With this application you will know how much money you can spend.

With 6 Flasks you will achieve your financial freedom faster.

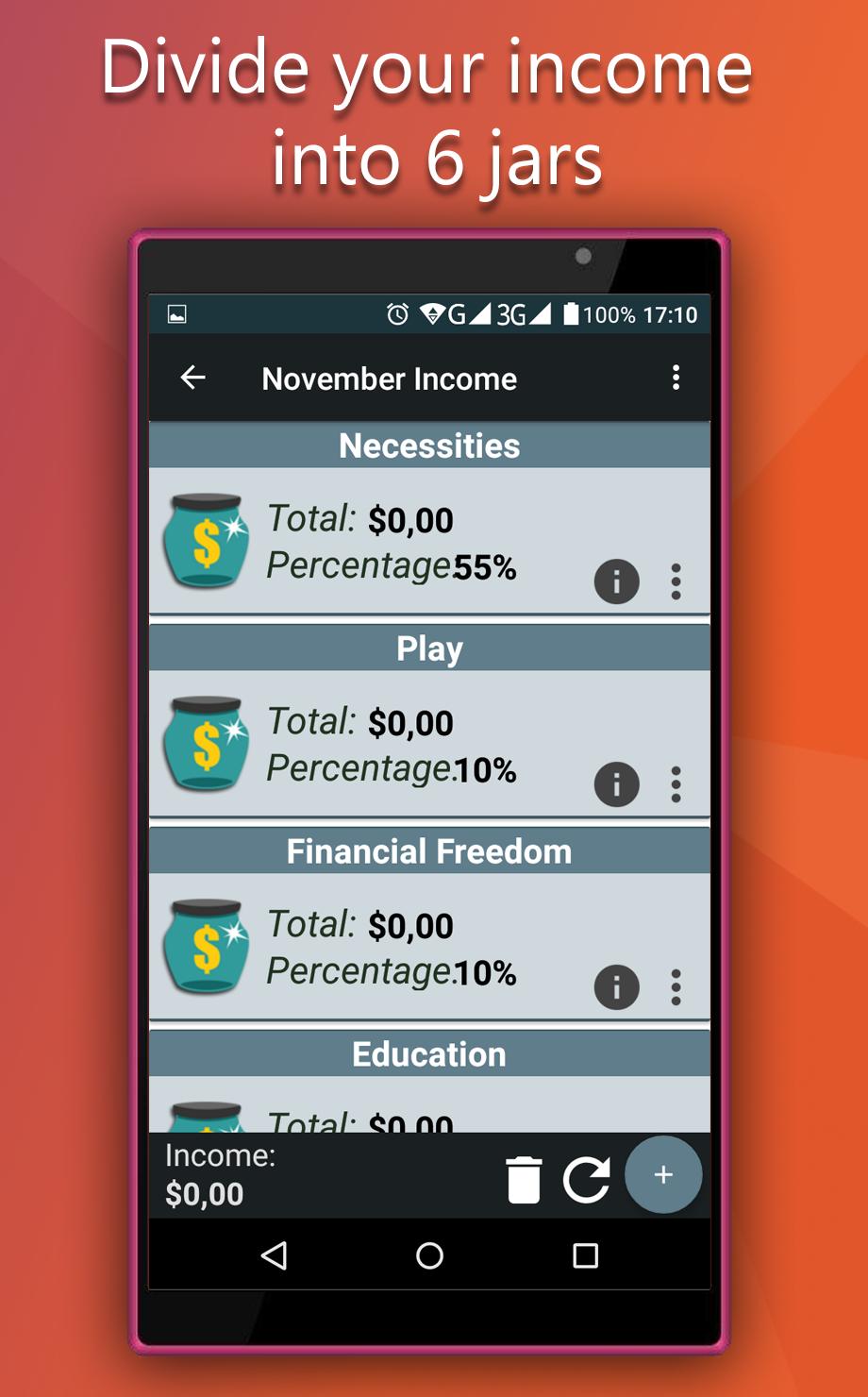

As recommended by T. Harv Eker in his book "The Secrets of the Millionaire Mind", organizing your income in 6 jars is essential to achieve your financial freedom. And this application does it for you.

Simply enter a quantity of money. And it will be divided into 6 percentages:

55% for your current expenses.

