A must-have payment tool to checkout with cryptos, earn cash back, maek down payment and manage bills!

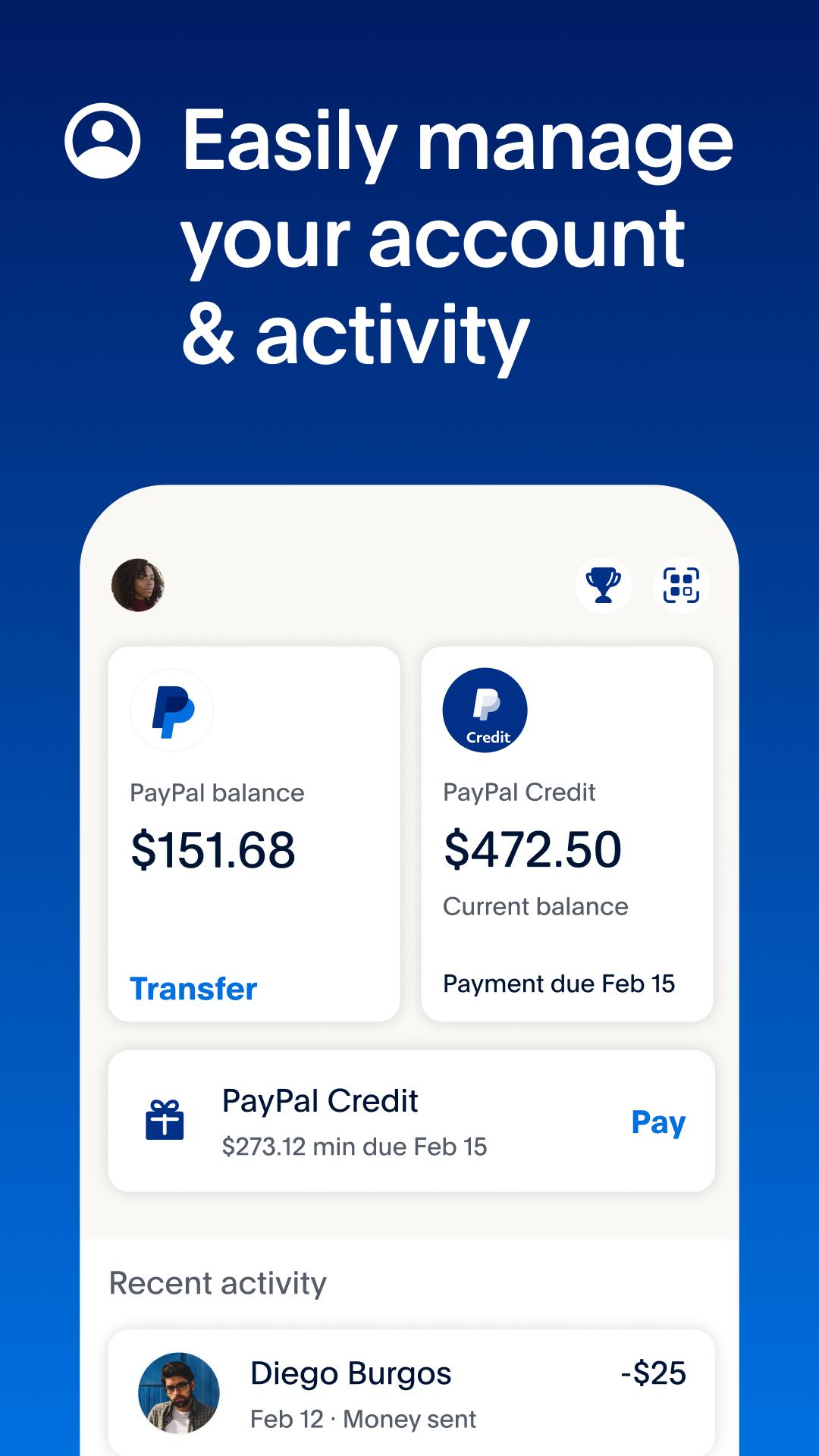

More ways to PayPal— It’s a simple and secure way to get paid back, send money to friends, discover cashback offers from brands you love, manage your account and more.

