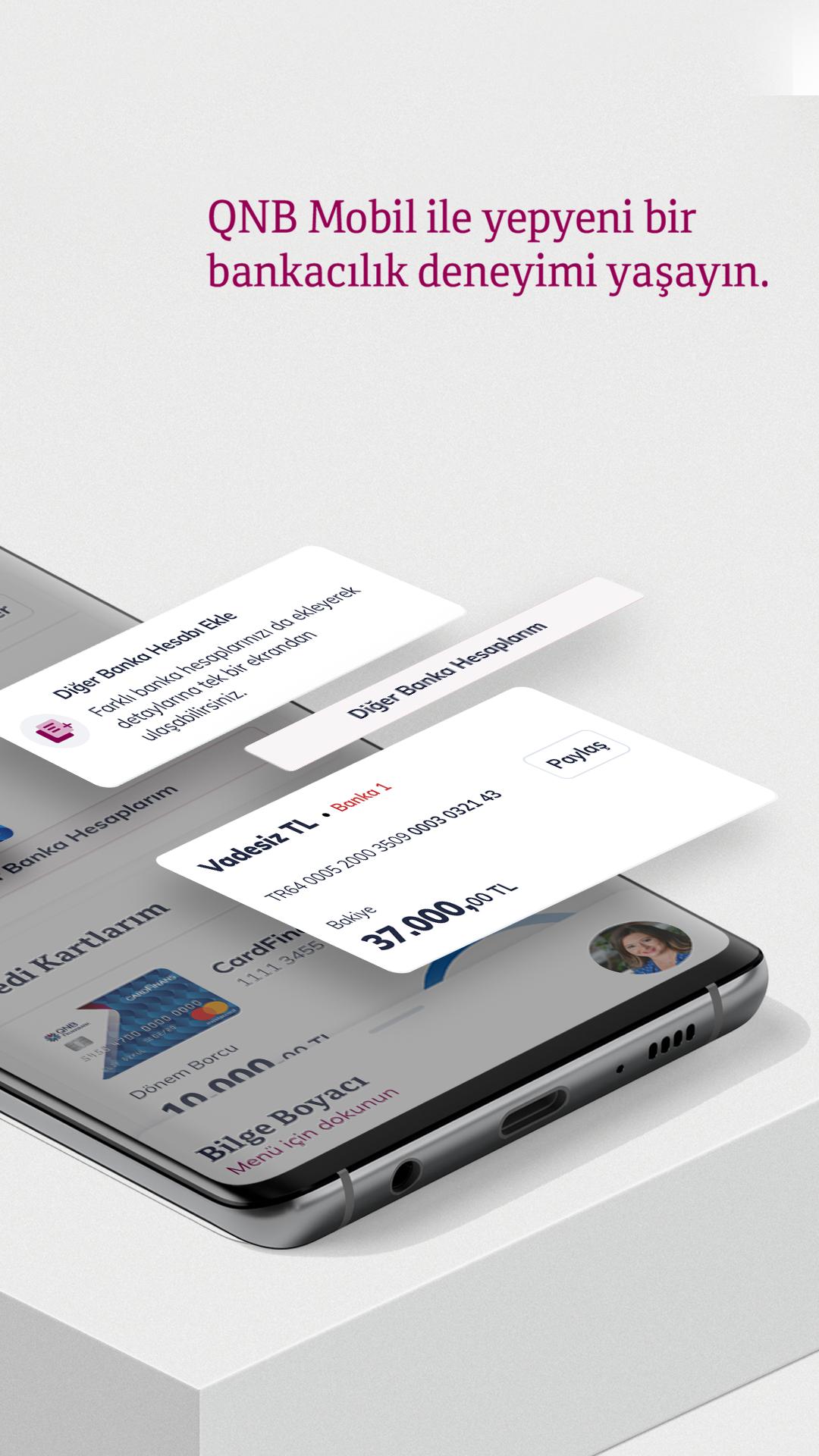

Make your banking transactions easily with QNB Mobil!

QNB Mobil allows you to access banking services anytime, anywhere!

You may easily track/manage your accounts and credit cards, transfer money and buy/sell foreign currency. You can also view exchange rates and use ATM/Branch Locator without logging in.

To start using QNB Mobil, all you need is your customer number and FinansPassword. If you do not have one, you can get it by calling our Call Center.