10% for Fun.

10% for investments.

10% for education.

10% for larger purchases.

5% for donations.

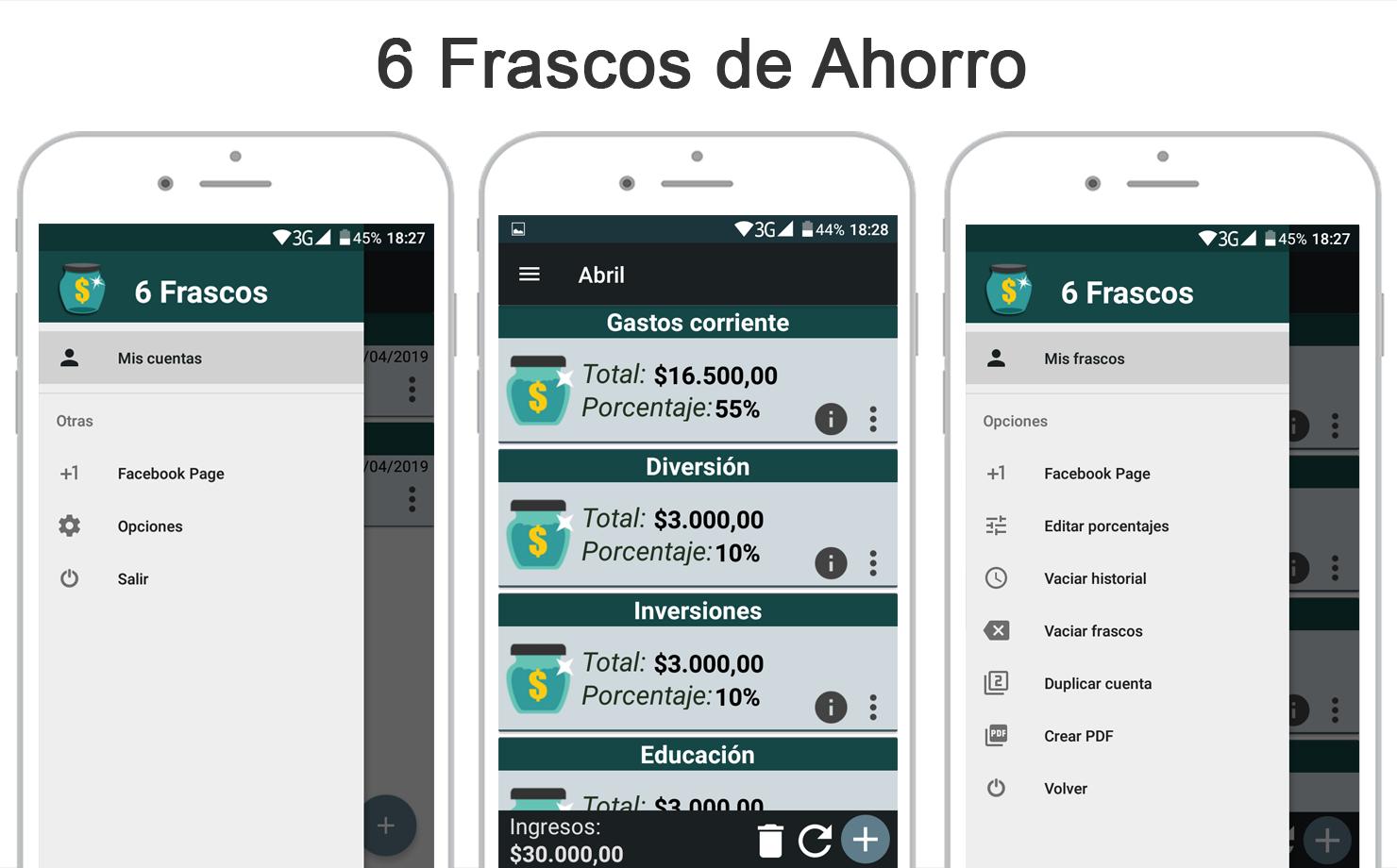

What can I do in the application?