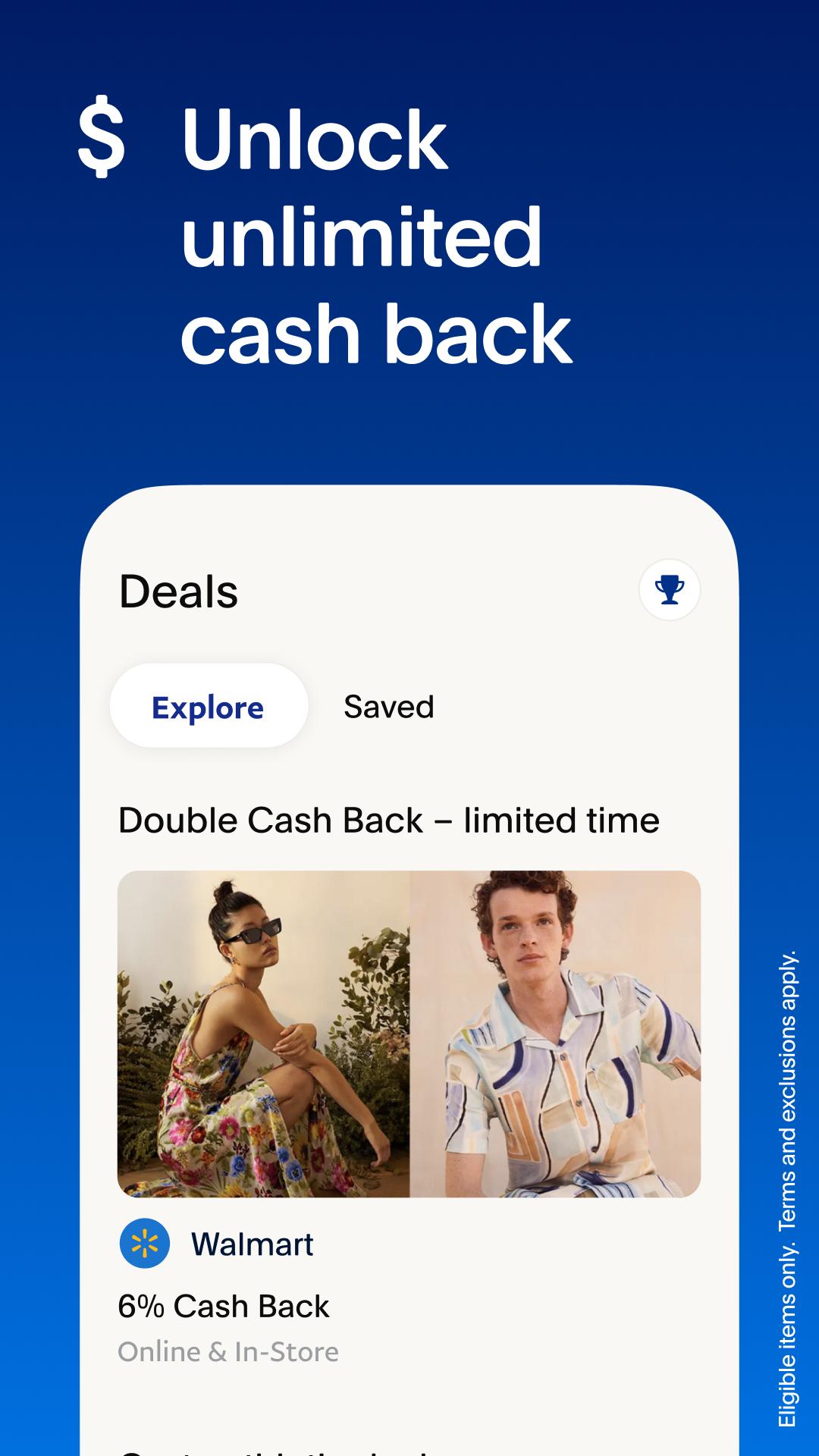

FIND DEALS RIGHT IN THE APP

• Stack your rewards – Get cashback offers³ from brands you love and keep collecting your eligible credit card rewards** on top of it all

³Eligible items only. Redeem points for cash or other options. Terms and exclusions apply. See PayPal Rewards terms and conditions at PayPal.com/rewards-terms. **Subject to issuer’s rewards program terms PayPal rewards are subject to applicable terms: paypal.com/us/legalhub/pp-rewards-program-tnc

