Access all information relevant to your VEGA instrument...

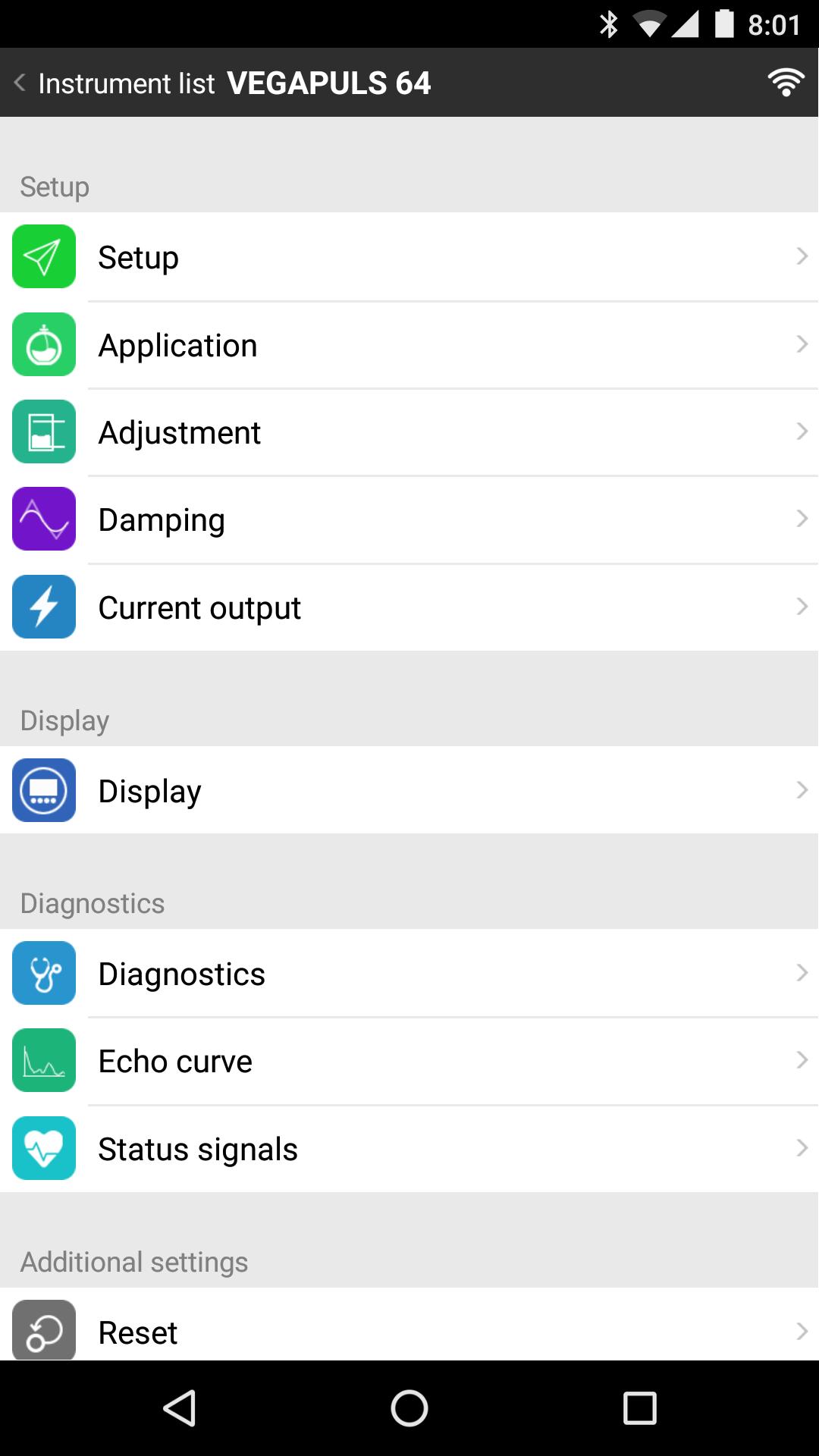

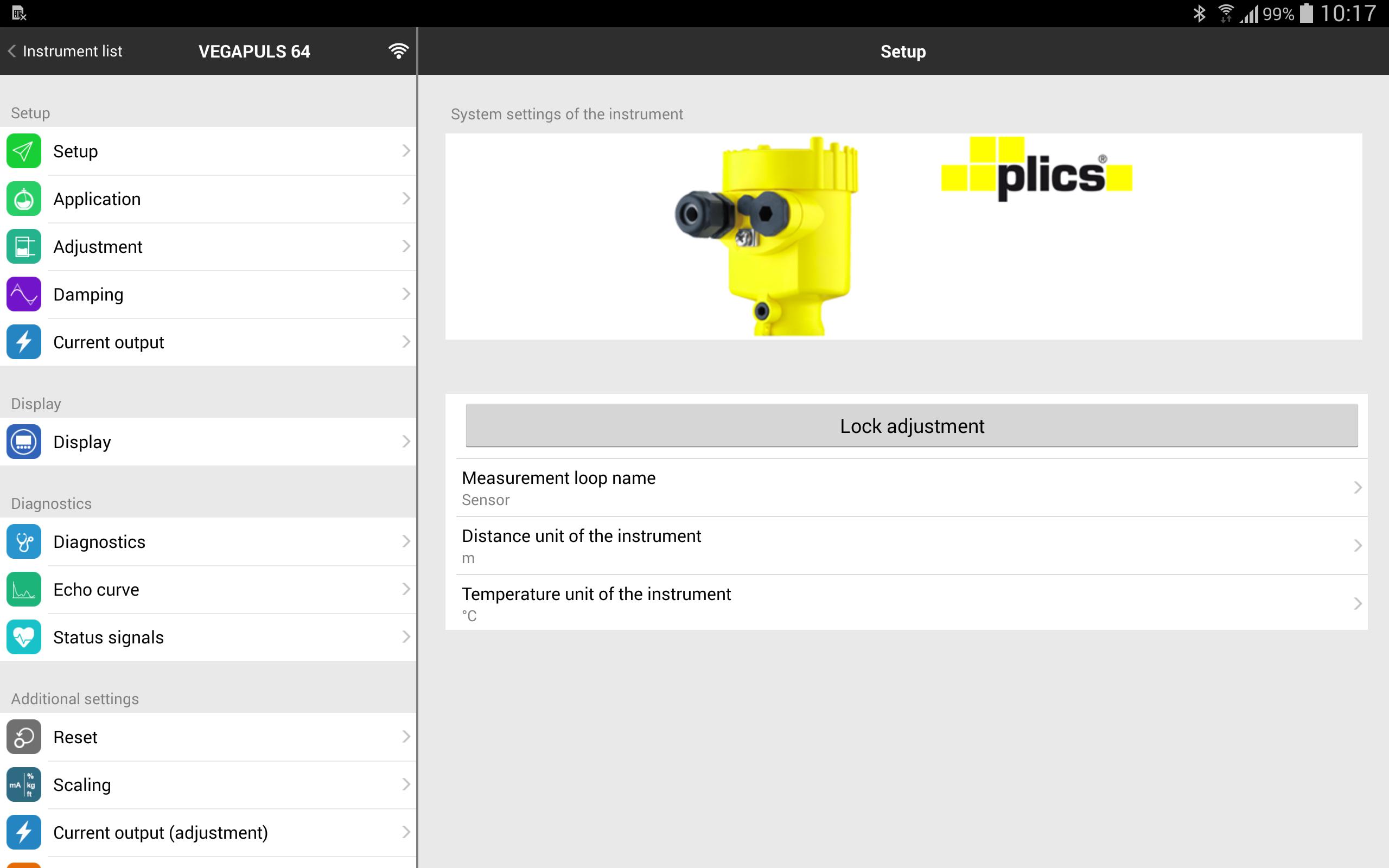

This app enables wireless adjustment of sensors that have the display/adjustment module PLICSCOM with Bluetooth. Your smartphone or tablet gives you convenient access to the adjustment functions of the sensor. The intuitive user interface of the app makes it very easy to configure the sensor and put it into operation.