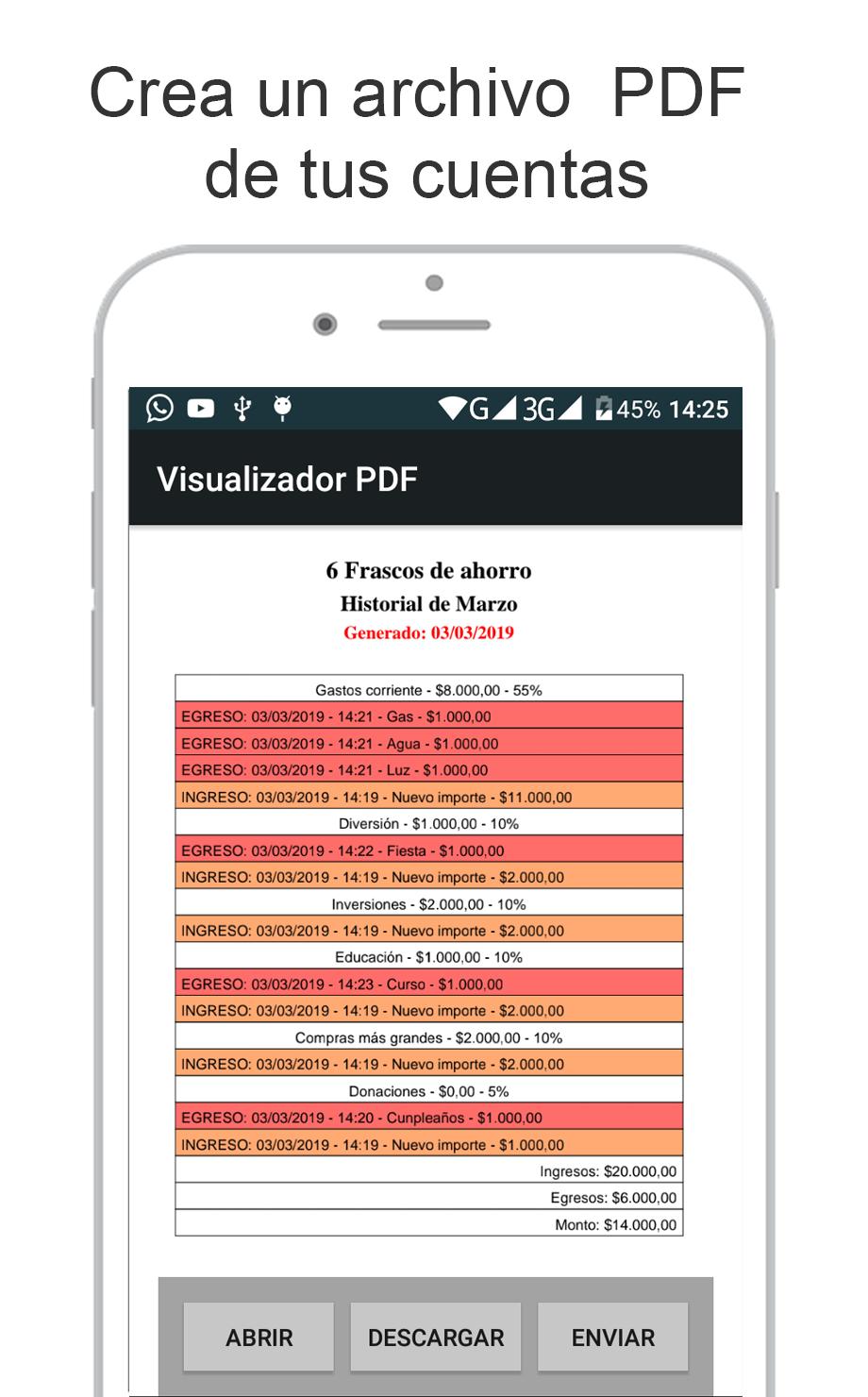

With this bonus you can create a PDF file of your accounts:

This file will contain the following information:

The complete history of each account with its corresponding income and expenses correctly organized by date and time. A summary of your account.

And the application will be free of advertising.

