Venmo is the fun and easy way to pay and get paid.

Venmo is the fast, safe, social way to pay and get paid. Join over 83 million people who use the Venmo app today.

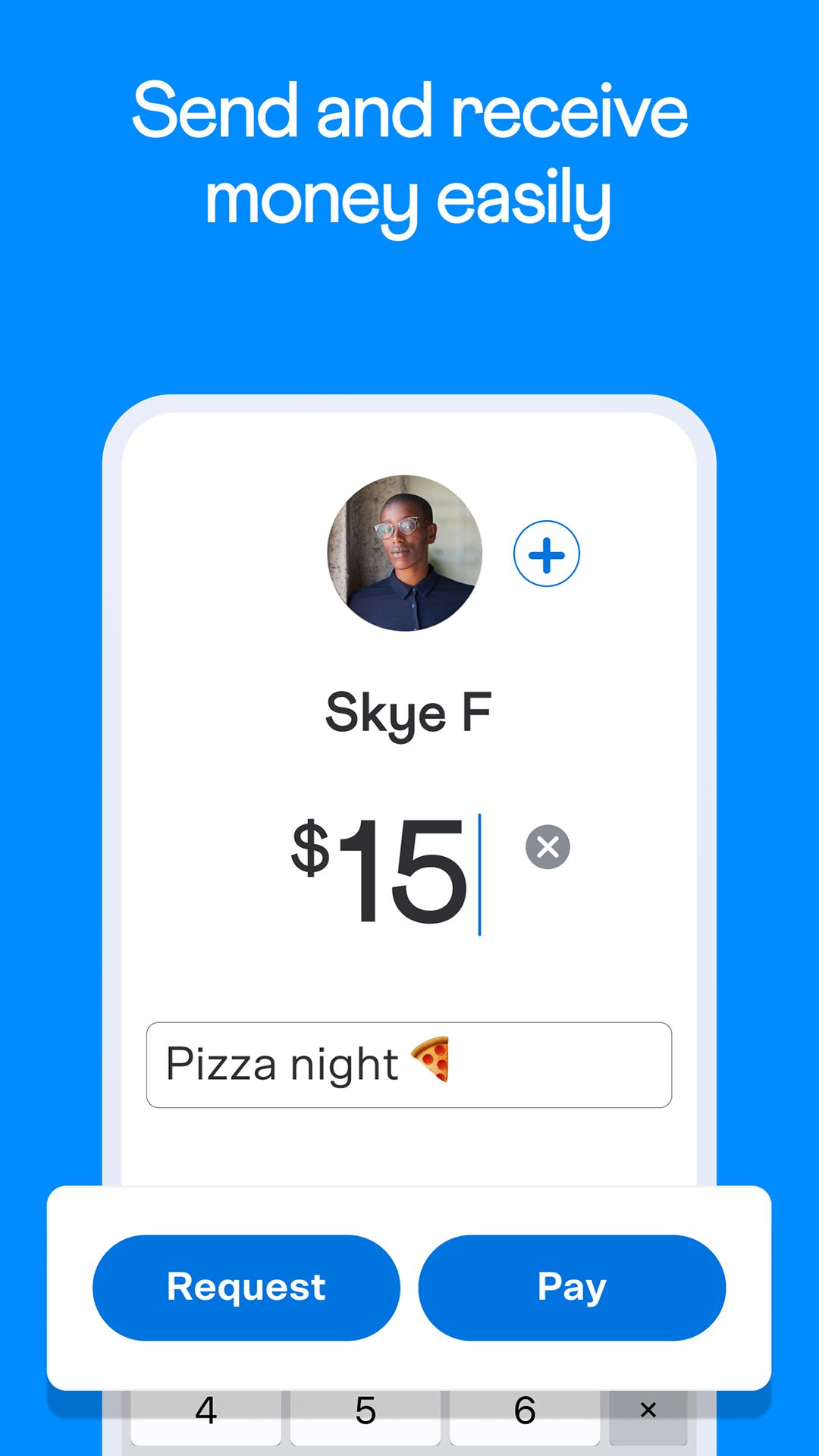

SEND AND RECEIVE MONEY

Pay and get paid for anything from your share of rent to a gift. Add a note to each payment to share and connect with friends.