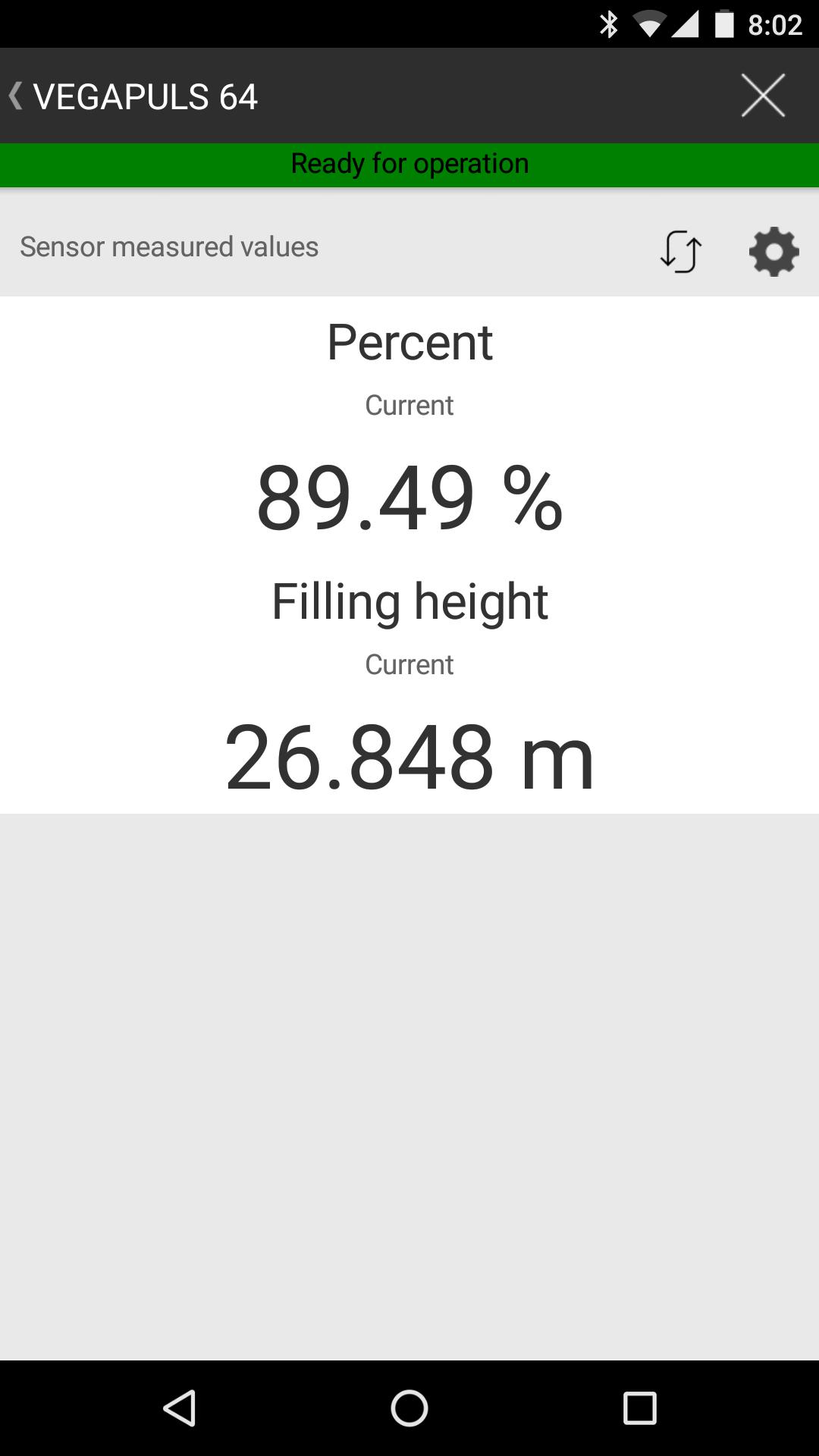

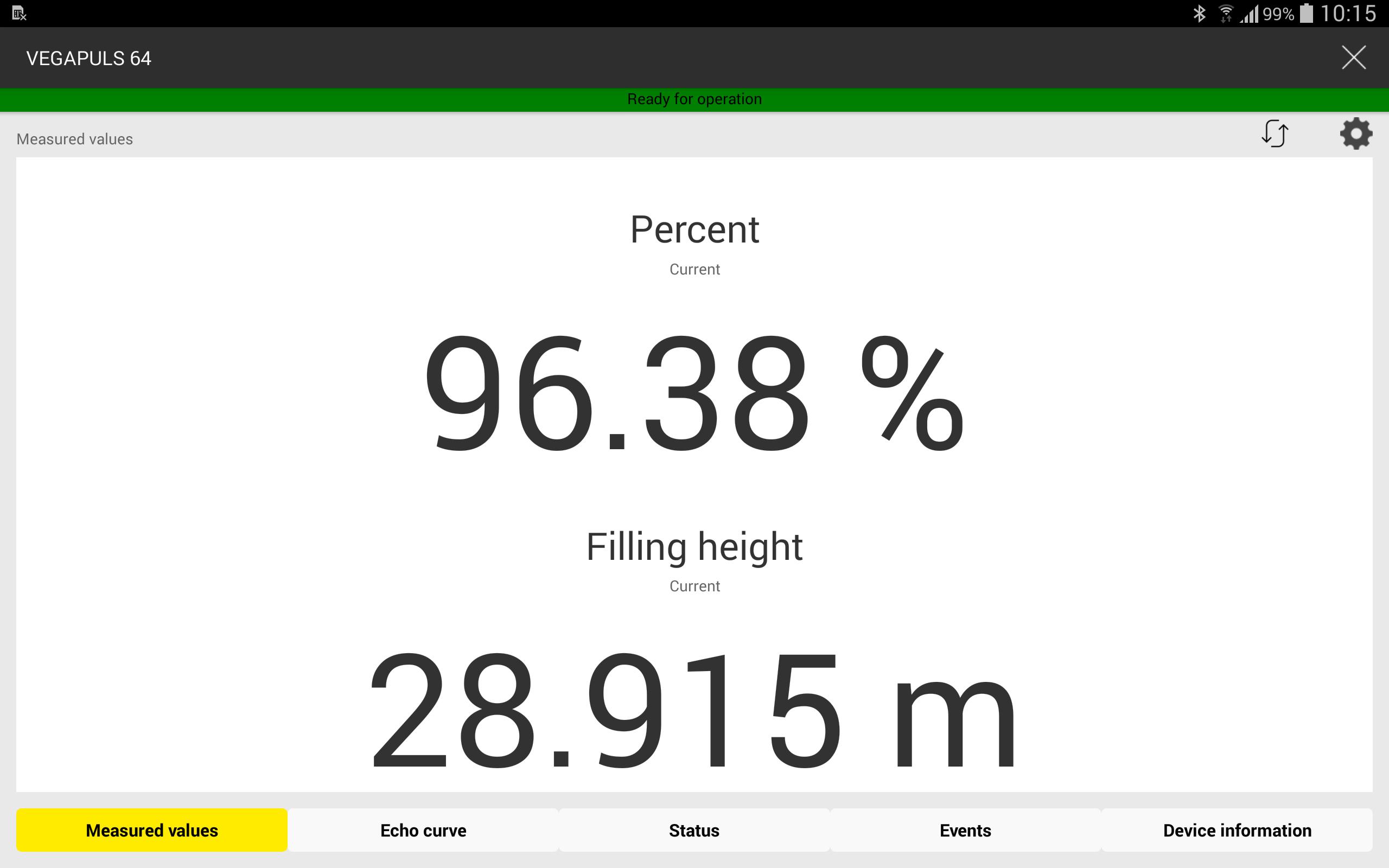

The optimized display and diagnostic function allows you to e.g. visualize the measured value or sensor status quickly and easily.