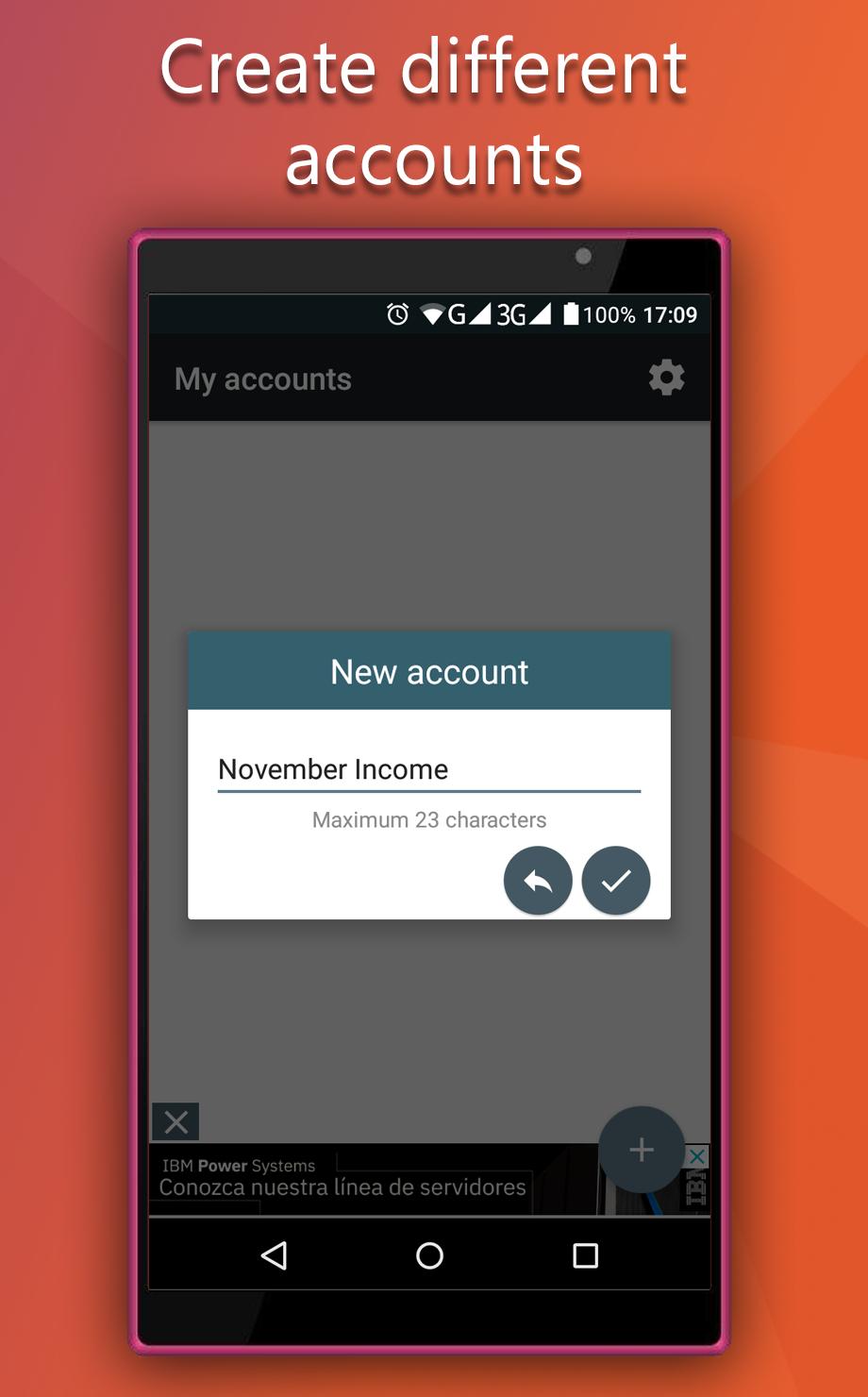

1- Create all the accounts you want, each one with its 6 corresponding jars.