What's New in the Latest Version 3.8.9

Last updated on Apr 17, 2024

We continue to renew QNB Mobil.

We made some improvements in this release.

Arabic language has been added as the third language on QNB Mobil.

You may reach us through qnbfinansbank.com/bize-ulasin/bize-ulasin.

Overview

QNB Mobil & Dijital Köprü is a mobile and digital banking platform offered by QNB Finansbank, one of Turkey's leading financial institutions. It provides a comprehensive suite of banking services, allowing customers to manage their finances conveniently and securely from their mobile devices and computers.

Features

Mobile Banking:

* Account management: View account balances, transaction history, and statements.

* Fund transfers: Send money within Turkey and internationally.

* Bill payments: Pay bills for utilities, credit cards, and other services.

* Mobile check deposit: Deposit checks using your phone's camera.

* Card management: Activate, block, or replace cards.

Digital Banking:

* Online account management: Access your accounts, view transactions, and manage settings.

* Loan applications: Apply for loans and track their status.

* Investment management: Invest in various financial instruments, such as mutual funds and stocks.

* Foreign exchange: Convert currencies and view exchange rates.

Security

QNB Mobil & Dijital Köprü prioritizes security measures to protect customer information and transactions. It employs:

* Multi-factor authentication: Uses multiple layers of verification to ensure the identity of users.

* Data encryption: Encrypts all data transmitted between devices and the bank's servers.

* Fraud detection: Monitors transactions for suspicious activity and alerts customers of potential fraud.

Convenience

The platform is designed for ease of use and accessibility:

* User-friendly interface: Intuitive navigation and clear menus make it easy to find what you need.

* 24/7 availability: Access your accounts and services anytime, anywhere.

* Multi-device compatibility: Use the platform on your smartphone, tablet, or computer.

* Personalization: Customize your account settings, such as notifications and transaction alerts.

Benefits

* Convenience: Manage your finances from the comfort of your home or on the go.

* Time-saving: Eliminate the need for in-person bank visits or phone calls.

* Security: Protect your information with robust security measures.

* Control: Take charge of your financial transactions and investments.

* Accessibility: Bank whenever and wherever it's convenient for you.

Make your banking transactions easily with QNB Mobil!

QNB Mobil allows you to access banking services anytime, anywhere!

You may easily track/manage your accounts and credit cards, transfer money and buy/sell foreign currency. You can also view exchange rates and use ATM/Branch Locator without logging in.

To start using QNB Mobil, all you need is your customer number and FinansPassword. If you do not have one, you can get it by calling our Call Center.

What's New in the Latest Version 3.8.9

Last updated on Apr 17, 2024

We continue to renew QNB Mobil.

We made some improvements in this release.

Arabic language has been added as the third language on QNB Mobil.

You may reach us through qnbfinansbank.com/bize-ulasin/bize-ulasin.

Overview

QNB Mobil & Dijital Köprü is a mobile and digital banking platform offered by QNB Finansbank, one of Turkey's leading financial institutions. It provides a comprehensive suite of banking services, allowing customers to manage their finances conveniently and securely from their mobile devices and computers.

Features

Mobile Banking:

* Account management: View account balances, transaction history, and statements.

* Fund transfers: Send money within Turkey and internationally.