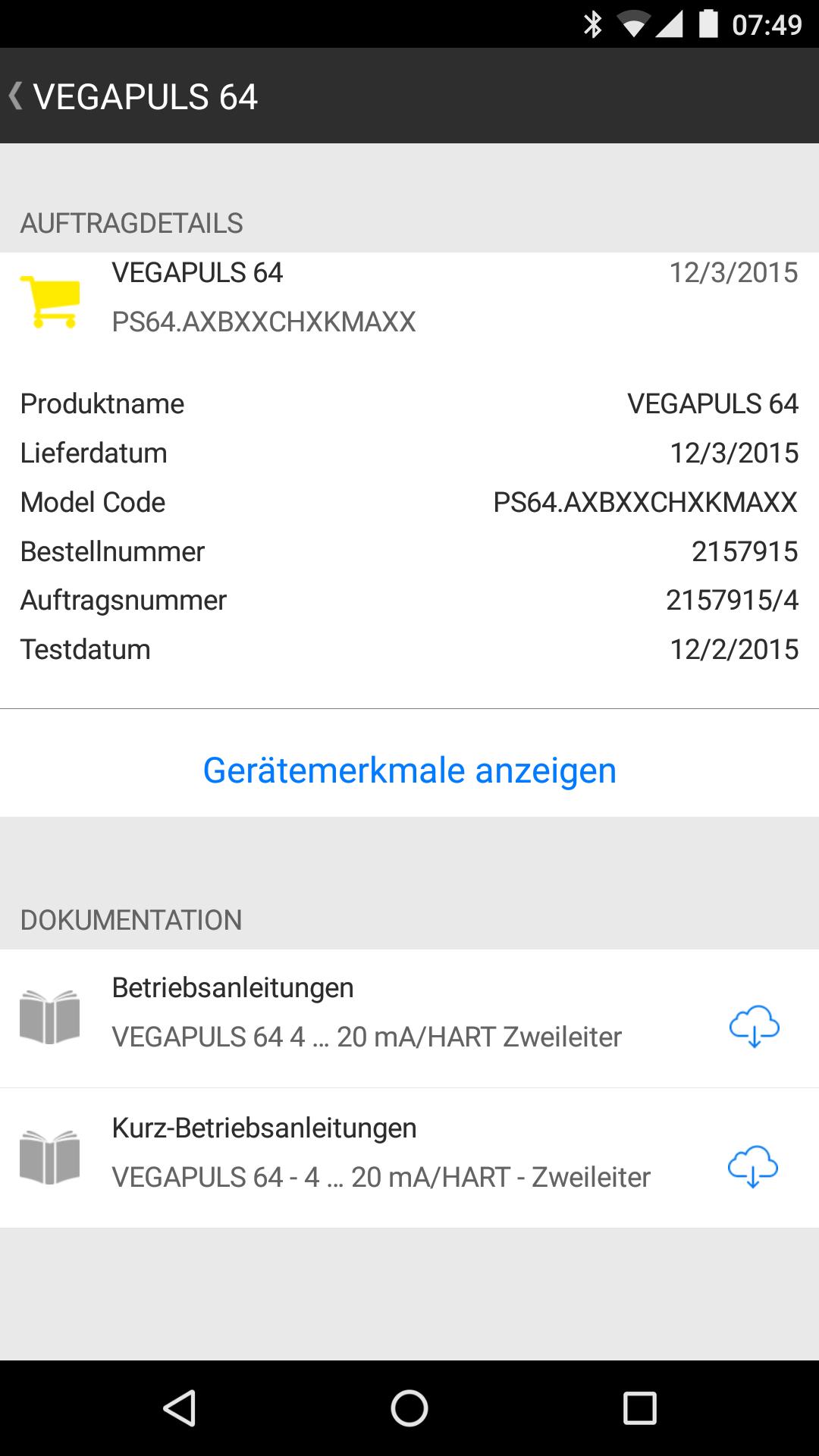

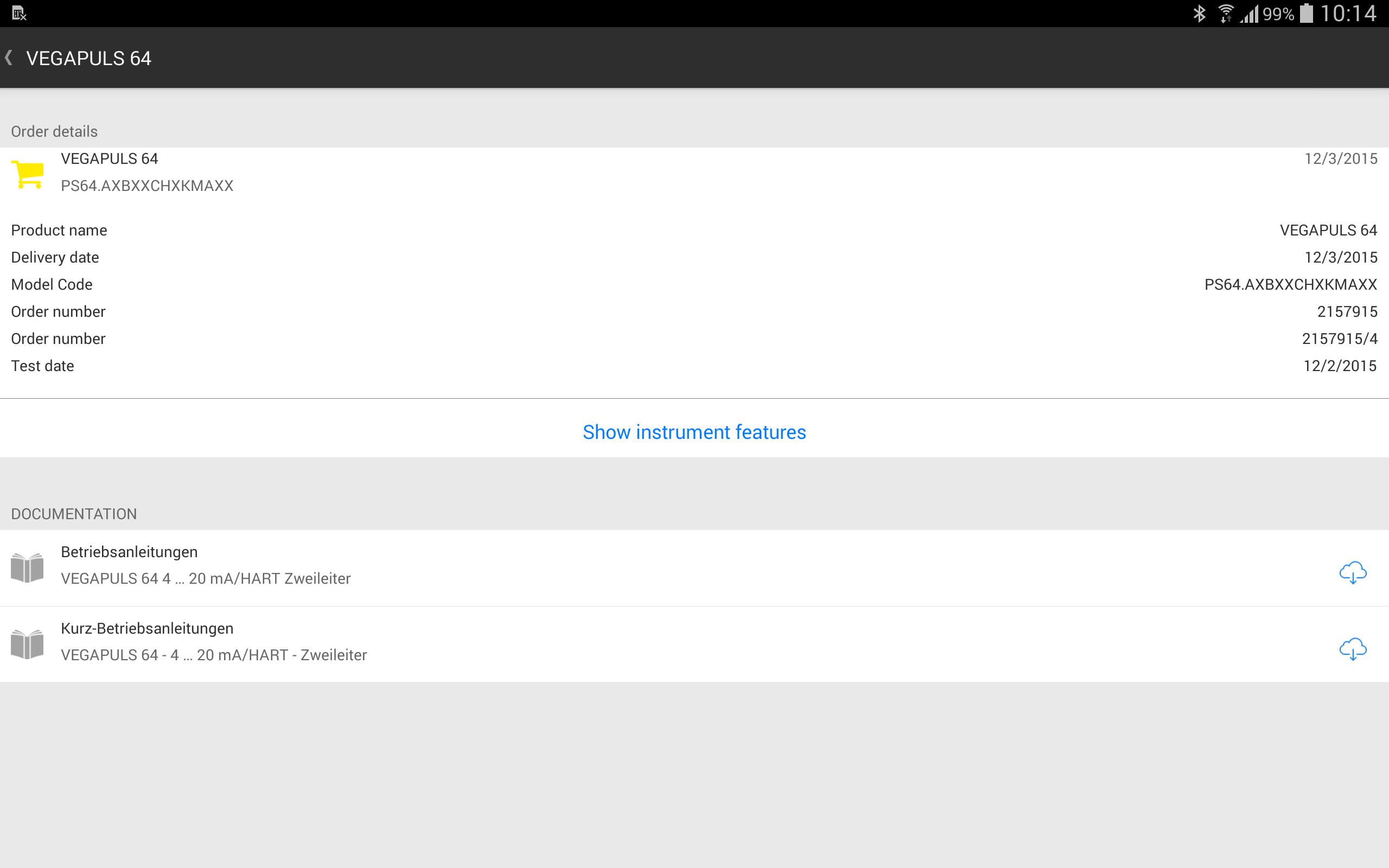

By entering the serial number, all relevant information about your VEGA instrument can be retrieved. Optionally, you can get this information on your smartphone by scanning the data matrix code or barcode on the type label.