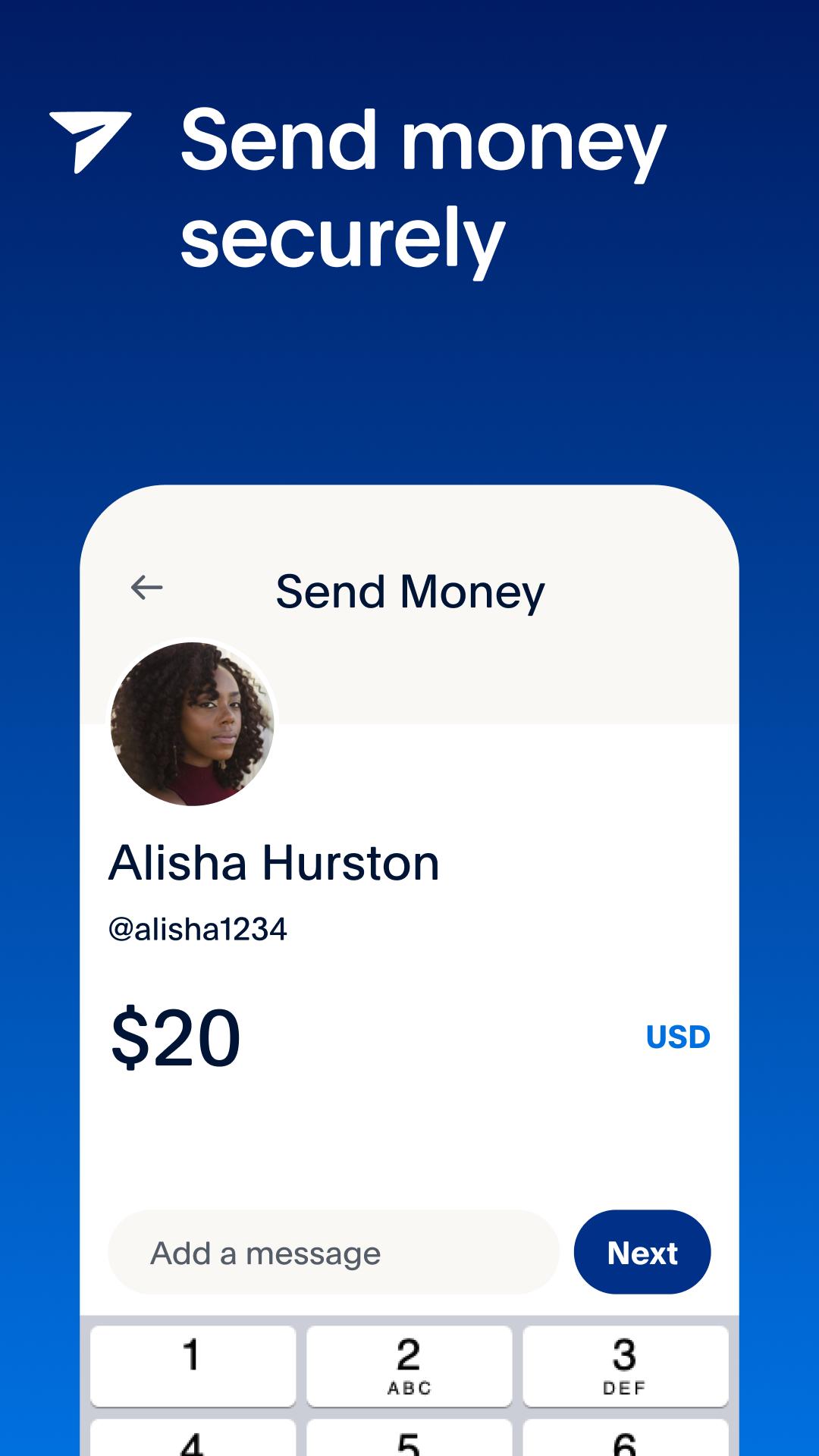

SEND AND REQUEST MONEY FOR FREE

• When funded by a bank account or with your PayPal balance, it’s free to send money or get paid back by friends and family in the US on PayPal

