Digital version of CNY

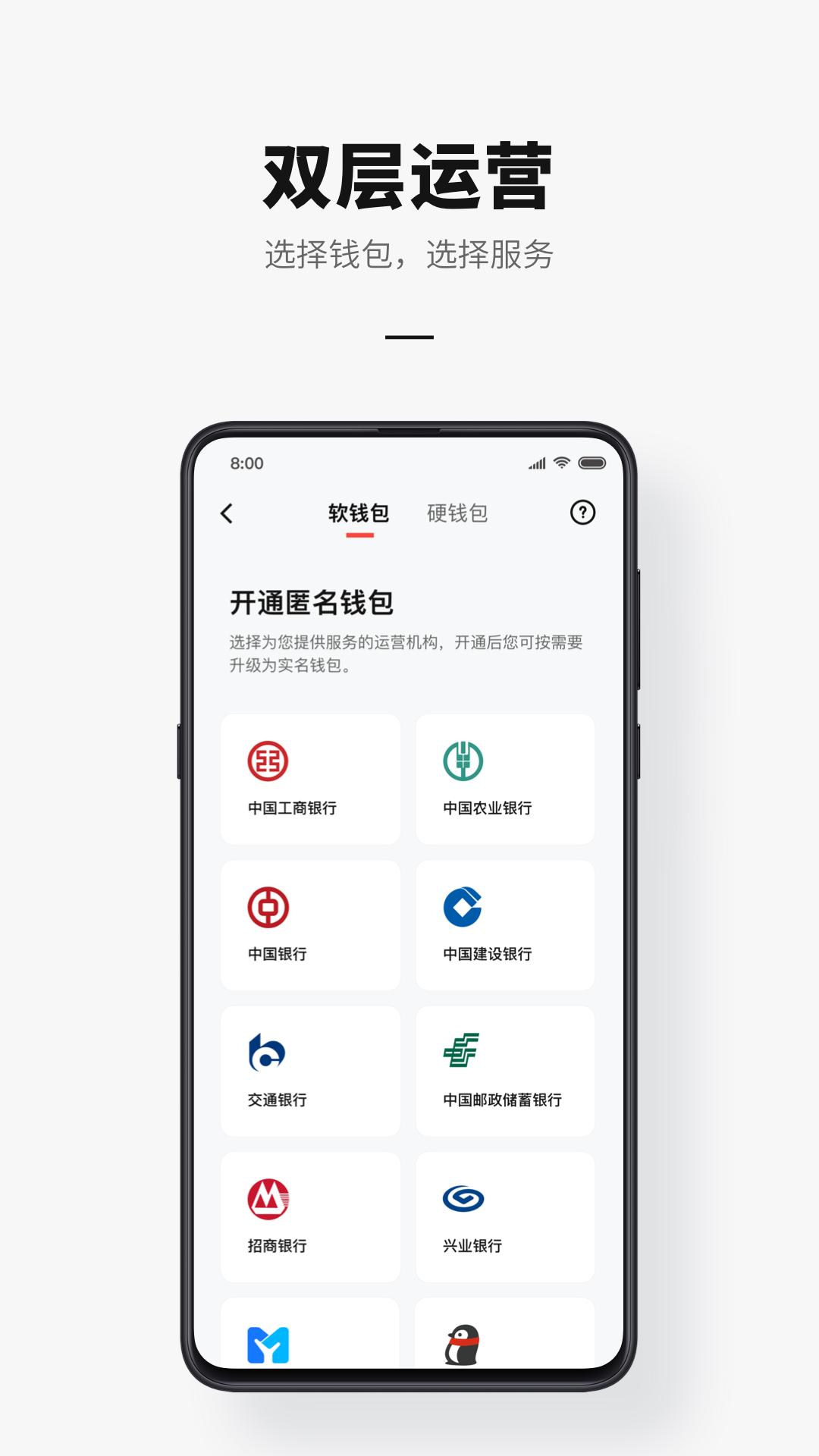

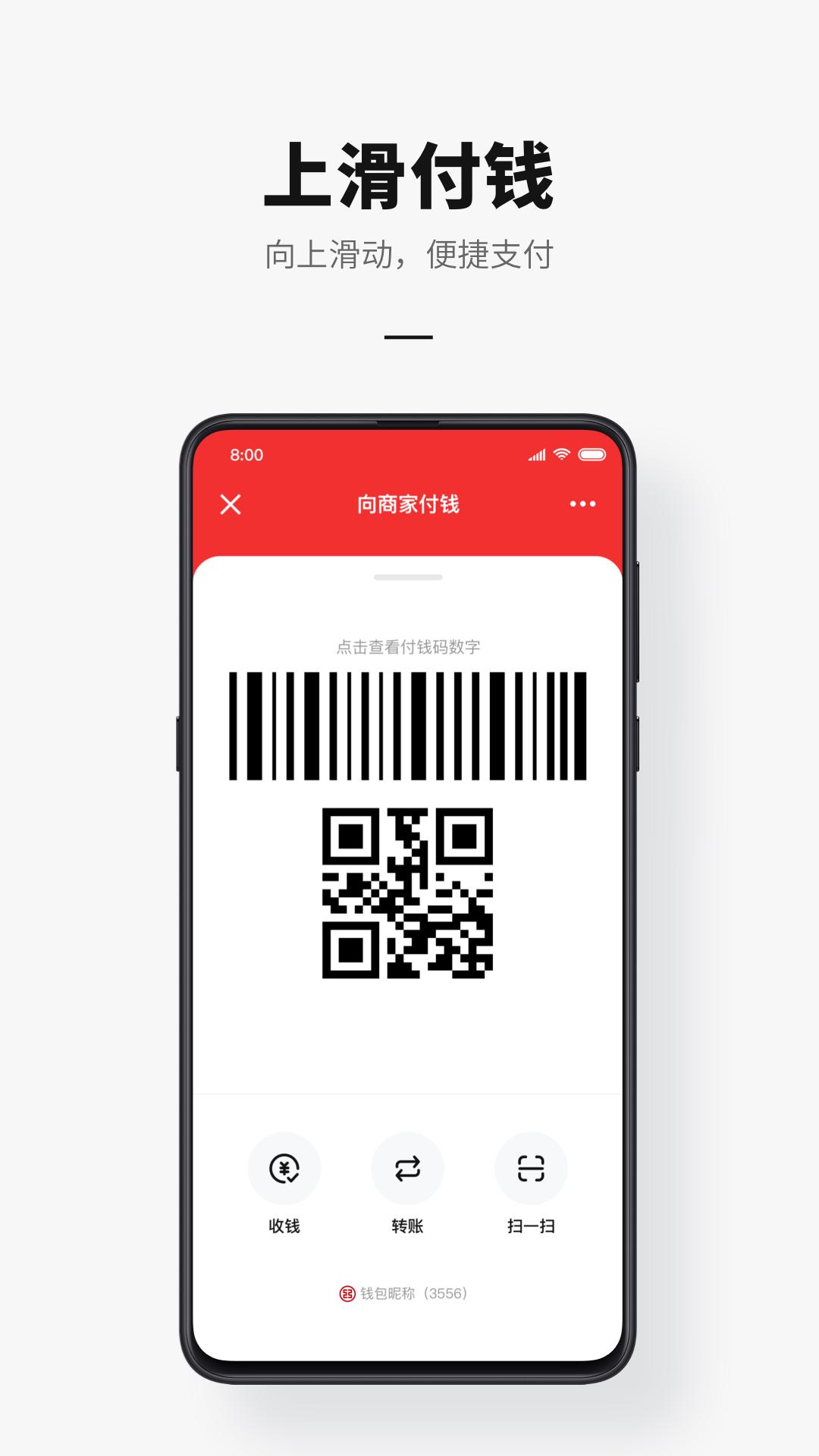

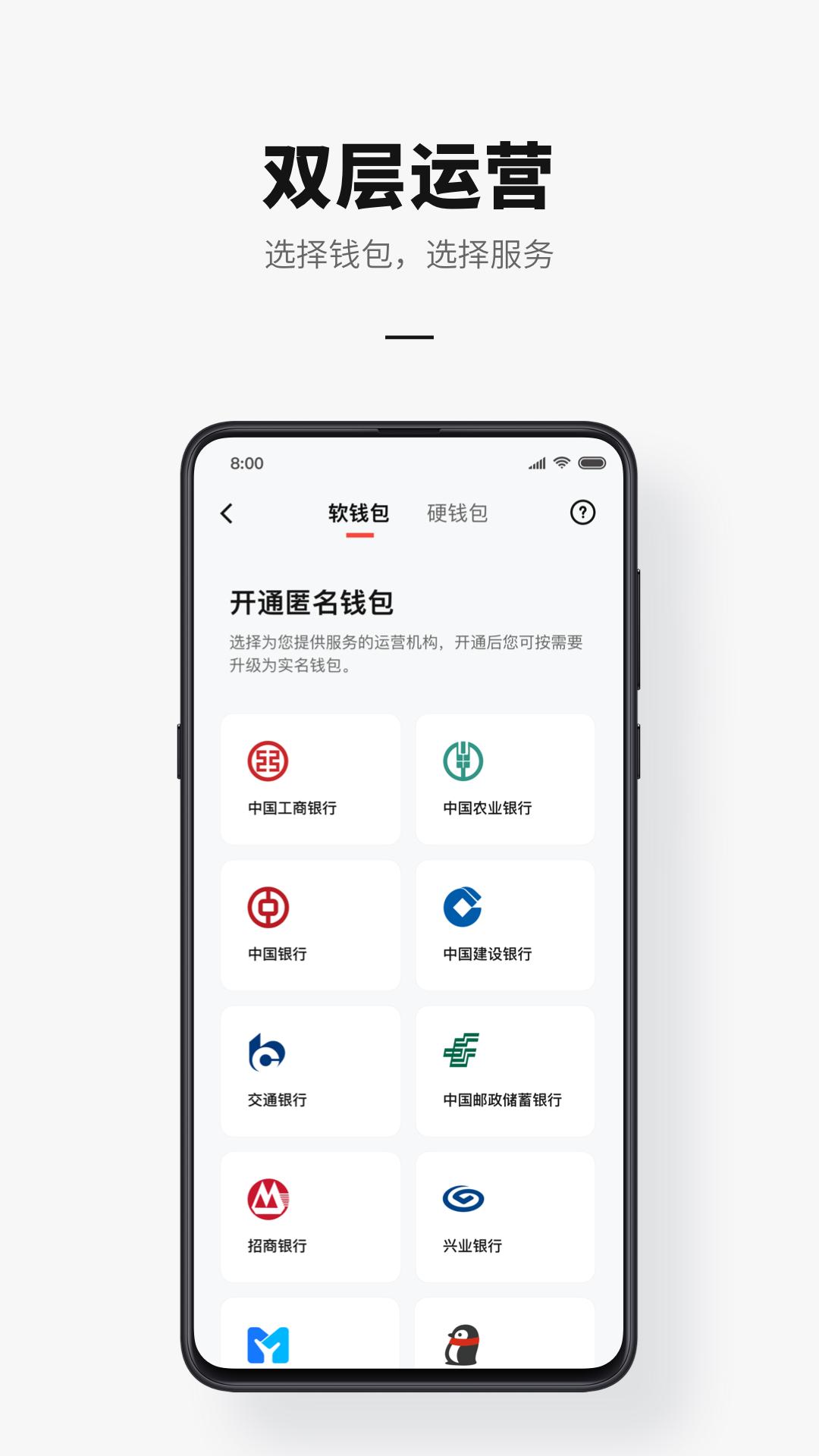

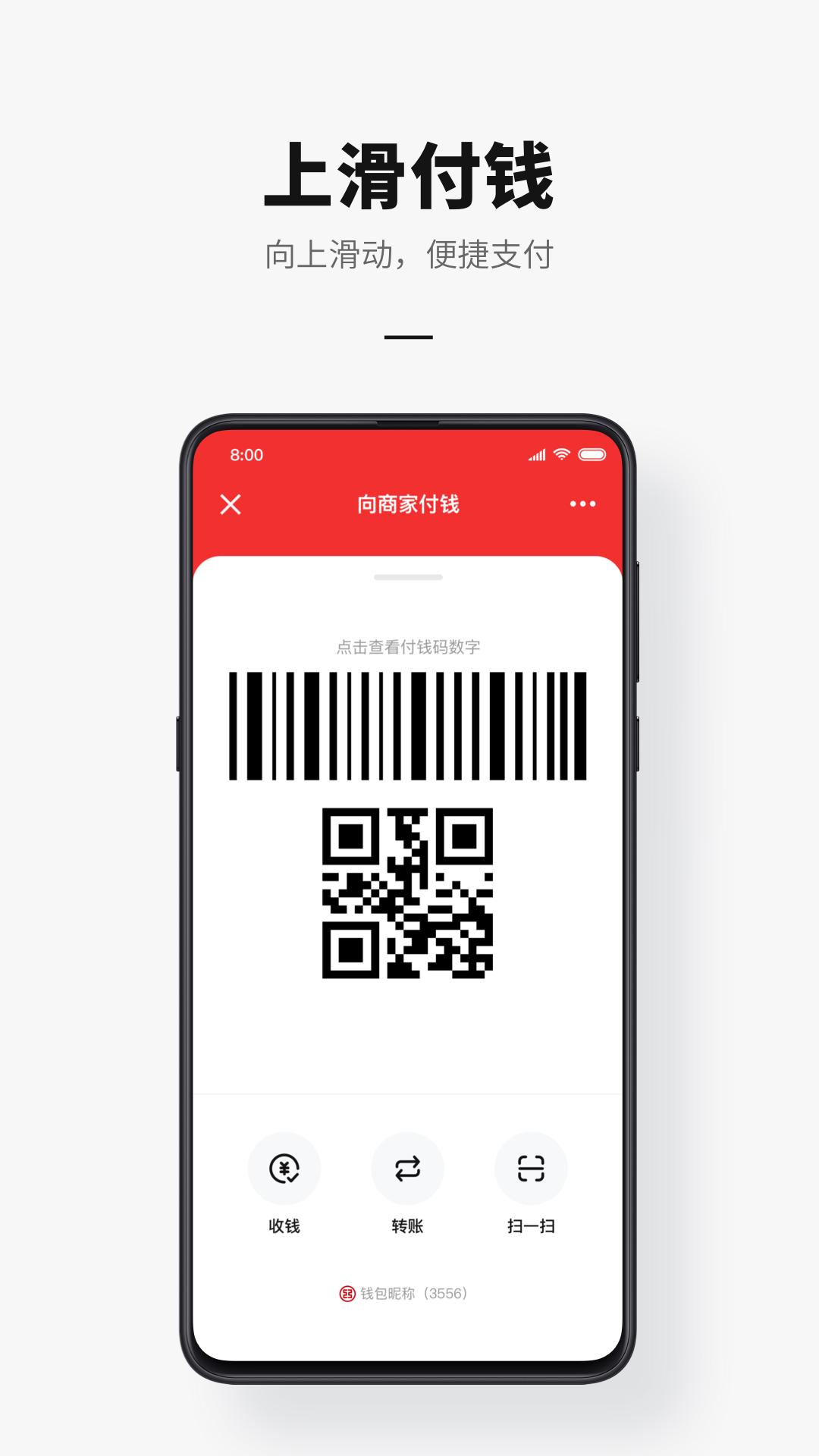

E-CNY app is the official service platform for the trial program of the digital version of fiat currency issued by the People’s Bank of China. The app is open to individual users, provides wallet opening and management services, and facilitates the exchange and circulation of e-CNY. E-CNY pilots in certain designated areas and designated pilot programs; pilot customers are qualified to register.

e-CNY: China's Central Bank Digital CurrencyIntroduction

e-CNY is the official central bank digital currency (CBDC) of China, issued by the People's Bank of China (PBOC). It is a digital form of the Chinese yuan (RMB) and is designed to complement physical cash and traditional electronic payment methods.