General device information (instrument name, article number, delivery date, etc.), an overview of product features and the device-specific documentation (operating instructions, test certificates and safety notes) are thus available anytime, anywhere.

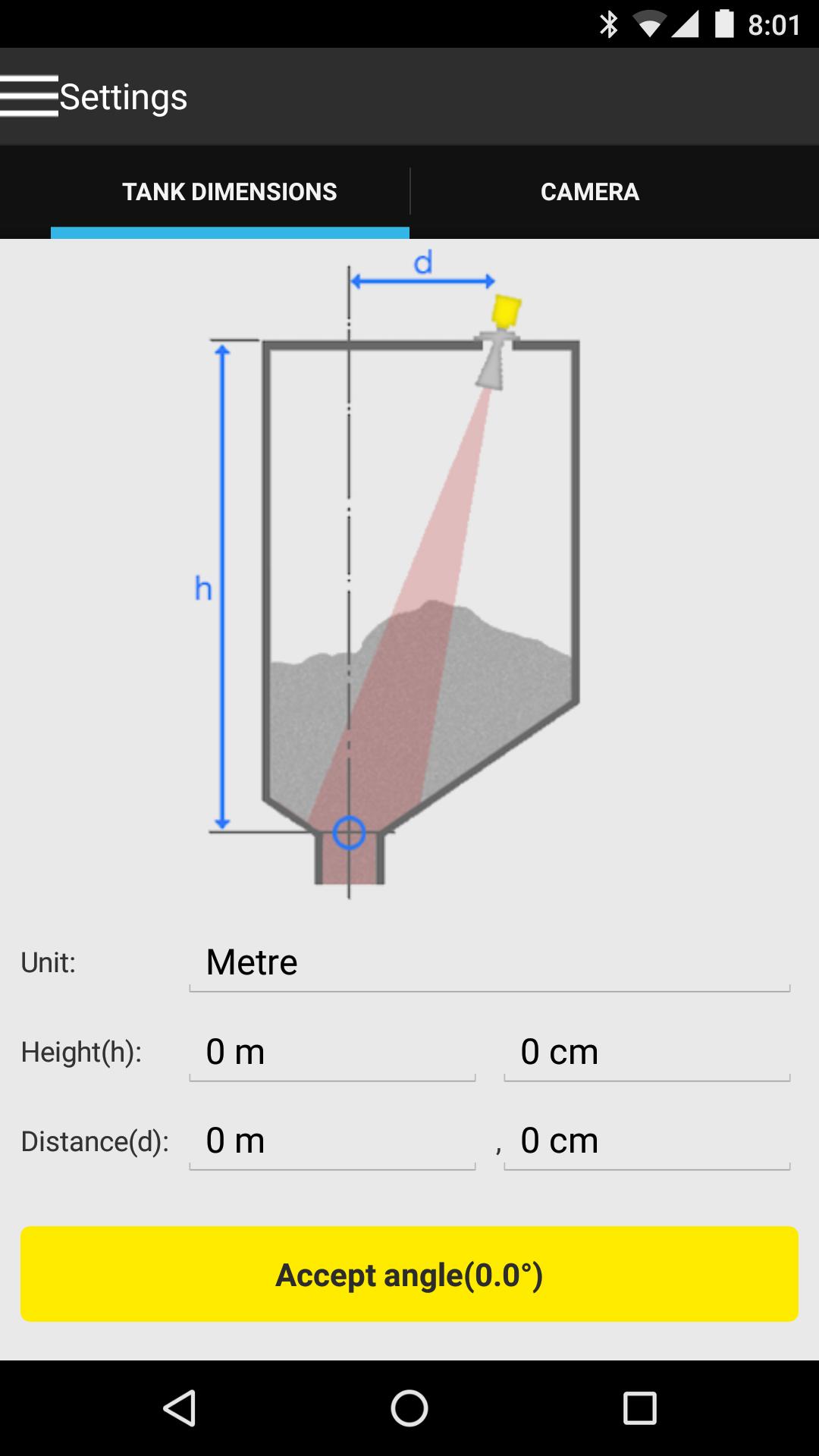

By making use of the tilt sensor integrated in the smartphone, the app also allows the user to optimally align the radar sensor with the tank discharge opening in bulk solids applications.