• Request money securely from friends or family and personalize your payments

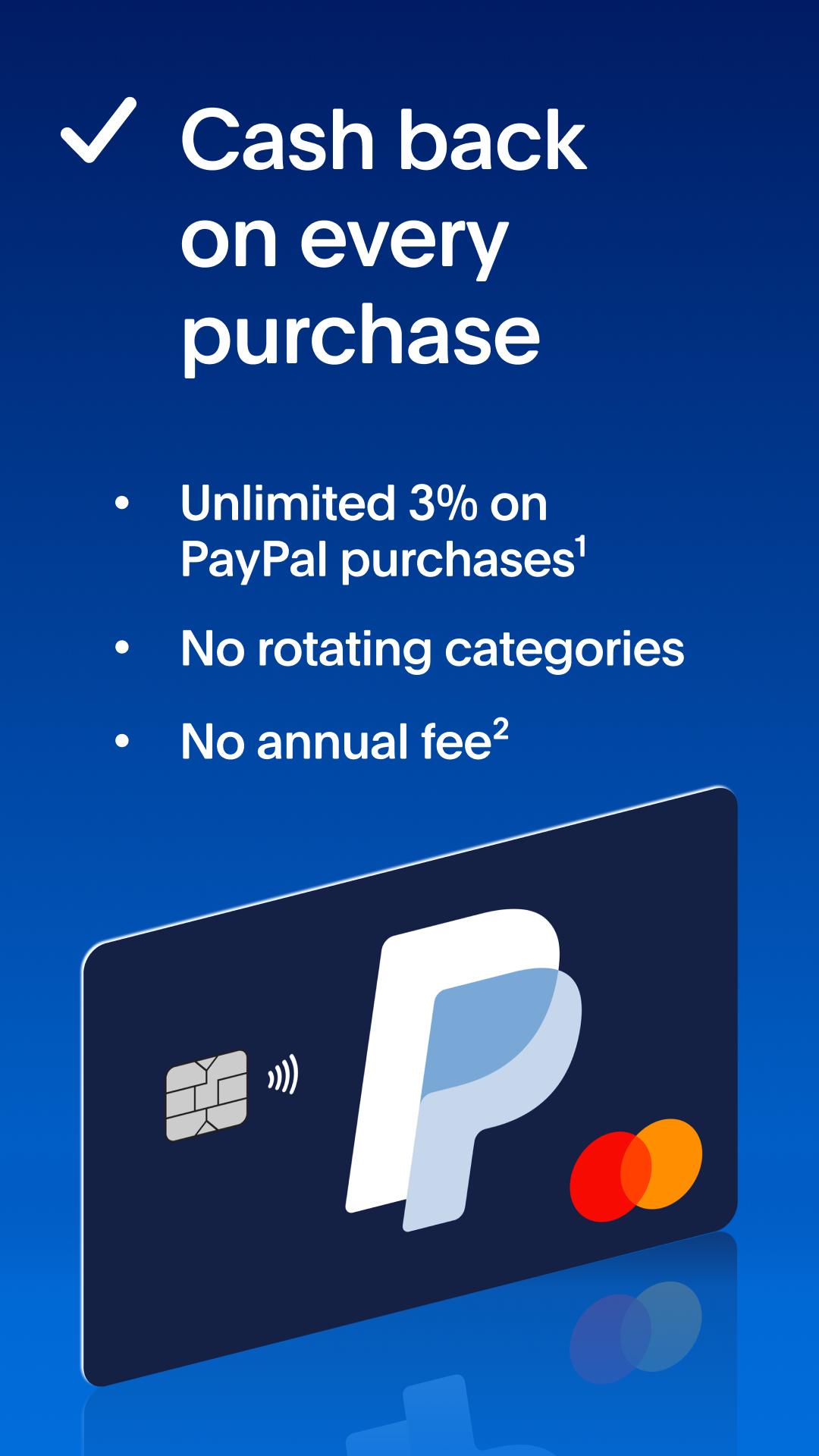

EARN UNLIMITED 3% CASH BACK

• Earn an unlimited 3% cash back¹ when you use the PayPal Cashback Mastercard(R) for PayPal purchases-unlimited cash back, no rotating categories, no annual fee²

• Apply for your card, manage your account, and redeem your cash back in the app.

¹Subject to credit approval. See Rewards Program Terms for details and eligibility criteria found at: https://www.synchronycredit.com/gecrbterms/html/PayPalCashbackRewardsTerms.htm

² For New Accounts: Variable Purchase APRs are 20.24%, 29.24% and 32.24%. Minimum Interest Charge is $2. APRs are accurate as of August 1, 2023, and will vary with the market based on Prime Rate.