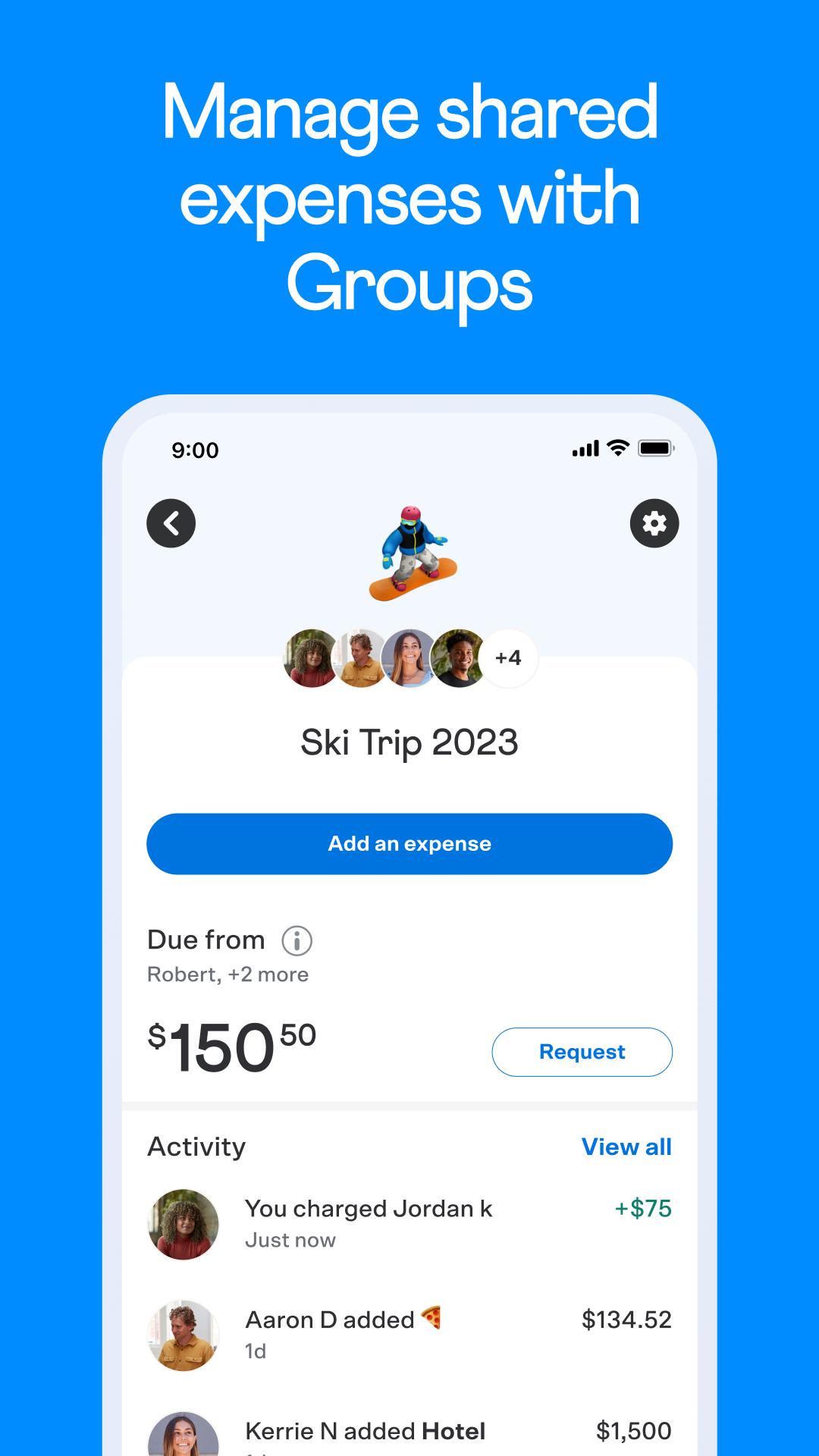

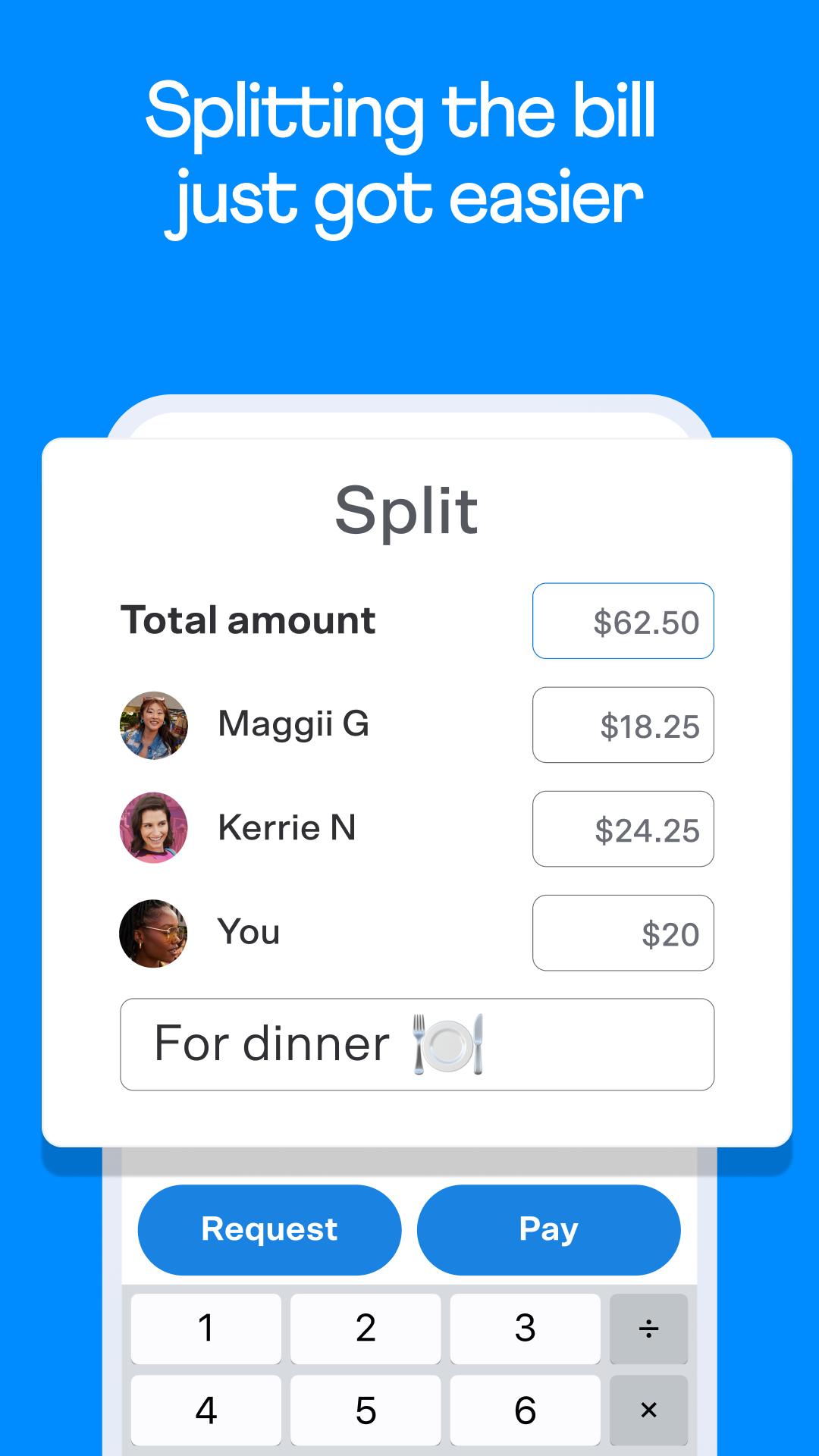

SPLIT A REQUEST AMONG MULTIPLE VENMO FRIENDS

You can now send a payment request to multiple Venmo friends at once and customize the amount each person owes.