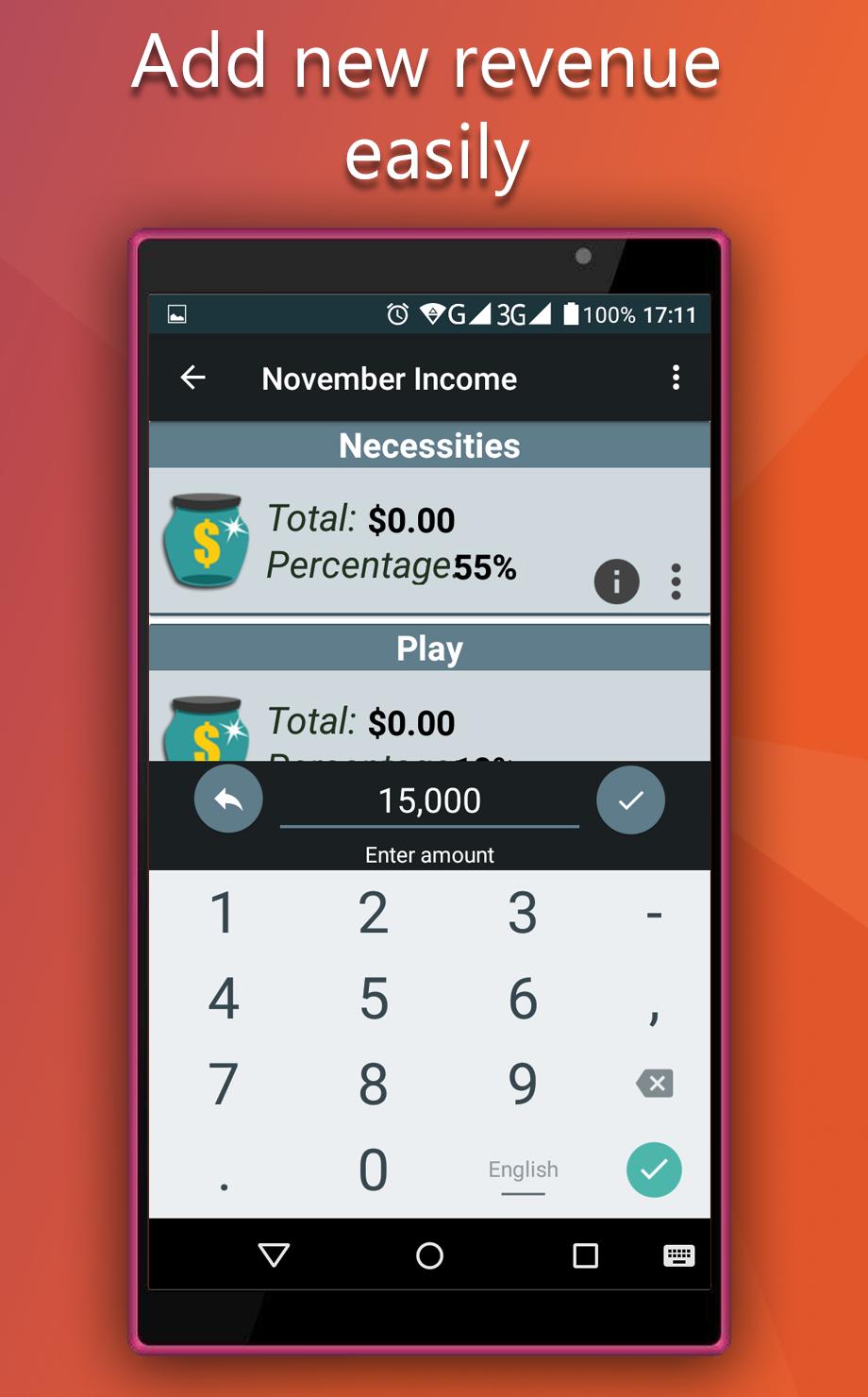

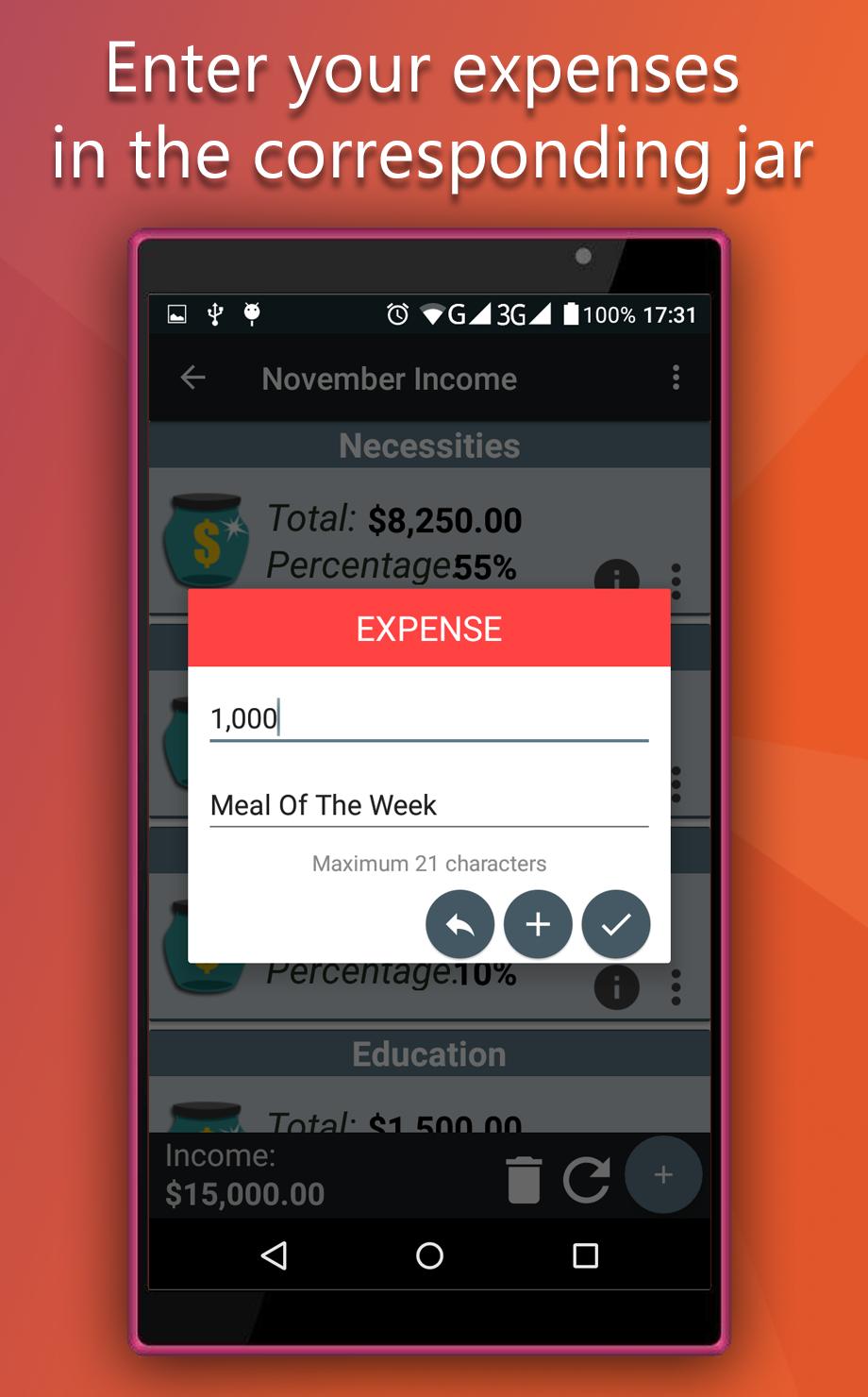

2- Enter one of the accounts and add an amount, this will be divided into 6 percentages.

3- Add an entry to a particular bottle. Example $ 200 "Borrowed money".

4- Add an expense to a particular bottle. Example $ 150 "Cinema"

The application can be customized:

1- You can change the name of each bottle and its description.

2- You can change the name of each account.

3- You can edit the percentages of each bottle.

