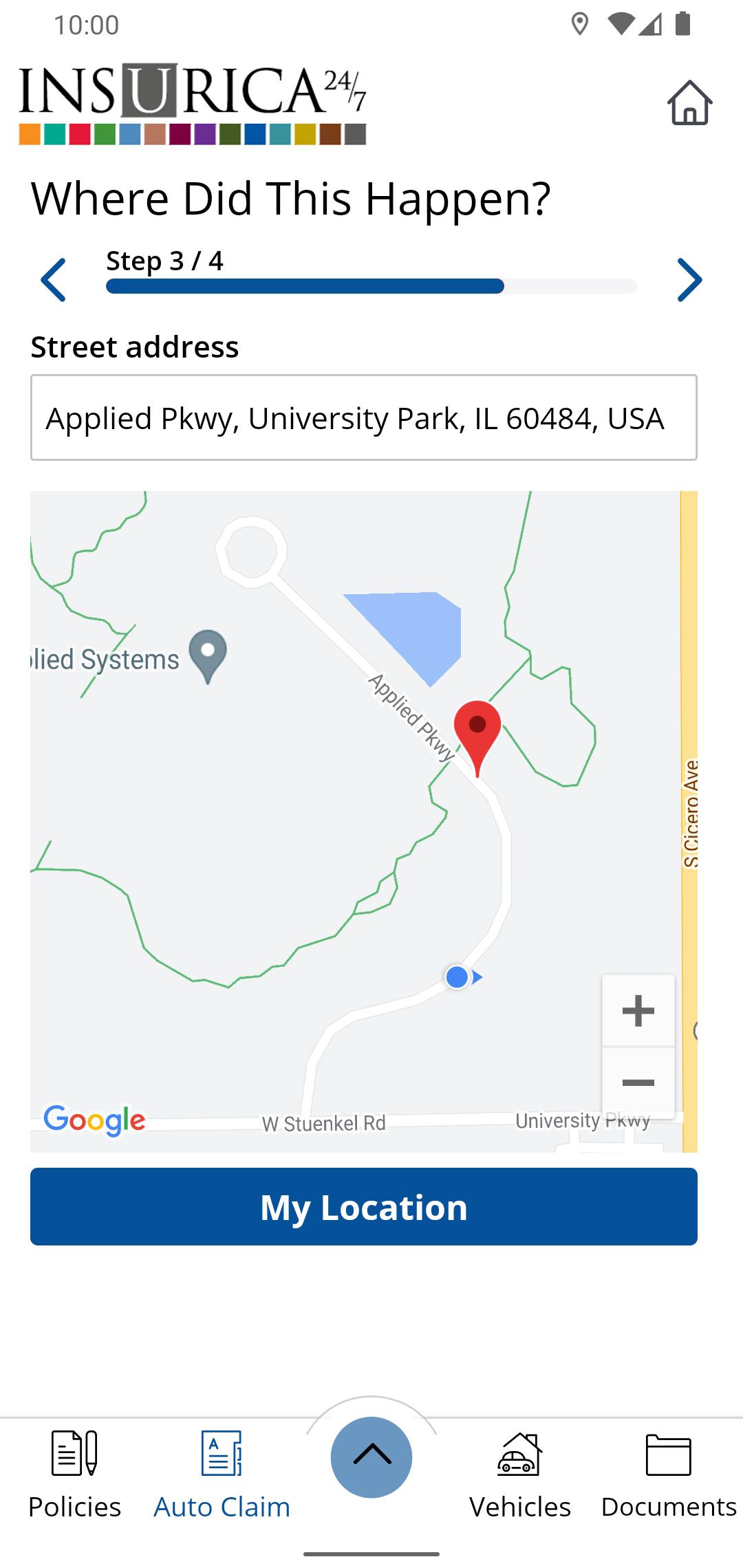

INSURICA clients can access their information in a rich mobile experience.

INSURICA 24/7 Mobile app gives our clients fast and simple access to their account information anytime, anywhere!

When INSURICA clients asked for mobile access to the self-service features they enjoy through our online platform, INSURICA 24/7, we listened and launched the INSURICA 24/7 Mobile app. Now clients access the same great features found in the desktop version now in a rich mobile experience, including:

Access to insurance documents

Review of open claims

Communication with INSURI

What's New in the Latest Version 2023.10.0

Last updated on Jul 1, 2024

Standard performance updates and maintenance completed.

INSURICA 24/7 is an immersive insurance simulation game that challenges players to manage an insurance company, navigate market fluctuations, and make strategic decisions to maximize profitability and growth.

Core Gameplay

As the CEO of your own insurance company, you are responsible for:

* Managing Risk: Assessing and pricing insurance policies based on risk factors, including age, health, driving history, and property value.

* Setting Premiums: Determining the optimal premium rates to balance risk coverage with profitability.

* Adjusting Reserves: Estimating and setting aside funds to cover future claims.