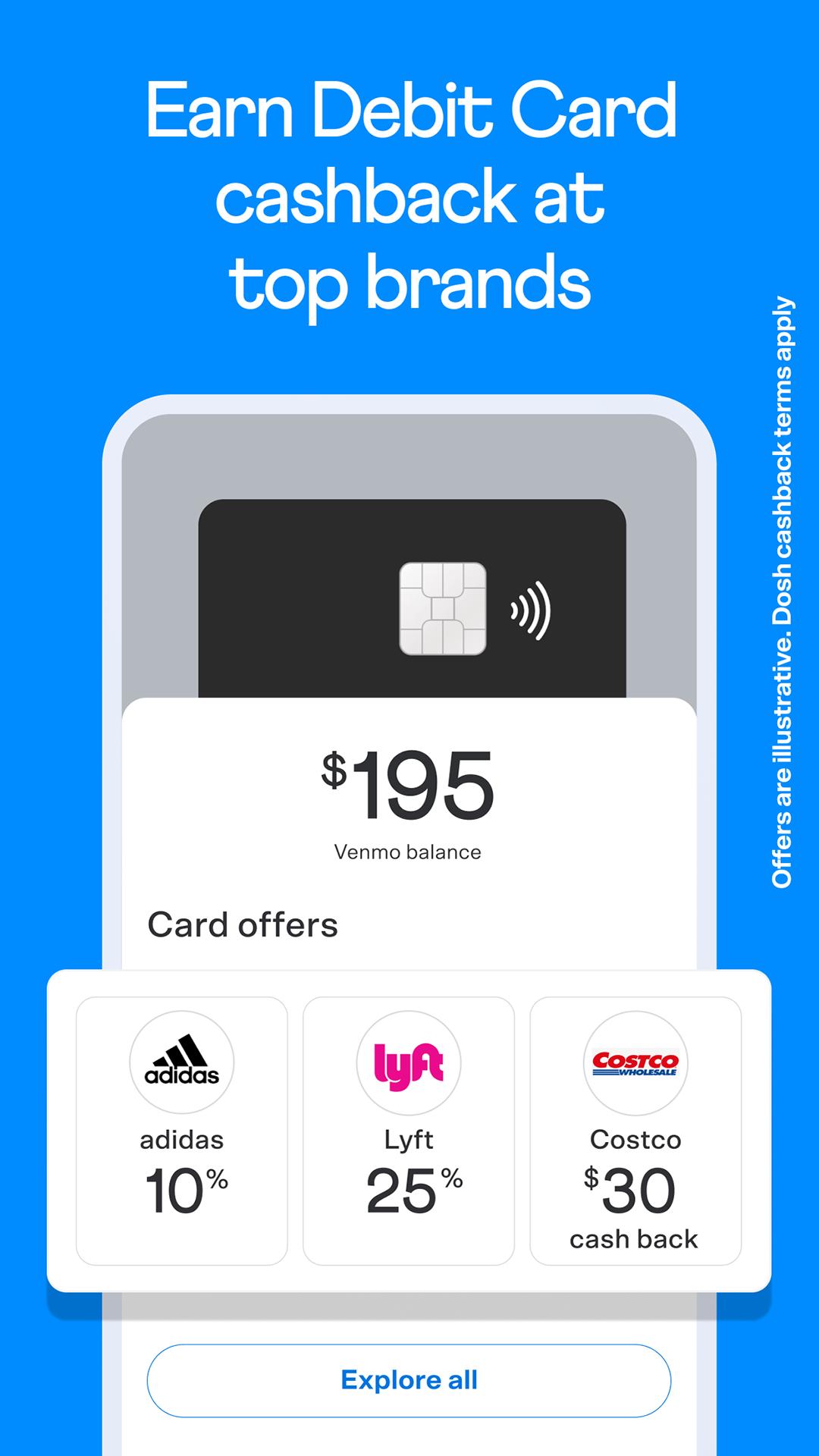

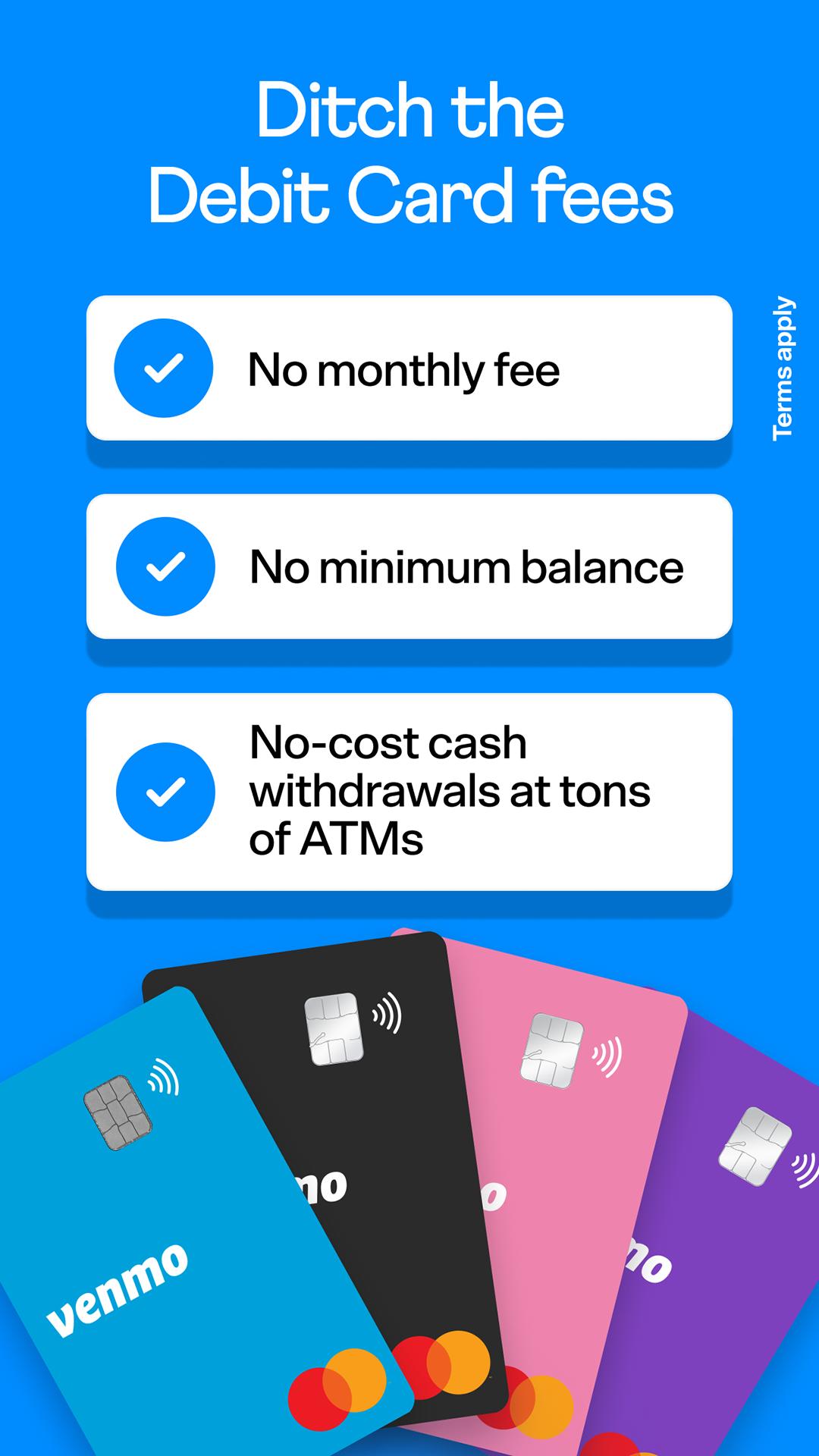

SHOP WITH THE VENMO DEBIT CARD

Get a debit card that gets YOU. Earn automatic cashback when you spend with Venmo Debit Card at some of your favorite merchants.¹ No monthly fee, no minimum balance.²