Learn more at https://paypal.com/cashbackcard

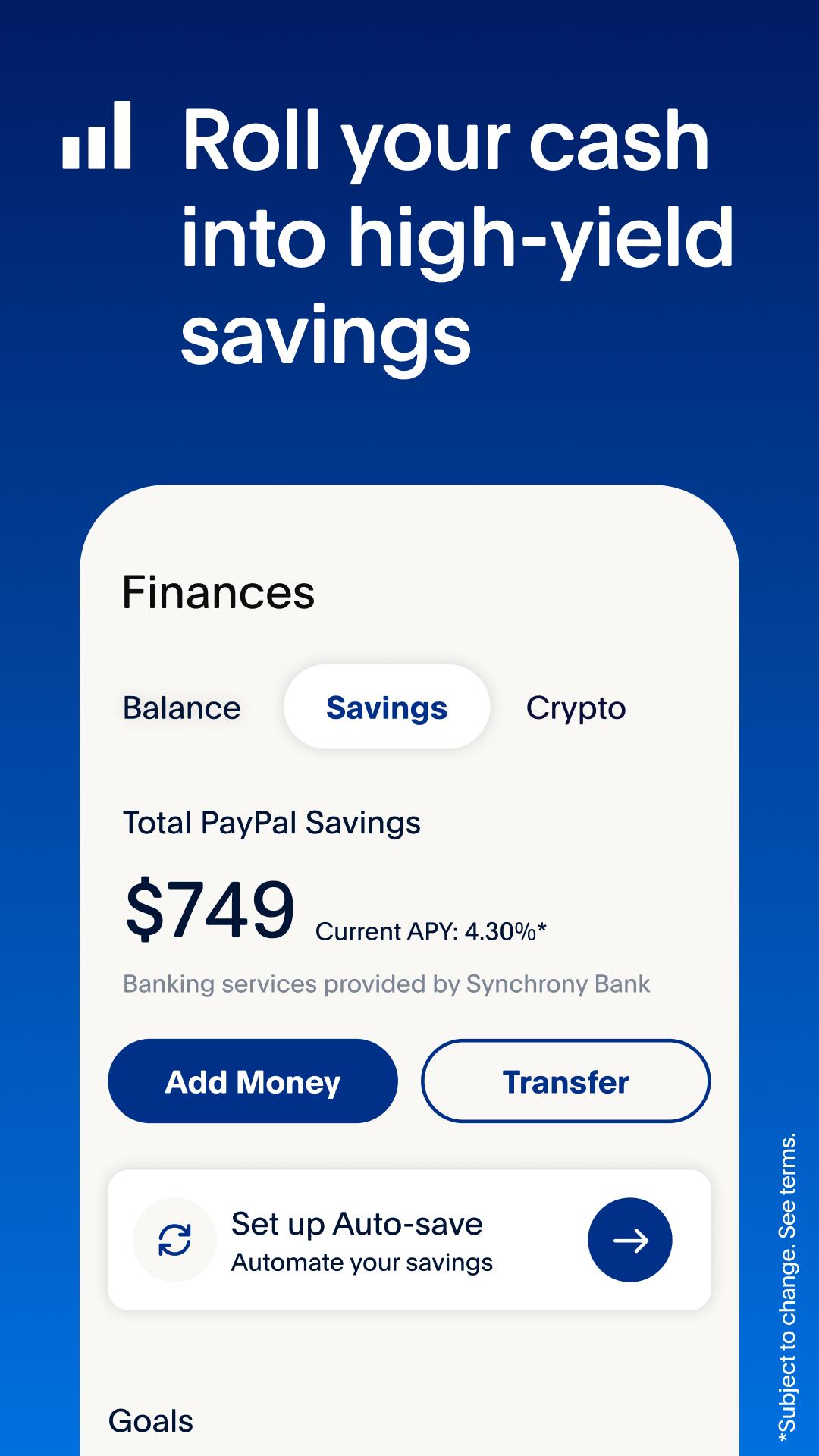

GROW YOUR MONEY WITH HIGH-YIELD SAVINGS

• Roll your money into PayPal Savings and earn a current 4.30% APY–that’s 9x the national average*.

• Easily manage your account right from the app. Transfer money in and out, set individual goals, and track your progress as your savings grows.

*As of June 07, 2023, the annual percentage yield (APY) for PayPal Savings is 4.30%. This is a variable rate and can change at any time, including after the account is opened. National average source: FDIC National Rates and Rate Caps as of April 15, 2024. https://www.fdic.gov/resources/bankers/national-rates/#one PayPal is a financial technology company, not a bank. Banking service provided by Synchrony Bank, Member FDIC. PayPal Balance account is required to use PayPal Savings.