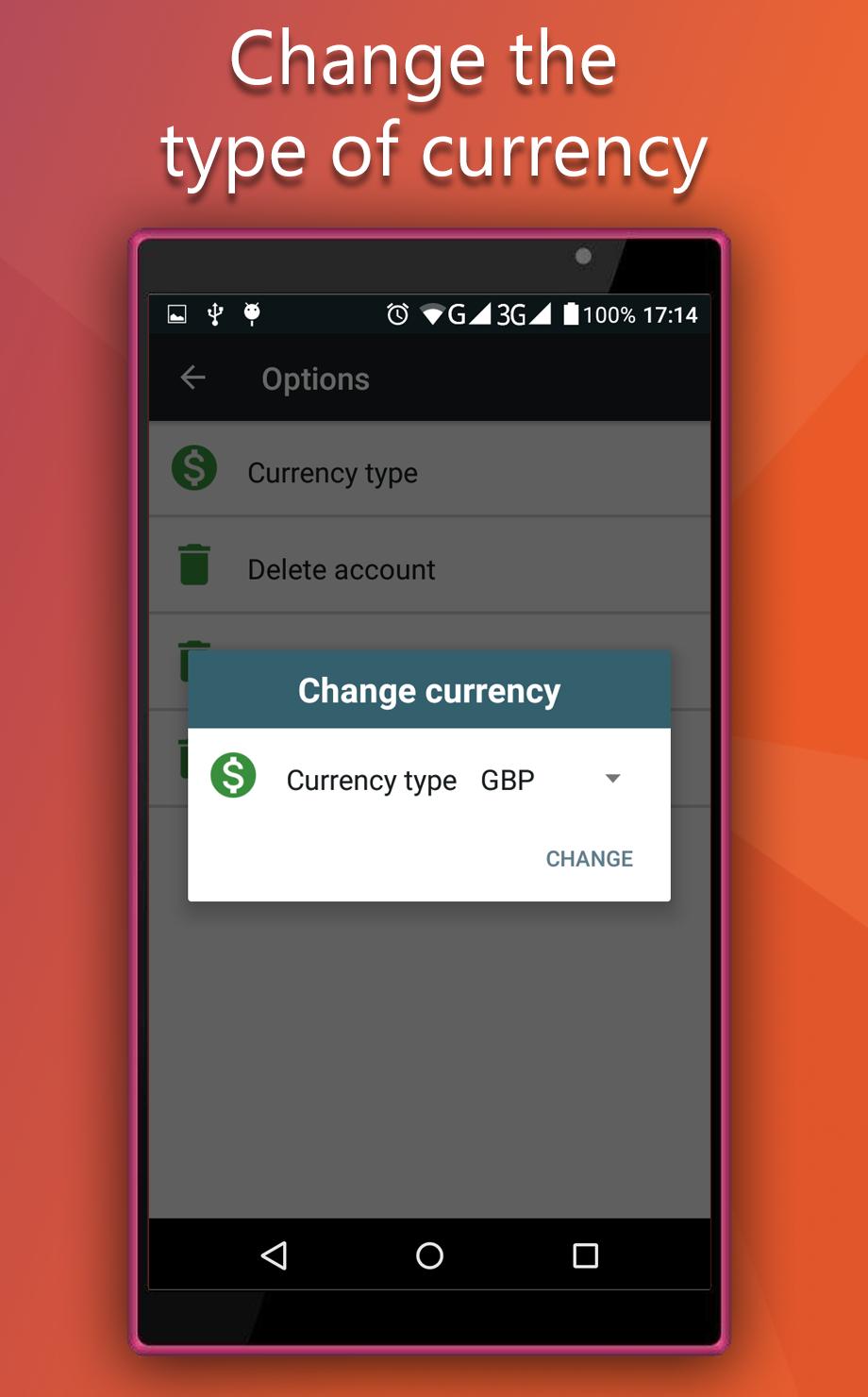

4- You can change the currency type.

As an extra you can duplicate the accounts and do the tests you want.

YOUR DATA IS A SAVED:

Your accounts, amounts, income, expenses, including history, all your data is safe and this application does not save your information on servers or other applications. Everything you do in the app stays on your cell phone.

IMPORTANT:

If you want to collaborate with the translation into English, I would be delighted. Contact me.

What's New in the Latest Version 1.9.2

Last updated on Apr 17, 2024

support for all devices

6 Jars: Manage and Save6 Jars is a financial management mobile application that helps users organize and manage their finances through a simple and intuitive six-jar system. Each jar represents a specific financial goal, allowing users to allocate their funds effectively and track their progress towards achieving those goals.

Key Features:

* Six-Jar System: Users create six jars, each dedicated to a different financial category: Needs, Wants, Savings, Investments, Education, and Play.

* Automatic Allocation: The app automates the allocation of income to each jar based on user-defined percentages.

* Budgeting Tools: Users can set budgets for each jar to ensure they stay within their financial limits.

* Transaction Tracking: All transactions are automatically recorded and categorized, providing users with a comprehensive view of their spending.