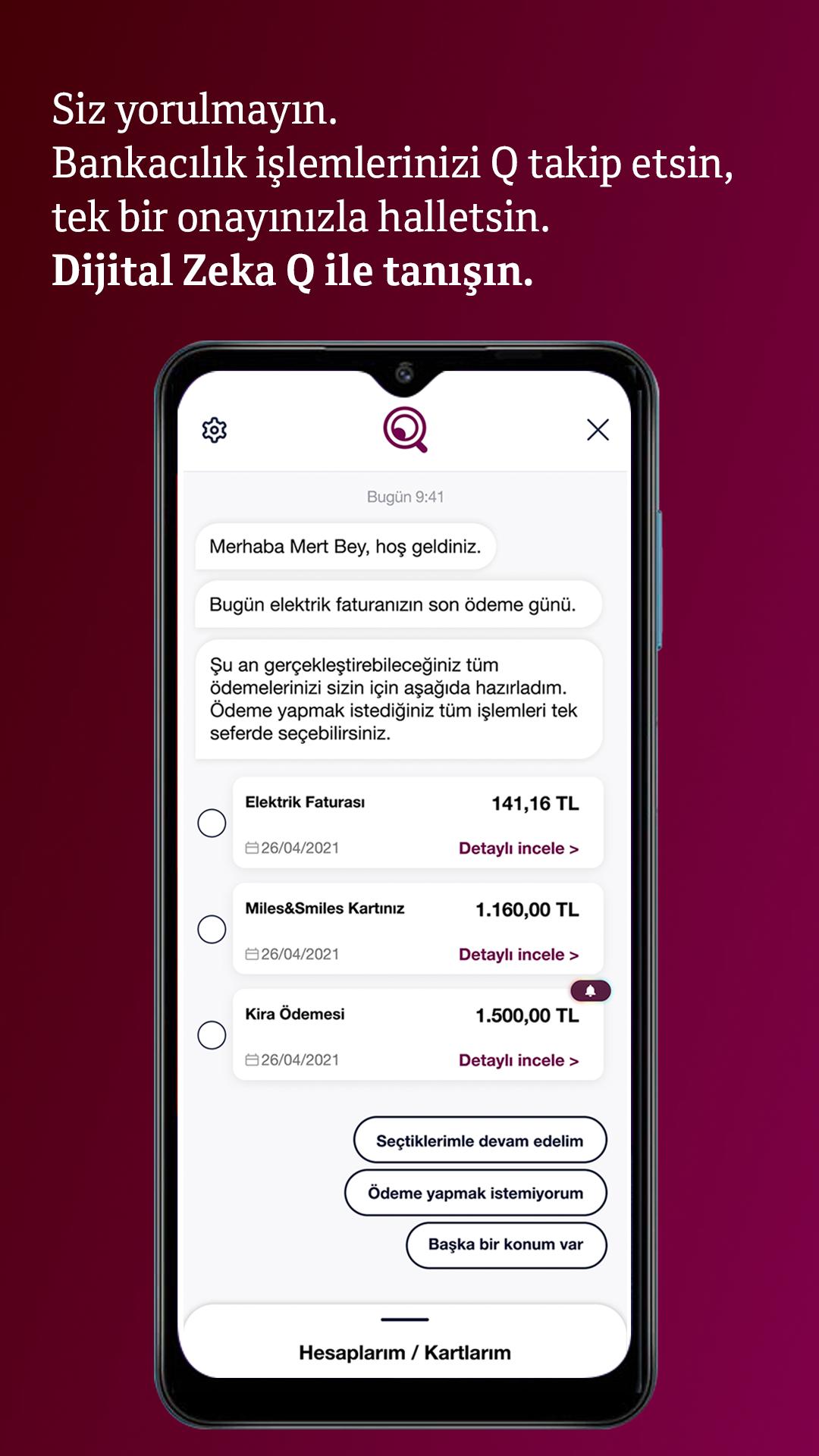

* Bill payments: Pay bills for utilities, credit cards, and other services.

* Mobile check deposit: Deposit checks using your phone's camera.

* Card management: Activate, block, or replace cards.

Digital Banking:

* Online account management: Access your accounts, view transactions, and manage settings.

* Loan applications: Apply for loans and track their status.

* Investment management: Invest in various financial instruments, such as mutual funds and stocks.

* Foreign exchange: Convert currencies and view exchange rates.

Security

QNB Mobil & Dijital Köprü prioritizes security measures to protect customer information and transactions. It employs:

* Multi-factor authentication: Uses multiple layers of verification to ensure the identity of users.

* Data encryption: Encrypts all data transmitted between devices and the bank's servers.

* Fraud detection: Monitors transactions for suspicious activity and alerts customers of potential fraud.

Convenience

The platform is designed for ease of use and accessibility:

* User-friendly interface: Intuitive navigation and clear menus make it easy to find what you need.

* 24/7 availability: Access your accounts and services anytime, anywhere.

* Multi-device compatibility: Use the platform on your smartphone, tablet, or computer.

* Personalization: Customize your account settings, such as notifications and transaction alerts.

Benefits

* Convenience: Manage your finances from the comfort of your home or on the go.

* Time-saving: Eliminate the need for in-person bank visits or phone calls.

* Security: Protect your information with robust security measures.

* Control: Take charge of your financial transactions and investments.

* Accessibility: Bank whenever and wherever it's convenient for you.