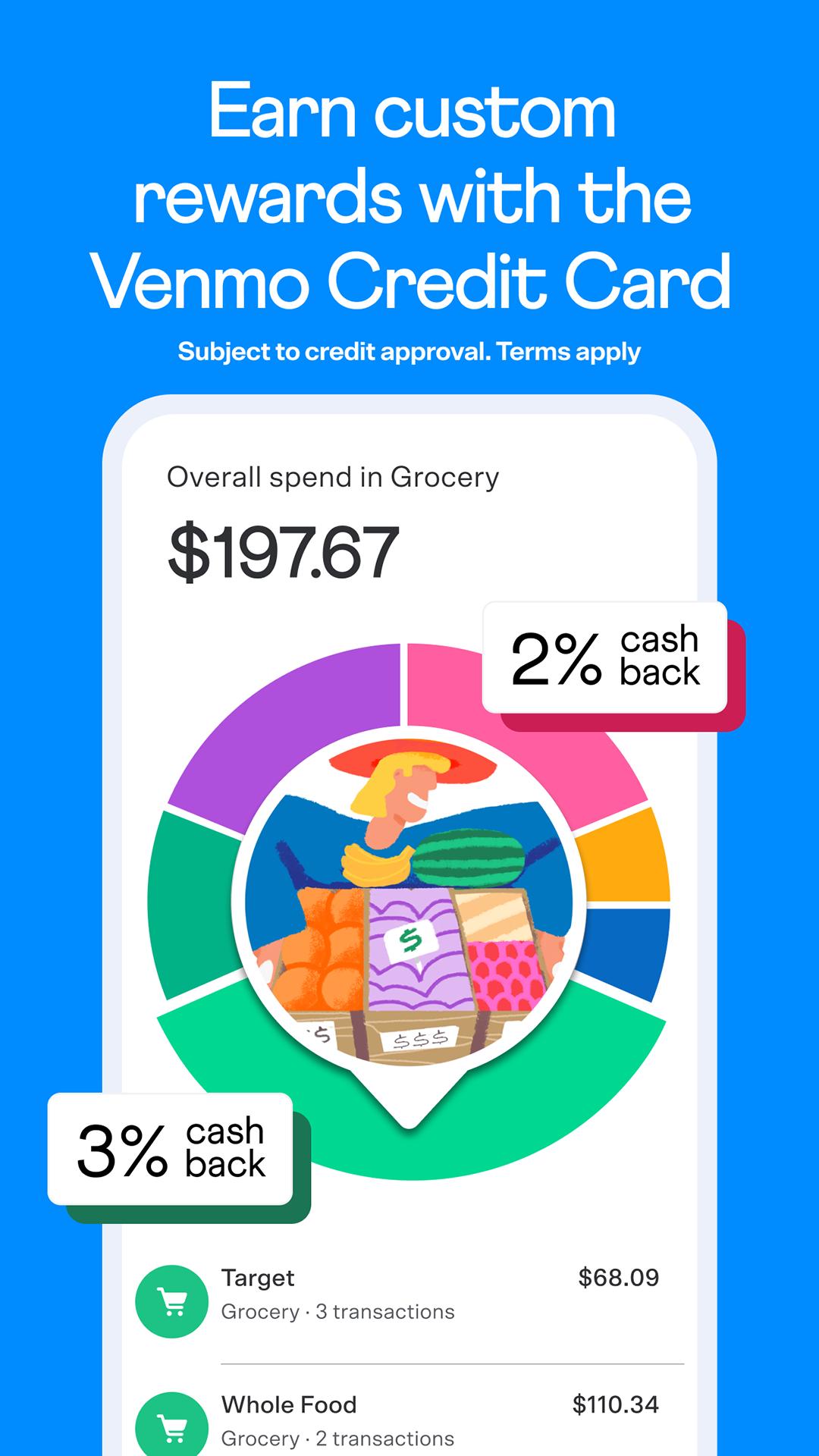

GET REWARDED WITH THE VENMO CREDIT CARD

Automatically earn 3% cash back on your eligible top spend category, 2% on the next, and 1% on the rest.³