What's New in the Latest Version 6.4.3

Last updated on Mar 26, 2024

Service communication improved

VEGA Tools, a multifaceted software suite, empowers users with a comprehensive array of functionalities designed for technical analysis, algorithmic trading, and market monitoring within the financial markets. Its modular design allows users to tailor the platform to their specific needs, whether they are day traders, swing traders, long-term investors, or institutional professionals. The core strength of VEGA Tools lies in its ability to integrate seamlessly with various data feeds, providing access to real-time and historical market data across a wide spectrum of asset classes, including stocks, futures, options, forex, and cryptocurrencies.One of the primary components of VEGA Tools is its charting module, which offers a robust platform for visualizing market trends and identifying potential trading opportunities. The charting functionality incorporates a vast library of technical indicators, drawing tools, and customizable chart types, enabling users to perform in-depth technical analysis. Users can create custom indicators and strategies using the built-in scripting language, further enhancing the platform's analytical capabilities. The charting module also supports multiple timeframes, allowing users to analyze market behavior across various granularities, from tick data to monthly charts.

Another key feature of VEGA Tools is its backtesting engine, which allows users to test the efficacy of their trading strategies against historical market data. This functionality enables traders to refine their strategies, optimize parameters, and evaluate potential risks before deploying them in live trading environments. The backtesting engine provides detailed performance metrics, including profit/loss calculations, drawdown analysis, and win/loss ratios, allowing users to make informed decisions based on empirical evidence. The platform also supports forward testing, enabling users to simulate real-time trading conditions and assess the robustness of their strategies.

VEGA Tools offers a sophisticated order management system (OMS) that streamlines the process of executing trades across multiple markets and brokers. The OMS provides advanced order routing capabilities, allowing users to optimize order execution and minimize slippage. It also supports various order types, including limit orders, market orders, stop-loss orders, and trailing stop orders, providing users with greater control over their trading activities. The OMS integrates seamlessly with the platform's charting and analysis tools, enabling users to place trades directly from their charts.

Algorithmic trading is a core competency of VEGA Tools, facilitated by its powerful scripting language and integrated development environment (IDE). Users can develop and deploy automated trading strategies using a variety of programming paradigms, including rule-based systems, machine learning algorithms, and statistical models. The platform provides access to a vast library of pre-built trading algorithms, which can be customized and adapted to specific market conditions. The IDE includes debugging tools, code completion, and syntax highlighting, simplifying the development process for both novice and experienced programmers.

Market scanning and screening are essential components of VEGA Tools, enabling users to identify potential trading opportunities based on predefined criteria. The platform provides a comprehensive set of filters and screening tools, allowing users to scan the market for stocks, futures, and other instruments that meet specific technical or fundamental criteria. Users can create custom scans based on a wide range of parameters, including price movements, volume changes, indicator values, and fundamental data. The scanning results can be displayed in real-time, allowing users to quickly identify and capitalize on emerging market trends.

Risk management is a crucial aspect of trading, and VEGA Tools provides a suite of tools to help users manage and mitigate risks. The platform includes features for position sizing, stop-loss order management, and margin monitoring. Users can define risk parameters and set alerts to notify them when their positions approach predefined risk thresholds. The platform also provides tools for analyzing portfolio risk and optimizing diversification.

VEGA Tools offers a range of customization options, allowing users to personalize the platform to their individual preferences. Users can customize chart layouts, indicator settings, and trading parameters. The platform also supports multiple workspaces, allowing users to create separate environments for different trading strategies or asset classes.

Data visualization is a key strength of VEGA Tools, enabling users to gain insights from complex market data. The platform provides a variety of charting options, including candlestick charts, bar charts, line charts, and point and figure charts. Users can customize the appearance of their charts, adding indicators, drawing tools, and annotations. The platform also supports interactive charting, allowing users to zoom, pan, and scroll through their charts.

VEGA Tools is a comprehensive trading platform that provides a wealth of functionalities for technical analysis, algorithmic trading, and market monitoring. Its modular design, customizable features, and powerful scripting language make it a versatile tool for traders of all levels of experience. The platform's integration with various data feeds, its robust backtesting engine, and its sophisticated order management system provide users with the tools they need to succeed in the financial markets. The focus on risk management and data visualization further enhances the platform's value proposition, making it a compelling choice for traders seeking a comprehensive and customizable trading solution.

Access all information relevant to your VEGA instrument...

This app enables wireless adjustment of sensors that have the display/adjustment module PLICSCOM with Bluetooth. Your smartphone or tablet gives you convenient access to the adjustment functions of the sensor. The intuitive user interface of the app makes it very easy to configure the sensor and put it into operation.

The optimized display and diagnostic function allows you to e.g. visualize the measured value or sensor status quickly and easily.