* Financial Insights: The app offers personalized insights and reports to help users understand their financial patterns and identify areas for improvement.

* Goal Tracking: Users can set specific financial goals and track their progress towards achieving them.

* Saving Challenges: The app provides challenges to encourage users to save more and develop healthy financial habits.

Benefits:

* Financial Organization: The six-jar system simplifies financial management and helps users stay organized.

* Goal-Oriented Savings: The app promotes intentional saving by allowing users to allocate funds specifically for their financial goals.

* Budget Control: By setting budgets for each jar, users can prevent overspending and ensure they stay on track with their financial plan.

* Increased Financial Awareness: The app provides insights and reports that help users understand their financial habits and make informed decisions.

* Financial Empowerment: 6 Jars empowers users to take control of their finances and achieve their financial goals.

Target Audience:

6 Jars is suitable for individuals of all income levels and financial experience who are looking to improve their financial management skills. It is particularly beneficial for those who want to automate their savings, set financial goals, and gain a better understanding of their financial habits.

With this application you will know how much money you can spend.

With 6 Flasks you will achieve your financial freedom faster.

As recommended by T. Harv Eker in his book "The Secrets of the Millionaire Mind", organizing your income in 6 jars is essential to achieve your financial freedom. And this application does it for you.

Simply enter a quantity of money. And it will be divided into 6 percentages:

55% for your current expenses.

10% for Fun.

10% for investments.

10% for education.

10% for larger purchases.

5% for donations.

What can I do in the application?

With this bonus you can create a PDF file of your accounts:

This file will contain the following information:

The complete history of each account with its corresponding income and expenses correctly organized by date and time. A summary of your account.

And the application will be free of advertising.

1- Create all the accounts you want, each one with its 6 corresponding jars.

2- Enter one of the accounts and add an amount, this will be divided into 6 percentages.

3- Add an entry to a particular bottle. Example $ 200 "Borrowed money".

4- Add an expense to a particular bottle. Example $ 150 "Cinema"

The application can be customized:

1- You can change the name of each bottle and its description.

2- You can change the name of each account.

3- You can edit the percentages of each bottle.

4- You can change the currency type.

As an extra you can duplicate the accounts and do the tests you want.

YOUR DATA IS A SAVED:

Your accounts, amounts, income, expenses, including history, all your data is safe and this application does not save your information on servers or other applications. Everything you do in the app stays on your cell phone.

IMPORTANT:

If you want to collaborate with the translation into English, I would be delighted. Contact me.

What's New in the Latest Version 1.9.2

Last updated on Apr 17, 2024

support for all devices

6 Jars: Manage and Save6 Jars is a financial management mobile application that helps users organize and manage their finances through a simple and intuitive six-jar system. Each jar represents a specific financial goal, allowing users to allocate their funds effectively and track their progress towards achieving those goals.

Key Features:

* Six-Jar System: Users create six jars, each dedicated to a different financial category: Needs, Wants, Savings, Investments, Education, and Play.

* Automatic Allocation: The app automates the allocation of income to each jar based on user-defined percentages.

* Budgeting Tools: Users can set budgets for each jar to ensure they stay within their financial limits.

* Transaction Tracking: All transactions are automatically recorded and categorized, providing users with a comprehensive view of their spending.

* Financial Insights: The app offers personalized insights and reports to help users understand their financial patterns and identify areas for improvement.

* Goal Tracking: Users can set specific financial goals and track their progress towards achieving them.

* Saving Challenges: The app provides challenges to encourage users to save more and develop healthy financial habits.

Benefits:

* Financial Organization: The six-jar system simplifies financial management and helps users stay organized.

* Goal-Oriented Savings: The app promotes intentional saving by allowing users to allocate funds specifically for their financial goals.

* Budget Control: By setting budgets for each jar, users can prevent overspending and ensure they stay on track with their financial plan.

* Increased Financial Awareness: The app provides insights and reports that help users understand their financial habits and make informed decisions.

* Financial Empowerment: 6 Jars empowers users to take control of their finances and achieve their financial goals.

Target Audience:

6 Jars is suitable for individuals of all income levels and financial experience who are looking to improve their financial management skills. It is particularly beneficial for those who want to automate their savings, set financial goals, and gain a better understanding of their financial habits.