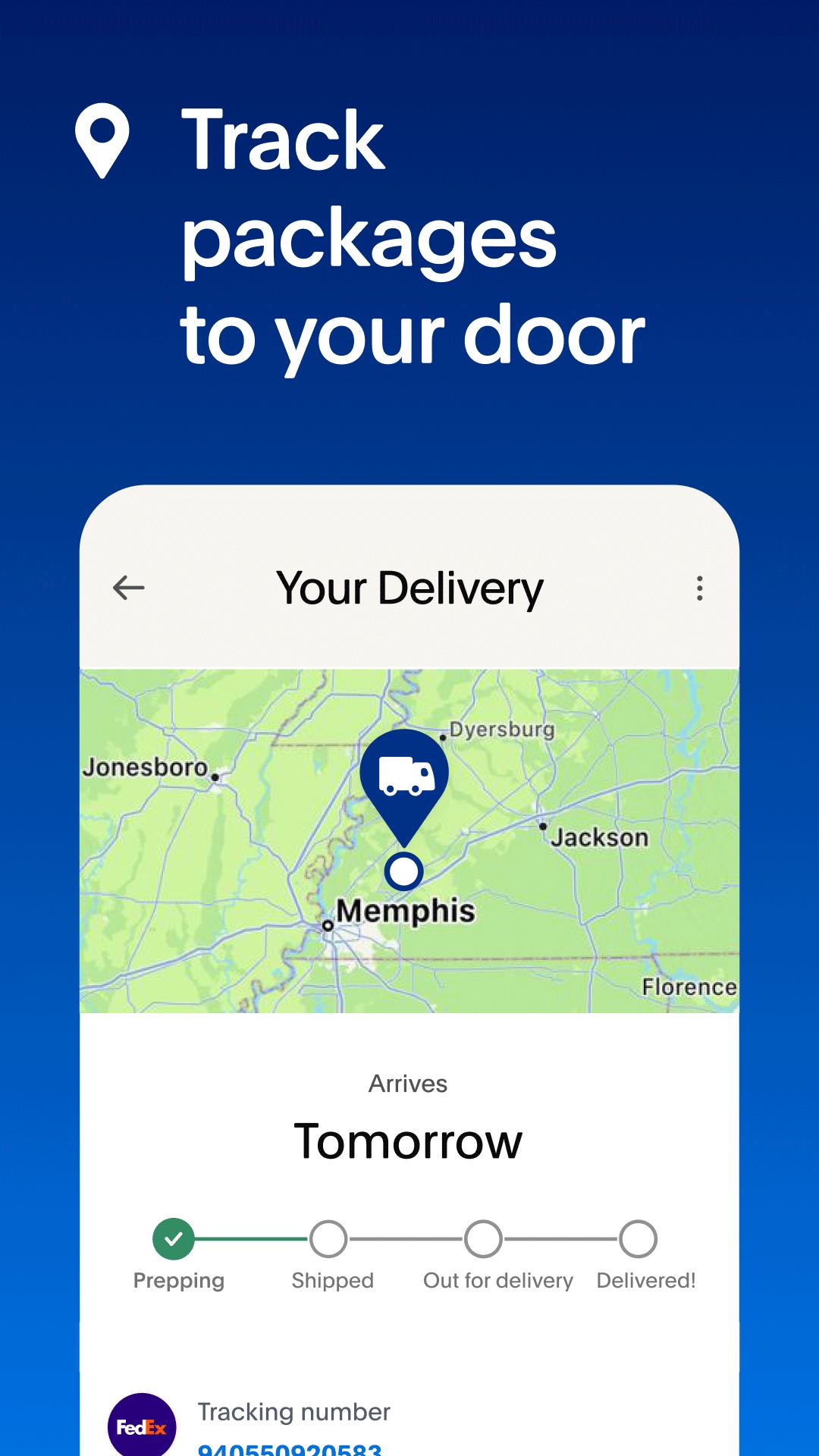

TRACK ORDERS STRAIGHT TO YOUR DOORSTEP

• Auto-track your packages even if you didn’t pay with PayPal and get live updates each step of the way

• Simply link your Gmail account to track your packages or add tracking details manually in the app if it didn't update automatically. Not all sellers are participants.