Features

* Digital: e-CNY exists solely in digital form, stored and transacted electronically.

* Centralized: Unlike cryptocurrencies like Bitcoin, e-CNY is issued and controlled by the central bank, ensuring stability and security.

* Legal Tender: e-CNY has the same legal status as physical cash, making it acceptable for all transactions within China.

* Two-Tier System: e-CNY is distributed through commercial banks, which act as intermediaries between the PBOC and the public.

* Privacy: e-CNY transactions are recorded on a distributed ledger, but personal information is encrypted and protected by the PBOC.

Benefits

* Convenience: e-CNY enables seamless and instant payments, reducing transaction costs and time delays.

* Efficiency: Digital transactions streamline processes, eliminating the need for physical cash handling and reducing errors.

* Financial Inclusion: e-CNY provides access to financial services for individuals who may not have access to traditional banking.

* Transparency: The distributed ledger system ensures transparency and accountability in transactions.

* Reduced Corruption: Digital payments can help reduce corruption by eliminating the use of physical cash.

Challenges

* Privacy Concerns: The centralized nature of e-CNY raises concerns about government surveillance and potential misuse of personal data.

* Technical Complexity: Implementing and managing a CBDC requires significant technological expertise and infrastructure.

* Interoperability: Ensuring interoperability with existing payment systems and international currencies is crucial for widespread adoption.

* Cybersecurity Risks: Digital currencies are vulnerable to cyberattacks, requiring robust security measures.

* Economic Impact: The introduction of e-CNY could impact the financial system and traditional banking models.

Future Prospects

e-CNY is still in its early stages of development, but it has the potential to revolutionize the Chinese financial system. As the technology matures and challenges are addressed, e-CNY is expected to become a widely used payment method in China and a model for other CBDCs around the world.

Digital version of CNY

E-CNY app is the official service platform for the trial program of the digital version of fiat currency issued by the People’s Bank of China. The app is open to individual users, provides wallet opening and management services, and facilitates the exchange and circulation of e-CNY. E-CNY pilots in certain designated areas and designated pilot programs; pilot customers are qualified to register.

e-CNY: China's Central Bank Digital CurrencyIntroduction

e-CNY is the official central bank digital currency (CBDC) of China, issued by the People's Bank of China (PBOC). It is a digital form of the Chinese yuan (RMB) and is designed to complement physical cash and traditional electronic payment methods.

Features

* Digital: e-CNY exists solely in digital form, stored and transacted electronically.

* Centralized: Unlike cryptocurrencies like Bitcoin, e-CNY is issued and controlled by the central bank, ensuring stability and security.

* Legal Tender: e-CNY has the same legal status as physical cash, making it acceptable for all transactions within China.

* Two-Tier System: e-CNY is distributed through commercial banks, which act as intermediaries between the PBOC and the public.

* Privacy: e-CNY transactions are recorded on a distributed ledger, but personal information is encrypted and protected by the PBOC.

Benefits

* Convenience: e-CNY enables seamless and instant payments, reducing transaction costs and time delays.

* Efficiency: Digital transactions streamline processes, eliminating the need for physical cash handling and reducing errors.

* Financial Inclusion: e-CNY provides access to financial services for individuals who may not have access to traditional banking.

* Transparency: The distributed ledger system ensures transparency and accountability in transactions.

* Reduced Corruption: Digital payments can help reduce corruption by eliminating the use of physical cash.

Challenges

* Privacy Concerns: The centralized nature of e-CNY raises concerns about government surveillance and potential misuse of personal data.

* Technical Complexity: Implementing and managing a CBDC requires significant technological expertise and infrastructure.

* Interoperability: Ensuring interoperability with existing payment systems and international currencies is crucial for widespread adoption.

* Cybersecurity Risks: Digital currencies are vulnerable to cyberattacks, requiring robust security measures.

* Economic Impact: The introduction of e-CNY could impact the financial system and traditional banking models.

Future Prospects

e-CNY is still in its early stages of development, but it has the potential to revolutionize the Chinese financial system. As the technology matures and challenges are addressed, e-CNY is expected to become a widely used payment method in China and a model for other CBDCs around the world.