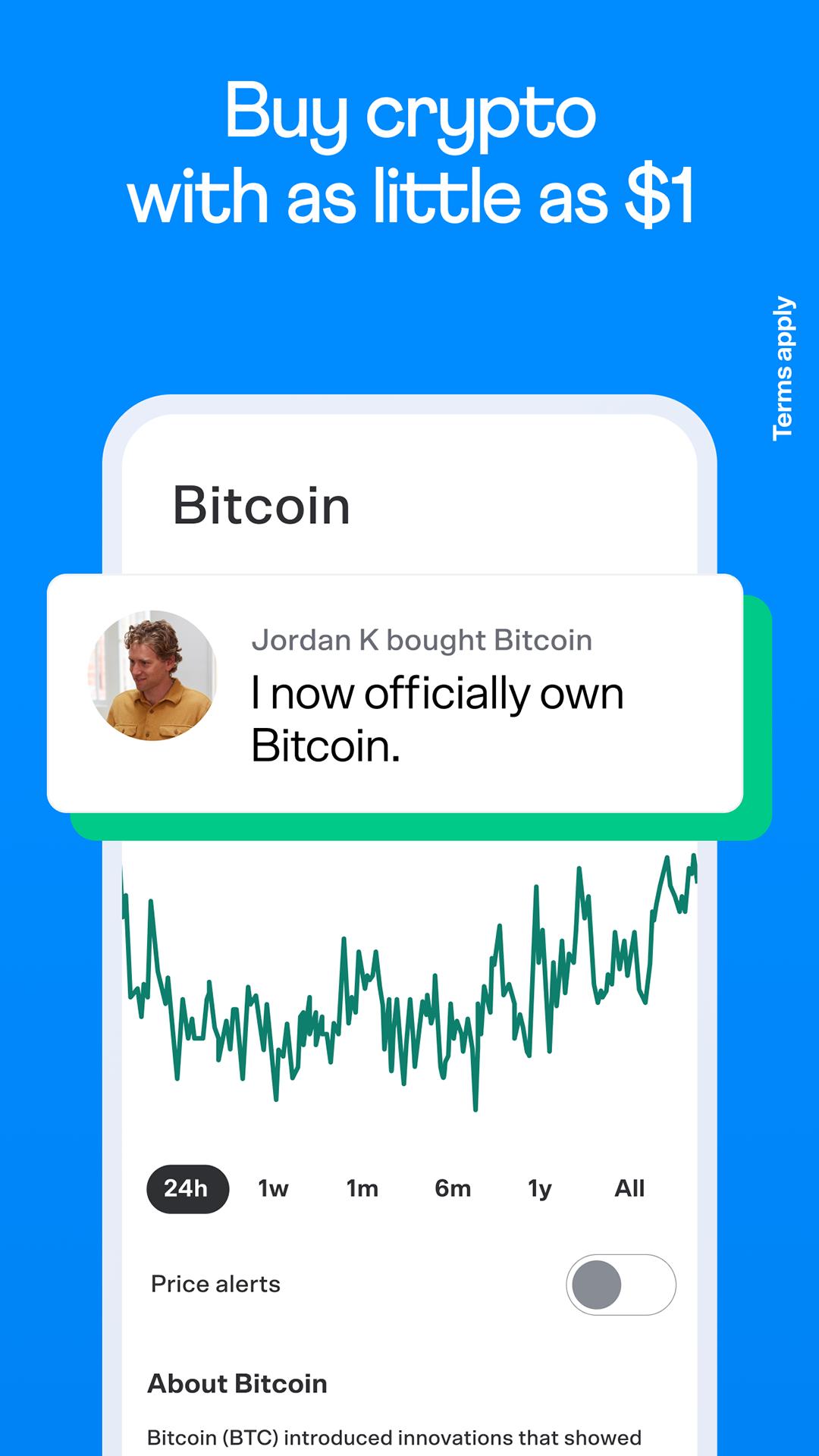

BUY CRYPTO WITH AS LITTLE AS $1

Buy, hold, and sell cryptocurrency right on the Venmo app. New to crypto? Learn more with in-app resources. Crypto is volatile, so it can rise and fall in value quickly. Be sure to take it at a pace you're comfortable with.⁴

DO BUSINESS ON VENMO

Create a business profile for your side gig, small business, or anything in between—all under your same Venmo account.

PAY IN STORES

Use your Venmo QR code to pay touch-free at stores like CVS. Just scan, pay, and go.

PAY IN APPS & ONLINE

Check out with Venmo on some of your favorite apps, like Uber Eats, StockX, Grubhub, and Zola.