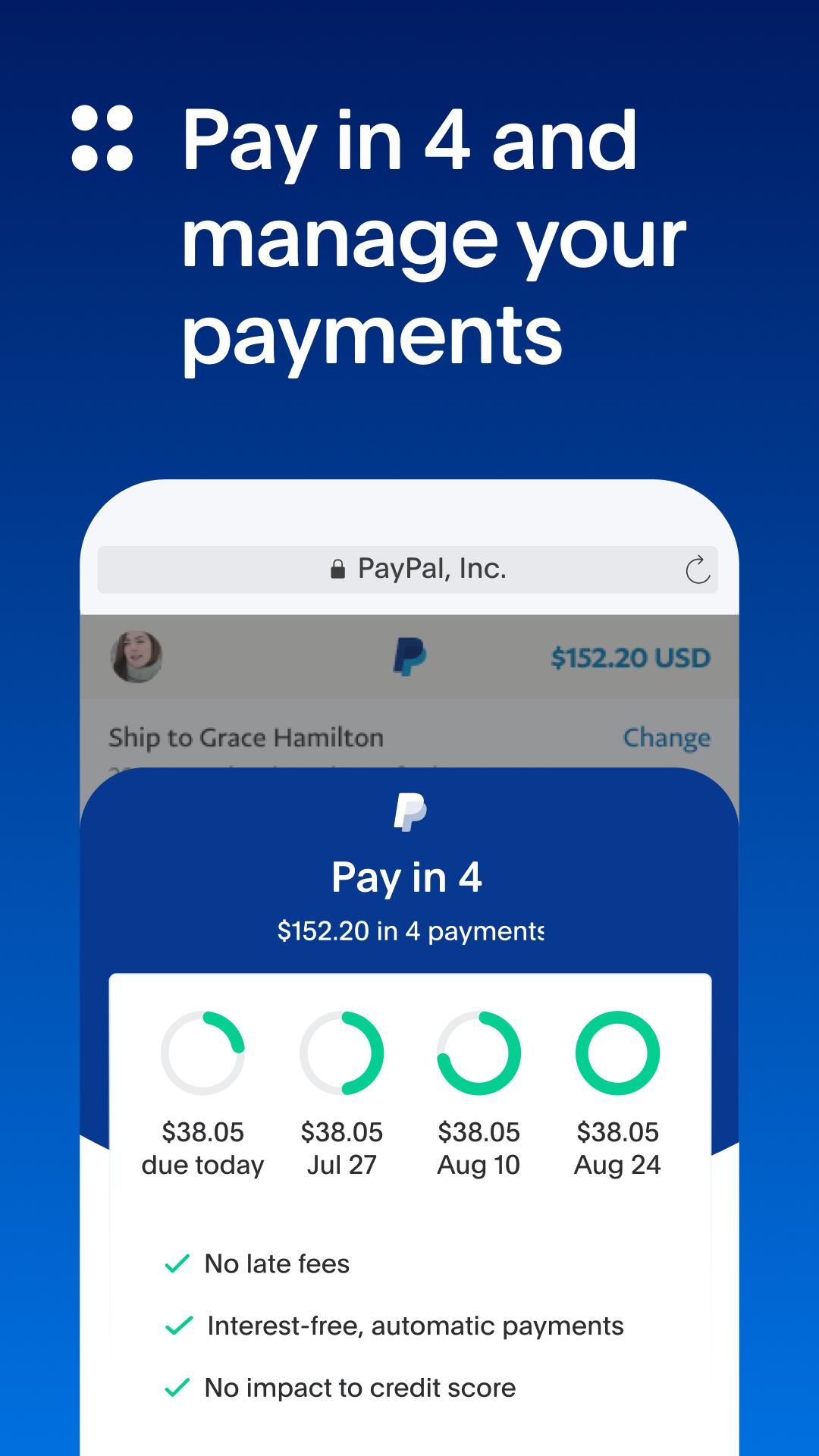

PAY IN 4 WITH PAYPAL

• Buy now and pay later by splitting your purchase into 4 interest-free payments at millions of online retailers with no late fees

• Payments are easy to manage in the app. Pay in 4 is available upon approval for purchases of $30 - $1500 and is currently not available to residents of MO or NV. 18 years old or older to apply. PayPal, Inc.: Loans to CA residents are made or arranged pursuant to a CA Financing Law License. GA Installment Lender Licensee, NMLS #910457. RI Small Loan Lender Licensee. NM residents: Go to paypal.com/us/webapps/mpp/campaigns/newmexicodisclosure. Learn more atpaypal.com/payin4

TRUST PAYPAL SECURE TRANSACTIONS

• PayPal helps keep your financial information secure, with commercially available encryption and fraud protection

Availability of features varies by market

What's New in the Latest Version 8.65.0

Last updated on Jun 25, 2024

Do more with PayPal, with more power packed into a single app. Shop the world with ease, send payments near and far, and much more. Find what matters to you and keep track of it more easily by downloading the latest version of the app.

PayPal: A Comprehensive OverviewIntroduction

PayPal is a global online payments system that enables individuals and businesses to transfer money securely and conveniently. It has revolutionized the way people send, receive, and manage their finances online.

History and Evolution

PayPal was founded in 1998 by Peter Thiel and Max Levchin. Initially known as Confinity, the company merged with Elon Musk's X.com in 2000 and adopted the PayPal name. In 2002, eBay acquired PayPal for $1.5 billion. PayPal became an independent company again in 2015.

Key Features

* Secure Transactions: PayPal uses advanced encryption and fraud detection systems to protect user data and prevent unauthorized access.

* Convenience: PayPal allows users to send and receive money without having to share sensitive financial information, such as bank account numbers or credit card details.

* Global Reach: PayPal operates in over 200 countries and supports multiple currencies, making it a convenient option for international transactions.

* Mobile Compatibility: PayPal offers mobile apps for iOS and Android devices, providing users with easy access to their accounts on the go.

* Merchant Services: PayPal offers a range of merchant services, including payment gateways, checkout buttons, and subscription management tools.

How PayPal Works

PayPal users create an account by providing their email address and personal information. They can then link their bank accounts, credit cards, or debit cards to their PayPal account. When sending money, users select the recipient's email address or mobile number and enter the amount. The funds are then transferred from the sender's PayPal account to the recipient's account.

Fees and Pricing

PayPal charges fees for certain transactions, such as sending money using a credit card or receiving payments from international sources. However, many transactions, such as sending money from a linked bank account, are free.

Security and Fraud Protection

PayPal takes security very seriously. It uses a variety of measures to protect user accounts, including two-factor authentication, encryption, and fraud monitoring. PayPal also offers a buyer protection program that provides coverage for unauthorized purchases or undelivered items.

Customer Support

PayPal offers 24/7 customer support via phone, email, and live chat. Users can also access a comprehensive help center with FAQs and troubleshooting guides.

Conclusion

PayPal has become a trusted and widely used online payment platform. Its secure transactions, convenience, global reach, and merchant services make it an ideal choice for individuals and businesses alike. As technology continues to evolve, PayPal is expected to remain at the forefront of the online payments industry.

A must-have payment tool to checkout with cryptos, earn cash back, maek down payment and manage bills!

More ways to PayPal— It’s a simple and secure way to get paid back, send money to friends, discover cashback offers from brands you love, manage your account and more.

FIND DEALS RIGHT IN THE APP

• Stack your rewards – Get cashback offers³ from brands you love and keep collecting your eligible credit card rewards** on top of it all

³Eligible items only. Redeem points for cash or other options. Terms and exclusions apply. See PayPal Rewards terms and conditions at PayPal.com/rewards-terms. **Subject to issuer’s rewards program terms PayPal rewards are subject to applicable terms: paypal.com/us/legalhub/pp-rewards-program-tnc

SEND AND REQUEST MONEY FOR FREE

• When funded by a bank account or with your PayPal balance, it’s free to send money or get paid back by friends and family in the US on PayPal

• Request money securely from friends or family and personalize your payments

EARN UNLIMITED 3% CASH BACK

• Earn an unlimited 3% cash back¹ when you use the PayPal Cashback Mastercard(R) for PayPal purchases-unlimited cash back, no rotating categories, no annual fee²

• Apply for your card, manage your account, and redeem your cash back in the app.