By entering the serial number, all relevant information about your VEGA instrument can be retrieved. Optionally, you can get this information on your smartphone by scanning the data matrix code or barcode on the type label.

General device information (instrument name, article number, delivery date, etc.), an overview of product features and the device-specific documentation (operating instructions, test certificates and safety notes) are thus available anytime, anywhere.

By making use of the tilt sensor integrated in the smartphone, the app also allows the user to optimally align the radar sensor with the tank discharge opening in bulk solids applications.

What's New in the Latest Version 6.4.3

Last updated on Mar 26, 2024

Service communication improved

VEGA Tools, a multifaceted software suite, empowers users with a comprehensive array of functionalities designed for technical analysis, algorithmic trading, and market monitoring within the financial markets. Its modular design allows users to tailor the platform to their specific needs, whether they are day traders, swing traders, long-term investors, or institutional professionals. The core strength of VEGA Tools lies in its ability to integrate seamlessly with various data feeds, providing access to real-time and historical market data across a wide spectrum of asset classes, including stocks, futures, options, forex, and cryptocurrencies.One of the primary components of VEGA Tools is its charting module, which offers a robust platform for visualizing market trends and identifying potential trading opportunities. The charting functionality incorporates a vast library of technical indicators, drawing tools, and customizable chart types, enabling users to perform in-depth technical analysis. Users can create custom indicators and strategies using the built-in scripting language, further enhancing the platform's analytical capabilities. The charting module also supports multiple timeframes, allowing users to analyze market behavior across various granularities, from tick data to monthly charts.

Another key feature of VEGA Tools is its backtesting engine, which allows users to test the efficacy of their trading strategies against historical market data. This functionality enables traders to refine their strategies, optimize parameters, and evaluate potential risks before deploying them in live trading environments. The backtesting engine provides detailed performance metrics, including profit/loss calculations, drawdown analysis, and win/loss ratios, allowing users to make informed decisions based on empirical evidence. The platform also supports forward testing, enabling users to simulate real-time trading conditions and assess the robustness of their strategies.

VEGA Tools offers a sophisticated order management system (OMS) that streamlines the process of executing trades across multiple markets and brokers. The OMS provides advanced order routing capabilities, allowing users to optimize order execution and minimize slippage. It also supports various order types, including limit orders, market orders, stop-loss orders, and trailing stop orders, providing users with greater control over their trading activities. The OMS integrates seamlessly with the platform's charting and analysis tools, enabling users to place trades directly from their charts.

Algorithmic trading is a core competency of VEGA Tools, facilitated by its powerful scripting language and integrated development environment (IDE). Users can develop and deploy automated trading strategies using a variety of programming paradigms, including rule-based systems, machine learning algorithms, and statistical models. The platform provides access to a vast library of pre-built trading algorithms, which can be customized and adapted to specific market conditions. The IDE includes debugging tools, code completion, and syntax highlighting, simplifying the development process for both novice and experienced programmers.

Market scanning and screening are essential components of VEGA Tools, enabling users to identify potential trading opportunities based on predefined criteria. The platform provides a comprehensive set of filters and screening tools, allowing users to scan the market for stocks, futures, and other instruments that meet specific technical or fundamental criteria. Users can create custom scans based on a wide range of parameters, including price movements, volume changes, indicator values, and fundamental data. The scanning results can be displayed in real-time, allowing users to quickly identify and capitalize on emerging market trends.

Risk management is a crucial aspect of trading, and VEGA Tools provides a suite of tools to help users manage and mitigate risks. The platform includes features for position sizing, stop-loss order management, and margin monitoring. Users can define risk parameters and set alerts to notify them when their positions approach predefined risk thresholds. The platform also provides tools for analyzing portfolio risk and optimizing diversification.

VEGA Tools offers a range of customization options, allowing users to personalize the platform to their individual preferences. Users can customize chart layouts, indicator settings, and trading parameters. The platform also supports multiple workspaces, allowing users to create separate environments for different trading strategies or asset classes.

Data visualization is a key strength of VEGA Tools, enabling users to gain insights from complex market data. The platform provides a variety of charting options, including candlestick charts, bar charts, line charts, and point and figure charts. Users can customize the appearance of their charts, adding indicators, drawing tools, and annotations. The platform also supports interactive charting, allowing users to zoom, pan, and scroll through their charts.

VEGA Tools is a comprehensive trading platform that provides a wealth of functionalities for technical analysis, algorithmic trading, and market monitoring. Its modular design, customizable features, and powerful scripting language make it a versatile tool for traders of all levels of experience. The platform's integration with various data feeds, its robust backtesting engine, and its sophisticated order management system provide users with the tools they need to succeed in the financial markets. The focus on risk management and data visualization further enhances the platform's value proposition, making it a compelling choice for traders seeking a comprehensive and customizable trading solution.