MANAGE YOUR MONEY

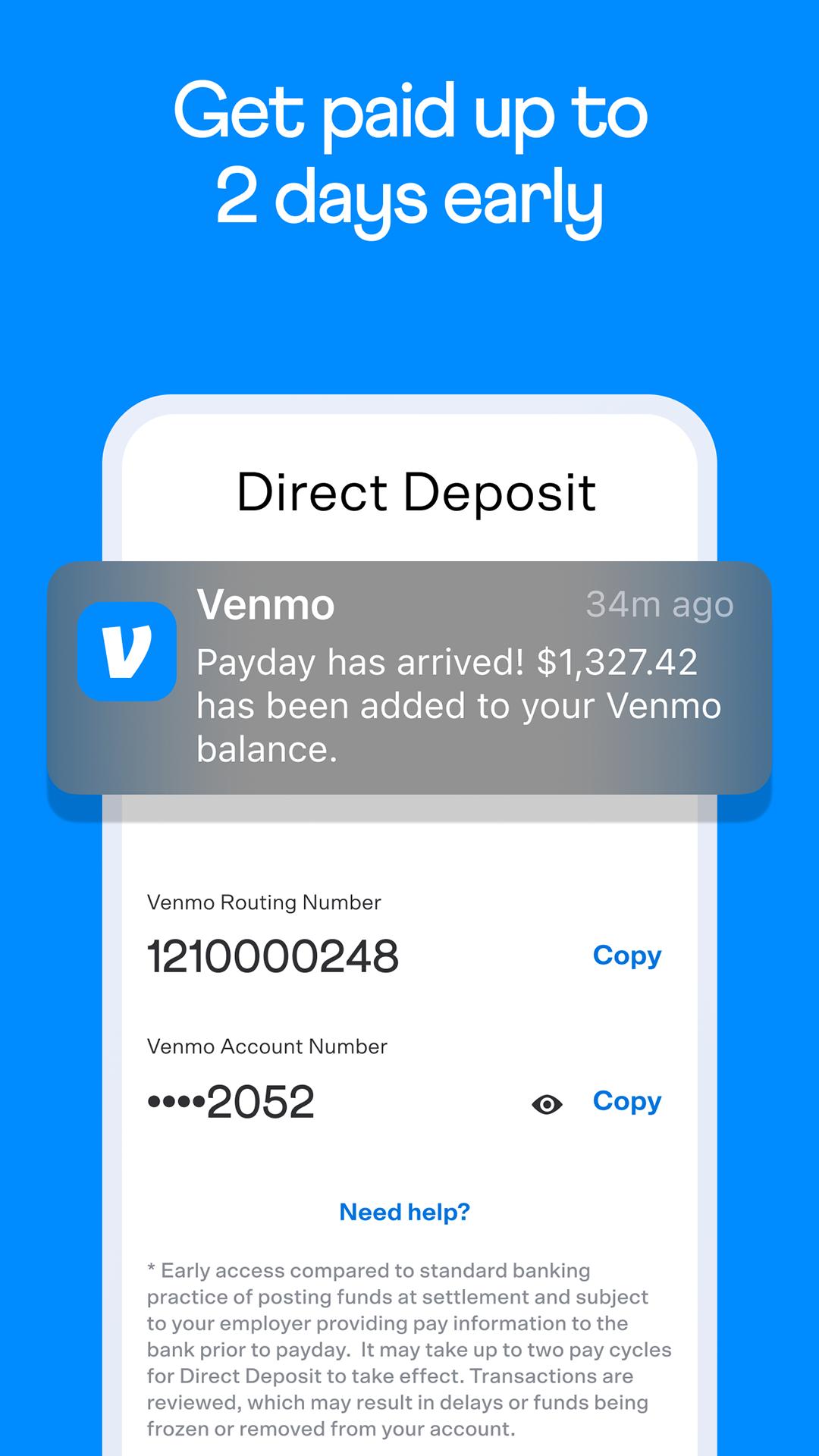

Get your Venmo money in the bank within minutes using Instant Transfer⁵. Want your paycheck up to two days early⁶ ? Try Direct Deposit on Venmo.

¹DOSH offer terms apply. Check app for availability.

²The Venmo Mastercard is issued by The Bancorp Bank, N.A., pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

³See Rewards Program Terms. For more information on the Venmo Credit Card go here: https://venmo.com/about/creditcard . The Venmo Visa Credit Card is issued by Synchrony Bank pursuant to a license from Visa USA Inc. VISA is a registered trademark of Visa International Service Association and used under license.

⁴Terms apply and available here: https://venmo.com/legal/crypto-terms . Only available in the US and limited in certain states. Buying and selling cryptocurrency is subject to a number of risk and may result in significant losses. Venmo does not make any recommendation regarding buying or selling cryptocurrency. Consider seeking advice from your financial or tax adviser.

⁵Transfer speed depends on your bank and could take up to 30 minutes. Transfers are reviewed, which may result in delays or funds being frozen or removed from your Venmo account.

⁶ Subject to bank/employer practices. Terms apply and available here: https://help.venmo.com/hc/en-us/articles/360037185594

What's New in the Latest Version 10.39.1

Last updated on Apr 19, 2024

Fresh new upgrade alert! This release contains bug fixes and improvements, stay tuned for more.

Venmo: A Comprehensive OverviewIntroduction

Venmo is a mobile payment service that enables users to send and receive money with ease and convenience. It operates through a secure platform that connects users' bank accounts and credit/debit cards. Venmo has gained immense popularity due to its user-friendly interface, social media integration, and seamless money transfer capabilities.

Features

Instant Money Transfers: Venmo allows users to transfer funds instantly between connected accounts. This feature is particularly useful for splitting bills, paying rent, or sending money to friends and family.

Social Media Integration: Venmo integrates seamlessly with social media platforms like Facebook and Twitter. This integration enables users to share their transactions with friends and add social context to their payments.

Group Payments: Venmo facilitates group payments, making it easy to split expenses among multiple individuals. Users can create groups for specific events or expenses and invite participants to contribute.

Security

Venmo employs robust security measures to protect user data and transactions. These measures include:

Two-Factor Authentication: Users can enable two-factor authentication to add an extra layer of security to their accounts. This requires a unique code sent to the user's phone for each login attempt.

Encryption: Venmo uses industry-standard encryption to protect sensitive data, including bank account and transaction information.

PCI Compliance: Venmo is PCI compliant, ensuring that it meets the Payment Card Industry Data Security Standard (PCI DSS) to safeguard payment card data.

Fees

Venmo generally does not charge fees for sending or receiving money using a linked bank account. However, a 3% fee applies to credit card transactions.

Usage

Venmo is widely used for a variety of purposes, including:

Personal Expenses: Splitting bills, paying rent, sending money to friends or family.

Business Transactions: Accepting payments for small businesses, freelancers, and online vendors.

Peer-to-Peer Donations: Collecting donations for charitable causes or crowdfunding initiatives.

Advantages

Convenience: Venmo's user-friendly interface and instant money transfer capabilities make it highly convenient for personal and business transactions.

Social Connectivity: The social media integration allows users to share their transactions and connect with others financially.

Security: Venmo's robust security measures ensure the protection of user data and transactions.

Disadvantages

Transaction Limits: Venmo has transaction limits for unverified accounts, which can be a limitation for high-value transfers.

Privacy Concerns: Some users may have concerns about the sharing of transaction details on social media.

Conclusion

Venmo is a highly accessible and convenient mobile payment service that simplifies money transfers and facilitates social interactions. Its user-friendly interface, social media integration, and robust security measures have contributed to its widespread adoption. However, users should be aware of the transaction limits and potential privacy implications associated with the platform.

Venmo is the fun and easy way to pay and get paid.