¹Subject to credit approval. See Rewards Program Terms for details and eligibility criteria found at: https://www.synchronycredit.com/gecrbterms/html/PayPalCashbackRewardsTerms.htm

² For New Accounts: Variable Purchase APRs are 20.24%, 29.24% and 32.24%. Minimum Interest Charge is $2. APRs are accurate as of August 1, 2023, and will vary with the market based on Prime Rate.

Learn more at https://paypal.com/cashbackcard

GROW YOUR MONEY WITH HIGH-YIELD SAVINGS

• Roll your money into PayPal Savings and earn a current 4.30% APY–that’s 9x the national average*.

• Easily manage your account right from the app. Transfer money in and out, set individual goals, and track your progress as your savings grows.

*As of June 07, 2023, the annual percentage yield (APY) for PayPal Savings is 4.30%. This is a variable rate and can change at any time, including after the account is opened. National average source: FDIC National Rates and Rate Caps as of April 15, 2024. https://www.fdic.gov/resources/bankers/national-rates/#one PayPal is a financial technology company, not a bank. Banking service provided by Synchrony Bank, Member FDIC. PayPal Balance account is required to use PayPal Savings.

TRACK ORDERS STRAIGHT TO YOUR DOORSTEP

• Auto-track your packages even if you didn’t pay with PayPal and get live updates each step of the way

• Simply link your Gmail account to track your packages or add tracking details manually in the app if it didn't update automatically. Not all sellers are participants.

PAY IN 4 WITH PAYPAL

• Buy now and pay later by splitting your purchase into 4 interest-free payments at millions of online retailers with no late fees

• Payments are easy to manage in the app. Pay in 4 is available upon approval for purchases of $30 - $1500 and is currently not available to residents of MO or NV. 18 years old or older to apply. PayPal, Inc.: Loans to CA residents are made or arranged pursuant to a CA Financing Law License. GA Installment Lender Licensee, NMLS #910457. RI Small Loan Lender Licensee. NM residents: Go to paypal.com/us/webapps/mpp/campaigns/newmexicodisclosure. Learn more atpaypal.com/payin4

TRUST PAYPAL SECURE TRANSACTIONS

• PayPal helps keep your financial information secure, with commercially available encryption and fraud protection

Availability of features varies by market

What's New in the Latest Version 8.65.0

Last updated on Jun 25, 2024

Do more with PayPal, with more power packed into a single app. Shop the world with ease, send payments near and far, and much more. Find what matters to you and keep track of it more easily by downloading the latest version of the app.

PayPal: A Comprehensive OverviewIntroduction

PayPal is a global online payments system that enables individuals and businesses to transfer money securely and conveniently. It has revolutionized the way people send, receive, and manage their finances online.

History and Evolution

PayPal was founded in 1998 by Peter Thiel and Max Levchin. Initially known as Confinity, the company merged with Elon Musk's X.com in 2000 and adopted the PayPal name. In 2002, eBay acquired PayPal for $1.5 billion. PayPal became an independent company again in 2015.

Key Features

* Secure Transactions: PayPal uses advanced encryption and fraud detection systems to protect user data and prevent unauthorized access.

* Convenience: PayPal allows users to send and receive money without having to share sensitive financial information, such as bank account numbers or credit card details.

* Global Reach: PayPal operates in over 200 countries and supports multiple currencies, making it a convenient option for international transactions.

* Mobile Compatibility: PayPal offers mobile apps for iOS and Android devices, providing users with easy access to their accounts on the go.

* Merchant Services: PayPal offers a range of merchant services, including payment gateways, checkout buttons, and subscription management tools.

How PayPal Works

PayPal users create an account by providing their email address and personal information. They can then link their bank accounts, credit cards, or debit cards to their PayPal account. When sending money, users select the recipient's email address or mobile number and enter the amount. The funds are then transferred from the sender's PayPal account to the recipient's account.

Fees and Pricing

PayPal charges fees for certain transactions, such as sending money using a credit card or receiving payments from international sources. However, many transactions, such as sending money from a linked bank account, are free.

Security and Fraud Protection

PayPal takes security very seriously. It uses a variety of measures to protect user accounts, including two-factor authentication, encryption, and fraud monitoring. PayPal also offers a buyer protection program that provides coverage for unauthorized purchases or undelivered items.

Customer Support

PayPal offers 24/7 customer support via phone, email, and live chat. Users can also access a comprehensive help center with FAQs and troubleshooting guides.

Conclusion

PayPal has become a trusted and widely used online payment platform. Its secure transactions, convenience, global reach, and merchant services make it an ideal choice for individuals and businesses alike. As technology continues to evolve, PayPal is expected to remain at the forefront of the online payments industry.