* Investing Surplus: Allocating excess capital into investments to generate additional revenue.

* Expanding Operations: Acquiring new customers, opening new branches, and expanding into different insurance lines.

Market Dynamics

The insurance market in INSURICA 24/7 is highly dynamic, influenced by factors such as:

* Economic Conditions: Economic downturns can lead to decreased demand for insurance, while economic booms can increase demand.

* Regulatory Changes: Government regulations can impact the pricing and coverage of insurance policies.

* Natural Disasters: Major events like hurricanes and earthquakes can trigger a surge in claims and affect insurance rates.

* Technological Advancements: Innovations in data analytics and risk assessment can improve underwriting accuracy and reduce costs.

Strategic Decisions

To succeed in INSURICA 24/7, players must make strategic decisions that balance risk, profitability, and customer satisfaction. These decisions include:

* Product Mix: Choosing which insurance lines to offer and adjusting coverage levels to meet market demand.

* Underwriting Criteria: Establishing guidelines for evaluating and accepting insurance applications.

* Claims Handling: Setting efficient and fair claims processing procedures.

* Customer Service: Maintaining high levels of customer satisfaction through responsive and effective support.

* Mergers and Acquisitions: Acquiring other insurance companies to expand market share or gain access to new capabilities.

Financial Performance

The financial performance of your insurance company is measured by key metrics, including:

* Revenue: Total income generated from insurance premiums and investments.

* Underwriting Profit: The difference between premiums collected and claims paid.

* Investment Income: The return generated from surplus funds invested in financial markets.

* Net Income: The overall profit of the company after expenses.

* Return on Equity (ROE): A measure of the profitability of the company relative to shareholder investment.

Skill Development

INSURICA 24/7 provides a realistic and engaging environment for players to develop their skills in:

* Insurance Risk Management

* Financial Planning

* Strategic Decision-Making

* Market Analysis

* Customer Service

INSURICA clients can access their information in a rich mobile experience.

INSURICA 24/7 Mobile app gives our clients fast and simple access to their account information anytime, anywhere!

When INSURICA clients asked for mobile access to the self-service features they enjoy through our online platform, INSURICA 24/7, we listened and launched the INSURICA 24/7 Mobile app. Now clients access the same great features found in the desktop version now in a rich mobile experience, including:

Access to insurance documents

Review of open claims

Communication with INSURI

What's New in the Latest Version 2023.10.0

Last updated on Jul 1, 2024

Standard performance updates and maintenance completed.

INSURICA 24/7 is an immersive insurance simulation game that challenges players to manage an insurance company, navigate market fluctuations, and make strategic decisions to maximize profitability and growth.

Core Gameplay

As the CEO of your own insurance company, you are responsible for:

* Managing Risk: Assessing and pricing insurance policies based on risk factors, including age, health, driving history, and property value.

* Setting Premiums: Determining the optimal premium rates to balance risk coverage with profitability.

* Adjusting Reserves: Estimating and setting aside funds to cover future claims.

* Investing Surplus: Allocating excess capital into investments to generate additional revenue.

* Expanding Operations: Acquiring new customers, opening new branches, and expanding into different insurance lines.

Market Dynamics

The insurance market in INSURICA 24/7 is highly dynamic, influenced by factors such as:

* Economic Conditions: Economic downturns can lead to decreased demand for insurance, while economic booms can increase demand.

* Regulatory Changes: Government regulations can impact the pricing and coverage of insurance policies.

* Natural Disasters: Major events like hurricanes and earthquakes can trigger a surge in claims and affect insurance rates.

* Technological Advancements: Innovations in data analytics and risk assessment can improve underwriting accuracy and reduce costs.

Strategic Decisions

To succeed in INSURICA 24/7, players must make strategic decisions that balance risk, profitability, and customer satisfaction. These decisions include:

* Product Mix: Choosing which insurance lines to offer and adjusting coverage levels to meet market demand.

* Underwriting Criteria: Establishing guidelines for evaluating and accepting insurance applications.

* Claims Handling: Setting efficient and fair claims processing procedures.

* Customer Service: Maintaining high levels of customer satisfaction through responsive and effective support.

* Mergers and Acquisitions: Acquiring other insurance companies to expand market share or gain access to new capabilities.

Financial Performance

The financial performance of your insurance company is measured by key metrics, including:

* Revenue: Total income generated from insurance premiums and investments.

* Underwriting Profit: The difference between premiums collected and claims paid.

* Investment Income: The return generated from surplus funds invested in financial markets.

* Net Income: The overall profit of the company after expenses.

* Return on Equity (ROE): A measure of the profitability of the company relative to shareholder investment.

Skill Development

INSURICA 24/7 provides a realistic and engaging environment for players to develop their skills in:

* Insurance Risk Management

* Financial Planning

* Strategic Decision-Making

* Market Analysis

* Customer Service