Venmo is the fast, safe, social way to pay and get paid. Join over 83 million people who use the Venmo app today.

SEND AND RECEIVE MONEY

Pay and get paid for anything from your share of rent to a gift. Add a note to each payment to share and connect with friends.

SPLIT A REQUEST AMONG MULTIPLE VENMO FRIENDS

You can now send a payment request to multiple Venmo friends at once and customize the amount each person owes.

SHOP WITH THE VENMO DEBIT CARD

Get a debit card that gets YOU. Earn automatic cashback when you spend with Venmo Debit Card at some of your favorite merchants.¹ No monthly fee, no minimum balance.²

GET REWARDED WITH THE VENMO CREDIT CARD

Automatically earn 3% cash back on your eligible top spend category, 2% on the next, and 1% on the rest.³

BUY CRYPTO WITH AS LITTLE AS $1

Buy, hold, and sell cryptocurrency right on the Venmo app. New to crypto? Learn more with in-app resources. Crypto is volatile, so it can rise and fall in value quickly. Be sure to take it at a pace you're comfortable with.⁴

DO BUSINESS ON VENMO

Create a business profile for your side gig, small business, or anything in between—all under your same Venmo account.

PAY IN STORES

Use your Venmo QR code to pay touch-free at stores like CVS. Just scan, pay, and go.

PAY IN APPS & ONLINE

Check out with Venmo on some of your favorite apps, like Uber Eats, StockX, Grubhub, and Zola.

MANAGE YOUR MONEY

Get your Venmo money in the bank within minutes using Instant Transfer⁵. Want your paycheck up to two days early⁶ ? Try Direct Deposit on Venmo.

¹DOSH offer terms apply. Check app for availability.

²The Venmo Mastercard is issued by The Bancorp Bank, N.A., pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

³See Rewards Program Terms. For more information on the Venmo Credit Card go here: https://venmo.com/about/creditcard . The Venmo Visa Credit Card is issued by Synchrony Bank pursuant to a license from Visa USA Inc. VISA is a registered trademark of Visa International Service Association and used under license.

⁴Terms apply and available here: https://venmo.com/legal/crypto-terms . Only available in the US and limited in certain states. Buying and selling cryptocurrency is subject to a number of risk and may result in significant losses. Venmo does not make any recommendation regarding buying or selling cryptocurrency. Consider seeking advice from your financial or tax adviser.

⁵Transfer speed depends on your bank and could take up to 30 minutes. Transfers are reviewed, which may result in delays or funds being frozen or removed from your Venmo account.

⁶ Subject to bank/employer practices. Terms apply and available here: https://help.venmo.com/hc/en-us/articles/360037185594

What's New in the Latest Version 10.39.1

Last updated on Apr 19, 2024

Fresh new upgrade alert! This release contains bug fixes and improvements, stay tuned for more.

Venmo: A Comprehensive OverviewIntroduction

Venmo is a mobile payment service that enables users to send and receive money with ease and convenience. It operates through a secure platform that connects users' bank accounts and credit/debit cards. Venmo has gained immense popularity due to its user-friendly interface, social media integration, and seamless money transfer capabilities.

Features

Instant Money Transfers: Venmo allows users to transfer funds instantly between connected accounts. This feature is particularly useful for splitting bills, paying rent, or sending money to friends and family.

Social Media Integration: Venmo integrates seamlessly with social media platforms like Facebook and Twitter. This integration enables users to share their transactions with friends and add social context to their payments.

Group Payments: Venmo facilitates group payments, making it easy to split expenses among multiple individuals. Users can create groups for specific events or expenses and invite participants to contribute.

Security

Venmo employs robust security measures to protect user data and transactions. These measures include:

Two-Factor Authentication: Users can enable two-factor authentication to add an extra layer of security to their accounts. This requires a unique code sent to the user's phone for each login attempt.

Encryption: Venmo uses industry-standard encryption to protect sensitive data, including bank account and transaction information.

PCI Compliance: Venmo is PCI compliant, ensuring that it meets the Payment Card Industry Data Security Standard (PCI DSS) to safeguard payment card data.

Fees

Venmo generally does not charge fees for sending or receiving money using a linked bank account. However, a 3% fee applies to credit card transactions.

Usage

Venmo is widely used for a variety of purposes, including:

Personal Expenses: Splitting bills, paying rent, sending money to friends or family.

Business Transactions: Accepting payments for small businesses, freelancers, and online vendors.

Peer-to-Peer Donations: Collecting donations for charitable causes or crowdfunding initiatives.

Advantages

Convenience: Venmo's user-friendly interface and instant money transfer capabilities make it highly convenient for personal and business transactions.

Social Connectivity: The social media integration allows users to share their transactions and connect with others financially.

Security: Venmo's robust security measures ensure the protection of user data and transactions.

Disadvantages

Transaction Limits: Venmo has transaction limits for unverified accounts, which can be a limitation for high-value transfers.

Privacy Concerns: Some users may have concerns about the sharing of transaction details on social media.

Conclusion

Venmo is a highly accessible and convenient mobile payment service that simplifies money transfers and facilitates social interactions. Its user-friendly interface, social media integration, and robust security measures have contributed to its widespread adoption. However, users should be aware of the transaction limits and potential privacy implications associated with the platform.